Estate planning is a crucial process that safeguards your assets and ensures your wishes are carried out after you’re gone. At Jameson Law, we often encounter clients seeking clarity on the estate planning meaning and its significance in their lives.

This comprehensive guide will walk you through the essentials of estate planning, key documents involved, and important legal considerations specific to Australia. By the end, you’ll have a solid understanding of why estate planning matters and how to get started.

What Is Estate Planning?

Definition and Purpose

Estate planning is the process of arranging your affairs to ensure your assets are managed and distributed according to your wishes after you pass away or become incapacitated. It’s a vital step in securing your family’s financial future and protecting your legacy.

Key Components of an Estate Plan

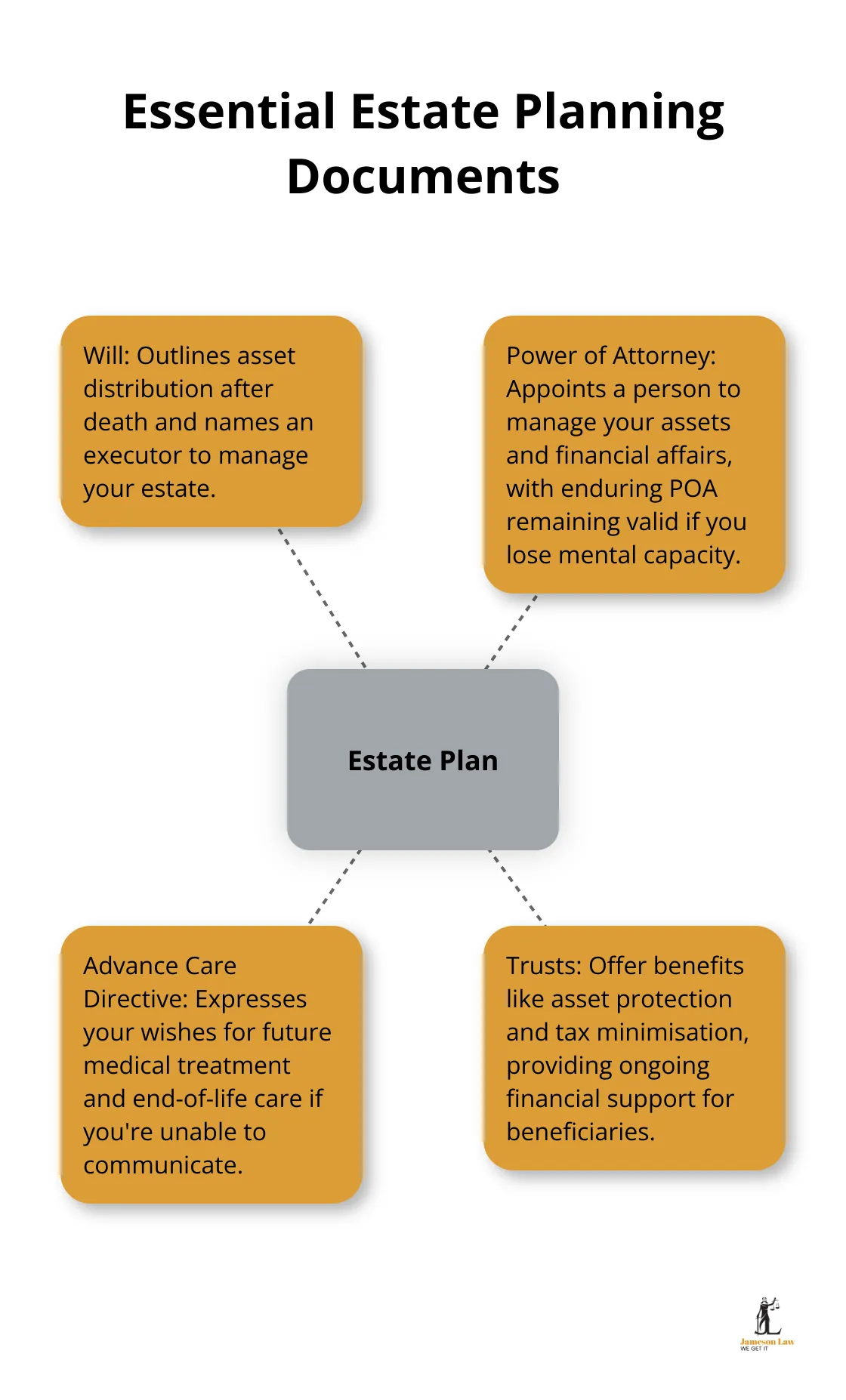

A comprehensive estate plan typically includes several essential elements. The cornerstone is usually a will, which outlines how you want your assets distributed after your death. However, estate planning extends beyond just creating a will.

Other important components include:

- Powers of attorney for financial and medical decisions

- Advance healthcare directives

- Trusts (in some cases)

These documents work together to provide a complete picture of your wishes and ensure they’re carried out effectively.

Importance for Australians

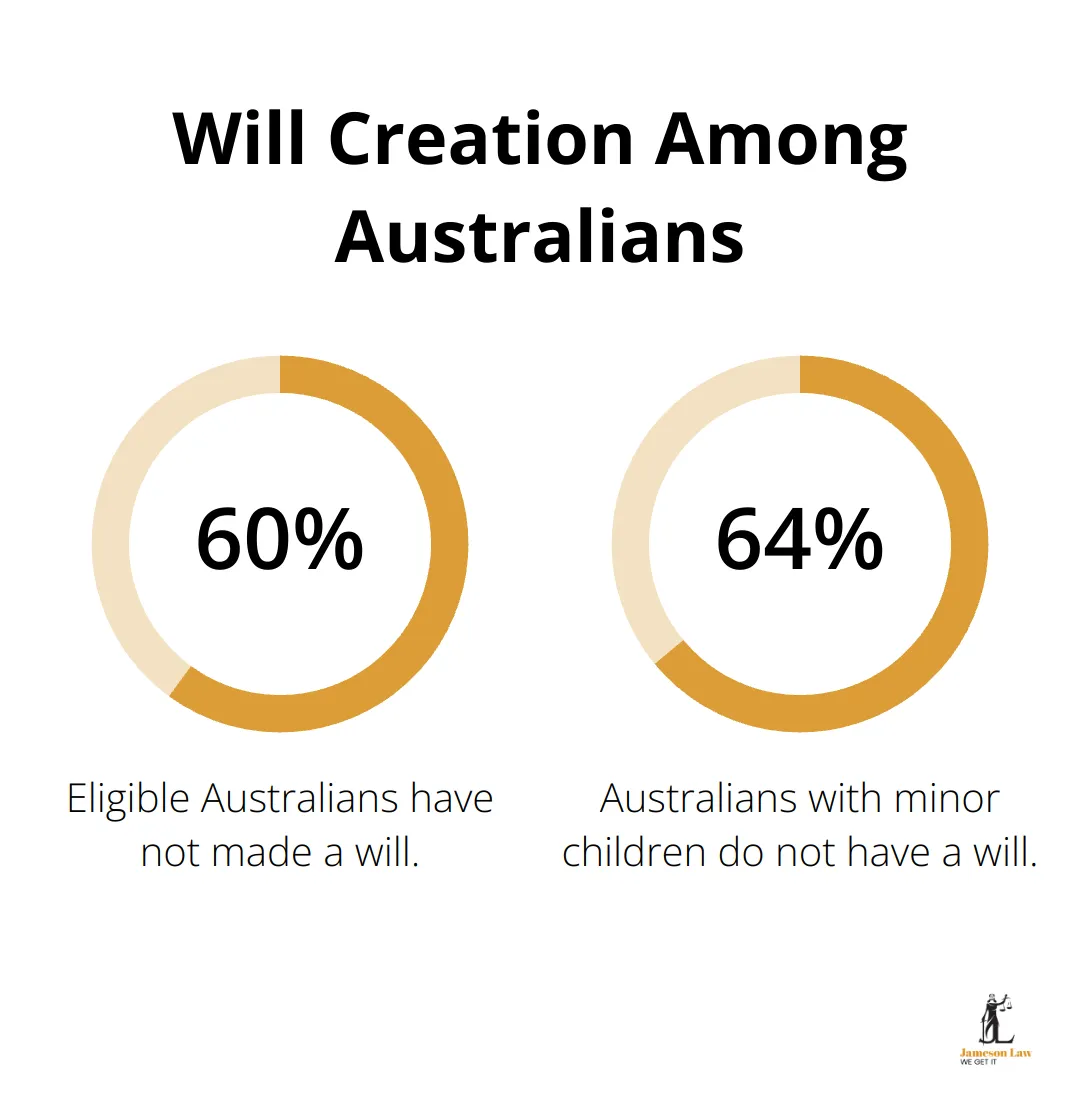

Estate planning holds particular significance for Australians due to our unique legal and financial landscape. Between 58% and 60% of eligible Australians, or around 12 million people, have not made a Will. About 64% of Australians with minor children do not have a Will.

Without a proper estate plan, your assets may not be distributed as you’d like, potentially leading to family disputes and unnecessary tax burdens.

The Value of Professional Advice

While it’s possible to create basic estate planning documents yourself, seeking professional legal advice often proves to be the best course of action. Estate laws can be complex and vary by state, making it easy to overlook important details or make mistakes that could invalidate your plans.

Professional estate planning lawyers (such as those at Jameson Law) specialise in creating tailored estate plans that account for your unique circumstances and goals. These experts stay up-to-date with the latest legal developments to ensure your estate plan remains robust and effective.

Common Misconceptions

Many Australians harbour misconceptions about estate planning. Some believe it’s only necessary for the wealthy, while others think a simple will suffices. However, estate planning is beneficial for everyone, regardless of wealth, and often requires more than just a will.

Another common myth is that estate planning is a one-time event. In reality, it’s an ongoing process that should be reviewed and updated regularly (especially after major life events such as marriage, divorce, or the birth of a child).

As we move forward, let’s explore the key documents involved in estate planning and their specific roles in protecting your assets and wishes.

Essential Estate Planning Documents

Last Will and Testament

A will forms the foundation of any estate plan. It outlines how you want your assets distributed after your death and names an executor to manage your estate. Between 58% and 60% of eligible Australians, or around 12 million people, have not made a Will. About 64% of Australians with minor children do not have a Will.

When you create a will, specify asset distribution details. Include information about personal items with sentimental value. Update your will after major life events like marriage, divorce, or the birth of a child.

Power of Attorney

A power of attorney (POA) is a legal document in which you appoint a person or trustee organisation of your choice to manage your assets and financial affairs. Australia recognises different types of POAs, including general, enduring, and medical.

An enduring POA is particularly important as it remains valid even if you lose mental capacity. Without this document, your family might need to apply to a tribunal to make decisions for you (a time-consuming and stressful process).

Advance Care Directive

An Advance Care Directive (ACD) is a legal document that allows you to express your wishes regarding future medical treatment and end-of-life care if you’re unable to communicate. This document provides clear guidance to your family and medical team about your end-of-life care wishes.

You should discuss your preferences with your family and doctor when you create this document. Try to be as specific as possible about treatments you would or wouldn’t want in various scenarios.

Trusts in Estate Planning

Trusts can serve as powerful tools in estate planning, offering benefits like asset protection and tax minimisation. A testamentary trust, created through your will, can provide ongoing financial support for your beneficiaries while potentially reducing their tax burden.

A testamentary trust can be particularly useful if you have young children or beneficiaries with special needs. It allows you to set conditions on how and when your assets are distributed.

The Role of Professional Advice

While these documents form the core of most estate plans, your specific needs may vary. An experienced estate planning lawyer can help ensure your plan is comprehensive and tailored to your unique circumstances. They can guide you through complex legal requirements and help you avoid common pitfalls that could invalidate your estate plan.

As we move forward, it’s important to understand the legal considerations specific to Australian estate planning. These factors can significantly impact how you structure your estate plan and the effectiveness of your chosen strategies.

Navigating Australian Estate Planning Laws

State-Specific Legal Frameworks

Australian estate planning laws differ significantly across states and territories. New South Wales follows the Succession Act 2006, while Victoria adheres to the Administration and Probate Act 1958. These variations impact estate management and distribution.

Queensland treats de facto partners equally to married couples in estate matters, which isn’t universal across all states. Consulting a local estate planning lawyer will help you understand your state’s specific legal nuances.

Tax Considerations in Estate Planning

Australia doesn’t impose inheritance tax, but other taxes can affect your estate. Capital Gains Tax (CGT) often applies when assets are sold or transferred after death, potentially reducing inheritance value.

Superannuation also carries tax implications. Death benefits paid to non-dependants may incur tax. Proper planning can help minimise these tax burdens on your beneficiaries.

Understanding the Probate Process

Probate validates a will and authorises the executor to administer the estate. This process can be time-consuming and expensive, often taking several months to complete.

New South Wales typically requires probate for estates valued over $100,000, while Western Australia sets a lower threshold. Understanding these state-specific requirements allows you to plan strategies that might avoid or simplify the probate process.

The Role of Professional Advice

Estate planning laws in Australia are complex and ever-changing. Professional legal advice can prove invaluable in navigating these intricacies. Lawyers specialising in estate planning stay current with legal developments and can tailor your plan to your unique circumstances.

Asset Protection Strategies

Estate planning isn’t just about distributing assets; it’s also about protecting them. Trusts (testamentary or inter vivos) can shield assets from potential creditors or legal claims. They can also provide ongoing financial support for beneficiaries while potentially reducing their tax burden.

Final Thoughts

Estate planning protects your assets and ensures your wishes are respected after death. The estate planning meaning encompasses control over asset distribution, potential tax minimisation, and provisions for dependants. Professional legal advice proves invaluable when navigating the complexities of Australian estate law, which varies by state and carries significant tax implications.

Jameson Law specialises in creating comprehensive, tailored estate plans that account for unique circumstances and goals. Our experienced team stays current with legal developments to maintain the effectiveness of your estate plan. Estate planning requires regular reviews as life circumstances change.

Take control of your future today and secure peace of mind. Your estate plan will safeguard your legacy and provide for your loved ones. Don’t leave your legacy to chance – act now to ensure your affairs are in order and your wishes will be honoured.