BOOK YOUR CONSULTATION

This form submission is encrypted and secure.

Will and Estate

Lawyer

Lawyer

Back to back winners of the most prestigious Local Business Awards and multiple criminal defence category awards.

Will and Estate

Lawyer

Lawyer

Back to back winners of the most prestigious Local Business Awards and multiple criminal defence category awards.

Let thy will be done. Our estate lawyers will protect your final wishes

Award-Winning Wills and Estate Services

We have been recognised with awards for excellence in Wills and Estate Planning every year up to and including 2025, ensuring trusted and expert service.

Proven Experience in Wills and Estates

With 40+ years of combined experience, we ensure successful outcomes in wills and estate planning.

5 Star Reviews

Everywhere

We fight hard for our clients, delivering exceptional results and earning 5-star reviews everywhere, especially in Wills and Estates.

Book a

Consultation Today

If your case is important to you, it’s important to us. Call Jameson Law and let us secure your Will and Estate plan today.

Award-Winning Wills and Estate Services

We have been recognised with awards for excellence in Wills and Estate Planning every year up to and including 2025, ensuring trusted and expert service.

Proven Experience in Wills and Estates

With 40+ years of combined experience, we ensure successful outcomes in wills and estate planning.

5 Star Reviews

Everywhere

We fight hard for our clients, delivering exceptional results and earning 5-star reviews everywhere, especially in Wills and Estates.

Book a

Consultation Today

If your case is important to you, it’s important to us. Call Jameson Law and let us secure your Will and Estate plan today.

There are only two things in life that are certain…death and taxes. Regardless of how morbid the topic, it is essential that you prepare for your death by having an estate plan. This not only gives you peace of mind about how your affairs will be managed once you’re gone, but it will also greatly assist your loved ones during one of the most difficult times in their life.

Professional Will and Estate Lawyers Sydney

Wills and estates are governed by the estate planning laws of each state and territory in Australia. In NSW, estate planning consists of:

![]() Wills

Wills

![]() Power of Attorney

Power of Attorney

![]() Enduring Guardianship

Enduring Guardianship

The laws governing estate planning in NSW are the Succession Act 2006 (NSW), Power of Attorney Act 2003 (NSW) and the Guardianship Act 1987 (NSW). Estate planning can be extremely complicated, especially where family trusts, businesses, mixed families and overseas wills or assets are involved. Make sure your wishes are carried out.

Speak to a lawyer today

Contact our law firm for a free initial consultation from one of our estate planning lawyers.

Why do I need a good Will and Estate Lawyer?

Hiring a good Estate Lawyer means all your T’s are crossed and I’s are dotted. Don’t leave it to chance – Jameson Law’s Estate Lawyers will protect your family’s well-being and your final wishes even when you’re no longer around to direct things.

Our lawyers are proficient and have a dedicated team of legal writers behind them. This ensures your will is accurate, valid and covers anything that means everything to you!

What information do you need when putting together your will?

![]() Vehicles: The model, year, and registration details of any vehicles you own; including motor vehicles, caravans, boats, and/or motorbikes

Vehicles: The model, year, and registration details of any vehicles you own; including motor vehicles, caravans, boats, and/or motorbikes

![]() Shares and Investments: All Security Reference Numbers – these can be found on dividend statements

Shares and Investments: All Security Reference Numbers – these can be found on dividend statements

![]() Funeral Arrangements: Details of any prepaid funeral plan/policy and/or funeral bond and/or prepaid monumental works

Funeral Arrangements: Details of any prepaid funeral plan/policy and/or funeral bond and/or prepaid monumental works

![]() Bank Accounts and Term Deposits: Recent bank account statement along with account numbers

Bank Accounts and Term Deposits: Recent bank account statement along with account numbers

![]() Superannuation: The name(s) of your Fund/s and your Member number(s)

Superannuation: The name(s) of your Fund/s and your Member number(s)

![]() Insurance: The company names and reference numbers relating to your life or life or funeral policies

Insurance: The company names and reference numbers relating to your life or life or funeral policies

![]() Overseas Assets: Details regarding any international assets you have

Overseas Assets: Details regarding any international assets you have

![]() Other Assets: The trust deeds, partnership agreements, and/or articles of association relating to private companies, partnerships, and/or family trusts AND Details of any digital assets such as online betting accounts

Other Assets: The trust deeds, partnership agreements, and/or articles of association relating to private companies, partnerships, and/or family trusts AND Details of any digital assets such as online betting accounts

![]() Liabilities: Details of any outstanding liabilities, such as a home loan or other loans, including loans to family members.

Liabilities: Details of any outstanding liabilities, such as a home loan or other loans, including loans to family members.

What considerations do you need to make?

![]() House:

House:

![]() Whether your house is mortgaged and to whom

Whether your house is mortgaged and to whom

![]() The location of the Certificate of Title and what the title reference is

The location of the Certificate of Title and what the title reference is

![]() Whether you own your property with one or more other people as either Tenants in Common or Joint Tenants

Whether you own your property with one or more other people as either Tenants in Common or Joint Tenants

![]() Vehicles

Vehicles

![]() Whether there are any loans against any of your vehicles, and to whom these loans are owed.

Whether there are any loans against any of your vehicles, and to whom these loans are owed.

![]() Shares/Investments

Shares/Investments

![]() Whether the shares are held jointly or individually and where your capital gains records are held

Whether the shares are held jointly or individually and where your capital gains records are held

![]() Funeral Arrangements

Funeral Arrangements

![]() Instructions with respect to your burial or cremation

Instructions with respect to your burial or cremation

![]() Superannuation

Superannuation

Whether there are named beneficiaries and/or whether you have a binding nomination

![]() Insurance

Insurance

![]() Whether you have any beneficiaries nominated in relation to your funeral and/or life policies

Whether you have any beneficiaries nominated in relation to your funeral and/or life policies

![]() Furniture and Effects

Furniture and Effects

![]() The estimated value of these items

The estimated value of these items

![]() Any specific items that might need a separate mention in your Will (especially those of a higher value and/or of sentimental value, for example, original paintings and/or service medals)

Any specific items that might need a separate mention in your Will (especially those of a higher value and/or of sentimental value, for example, original paintings and/or service medals)

![]() Guardianship for Children under 18 years of age

Guardianship for Children under 18 years of age

![]() Your wishes in relation to the guardianship of any children under 18 years of age

Your wishes in relation to the guardianship of any children under 18 years of age

Speak to a lawyer today

Let thy will be done – protect your family’s well-being and your final wishes even when you’re no longer around to direct things.

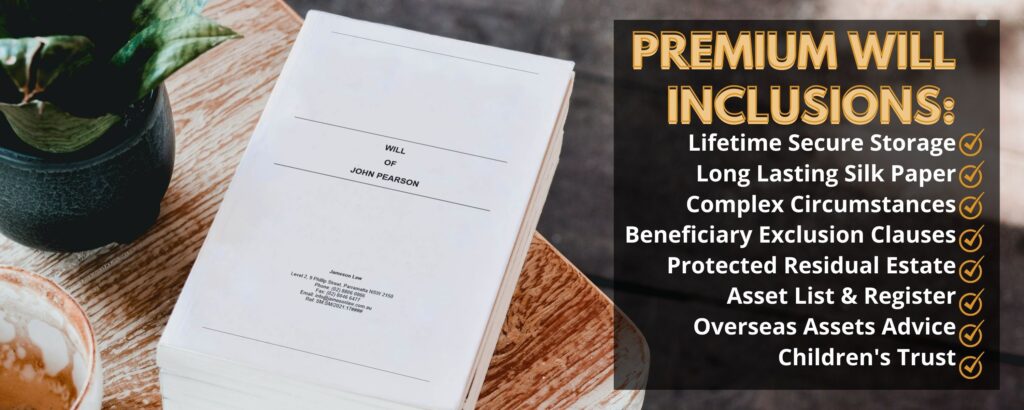

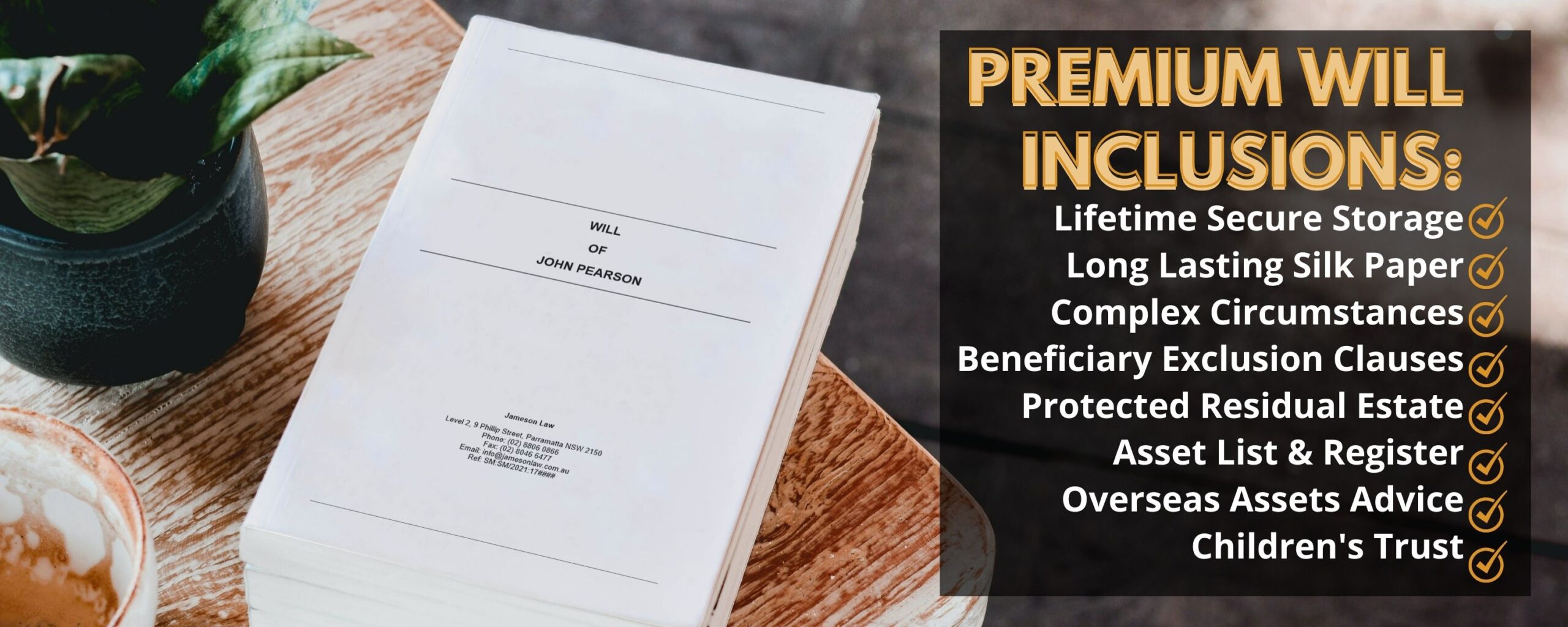

Wills

A will is a testamentary document or instruction manual about how your affairs and your body are to be dealt with upon your death. Many people look to cost-effective solutions such as do-it-yourself will kits. While they may be cost-effective in the short term, they can complicate the process once you pass away if they are completed incorrectly. These complications can result in your deceased estate (your estate once you die) being used to pay for legal costs when someone challenges the will. Solicitors are governed by professional standards legislation and are required to keep up to date with changes in legislation and processes that you may be unaware of. To avoid the pitfalls of writing your own will or using a will kit, contact our experienced wills team for a free initial consultation. A will states:

What information do you need when putting together your will?

A testamentary trust is a trust established through the terms set out in your will. Your will can have a single or multiple testamentary trusts. It is not effective until your death.

Advantages:

![]() The assets are owned by one person (the trustee), but the benefit derived from them goes to the nominated beneficiaries. That means the assets are protected from adverse action against the beneficiary e.g. bankruptcy, divorce, personal lawsuits from high-risk occupations (e.g. as a doctor, lawyer, etc), etc.

The assets are owned by one person (the trustee), but the benefit derived from them goes to the nominated beneficiaries. That means the assets are protected from adverse action against the beneficiary e.g. bankruptcy, divorce, personal lawsuits from high-risk occupations (e.g. as a doctor, lawyer, etc), etc.

![]() Taxation. A testamentary trust does not pay personal income tax. Any income, fringe benefits or franked dividends that may be accrued by the trust is distributed equally among the beneficiaries of that trust.

Taxation. A testamentary trust does not pay personal income tax. Any income, fringe benefits or franked dividends that may be accrued by the trust is distributed equally among the beneficiaries of that trust.

![]() If your beneficiary receives an Australian pension, testamentary trusts are not taken into consideration when determining a person’s eligibility for the pension.

If your beneficiary receives an Australian pension, testamentary trusts are not taken into consideration when determining a person’s eligibility for the pension.

![]() You can nominate the trustee. A trustee can be a family member, friend or professional trustee.

You can nominate the trustee. A trustee can be a family member, friend or professional trustee.

![]() You can set the expiration date of the trust. A testamentary trust can last up to 80 years. This is particularly beneficial if you have a child with ongoing needs.

You can set the expiration date of the trust. A testamentary trust can last up to 80 years. This is particularly beneficial if you have a child with ongoing needs.

![]() If you are unsure whether you want to establish a testamentary trust, you can include a clause in your will giving discretion to the executor of your will to establish one after your death.

If you are unsure whether you want to establish a testamentary trust, you can include a clause in your will giving discretion to the executor of your will to establish one after your death.

Disadvantages:

![]() The ongoing costs associated with a testamentary trust can be prohibitive, especially if the trustee is a professional trustee hired to administer the trust. Ongoing costs include annual trust tax returns as well as the fee payable to the professional trustee.

The ongoing costs associated with a testamentary trust can be prohibitive, especially if the trustee is a professional trustee hired to administer the trust. Ongoing costs include annual trust tax returns as well as the fee payable to the professional trustee.

![]() The trustee has total control over the trust and distribution of income earned from the trust. Assets of the trust can be borrowed, used as security or removed from the trust by the trustee. It is essential that you nominate a trustee that can be trusted 100%.

The trustee has total control over the trust and distribution of income earned from the trust. Assets of the trust can be borrowed, used as security or removed from the trust by the trustee. It is essential that you nominate a trustee that can be trusted 100%.

![]() Assets may be subject to Stamp Duty or Capital Gains Tax. The Australian taxation system is complex and it is recommended that you seek financial advice from a licenced financial planner to make sure this is the best decision for you and your estate.

Assets may be subject to Stamp Duty or Capital Gains Tax. The Australian taxation system is complex and it is recommended that you seek financial advice from a licenced financial planner to make sure this is the best decision for you and your estate.

![]() The assets of a family trust do not roll over to the testamentary trust. If you wish to include your family assets in a testamentary trust, you will need to dissolve the family trust to create the testamentary trust. Before making this decision, you should speak with your financial planner.

The assets of a family trust do not roll over to the testamentary trust. If you wish to include your family assets in a testamentary trust, you will need to dissolve the family trust to create the testamentary trust. Before making this decision, you should speak with your financial planner.

What makes a will valid?

For a will to be considered valid in NSW, it must:

![]() Be in writing (typed or handwritten – handwritten must be in legible writing).

Be in writing (typed or handwritten – handwritten must be in legible writing).

![]() Signed by the will-maker (testator).

Signed by the will-maker (testator).

![]() When you sign your will, it must be witnessed by two people and they have to sign it as witnesses at the time that you sign it.

When you sign your will, it must be witnessed by two people and they have to sign it as witnesses at the time that you sign it.

![]() When you sign your will, you should sign the bottom of each page and initial any amendments that have been made.

When you sign your will, you should sign the bottom of each page and initial any amendments that have been made.

![]() You should not be a witness to the will signing if you are a beneficiary. This can cause issues if the will is contested and you may lose any benefit from the will.

You should not be a witness to the will signing if you are a beneficiary. This can cause issues if the will is contested and you may lose any benefit from the will.

![]() Anyone signing the will should use the same pen to avoid accusations of tampering.

Anyone signing the will should use the same pen to avoid accusations of tampering.

Deceased Estates

The passing of a loved one can be a difficult time. Not only do you need to navigate your emotions, you also have to deal with the deceased person’s estate. In Australia, wills and estate law can be complex, especially when the assets of the deceased are in another state or country. Let us assist you to navigate the estate administration process. Contact our office for a free initial consultation.

In NSW, deceased estate administration is dealt with under the Succession Act 2006 (NSW), the common law and equity. Estate matters are heard by the Supreme Court of New South Wales.

What is the deceased estate?

The deceased estate is made up of all the assets of the estate and liabilities (debts). These include:

![]() bank accounts

bank accounts

![]() building society accounts

building society accounts

![]() superannuation

superannuation

![]() income tax

income tax

![]() real estate

real estate

![]() insurance policies

insurance policies

![]() debts

debts

![]() motor vehicles

motor vehicles

![]() artworks

artworks

![]() collectibles

collectibles

Process for the administration of the estate with a valid Will:

1. Contact Jameson law for legal advice.

2. Locate a copy of the deceased person’s Last Will and Testament. Wills are not registered. However, if you are unable to locate it, your solicitor may be able to assist by reaching out to other legal practitioners to see if they have it.

3. Advertise a notice of your intention to apply for a grant of probate. This is completed using the Online Registry. You must wait 14 days after advertising your intention before you can file your summons for probate. This gives creditors the opportunity to claim on the estate for any outstanding debts owed to them and provides family members with an opportunity to make a family provisions claim.

4. Complete and file the summons for probate,

5. Draft and file the grant of probate and inventory of property

6. Prepare and file the Affidavit of the Executor and attach a copy of the will and the inventory of property

7. File your application with the Supreme Court of NSW along with a self-addressed envelope. DO NOT file the original copy of the will as you will not get it back. Make sure you have a copy of the application and give your lawyer a copy if you file it yourself.

8. Once probate has been granted, it will be sent to you in the self-addressed envelope you supplied the Court.

9. Contact the deceased’s financial institutions, superannuation funds, etc to close accounts. You will also need to notify the Australian Taxation Office (ATO). You will need a copy of the deceased’s death certificate.

10. You will need to complete a tax return for any taxable income, e.g. income tax, derived prior to the date of death.

Process for the administration of the estate when intestate:

Letters of Administration apply when there is no valid Will (intestacy), no executor named in the will or the executor of the Will has died and no substitute executor was identified in the Will. If you need to apply for Letters of Administration, contact our probate lawyers for expert legal advice.

The Letters of Administration process is as follows:

1. When you have been notified of the death and are unable to locate a will, or the executor is not listed on the will or has passed away, contact Jameson Law for advice and assistance to apply for Letters of Administration.

2. Ensure you have all of your documents together. Documents include a copy of the Will if it exists, any codicils attached to the will, and a copy of the death certificate.

3. Advertise a notice of your intention to apply for Letters of Administration. This is completed through the Online Registry. You must wait 14 days after advertising your intention to apply for Letters of Administration before you can file your Summons for Letters of Administration.

4. File your Summons for Letters of Administration, draft Grant of Letters of Administration, Affidavit of the Applicant for Administration, inventory of property, original will (if it exists), and death certificate.

5. You may need to file a Consent to Administration if there are additional beneficiaries but they are not included in your application.

6. You will be notified by the court once the Letters of Administration have been approved.

7. Contact the deceased’s financial institutions, superannuation funds, etc., to close accounts. You will also need to notify the Australian Taxation Office (ATO). You will need a copy of the deceased’s death certificate.

8. You will need to complete a tax return for any taxable income, e.g., income tax, derived prior to the date of death.

Letter of Administration

Letters of Administration apply when there is no valid will (intestacy), no executor named in the will or the executor of the will has died and no substitute executor was identified in the will. If you need to apply for Letters of Administration, contact our probate lawyers for expert legal advice. The Letters of Administration process is as follows:- When you have been notified of the death and are unable to locate a will, or the executor is not listed on the will or has passed away, contact Jameson Law for advice and assistance to apply for Letters of Administration.

- Ensure you have all of your documents together. Documents include a copy of the will if it exists, any codicils attached to the will and a copy of the death certificate.

- Advertise a notice of your intention to apply for Letters of Administration. This is completed through the Online Registry. You must wait 14 days after advertising your intention to apply for Letters of Administration before you can file your Summons for Letters of Administration.

- File your Summons for Letters of Administration, draft Grant of Letters of Administration, Affidavit of the Applicant for Administration, inventory of property, original will (if it exists), and death certificate.

- You may need to file a Consent to Administration if there are additional beneficiaries but they are not included in your application.

- You will be notified by. the court once the Letters of Administration have been approved.

Time limits

In the event a grant of probate or Letters of Administration are required, you need to start the process within 6 months of the person’s death. If there is a delay, you will need to notify the court as to the reason for the delay in the Executor’s Affidavit, or by filing an Affidavit of Delay with the Supreme Court.

If you wish to establish a testamentary trust, you have 3 years from the date of death. If you attempt to establish the trust after 3 years, it may result in significant taxation complications.

If you need to contest a will on the grounds of family provisions (i.e. wife, husband, de facto, child, dependent, ex-partner, etc who has been left out of the will or believes they are entitled to more), you have 12 months from the date of death. If you are not challenging the will under family provisions, there is no time limit.

Probate can be challenged once it has been finalised.

Probate process

If you are an executor to a will, you may be required to apply for a grant of probate. Probate is not always required. It depends on the value of the assets and whether any real estate is involved. If you are unsure whether you need to apply for probate, contact our law firm for expert legal advice from our probate lawyers.

The probate process is as follows:

1. When you have been notified of the death, contact Jameson Law for advice and assistance with the probate process.

2. Make sure you have all of your documents together. You will need a copy of the will, any codicils attached to the will, and a copy of the death certificate.

3. Advertise a notice of your intention to apply for a grant of probate. This is completed using the Online Registry. You must wait 14 days after advertising your intention before you can file your summons for probate. This gives creditors the opportunity to claim on the estate for any outstanding debts owed to them and provides family members with an opportunity to make a family provisions claim.

4. Complete and file the summons for probate.

5. Draft and file the grant of probate and inventory of property.

6. Prepare and file the Affidavit of the Executor and attach a copy of the will and the inventory of property.

7. File your application with the Supreme Court of NSW along with a self-addressed envelope. DO NOT file the original copy of the will as you will not get it back. Make sure you have a copy of the application and give your lawyer a copy if you file it yourself.

8. Once probate has been granted, it will be sent to you in the self-addressed envelope you supplied the court.

Disputes

Will disputes are heard in the Equity Division of the Supreme Court of New South Wales.

A will dispute may arise because:

![]() A party believes they have an entitlement to make a claim (family provisions)

A party believes they have an entitlement to make a claim (family provisions)

![]() They believe the testator was not of sound mind at the time the will was made

They believe the testator was not of sound mind at the time the will was made

![]() Undue influence

Undue influence

![]() Fraud

Fraud

![]() Forgery

Forgery

![]() The testator didn’t know and approve of the contents of the will

The testator didn’t know and approve of the contents of the will

You can only contest or challenge a will if you have an interest in the deceased estate. For example:

![]() You were listed as a beneficiary in the testator’s previous will

You were listed as a beneficiary in the testator’s previous will

![]() You would be considered a beneficiary under NSW law if the testator didn’t have a will

You would be considered a beneficiary under NSW law if the testator didn’t have a will

![]() You are a beneficiary in the current will.

You are a beneficiary in the current will.

If you need to challenge or contest a will, you will need to find out if a grant of probate has been issued. If it hasn’t, you can lodge a probate caveat to prevent probate from being granted. You will then need to work with the executor to resolve your issue. If it cannot be resolved, you will need to file an application with the court to have the court resolve it.

Contesting a will can be expensive and time-consuming. It is essential that you have all required evidence before contesting the will to ensure the speedy resolution of your matter.

In a nutshell...

Wills are an instruction manual on how you want your affairs dealt with when you die. A testamentary trust is an option available to protect assets of the trust, especially when you need to provide ongoing care for a dependent. To find out more, contact our wills team for a free initial consultation.

Case Study

Paul and Amanda were married for 35 years. Paul passed five years ago and Amanda passed away earlier this year. Paul and Amanda were well prepared and both had a valid Will. Each Will itemised all assets such as their property in Queensland and liabilities such as car loans. Each Will also detailed their various accounts such as banking, utilities, and superannuation. Amanda also itemised all of her personal possessions and who she wanted to gift them to in a codicil attached to her Will.

Amanda and Paul’s preparedness greatly assisted their Executor and loved ones. It also reduced the length of time required for the administration of the estate.

Enduring Power of Attorney

There are two types of Power of Attorney available in NSW:

![]() Power of Attorney

Power of Attorney

![]() Enduring Power of Attorney

Enduring Power of Attorney

Power of Attorney

A Power of Attorney is a legal document that authorises another person to act on your behalf in respect of your finances. You can give that person as much or as little authority as you choose. It takes effect from the time you and your Attorney have signed it. You can set the length of time that Power of Attorney will be in place. You can end it at any time you require. If you don’t set a time limit, it expires on your death, or in the event you no longer have the mental capacity to make your own decisions.

Requirements:

![]() You must be of sound mind.

You must be of sound mind.

![]() Your Attorney (the person you are giving control to) must be over the age of 18 and able to assist with your requirements. For example, if you live in NSW, your Attorney shouldn’t live interstate or overseas.

Your Attorney (the person you are giving control to) must be over the age of 18 and able to assist with your requirements. For example, if you live in NSW, your Attorney shouldn’t live interstate or overseas.

![]() You must sign it and have it witnessed and signed by someone over the age of 18 (not your Attorney).

You must sign it and have it witnessed and signed by someone over the age of 18 (not your Attorney).

![]() It must be completed using the required forms.

It must be completed using the required forms.

Case Study

Frank was a 22 year old with his own business. He passed away after a car accident on his way to work. Unfortunately, he did not have a Will. Frank was unmarried and did not have any children, however, his mother is still alive. After the investigation into his death, the Coroner’s Court allocated his mother as Senior Next of Kin for the purposes of the Inquest. However, outside of Coroner’s Court, there is no next of kin. Frank’s mother made an Application for Letters of Administration to allow her to legally administer his estate.

Enduring Power of Attorney

An Enduring Power of Attorney is a legal document that authorises another person to act on your behalf in respect of your finances when you no longer have the mental capacity to so. It expires upon your death and all decisions thereafter are made by your executor. An Enduring Power of Attorney can take effect when you get dementia/Alzheimers or in the event you have an accident and are unable to make your own health directives.

Requirements:

![]() You must be of sound mind. If you are not, an application can be made to NCAT to have one appointed.

You must be of sound mind. If you are not, an application can be made to NCAT to have one appointed.

![]() Your Attorney (the person you are giving control to) must be over the age of 18 and able to assist with your requirements. For example, if you live in NSW, your Attorney shouldn’t live interstate or overseas.

Your Attorney (the person you are giving control to) must be over the age of 18 and able to assist with your requirements. For example, if you live in NSW, your Attorney shouldn’t live interstate or overseas.

![]() You must sign it and have it witnessed by a prescribed witness e.g. legal practitioner or Register of the Court.

You must sign it and have it witnessed by a prescribed witness e.g. legal practitioner or Register of the Court.

![]() The Attorney must sign the attached form to show they consent and understand what is required of them. If you have been asked to be an Enduring Power of Attorney, you should get your own independent legal advice before signing the forms.

The Attorney must sign the attached form to show they consent and understand what is required of them. If you have been asked to be an Enduring Power of Attorney, you should get your own independent legal advice before signing the forms.

![]() It must be completed using the required forms.

It must be completed using the required forms.

If you are concerned about the decisions being made by an Enduring Power of Attorney, you can make an application to NCAT to have the Enduring Power of Attorney reviewed and amended where necessary. For advice on how to make an application to NCAT, contact our office for a free initial consultation.

In a nutshell...

You may think that your financial circumstances limit or void your need for a will. However, not having a will can complicate dealing with your deceased estate. As the saying goes ‘asset rich, cash poor.’ Just because you don’t have a lot of money, doesn’t mean you don’t have an estate worth protecting. Contact our expert wills team for a free initial consultation.

Case Study

John and Mindi want to make a will, but they are unsure where to start. They live in Sydney but jointly own a number of properties in Perth, Adelaide, Victoria and have a family business in Brisbane, Queensland. John also has property he owns with his brother (tenants in common) in Melbourne. They have four children, one with an acquired brain injury who requires ongoing care. Due to the value of their assets and the care requirements of one of their children, John and Mindi should consult their financial planner to discuss the benefits and risks of a testamentary trust. They should also make an appointment with an estate planning specialist to draft their will to ensure it meets the requirements of a valid will.

Enduring Guardianship

An Enduring Guardianship is a legal document authorising another person or persons to make decisions relating to your healthcare and lifestyle in the event you are unable to do so yourself. This can range from agreeing to conduct medical tests, placing you in a care facility or terminating life support. It is up to you how narrow or broad the terms of the Enduring Guardianship are.

It is essential that you have an Enduring Guardianship as the ‘next of kin’ has no legal status in Australia. In the event that you do not have one appointed, a process of substitute decision making applies. That means, your spouse or de facto is required to make a decision, followed by a close family member, friend, etc. Don’t leave your care to chance. Contact our office for advice about future-proofing your care when you can no longer make that decision for yourself.

Requirements:

![]() You must be of sound mind. If you are not, an application can be made to NCAT to appoint an Enduring Guardian.

You must be of sound mind. If you are not, an application can be made to NCAT to appoint an Enduring Guardian.

![]() Your Enduring Guardian must be over the age of 18 and able to assist you with your requirements.

Your Enduring Guardian must be over the age of 18 and able to assist you with your requirements.

![]() You must sign it and have it witnessed by an eligible witness e.g. legal practitioner, registrar of the court, etc.

You must sign it and have it witnessed by an eligible witness e.g. legal practitioner, registrar of the court, etc.

![]() Your Enduring Guardian must sign it and have it witnessed by an eligible witness e.g. legal practitioner, local court registrar, etc. Signing the form means you consent and are aware of your obligations. If you have been asked to be someone’s Enduring Guardian, you should get your own independent legal advice before signing the form.

Your Enduring Guardian must sign it and have it witnessed by an eligible witness e.g. legal practitioner, local court registrar, etc. Signing the form means you consent and are aware of your obligations. If you have been asked to be someone’s Enduring Guardian, you should get your own independent legal advice before signing the form.

![]() It must be completed using the required forms.

It must be completed using the required forms.

If you are concerned about the care being given or decisions being made by an Enduring Guardian, you can make an application to NCAT to have the Enduring Guardianship reviewed and amended where necessary. For advice on how to make an application to NCAT, contact our office for a free initial consultation.

In a nutshell...

Estate law can be complex, time-consuming and expensive. Time limits for challenging or contesting a will do apply. Don’t leave it to chance. Contact our office for expert legal services.

Speak to a lawyer today

The deceased estate is made up of all the deceased person’s assets and liabilities. If they have not left a Will detailing all of this, you should get legal advice. Contact our team for a free initial consultation..

The above is general legal information and should not be considered legal advice. You should speak with one of our solicitors for legal advice tailored to your specific legal problem. The courts deal with matters on a case by case basis. It should also be noted that there may be court delays due to COVID-19.

Speak to an Expert Lawyer today

WE'RE IN IT TO WIN IT

Book your consultation

- This form submission is encrypted and secured to ensure your information remains confidential.

This form submission is encrypted and secured to ensure your information remains confidential.

What our Clients Say

Trustindex verifies that the original source of the review is Google. Worked with Nora and Cooper both really supportive and great help with my traffic matter highly recommendTrustindex verifies that the original source of the review is Google. I had the pleasure of being represented by Nora Sayeed from Jameson Law, and I couldn’t be more grateful for her support and professionalism throughout my legal matter. From our very first interaction, Nora was attentive, understanding, and thorough in her approach. She took the time to carefully listen to my situation, explained every step clearly, and made sure I felt supported at every stage. What stood out the most was her dedication and prompt action. Thanks to her efforts, we were able to successfully withdraw the charge before it even reached the hearing stage. Nora’s expertise, compassion, and calm demeanor made a stressful situation far more manageable. I truly appreciated how she went above and beyond to ensure a positive outcome. I highly recommend Nora to anyone in need of reliable and empathetic legal representation.Trustindex verifies that the original source of the review is Google. Reduced my suspension to 3wks from 3months.. for serious speeding charge. Amazing lawyers nora and cooperTrustindex verifies that the original source of the review is Google. I highly recommend Nora and the team at Jameson Law. Nora is professional, courteous, hard working and diligent. I cannot Thank you enough for our positive outcome. I recommend this firm 100%. A big shout out to Nora and Cooper. Keep up your professionalism. Would not go to anyone else for my legal matters. From the bottom of my heart THANKYOU.Trustindex verifies that the original source of the review is Google. Excellent service would recommend to othersTrustindex verifies that the original source of the review is Google. Nora and Cooper, what a team. Nora , you are absolutely beautiful and super intelligent.If you get in trouble Nora and Cooper are the team to help you.Such professionalism and style. Thank you both so very much.God bless you both.Trustindex verifies that the original source of the review is Google. Nora Sayed’s representation in April 2025 was outstanding. Jameson Law has a brilliant, knowledgeable Lady in their employment. The outcome was nothing short of a miracle. Nora achieved this! I thank her & wish her all the success in her Career. I would recommend Nora & Jameson Law without hesitation. Well done Thanks again. 👏🏼👏🏼😊Trustindex verifies that the original source of the review is Google. I had the pleasure of working with Nora Sayed for a legal matter, and I cannot recommend her highly enough. From the very beginning, Nora proved to be not just a knowledgeable and skilled attorney, but also someone who genuinely cares about her clients. What truly sets Nora apart was her dedication and commitment to ensuring the best possible outcome. She was always available to answer my questions, even after hours, and she was consistently responsive and approachable. Nora took the time to speak with my family, addressing their concerns and providing reassurance every step of the way, especially after hours. This level of personalized attention and care is rare to find in the legal field. Throughout the process, Nora's expertise and strategic thinking were invaluable. She made sure I understood my options, walked me through every detail, and provided guidance that gave me confidence in the decisions I was making. It was clear to me that Nora was invested in not just achieving a good result, but in helping me navigate a difficult situation with as much peace of mind as possible. I found her also very kind and compassionate. She truly goes above and beyond for her clients, and I am incredibly grateful for all the hard work she put into my case. Thanks to Nora, I had the best possible outcome, and I will forever be thankful for her support. Thank you, Nora, for everything you did!

Wills and Estate Planning Services

The process of estate administration can be a complex process even where a will maker (known as the testator) has

In Australia, estate planning has progressed beyond traditional wills and material possessions in an increasingly digital world. For those trying

Stamp duty (also called transfer duty) is a substantial cost component of a property purchase, and if there’s any exemption

FAQs

Frequently Asked Questions.

How long does it take to get my will done?

When it comes to your will, no one is looking at the clock. It is critical that we capture your requests with absolute clarity. Prior to your consultation, we highly recommend emailing through the details and documents outlined in the checklist above.

After your consultation, our dedicated legal drafters will draw up your will in a format to protect your will from contests and ensure your will is executed as intended.

When should I update my will?

How can I remove my children, partners and/or ex's as beneficiaries?

What else should I know about wills?

A Will must be signed by the person making the Will, and witnessed by 2 or more witnesses.

Beneficiaries should not be witnesses as it may cancel out their entitlement.

You can appoint Jameson Law as an independent and professional executor of your Will, and/or we can take over the task if requested.

What happens if I die without a will? Does the government get the whole of my estate?

Do estate planning documents need to be registered?

How often should I update my estate planning documents?

Who can I nominate as my executor (legal personal representative)?

You need to be careful if you nominate an executor who is also a beneficiary of your estate. It could create a conflict and result in your

Do I have to pay tax on any property I inherit?

How long does it take to administer a deceased estate?

In the event a Grant of Probate or Letters of Administration are required, you need to start the process within 6 months of the person’s death. If there is a delay, you will need to notify the court as to the reason for the delay in the Executor’s Affidavit, or by filing an Affidavit of Delay with the Supreme Court. The longer you take to make this application, the longer the process becomes.

The process can be further delayed in the event someone contests the Will.

Wills and Estate Planning Services – Proven Success in Protecting Legacies

The process of estate administration can be a complex process even where a will maker (known as the testator) has

Our client is a 25-year-old man who was the holder of an unrestricted Class C (driver’s) licence and a P1

Our client is a 64-year-old man who had no criminal history. In 2012, he was diagnosed with HIV and was

WE'RE IN IT TO WIN IT

Book your consultation

- This form submission is encrypted and secured to ensure your information remains confidential.

This form submission is encrypted and secured to ensure your information remains confidential.

OUR SYDNEY OFFICES

Parramatta CBD - Head Office

- (02) 8806 0866

- 0488 817 882

- 02 9052 0840

- info@jamesonlaw.com.au

- Suite 301, 67-69 Philip St Parramatta NSW 2150

Sydney CBD - Practice Office

- 02-8806-0866

- 0488 817 882

- 02 9052 0840

- info@jamesonlaw.com.au

- Tower One Barangaroo International Towers Level 35, 100 Barangaroo Ave Sydney NSW 2000

Blacktown CBD - Practice Office

- (02) 8806 0866

- 0488 817 882

- 02 9052 0840

- info@jamesonlaw.com.au

-

Level 3 81 Flushcombe Road, Blacktown NSW 2148

(By Appointment Only)

Liverpool CBD - Practice Office

- (02) 8806 0866

- 0488 817 882

- 02 9052 0840

- info@jamesonlaw.com.au

-

Level 2, 215-219 George Street, Liverpool NSW 2170

(By Appointment Only)

Bankstown CBD - Practice Office

- (02) 8806 0866

- 0488 817 882

- 02 9052 0840

- info@jamesonlaw.com.au

-

23 Restwell Street, Bankstown NSW 2200

(By Appointment Only)

Court Houses We Frequent

Local Courts

Balmain Local Court

- 1300 679 272

- local-court-burwood@justice.nsw.gov.au

- 368 Darling Street, Balmain NSW 2041

Registry: Monday to Friday, 9:00am to 4:30pm

Bankstown Local Court

- 1300 679 272

- (02) 9722 6060

- PO Box 71 BANKSTOWN NSW 2200

- local-court-bankstown@justice.nsw.gov.au

- Cnr Chapel Road and The Mall BANKSTOWN NSW 2200

Court Operating Hours: 9:30am-4:30pm

Blacktown Local Court

- 1300 679 272

- (02) 9672 2666

- PO Box 217 BLACKTOWN NSW 2148

- local-court-blacktown@justice.nsw.gov.au

- 1 Kildare Road Blacktown NSW 2148

Registry Hours: 9:00 – 4:30

Telephone Hours: 8:30 -4:30

Days open: Mon-Fri

Burwood Local Court

- 1300 679 272

- (02) 9744 4144

- PO Box 235 BURWOOD NSW 1805

- local-court-burwood@justice.nsw.gov.au

- 7-9 Belmore Street BURWOOD NSW 2134

Registry Hours: 9:00 – 4:30

Telephone Hours: 8:30 – 4:30

Days open: Mon – Fri

Campbell Local Court

- 1300 679 272

- (02) 9821 7888

- PO Box 3435 LIVERPOOL WESTFIELDS NSW 2170

- local-court-campbelltown@justice.nsw.gov.au

- 150 George Street LIVERPOOL NSW 2170

Registry Hours: 9:00 – 4:30

Telephone Hours: 8:30 – 4:30

Days open: Mon – Fri

Central Local Court

- 1300 679 272

- (02) 4223 3633

- PO Box 5395 WOLLONGONG NSW 2500

- local-court-wollongong@justice.nsw.gov.au

- Cnr Market and Church Streets WOLLONGONG NSW 2500

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Downing Local Court

- 1300 679 272

- (02) 4223 3633

- PO Box 5395 WOLLONGONG NSW 2500

- dclc@justice.nsw.gov.au

- 143-147 Liverpool Street, Sydney NSW 2000

- Nearest Train Station: Museum Station (Liverpool Street entrance is directly opposite)

- Levels: Local Court matters are heard on levels 4 and 5.

- Public Transport: Well-served by buses and trains, with easy access to nearby bus stops and Museum Station.

- Parking: Limited street parking is available, and there are several public parking garages nearby.

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Wollongong Local Court

- 1300 679 272

- (02) 4223 3633

- PO Box 5395 WOLLONGONG NSW 2500

- local-court-wollongong@justice.nsw.gov.au

- Cnr Market and Church Streets WOLLONGONG NSW 2500

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Fairfield Local Court

- 1300 679 272

- (02) 4223 3633

- PO Box 5395 WOLLONGONG NSW 2500

- local-court-wollongong@justice.nsw.gov.au

- Cnr Spencer St & Court Rd, Fairfield NSW 2165

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Hornsby Local Court

- 1300 679 272

- (02) 9847 9955

- PO Box 96 HORNSBY NSW 1630

- local-court-hornsby@justice.nsw.gov.au

- 294 Peats Ferry Rd HORNSBY NSW 2077

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Liverpool Local Court

- 1300 679 272

- (02) 9722 6060

- PO Box 71 BANKSTOWN NSW 2200

- local-court-bankstown@justice.nsw.gov.au

- Cnr Chapel Road and The Mall BANKSTOWN NSW 2200

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Manly Local Court

- 1300 679 272

- (02) 9722 6060

- PO Box 71 BANKSTOWN NSW 2200

- local-court-bankstown@justice.nsw.gov.au

- Cnr Chapel Road and The Mall BANKSTOWN NSW 2200

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Newtown Local Court

- 1300 679 272

- (02) 9722 6060

- PO Box 71 BANKSTOWN NSW 2200

- local-court-bankstown@justice.nsw.gov.au

- Cnr Chapel Road and The Mall BANKSTOWN NSW 2200

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Parramatta Local Court

- 1300 679 272

- (02) 4223 3633

- PO Box 92 Parramatta NSW 2150, Australia

- local-court-parramatta@justice.nsw.gov.au

- 12 George Street Parramatta NSW 2150, Australia

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Penrith Local Court

- 1300 679 272

- (02) 9722 6060

- PO Box 71 BANKSTOWN NSW 2200

- local-court-bankstown@justice.nsw.gov.au

- Cnr Chapel Road and The Mall BANKSTOWN NSW 2200

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Sutherland Local Court

- 1300 679 272

- PO Box 37, Sutherland 2232

- local-court-sutherland@justice.nsw.gov.au

- Cnr Flora and Belmont Street, Sutherland NSW 2232

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Waverley Local Court

- 1300 679 272

- (02) 9722 6060

- PO Box 71 BANKSTOWN NSW 2200

- local-court-bankstown@justice.nsw.gov.au

- Cnr Chapel Road and The Mall BANKSTOWN NSW 2200

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Windsor Local Court

- 1300 679 272

- (02) 9722 6060

- PO Box 71 BANKSTOWN NSW 2200

- local-court-bankstown@justice.nsw.gov.au

- Cnr Chapel Road and The Mall BANKSTOWN NSW 2200

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Wollongong Local Court

- 1300 679 272

- (02) 9722 6060

- PO Box 71 BANKSTOWN NSW 2200

- local-court-bankstown@justice.nsw.gov.au

- Cnr Chapel Road and The Mall BANKSTOWN NSW 2200

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

District Courts

Downing Centre District Court

- 1300 679 272

- PO Box 71 BANKSTOWN NSW 2200

- downingcentredc@justice.nsw.gov.au

- 143-147 Liverpool Street, Sydney NSW 2000

Registry Hours: 9:00 – 4:30

Telephone Hours: 8:30 – 4:30

Days open: Mon – Fri

Parramatta District Court

- (02) 8688 7777

- local-court-bankstown@justice.nsw.gov.au

- 12 George Street, Parramatta NSW 2150

Registry Hours: 9:00 – 4:30

Days open: Mon-Fri

Penrith District Court

- 1300 679 272

- local-court-penrith@justice.nsw.gov.au

- 64-72 Henry Street, Penrith NSW 2750

Registry Hours: 9:00 – 4:30

Days open: Mon-Fri

Campbelltown District Court

- 1300 679 272

- local-court-campbelltown@justice.nsw.gov.au

- Railway Street, Campbelltown NSW 2560

Registry Hours: 9:00 – 4:30

Days open: Mon – Fri

Liverpool District Court

- 1300 679 272

- local-court-liverpool@justice.nsw.gov.au

- 150 George Street, Liverpool NSW 2170

Registry Hours: 9:00 – 4:30

Days open: Mon – Fri

Wollongong District Court

- 1300 679 272

- local-court-wollongong@justice.nsw.gov.au

- 97-99 Market Street, Wollongong NSW 2500

Registry Hours: 9:00 – 1:00 and 2:00 – 4:30

Telephone Hours: 8:30 – 4:30

Supreme Courts

Supreme Court New South Wales

- 1300 679 272

- (02) 9230 8025

- (02) 9230 8233

- GPO Box 3 Sydney NSW 2001 Australia

- sc.enquiries@justice.nsw.gov.au

- Law Courts Building 184 Phillip Street Sydney NSW 2000

Registry Hours: 9:00 AM – 4:30 PM

Telephone Hours: 8:30 AM – 4:30 PM

Days Open: Monday to Friday

Federal Court

Federal Circuit and Family Court of Australia

- 1300 352 000

- (02) 9230 8000

- GPO Box 9991, Sydney NSW

- enquiries@fcfcoa.gov.au

- Lionel Bowen, Building, 97/99 Goulburn St, Sydney NSW 2001

Registry Hours: 9:00 AM – 4:30 PM

Telephone Hours: 8:30 AM – 5:00 PM

Days Open: Monday to Friday

Federal Court

- 1300 720 980

- (02) 9230 8020

- GPO Box 9991, Sydney NSW

- enquiries@fedcourt.gov.au

- 97-99 Goulburn St in the heart of the Sydney CBD

Monday to Friday, 8:30 AM – 4:30 PM

High Court

- (02) 6270 6811

- (02) 6270 6868

- Parkes Place, Canberra ACT 2600

- enquiries@hcourt.gov.au

- Parkes Place, Canberra ACT 2600

Monday to Friday, 8:30 AM – 5:00 PM

Specialised Courts

Children’s Court of New South Wales

- 1300 679 272

- (02) 9722 6060

- Cnr Chapel Road and The Mall BANKSTOWN NSW 2200

- PO Box 71 BANKSTOWN NSW 2200

- sc.enquiries@justice.nsw.gov.au

Registry Hours: 9:00 AM – 4:30 PM

Telephone Hours: 8:30 AM – 4:30 PM

Days Open: Monday to Friday

Coroner’s Court New South Wales

- 1300 679 272

- (02) 9230 8025

- (02) 9230 8233

- GPO Box 3 Sydney NSW 2001 Australia

- sc.enquiries@justice.nsw.gov.au

- Law Courts Building 184 Phillip Street Sydney NSW 2000

Registry Hours: 9:00 AM – 4:30 PM

Telephone Hours: 8:30 AM – 4:30 PM

Days Open: Monday to Friday

Industrial Relations Commission of New South Wales

- 1300 679 272

- (02) 9230 8025

- (02) 9230 8233

- GPO Box 3 Sydney NSW 2001 Australia

- sc.enquiries@justice.nsw.gov.au

- Law Courts Building 184 Phillip Street Sydney NSW 2000

Registry Hours: 9:00 AM – 4:30 PM

Telephone Hours: 8:30 AM – 4:30 PM

Days Open: Monday to Friday

Land and Environment Court of New South Wales

- 1300 679 272

- (02) 9230 8025

- (02) 9230 8233

- GPO Box 3 Sydney NSW 2001 Australia

- sc.enquiries@justice.nsw.gov.au

- Law Courts Building 184 Phillip Street Sydney NSW 2000

Registry Hours: 9:00 AM – 4:30 PM

Telephone Hours: 8:30 AM – 4:30 PM

Days Open: Monday to Friday