Frequently Asked Questions.

Your consultation will take anywhere from 30 minutes to 90 minutes

When it comes to your will, no one is looking at the clock. It is critical that we capture your requests with absolute clarity. Prior to your consultation, we highly recommend emailing through the details and documents outlined in the checklist above.

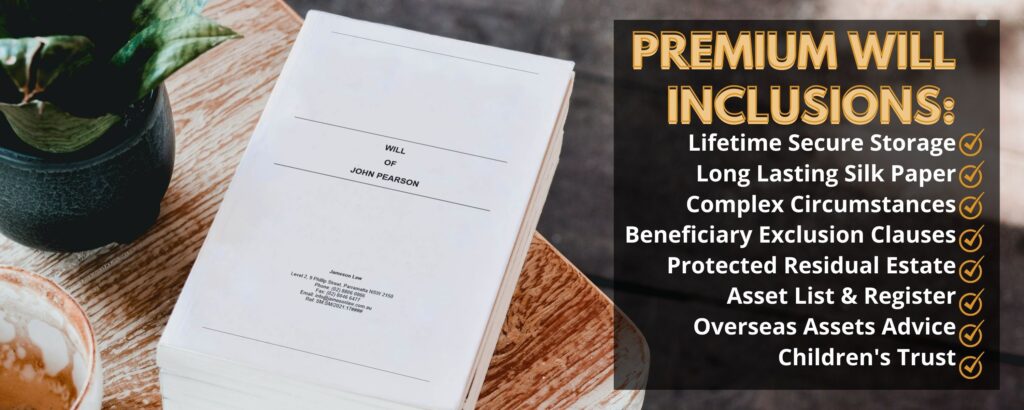

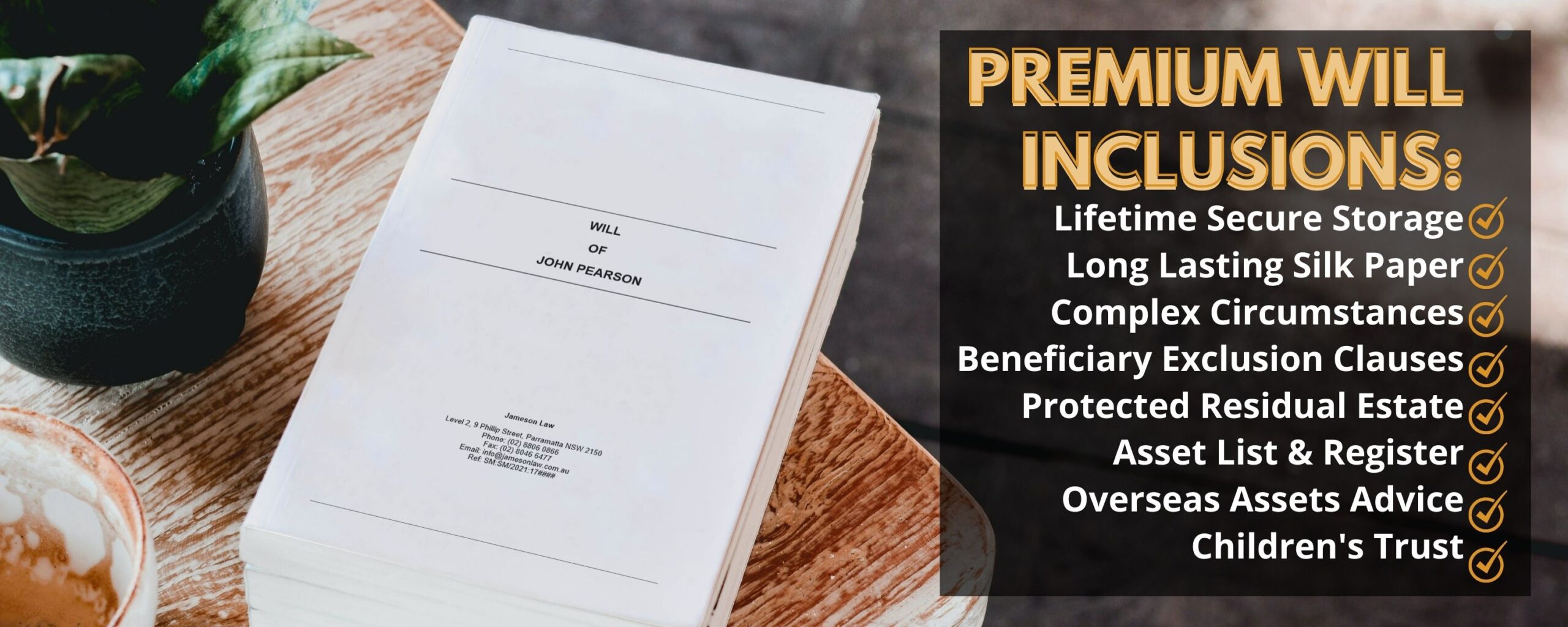

After your consultation, our dedicated legal drafters will draw up your will in a format to protect your will from contests and ensure your will is executed as intended.

It is important to update your will if and when there is a critical change in your asset holdings, you get married, a beneficiary or executed pass, you get married, you get a divorce, a new baby, changing your mind, and of course you simply change your mind.

Wills can be contested when children, partners and even ex’s are not given a share in the inheritance. Our estate lawyers follow case law closely and provide advice on the best possible avenues to ensure your final wishes are fulfilled. This can often include annexing additional letters and statements to your will to support your expressed exclusion of those individuals from receiving all or any part of your estate.

Life circumstances change, so it’s advisable to regularly review your Will to ensure that it accurately reflects your current wishes.

A Will must be signed by the person making the Will, and witnessed by 2 or more witnesses.

Beneficiaries should not be witnesses as it may cancel out their entitlement.

You can appoint Jameson Law as an independent and professional executor of your Will, and/or we can take over the task if requested.

If you die without a will, it means you die intestate. Your estate will be automatically split between your spouse and your children. If you do not have a spouse or children, your estate will be split amongst your remaining family members. Your estate will only go to the government once all options have been exhausted.

Wills, Enduring Power of Attorneys and Enduring Guardianship do not need to be registered. However, in order to conduct property transactions in NSW, a Power of Attorney and Enduring Power of Attorney need to be registered. For example, if you need to move into a nursing home due to dementia and your house needs to be sold to fund the move, your Enduring Power of Attorney cannot sell the property unless your Enduring Power of Attorney is registered with the General Registry of Deeds.

You should update your estate planning documents whenever there is a change in your personal circumstances. For example, divorce, death of an executor or beneficiary, you move interstate, acquire new assets, etc.

You can nominate a family member or friend to be your executor, however, it should be someone you trust. If you don’t have anyone that you trust to administer your estate, you can nominate the NSW Trustee and Guardian (previously known as the Public Trustee).

You need to be careful if you nominate an executor who is also a beneficiary of your estate. It could create a conflict and result in your

In Australia, there is no inheritance tax. If real property is transferred to you as the beneficiary of a deceased estate, you will need to pay a transfer fee of $50 (fee current at the time of publishing). However, if you gift your share of the property to another person, they will need to pay duty (tax) on the portion transferred.

The length of time depends on a number of factors including whether a Grant of Probate or Letters of Administration are required.

In the event a Grant of Probate or Letters of Administration are required, you need to start the process within 6 months of the person’s death. If there is a delay, you will need to notify the court as to the reason for the delay in the Executor’s Affidavit, or by filing an Affidavit of Delay with the Supreme Court. The longer you take to make this application, the longer the process becomes.

The process can be further delayed in the event someone contests the Will.