Expert Binding Financial Agreement Lawyer Sydney & Parramatta

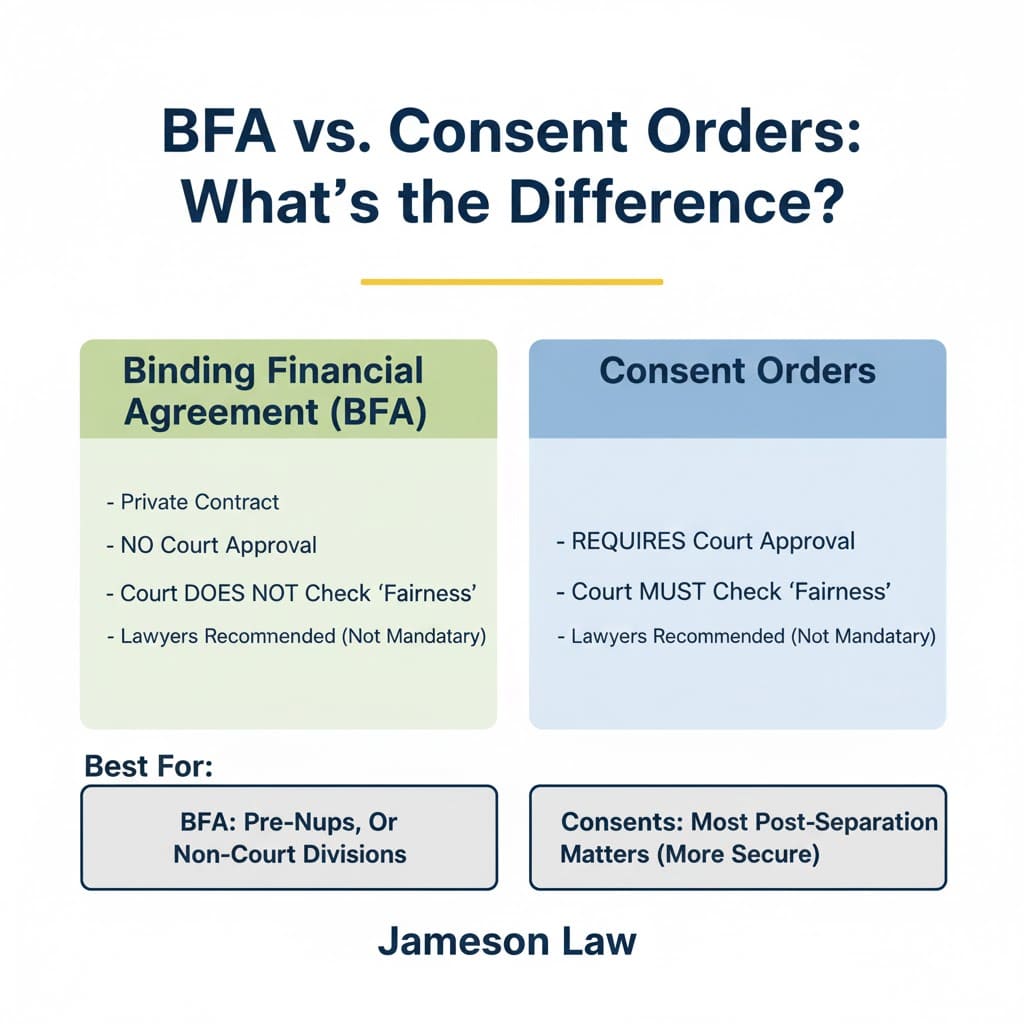

In any relationship, protecting your financial future is a sensible and prudent step. A Binding Financial Agreement (BFA) is a powerful tool that lets couples decide how property will be divided if they separate, without going to court.

BFAs are complex. The law is strict and small mistakes can void an agreement. At Jameson Law, our Binding Financial Agreement lawyers in Sydney and Parramatta draft and advise on BFAs that are built to last.

What is a Binding Financial Agreement (BFA)?

A BFA is a private contract that sets out how assets, liabilities, superannuation and financial resources will be divided if a marriage or de facto relationship ends.

Its power comes from the Family Law Act 1975. When correctly made, a BFA ousts the jurisdiction of the Federal Circuit and Family Court of Australia, so the court cannot make orders about your property division.

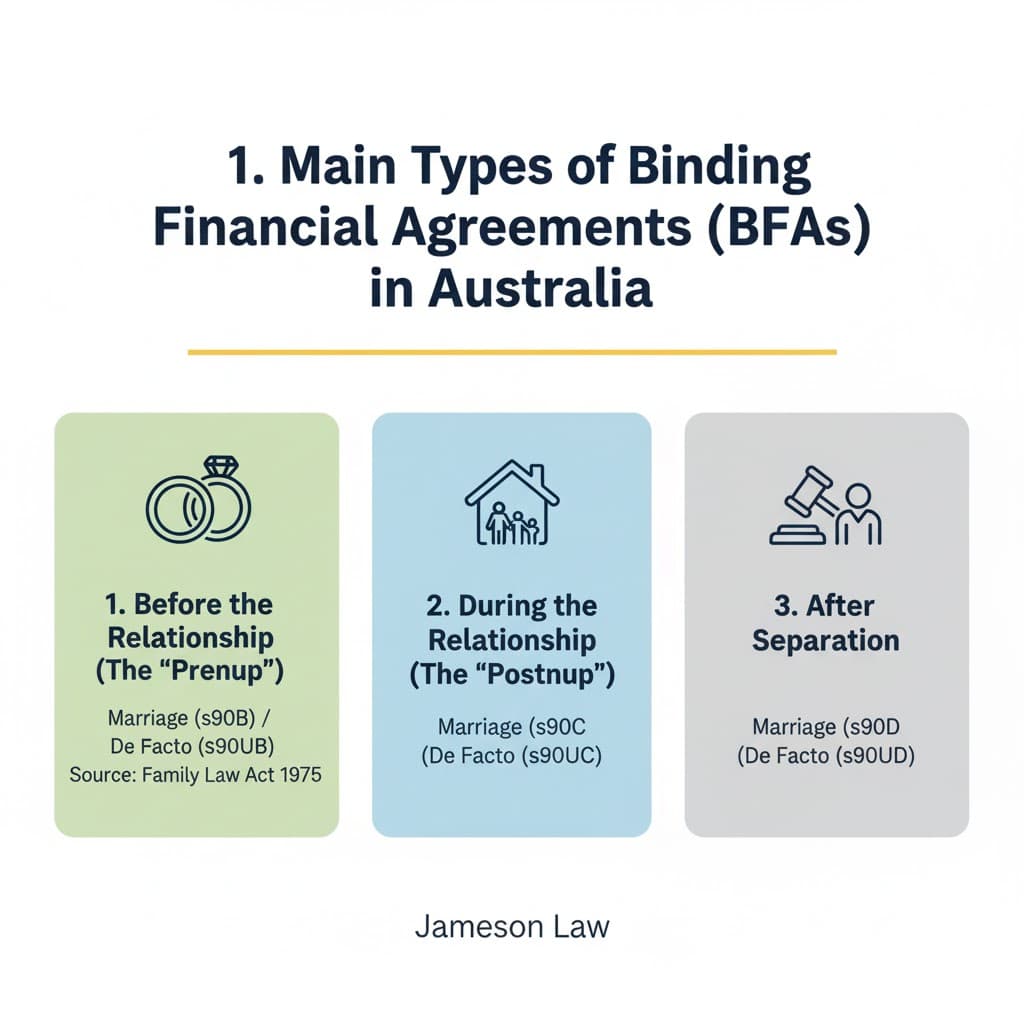

The 3 Main Types of Financial Agreements

1. Agreements Before the Relationship (the prenup)

- Marriages (s 90B): Parties contemplating marriage.

- De facto (s 90UB): Parties contemplating a de facto relationship.

Ideal if you bring significant assets, own a business, expect an inheritance, or need to protect children from a previous relationship.

2. Agreements During the Relationship (the postnup)

- Marriages (s 90C)

- De facto (s 90UC)

Useful when circumstances change, for example a large inheritance or major business growth.

3. Agreements After Separation or Divorce

- Marriages (s 90D) after separation or divorce.

- De facto (s 90UD) after a relationship breakdown.

Often a faster, more private way to finalise a property settlement than Consent Orders.

Why do I need a BFA?

- Certainty and control: You decide outcomes.

- Asset protection: Shield wealth, businesses and inheritances.

- Avoid court: Reduce stress, delay and cost.

- Privacy: Keep financial affairs confidential.

- Flexibility: Agree to tailored solutions a court may not order.

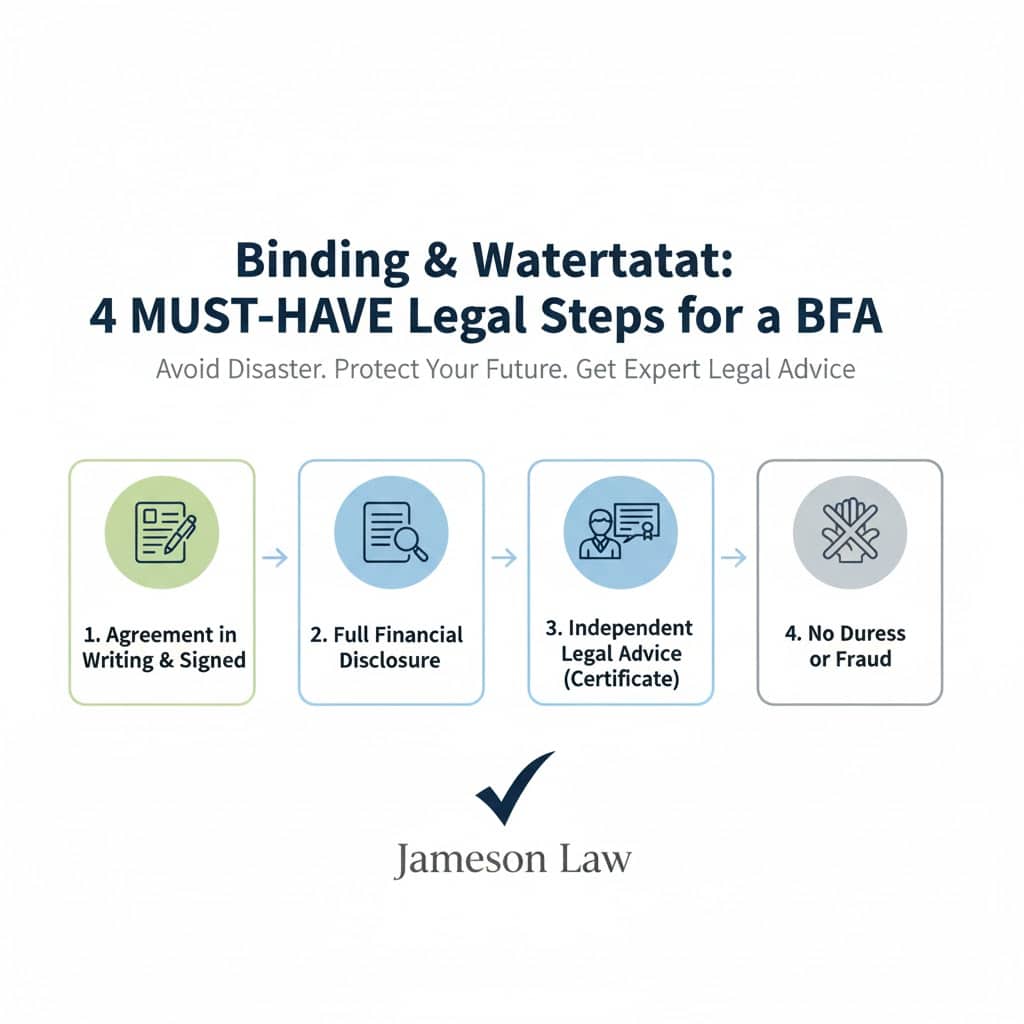

The binding requirements you cannot miss

A BFA is not binding unless:

- The agreement is in writing and signed by both parties.

- There is full and frank financial disclosure before signing.

- Each party receives independent legal advice from a separate lawyer about the effect and pros and cons of the agreement.

- Each party provides a signed Certificate of Independent Legal Advice from their lawyer.

When can a BFA be set aside?

The Family Court can set aside a BFA in limited situations:

- Fraud or non-disclosure such as hiding assets.

- Duress or unconscionable conduct such as pressure to sign.

- Failure to meet strict legal requirements including independent advice.

- Significant change in circumstances in rare cases, often involving care of a child.

Final thoughts

A BFA interacts with contract law, equity and the Family Law Act. Do not risk a DIY approach. If you need to protect assets or finalise a private settlement, our Binding Financial Agreement lawyers in Sydney and Parramatta can help. Contact us or call (02) 8806 0866.

Disclaimer

The above is general legal information and not legal advice. Get advice tailored to your matter. Our lawyers are based in Parramatta and Sydney.