When someone passes away in NSW, their estate must go through probate-a legal process that can feel overwhelming for families already dealing with grief. At Jameson Law, we’ve guided countless executors through NSW wills probate, and we know the process doesn’t have to be complicated.

This guide walks you through each step, from obtaining a Grant of Probate to distributing assets to beneficiaries. We’ll also show you how to sidestep the common pitfalls that delay estates and create unnecessary stress.

What is Probate in NSW and When You Actually Need It

Understanding a Grant of Probate

A Grant of Probate is a formal order from the NSW Supreme Court that confirms a will is valid and authorises the executor to distribute the estate according to the deceased’s wishes. Without it, banks will not release funds, real estate cannot be transferred, and beneficiaries remain stuck. The court’s role is not to judge whether the will is fair-it simply verifies the document is genuine and the executor has the legal standing to act. This distinction matters because probate is about compliance, not fairness.

When Probate Becomes Mandatory

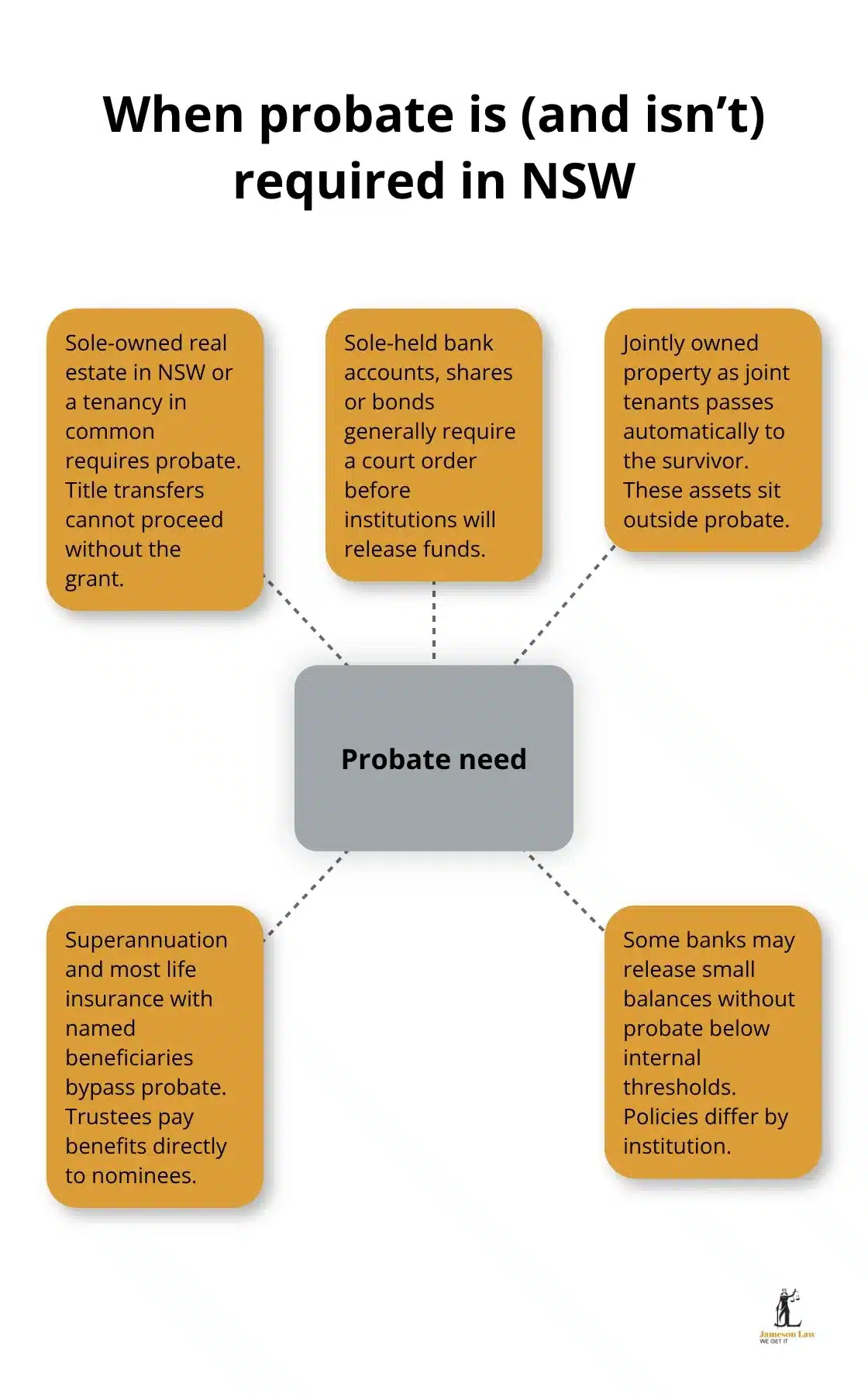

If the deceased owned real estate in NSW in their sole name or as a tenant in common, probate is non-negotiable. The same applies when assets like bank accounts, shares, or bonds are held solely in the deceased’s name and the institution holding them will not release funds without a court order. However, not every estate needs probate.

If the deceased owned property as joint tenants, those assets pass automatically to the surviving owner outside probate. Superannuation and most life insurance policies bypass probate entirely because they have named beneficiaries. Some financial institutions will release smaller amounts without probate, particularly where assets sit below certain thresholds, though this varies by bank and fund.

The NSW Supreme Court publishes processing times for probate applications, and delays typically occur when documentation is incomplete or the application contains errors. Getting the detail right upfront matters significantly.

How Intestacy Changes the Rules

When someone dies without a valid will, NSW intestacy rules determine who inherits and in what order. These are not suggestions-they are strict legal rules that apply regardless of what the deceased might have wanted. A spouse receives the estate or a portion of it depending on whether there are children. Adult children inherit if there is no spouse. Parents inherit only if there is no spouse or children. This rigid hierarchy often creates conflict because the legal outcome rarely matches family expectations.

Letters of Administration vs. Probate

If no will exists and no executor is named, a beneficiary must apply for Letters of Administration instead of a Grant of Probate. The process is similar but follows intestacy rules rather than the deceased’s wishes. The NSW Trustee and Guardian can administer intestate estates if no family member is willing or able to take on the role-contact them on 1300 723 267 or email clientestablishment@tag.nsw.gov.au.

The Six-Month Deadline That Matters

Probate applications must be lodged within six months of death, and if you apply later, the court requires an explanation via affidavit. Missing this deadline does not stop the process, but it creates unnecessary friction and requires additional documentation. Understanding whether your estate needs probate at all-and which application type to pursue-determines everything that follows in the administration process.

Getting Your Probate Application Lodged

The Five-Step Timeline to a Valid Grant

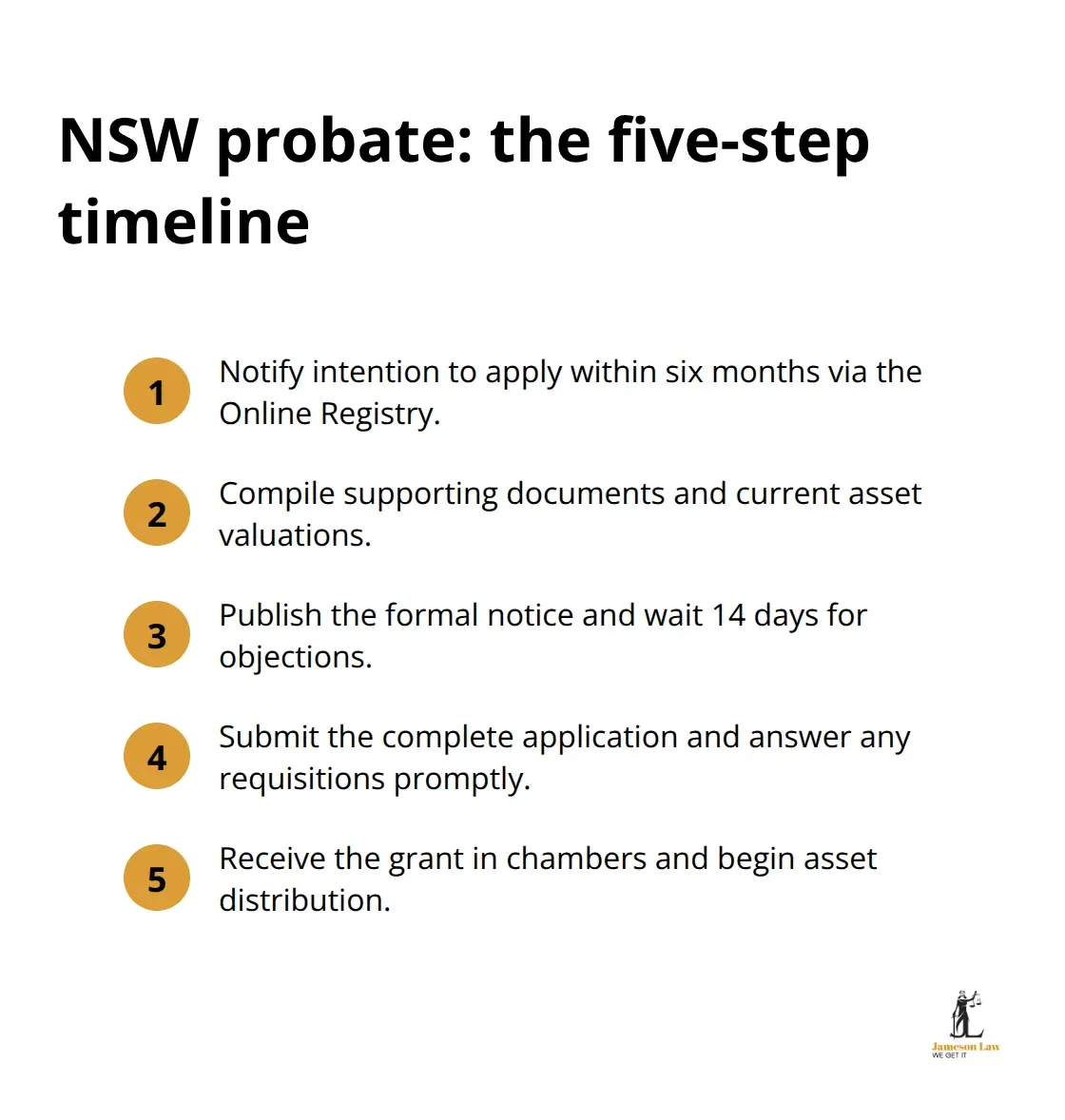

The path from death to a valid grant involves five distinct steps, and the NSW Supreme Court’s Online Registry has made the process considerably more navigable than it was a decade ago. You must notify the court of your intention to apply within six months of death, gather supporting documents, publish a formal notice, wait 14 days for creditor objections, then submit your complete application.

The court will issue requisitions if anything is missing or unclear, and you must respond promptly to avoid dismissal. Once the Registrar grants probate in chambers, no court appearance occurs, and you can proceed to asset distribution. The entire timeline typically spans 8 to 12 weeks for straightforward estates, though incomplete applications can stretch this to four or five months.

Compiling Your Asset Inventory and Understanding Fees

Before you lodge anything, compile a complete asset inventory because property cannot transfer until probate is granted. You must identify every bank account, share holding, real estate title, bond, and superannuation balance in the deceased’s sole name or as tenant in common. The gross value of NSW assets determines your filing fee on a tiered scale: estates under $100,000 pay nothing, those valued $100,000 to $250,000 pay $899, rising to higher amounts for estates exceeding $250,000 according to the NSW Supreme Court fee schedule. Two additional online notices cost $57 each. These fees change annually on 1 July, so verify the current year’s amounts on the NSW Supreme Court website before you calculate your total costs.

Gathering Documents and Preparing Forms

You must gather the original will and any codicils, the original death certificate, the deceased’s full name and last NSW address, the executor names, beneficiary names and entitlements, and witness contact details. Sign all forms in front of a prescribed witness such as a lawyer or Justice of the Peace, and the executor and witness must sign the left-hand margin of the will’s first page to identify the document. You will upload your Summons for Probate, Affidavit of Executor, Inventory of Property, death certificate, and original will through the NSW Supreme Court portal. If you apply after six months, you must draft an affidavit explaining the delay; the court rarely refuses late applications if the reason is reasonable.

Filing and Managing Court Requisitions

You must file the original will by post or in person with a covering letter containing your case number, and keep copies because the court will not return the original. If the court issues requisitions requesting additional information or corrections, you must respond within the specified timeframe or face dismissal of your application. The NSW Supreme Court publishes current processing times on its website, and delays typically occur when documentation is incomplete or the application contains errors. Getting the detail right upfront matters significantly because corrections and resubmissions extend the timeline considerably.

Moving Forward with Asset Distribution

Once probate is granted, you receive notification by email and can begin the asset distribution process. The next phase involves contacting asset holders (banks, superannuation trustees, and property registries), providing them with certified copies of the grant, and transferring funds and titles to beneficiaries according to the will’s terms. Understanding the specific requirements of each asset holder before you lodge your probate application helps you prepare for what comes next.

Common Challenges That Derail Probate Applications

Incomplete Applications and Court Requisitions

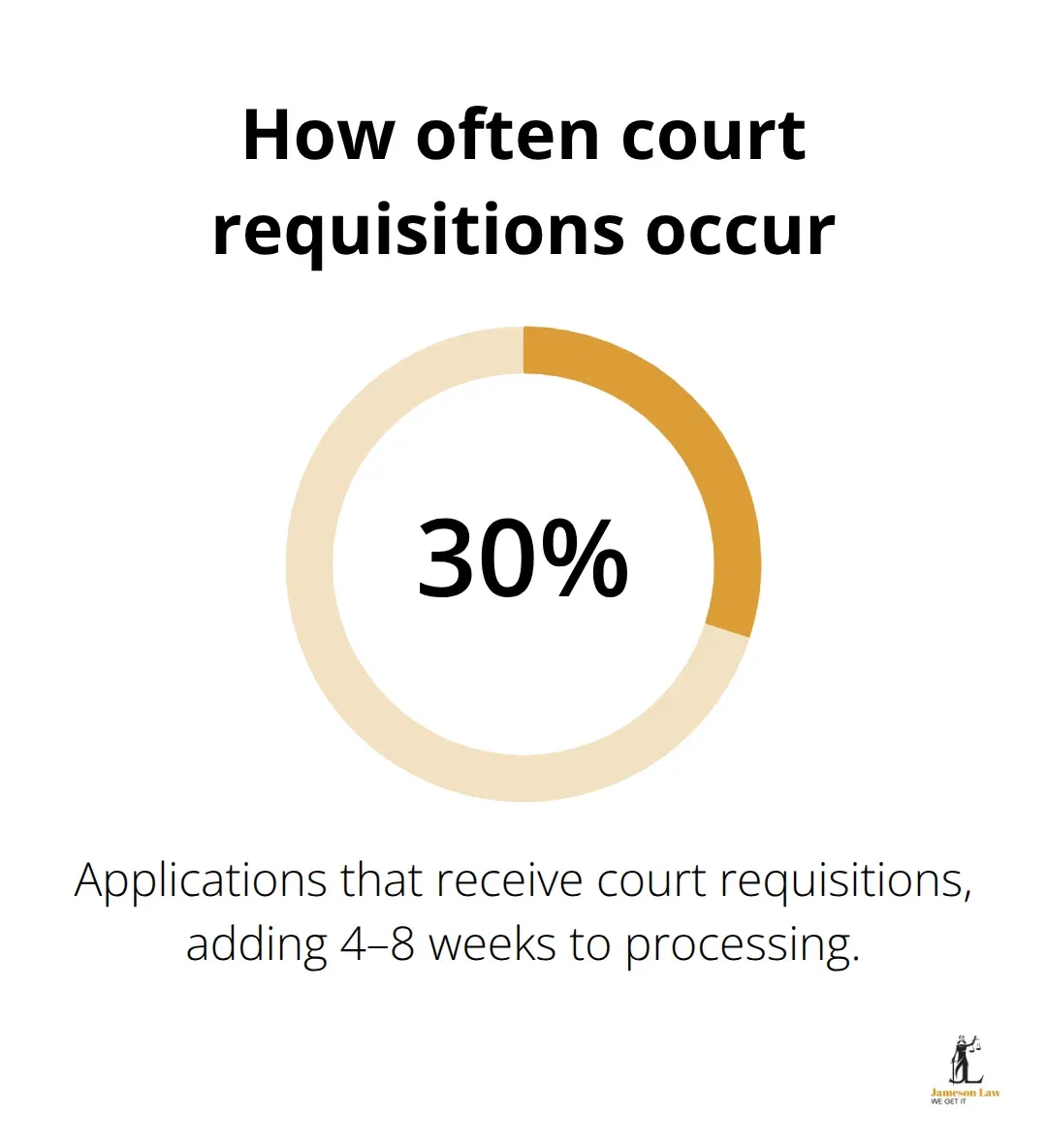

The most expensive mistake executors make is filing incomplete applications. The NSW Supreme Court issues requisitions on roughly 30% of probate applications, according to practitioners managing high volumes through the Online Registry, and each requisition adds four to eight weeks to your timeline. Missing documents, incorrect valuations, or unclear affidavits force you to resubmit, and the court will dismiss your application entirely if you fail to respond within the specified timeframe.

Executors lose months because they fail to gather the original will upfront or fail to obtain certified copies of the death certificate before lodging. The solution is straightforward: compile every document the NSW Supreme Court requires before you create your account on the Online Registry. This includes the original will, original death certificates, a complete asset inventory with current valuations, and witness contact details. If you apply after the six-month deadline, draft your delay affidavit first and have it reviewed by a lawyer or Justice of the Peace before submission, because clear explanations prevent additional court questions.

Ambiguous Wills and Beneficiary Disputes

Beneficiary disputes emerge when the will is ambiguous or when family members believe they deserve more than the legal document allows. The Succession Act 1995 (NSW) permits certain dependants to claim against the estate if they were not adequately provided for, but these claims must be filed within 12 months of death or the court will reject them. Once probate is granted and assets begin to distribute, reversing those distributions becomes expensive and complicated. Family conflict intensifies when multiple beneficiaries interpret the will’s language differently, and resolving these disputes through the courts consumes both time and money that could otherwise go to beneficiaries.

Estate Debt and Tax Obligations

Estate debt and tax obligations compound this pressure because executors are personally liable for unpaid liabilities. The ATO can pursue executors directly if the deceased’s tax returns were incomplete or if capital gains tax is owing on asset sales. Before you distribute a single dollar, identify all debts, obtain tax clearance from the Australian Taxation Office, and set aside funds to cover funeral expenses, probate fees, and outstanding liabilities. Obtain a tax position statement from an accountant before you distribute assets, because tax disputes can arise months or even years after probate is granted, and executors who have already distributed funds may need to recover money from beneficiaries to settle those obligations. The executor’s role is not to rush distribution; it is to protect the estate and beneficiaries from hidden liabilities that surface later.

Final Thoughts

NSW wills probate demands precision from the moment the deceased passes away, and the six-month deadline, tiered fee structure, and court requisitions leave no room for careless mistakes. Executors who rush through asset inventories or file incomplete applications lose months to court delays and requisition requests. Those who ignore tax clearance requirements expose themselves to personal liability long after probate is granted, and beneficiary disputes that could have been prevented with clear communication often consume time and money that should reach the estate’s beneficiaries.

We at Jameson Law have guided executors through estates delayed by missing documents, beneficiary conflicts, and unexpected tax liabilities. Professional legal guidance identifies missing documents before submission, ensures your affidavits are clear and complete, and prevents the costly delays that plague incomplete applications. This upfront investment protects your estate and shields you from personal liability that surfaces months or years after probate is granted.

If the deceased has recently passed and you are the executor, start by gathering the original will, death certificate, and a complete asset inventory. Verify the six-month deadline from the date of death and confirm whether probate is actually required for the assets involved. If you need guidance on NSW wills probate, tax obligations, or beneficiary entitlements, contact Jameson Law for expert advice tailored to your estate’s specific circumstances.