Being named as an executor is a significant responsibility. You’re tasked with managing someone’s estate, settling debts, and distributing assets to beneficiaries-all while navigating complex legal and tax requirements.

At Jameson Law, we’ve seen firsthand how executor duties in Australia can overwhelm even the most organised people. This guide walks you through your obligations, common pitfalls, and practical strategies to handle the role effectively.

What Executor Duties Actually Involve

Your Core Responsibilities as Executor

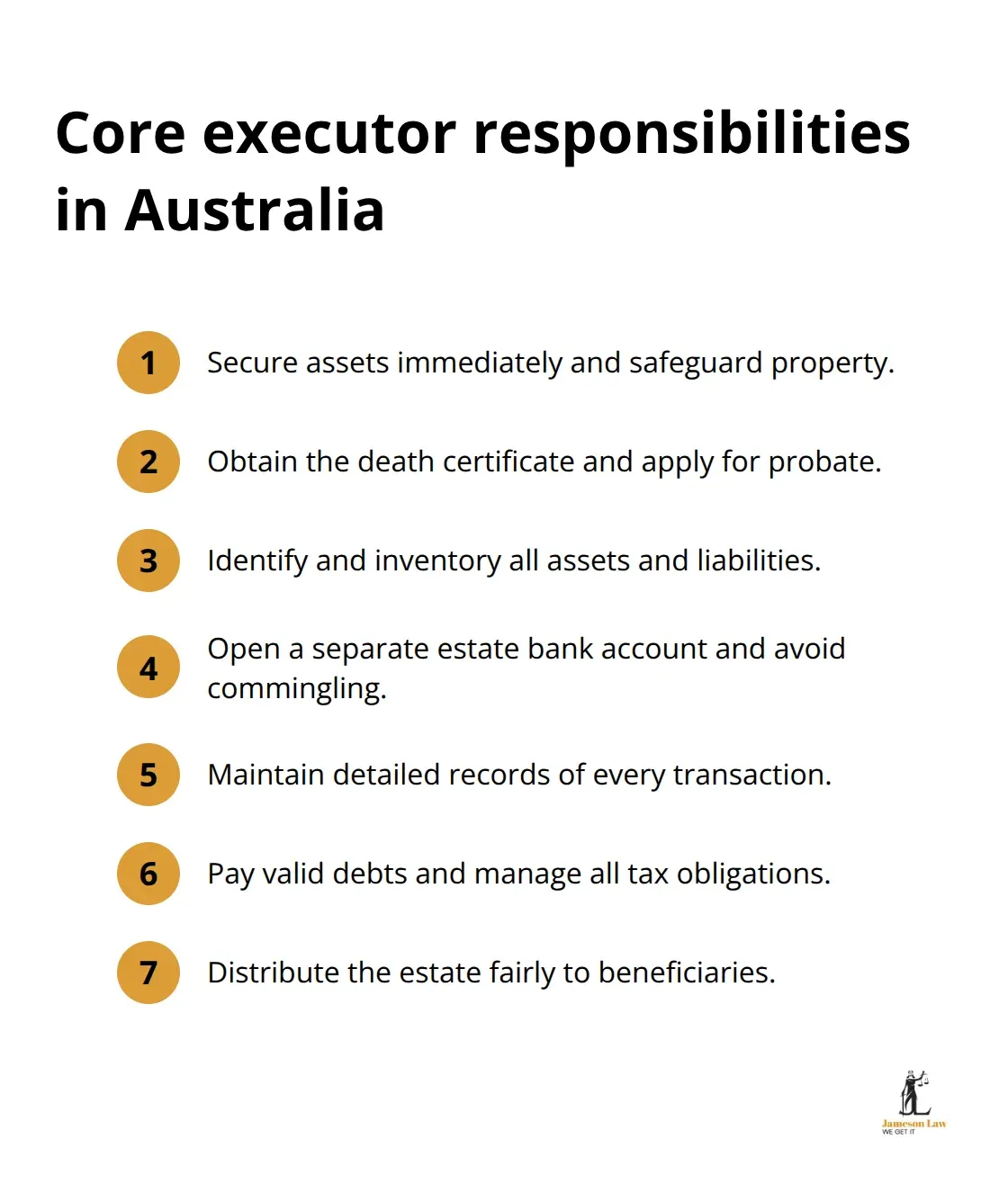

An executor’s role is fundamentally about managing someone’s financial and legal affairs after they die. You locate the will, obtain probate, identify all assets and liabilities, pay debts, and distribute what remains to beneficiaries. This isn’t ceremonial work-it’s hands-on administration that requires attention to detail and strict adherence to legal obligations. Under Australian law, you act as a fiduciary, meaning you must prioritise the best interests of the estate and its beneficiaries, not yourself. This fiduciary duty creates personal liability if you breach it or fail to pay tax obligations. The role typically takes 6–12 months for straightforward estates, though complex situations with multiple properties, business interests, or interstate assets extend significantly longer. Estate administration firms report that executors spend an average of 100–150 hours managing a moderate estate. Your core responsibilities include securing assets immediately, obtaining death certificates, notifying beneficiaries, gathering financial records, arranging probate, managing an estate bank account separate from your personal funds, and ultimately preparing detailed accounts showing every transaction before distribution occurs.

Executors vs. Administrators: Understanding the Difference

The distinction between an executor and an administrator affects how you obtain authority to act. An executor is named in the will and applies for a grant of probate to validate their appointment and authority. An administrator steps in when there’s no will or no named executor, and they apply to the court for letters of administration instead-the process is similar but the legal pathway differs. Regardless of which applies to you, the duties remain essentially identical: you inventory assets, pay liabilities, manage tax obligations, and distribute fairly. Both roles carry the same fiduciary responsibilities and personal liability exposure.

The Six-Month Rule and Asset Distribution

The six-month rule is critical in Australian administration. While you’re not legally required to distribute everything within six months, avoiding distribution for at least that period protects you against late claims from beneficiaries who weren’t initially disclosed. Waiting the full 12 months provides even stronger protection. If beneficiaries pressure you for early distribution, obtain written consent from all of them before proceeding-this shifts responsibility onto them if problems emerge later. This written protection becomes invaluable if disputes arise after distribution.

Managing Tax Obligations and Personal Liability

Tax obligations demand particular attention because unpaid estate taxes create direct personal liability for you as executor. You must lodge outstanding income tax returns for the deceased, manage capital gains tax on asset sales, and confirm all superannuation and insurance proceeds have been correctly identified and distributed according to policy terms, not the will. These tax responsibilities often catch executors off guard, yet they represent one of the most significant areas of personal exposure. Understanding what you owe-and when-separates smooth administrations from problematic ones that drag on for years.

What Derails Estate Administration

Asset and Debt Mismanagement

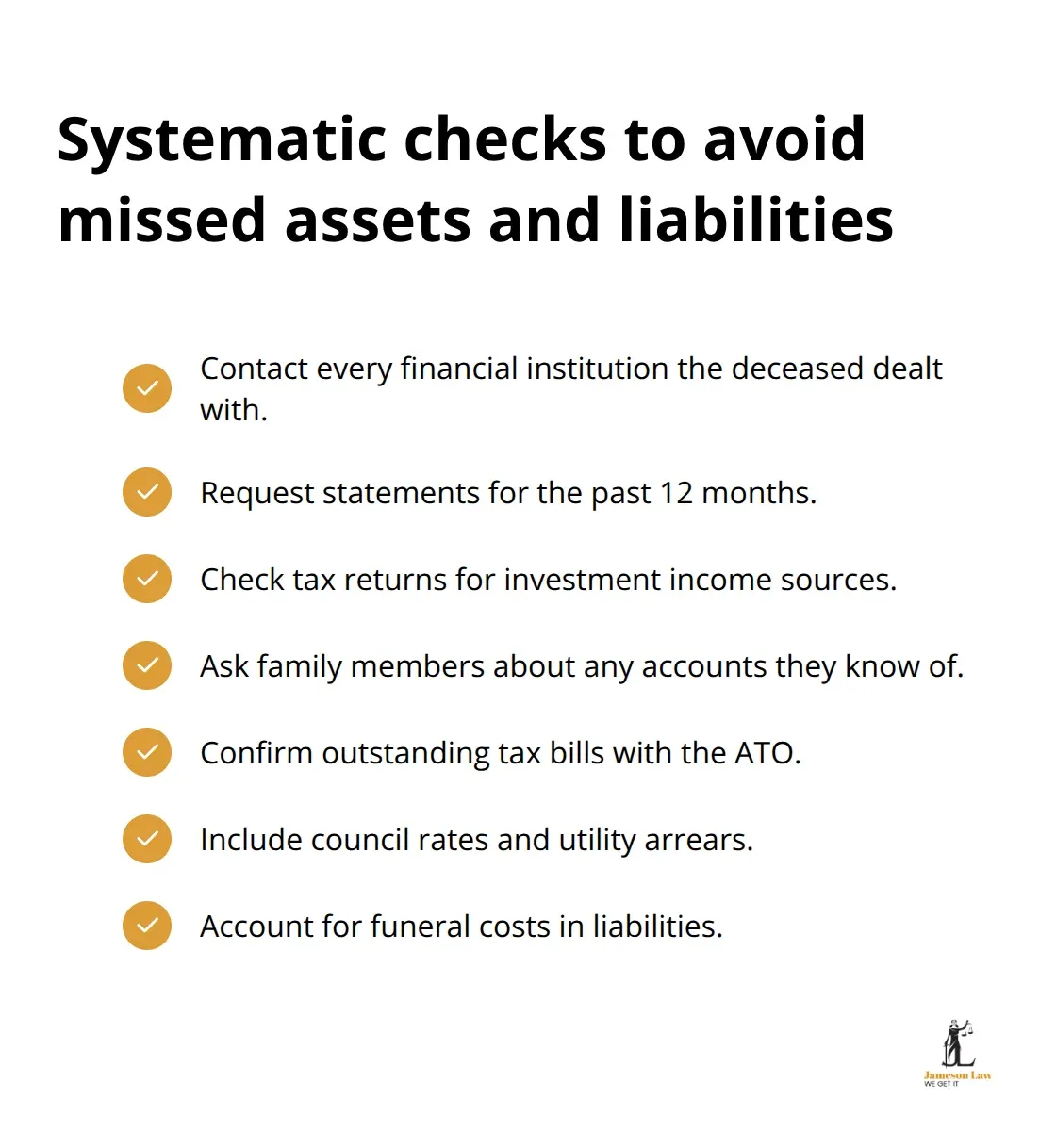

Navigate the complexities of estate administration with ease through this comprehensive 10-step guide to managing deceased estates. Estate administration fails most often when executors underestimate the sheer volume of financial and legal complexity involved. Asset identification alone trips up most executors because people accumulate holdings across multiple institutions over decades. A deceased person might have bank accounts at three different banks, shares held in their own name plus through a managed fund, a property in their name and another held jointly, superannuation with a death benefit nomination, life insurance policies some beneficiaries don’t know about, and digital assets scattered across email accounts and cryptocurrency exchanges. Missing even one asset creates problems later when beneficiaries discover you failed to account for something.

The practical fix is systematic: contact every financial institution the deceased dealt with, request statements for the past 12 months, check tax returns for investment income sources, and ask family members directly about any accounts they know of. Many executors also miss liabilities because they focus only on obvious debts like mortgages and credit cards. Outstanding tax bills, council rates, utility arrears, and funeral costs all rank as legitimate liabilities that reduce what beneficiaries receive. One executor failed to discover a $45,000 tax debt that emerged six months after distribution, creating personal liability that took years to resolve.

Beneficiary Disputes and Communication Failures

Beneficiary disputes escalate quickly when communication breaks down or expectations aren’t managed clearly. Some beneficiaries expect faster distributions than the law allows, others challenge the fairness of specific bequests, and some dispute whether certain assets should form part of the estate at all. The solution is ruthless transparency from day one: notify beneficiaries of your appointment immediately, provide a copy of the will, outline the administration timeline clearly, and commit to regular updates on progress.

If you anticipate disputes-particularly if family dynamics were already tense-contact a solicitor before distribution occurs rather than after conflict erupts. Early legal intervention prevents escalation and protects your position as executor. Mediation often resolves disagreements without litigation, saving time and estate funds that would otherwise go to legal costs.

Tax Obligations and Personal Liability

Tax obligations create the highest personal liability exposure because many executors simply don’t understand what they’re responsible for. You must lodge outstanding income tax returns for the deceased with the Australian Taxation Office, manage capital gains tax when assets are sold, confirm superannuation and life insurance proceeds are distributed according to policy terms (not the will), and identify any estate duty obligations. These aren’t optional tasks you can delegate without oversight.

Engage an accountant experienced in estate taxation early, not after problems arise, because tax positions taken during administration become difficult to correct later. The Australian Taxation Office expects executors to act with competence in these matters, and mistakes attract penalties and interest that compound over time. Understanding what you owe-and when-separates smooth administrations from problematic ones that drag on for years and expose you to significant financial risk.

How to Protect Yourself as Executor

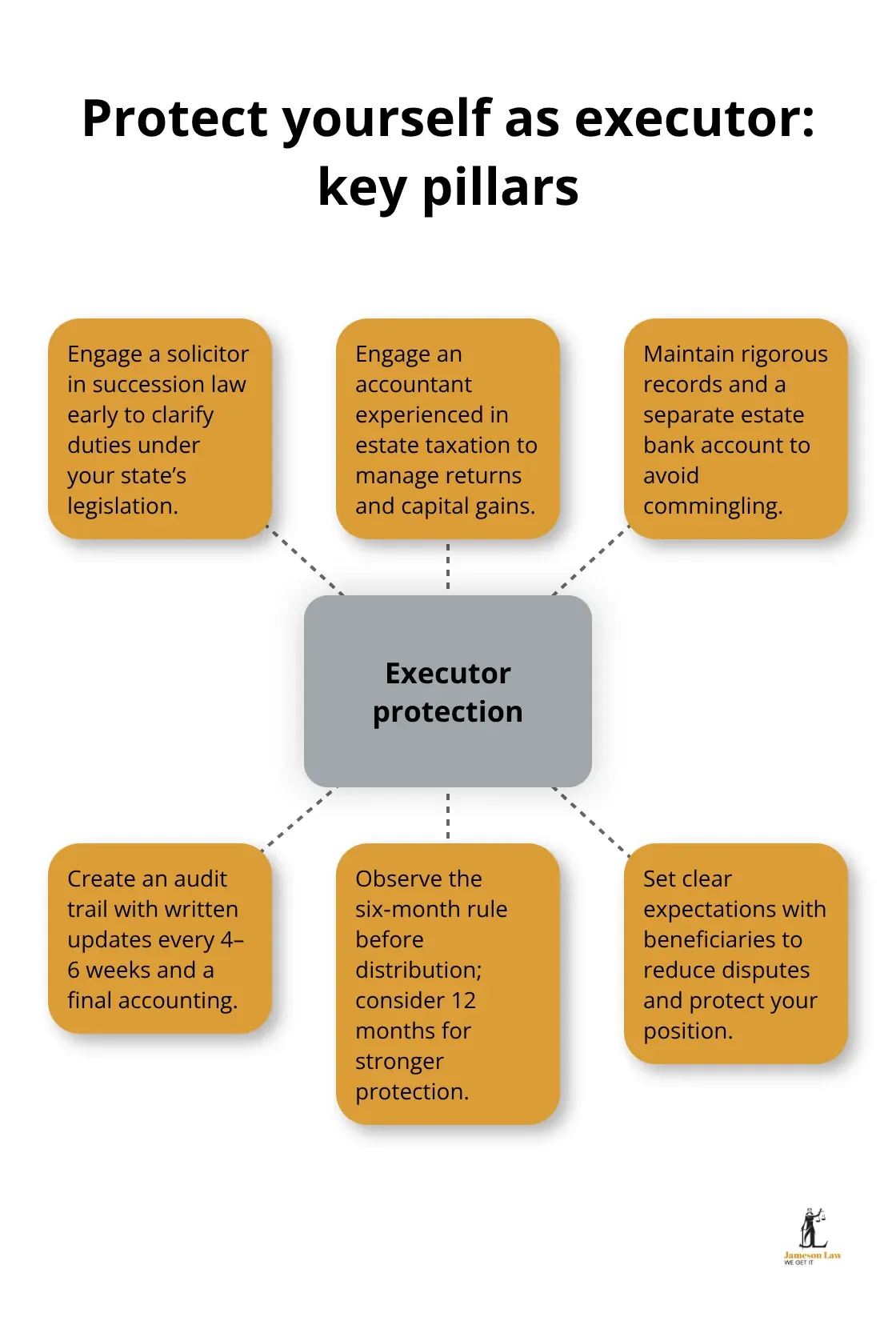

Engage Professional Support Early

Protecting yourself from liability starts with recognising that executor duties demand professional support you cannot reasonably handle alone. Executors who attempt to manage complex estates without legal guidance often discover months later that they’ve made decisions exposing them to significant personal liability. A solicitor experienced in succession law should be engaged immediately to clarify your obligations under your state’s legislation, which varies considerably across Australia. In Victoria, the Administration and Probate Act 1958 governs your duties; in New South Wales, the Succession Act 1995 applies; Queensland operates under the Succession Act 1988. These differences matter because timeframes, claim periods, and distribution rules differ by jurisdiction. An accountant experienced in estate taxation should be engaged simultaneously because tax obligations create the highest personal exposure. The Australian Taxation Office expects you to lodge outstanding income tax returns for the deceased, manage capital gains tax on asset sales, and correctly identify superannuation and insurance proceeds distributed according to policy terms rather than the will.

Early professional engagement costs less than fixing mistakes made during administration. A solicitor can review your asset and liability inventory before you submit probate, identify potential tax issues, and advise whether beneficiaries might challenge distributions under family provision laws. This preventive approach costs several hundred to a few thousand dollars but prevents liability claims that cost tens of thousands to defend.

Maintain Rigorous Documentation Standards

Documentation discipline separates executors who complete administration smoothly from those who face disputes years later. Proper record-keeping helps prevent disputes, protects the executor from liability, and ensures the efficient administration of the estate. You must record every financial transaction related to the estate in detail: what was paid, when, to whom, and why. Open a separate estate bank account immediately and deposit all estate funds into that account-never mix personal and estate money because commingling funds can constitute fraud with civil or criminal consequences. Maintain physical files organised by category (assets, liabilities, probate documents, correspondence with beneficiaries, tax records, and distribution calculations). Digital records matter equally; photograph or scan all original documents, store copies securely, and create a master spreadsheet tracking every asset from identification through valuation to final distribution.

Create an Audit Trail Through Written Communication

When you communicate with beneficiaries, document those conversations in writing through email rather than phone calls, creating an audit trail that protects you if disputes arise later. Provide beneficiaries with an initial notification letter outlining your appointment and timeline, progress updates every 4–6 weeks during administration, and a final accounting statement before distribution showing every expense and transaction. This transparency reduces disputes significantly because beneficiaries understand exactly how you’ve managed their inheritance. Courts expect you to maintain this level of documentation as evidence of proper administration; without it, you have no defence if a beneficiary later claims misconduct.

Final Thoughts

Executor duties in Australia demand more than good intentions-you manage someone’s financial legacy while navigating probate requirements, tax obligations, and beneficiary expectations simultaneously. The core responsibilities remain consistent across states: secure assets immediately, obtain probate, identify all liabilities, manage tax returns, and distribute fairly according to the will. Yet the legal framework differs between Victoria, New South Wales, Queensland, and other jurisdictions, making professional guidance essential rather than optional.

Executors who complete administration smoothly share common practices that protect them from liability and disputes. They document every transaction meticulously, maintain separate estate bank accounts, communicate transparently with beneficiaries through written updates, and engage professional support early rather than after problems emerge. They understand that the six-month rule protects them against late claims, that tax obligations create personal liability, and that beneficiary disputes escalate fastest when communication breaks down.

Straightforward estates with minimal assets and no disputes may proceed with careful self-management and basic professional review, while complex estates involving multiple properties, business interests, interstate assets, or anticipated family provision claims require immediate legal engagement. We at Jameson Law specialise in wills and estates administration across Australia and can guide you through your specific obligations based on your state’s legislation. Contact us to discuss your situation and determine what professional support makes sense for your circumstances.