Commercial contract law forms the backbone of business transactions worldwide. It governs the agreements that keep commerce flowing smoothly and protects the interests of all parties involved.

At Jameson Law, we’ve seen first-hand how understanding these legal principles can make or break a business deal. This post will break down the key elements, types, and common issues in commercial contracts to help you navigate this complex field with confidence.

Operating in NSW or greater Sydney? Our commercial contract lawyers in Sydney can review, draft and negotiate agreements tailored to your industry and risk profile, so you sign with certainty.

What Makes a Commercial Contract Valid?

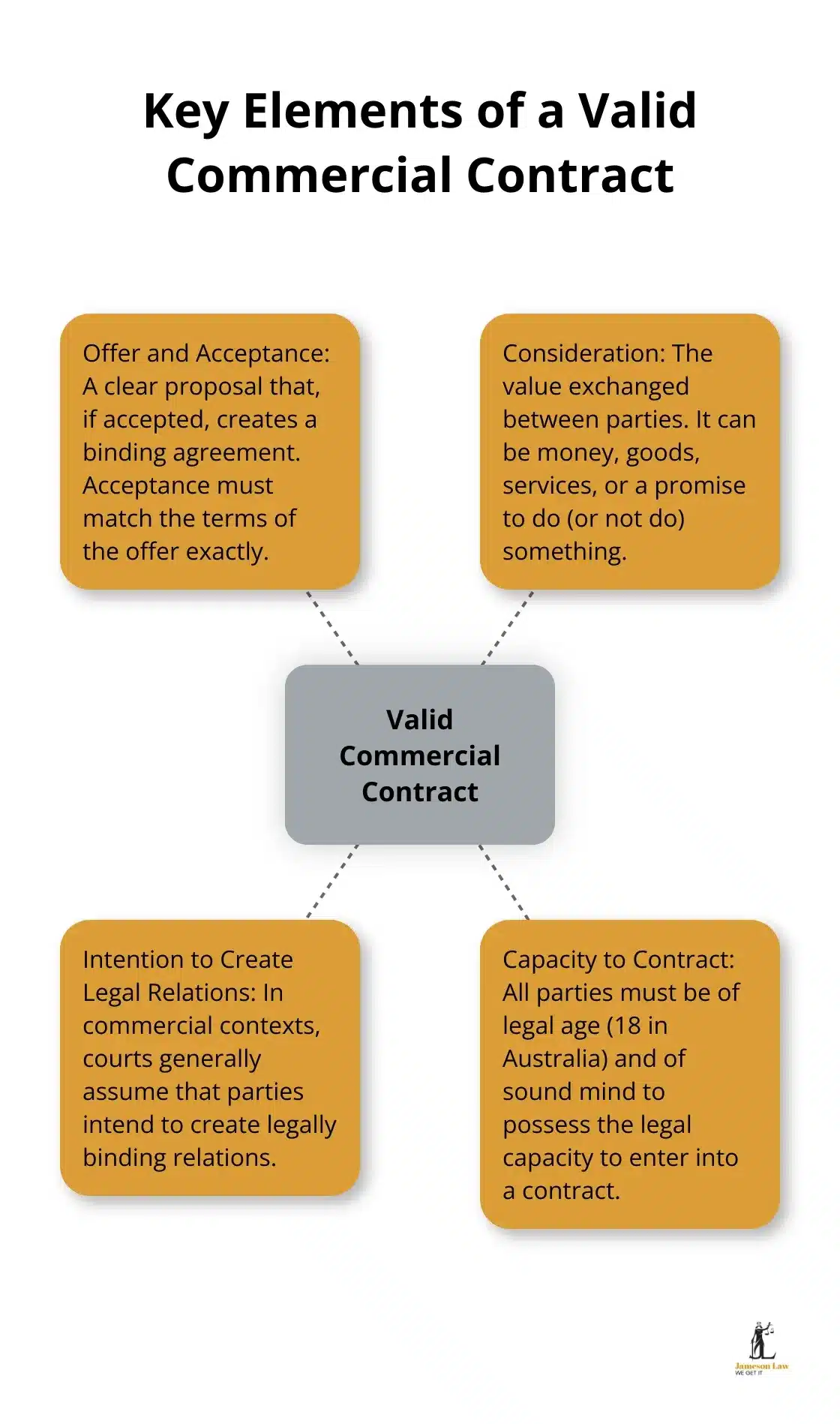

Commercial contracts form the foundation of business transactions. These agreements rely on four key elements that determine their validity and enforceability. Understanding these elements is essential for anyone involved in business dealings.

The Power of Offer and Acceptance

A contract begins with an offer. This isn’t a casual suggestion, but a clear proposal that, if accepted, creates a binding agreement. In Australia, the offer must be specific and communicated to the other party. For instance, a company offering to sell 1000 widgets at $10 each makes a clear offer.

Acceptance must be unequivocal and match the terms of the offer exactly. Any variation becomes a counter-offer. Many businesses believe they have a deal, only to discover their “acceptance” changed the terms, thus voiding the original offer.

Tip for NSW suppliers: lock in how acceptance must be communicated (e.g., “by signed PO emailed to …”). For standard-form documents, also sanity-check unfair terms under the ACCC’s unfair contract terms guidance.

The Role of Consideration

Consideration is the value exchanged between parties. It doesn’t have to be money – it can be goods, services, or even a promise to do (or not do) something. Without consideration, you don’t have a contract; you have a gift.

An example of non-monetary consideration might involve one party offering goods to the other in exchange for a service.

Intention to Create Legal Relations

In commercial contexts, courts generally assume that parties intend to create legally binding relations. However, clear evidence to the contrary can rebut this assumption.

Informal agreements between friends sometimes turn into legal disputes because one party didn’t realise they were entering a binding contract. Always clarify your intentions when making business agreements.

Capacity to Contract

Not everyone can enter into a valid contract. All parties must be of legal age (18 in Australia) and of sound mind to possess the legal capacity to enter into a contract.

It’s important to verify who you’re dealing with. Contracts can collapse because one party didn’t have the authority to sign on behalf of their company. Always check the other party’s capacity to enter into the agreement.

Authority check: for companies, confirm the signatory’s authority (e.g., director or properly delegated officer). You can quickly verify company details via ASIC.

Understanding these elements is just the beginning. Each contract is unique and can have complex implications. That’s why professional legal advice before signing on the dotted line is invaluable. Legal experts can review and draft commercial contracts to ensure they’re watertight and protect your interests.

Now that we’ve covered the key elements of a valid commercial contract, let’s explore the different types of commercial contracts you might encounter in the business world.

What Are the Main Types of Commercial Contracts?

Commercial contracts come in various forms, each tailored to specific business needs. Let’s explore some of the most common types of commercial contracts you’re likely to encounter in the Australian business landscape.

Sale of Goods Contracts

Sale of goods contracts form the foundation of many businesses. These agreements outline the terms under which one party sells goods to another. In Australia, Sale of Goods Acts govern these contracts, applying when the seller agrees to transfer, or actually transfers, the ownership of specific goods to the buyer in exchange for money.

A critical aspect of these contracts is the clear description of the goods. Disputes often arise when product specifications lack clarity. For example, a contract for “100 laptops” without detailing the brand, model, or specifications can lead to disagreements.

Another key element is the passing of risk. This determines when the responsibility for the goods transfers from the seller to the buyer. According to the Australian Consumer Law, the Sale of Goods Act refers to a collection of state-based laws that set out the rights and duties of buyers and sellers when selling goods.

NSW reference: see the Sale of Goods Act 1923 (NSW) and consumer guarantees under the ACL via ACCC.

Service Agreements

Service agreements prevail in our service-oriented economy. These contracts define the scope of services, deliverables, and performance metrics.

One common pitfall is the lack of clear Key Performance Indicators (KPIs). Without measurable KPIs, it’s challenging to determine if a service provider has met their obligations. For instance, an IT support contract should specify response times for different types of issues.

Payment terms are another essential element. Clear outlines of payment schedules, late payment penalties, and any conditions for withholding payment can prevent future disputes.

Practical add-ons: build in change-control (how scope changes are approved and priced) and an escalation ladder for service failures before termination rights kick in.

Distribution Agreements

Distribution agreements play a vital role for businesses looking to expand their market reach. These contracts outline the terms under which a distributor sells a manufacturer’s products.

Exclusivity often becomes a key negotiation point in these agreements. Vague exclusivity clauses can lead to disputes. For example, a clause granting “exclusive rights in the Sydney area” could be interpreted differently by each party.

Setting realistic sales targets is another important aspect. Overly ambitious targets can strain the relationship between manufacturer and distributor. Including clauses for reviewing and adjusting targets based on market conditions (e.g., economic downturns or supply chain disruptions) can help maintain a healthy business relation.

Franchise Agreements

Franchise agreements are complex and highly regulated in Australia. These contracts must comply with the Franchising Code of Conduct, which requires franchisors to include details in their disclosure document of whether the franchisee will be required to undertake certain activities.

One critical element is the franchisor’s obligations regarding training and support. Franchisees often struggle when these obligations lack clear definition. For instance, a clause promising “adequate training” is too vague and can lead to disputes.

Territory rights represent another crucial aspect. Clear definitions of the franchisee’s territory, including any online sales rights, can prevent future conflicts.

Good to know: you can review the Franchising Code of Conduct (ACCC) for disclosure, cooling-off and dispute rules.

Each of these contract types has its nuances and potential pitfalls. While this overview provides a starting point, the complexities of commercial contracts often require expert guidance. Professional legal advice can help ensure these agreements protect your interests and comply with Australian law.

As we move forward, it’s important to understand that even well-drafted contracts can face challenges. Let’s examine some common issues that arise in commercial contract law and how they can impact your business.

Navigating Common Pitfalls in Commercial Contracts

The Costly Consequences of Contract Breaches

Contract breaches represent one of the most frequent issues in commercial law. A breach occurs when a party fails to fulfil their contractual obligations, ranging from late payments to substandard service delivery.

In Australia, the consequences of a breach can be severe. Stress-related absenteeism and ‘presenteeism’ are costing Australian employers $10.11 billion annually. These costs extend beyond financial losses, often damaging reputations and business relationships.

To reduce this risk, include clear performance metrics and milestones in your contracts. For instance, instead of stating “timely delivery,” specify “delivery within 14 business days of order confirmation.” This precision leaves little room for misinterpretation.

The Danger of Misrepresentation in Contracts

Misrepresentation poses another significant issue in commercial contracts. This occurs when one party provides false information that induces the other party to enter into the contract.

A landmark case in this area is Accounting Systems 2000 (Developments) Pty Ltd v CCH Australia Limited [1993] FCA 306. The prohibitions on specific misrepresentations are clear and individuals and corporations can readily identify the representations which are prohibited.

To protect yourself, verify key information before signing a contract. If you rely on specific representations, ensure they appear explicitly in the contract. This approach can prevent disputes and provide a clear basis for action if misrepresentation occurs.

Unfair Contract Terms: A Growing Concern

Unfair contract terms have become a significant focus in Australian contract law. The Australian Competition and Consumer Commission (ACCC) has intensified its efforts to address these, particularly in standard form contracts used with small businesses.

In the 2018-19 financial year, the ACCC reviewed over 1,000 standard form contracts and identified 1,500 potentially unfair terms. Common issues include unilateral variation clauses and excessive cancellation fees.

Update: penalties for unfair terms increased in late 2023. Review standard templates against the ACCC’s UCT guidance and consider a Sydney-focused refresh with our contract solicitors.

Termination and Remedies: Getting It Right

Termination clauses and remedies form critical components of any commercial contract. They outline how parties can end the agreement and what happens if things go wrong.

A common mistake involves failing to specify clear termination triggers. Vague clauses like “material breach” can lead to disputes. Instead, list specific events that constitute grounds for termination.

As for remedies, don’t limit yourself to monetary compensation. Try to include provisions for specific performance or injunctive relief where appropriate. This approach can provide more flexibility in resolving disputes.

Quick pre-signing checks:

![]() Who can sign? (authority verified)

Who can sign? (authority verified)

![]() Scope, KPIs and service levels are measurable

Scope, KPIs and service levels are measurable

![]() Price adjustments/change control defined

Price adjustments/change control defined

![]() Termination triggers & remedies are precise

Termination triggers & remedies are precise

![]() UCT and ACL compliance double-checked

UCT and ACL compliance double-checked

Navigating these common pitfalls in commercial contracts requires expertise and attention to detail. While this overview provides a starting point, each situation is unique. Professional legal advice (such as that provided by Jameson Law) can help ensure your contracts are robust, fair, and protect your interests in the complex world of Australian commercial law.

Final Thoughts

Commercial contract law shapes the foundation of business transactions in Australia. Understanding its complexities protects interests and ensures smooth operations. Knowledge in this area saves businesses significant time, money, and stress.

Professional legal advice becomes invaluable when navigating the nuances of contract drafting, negotiation, and dispute resolution. Experts can spot potential issues before they become problems, ensuring contracts are robust, fair, and compliant with Australian law. They provide current, relevant advice based on the latest developments in commercial contract law.

Jameson Law offers assistance in drafting, reviewing, and negotiating contracts that protect your interests. Our team of experienced lawyers (who stay up-to-date with Australian commercial law) can help you create contracts that build trust, manage expectations, and lay the groundwork for successful business relationships.

Need a commercial contract lawyer in Sydney? Speak to Jameson Law on 1800 883 681 or book an appointment here. We’ll help you sign smarter and reduce risk from day one.