Buying a property involves multiple stages, and understanding each one helps you avoid costly mistakes. The conveyancing settlement process can feel overwhelming without proper guidance, but breaking it down into clear steps makes it manageable.

We at Jameson Law have guided hundreds of clients through this journey. This guide walks you through every phase, from your initial offer through to the moment you receive the keys.

Getting the Property Offer Right

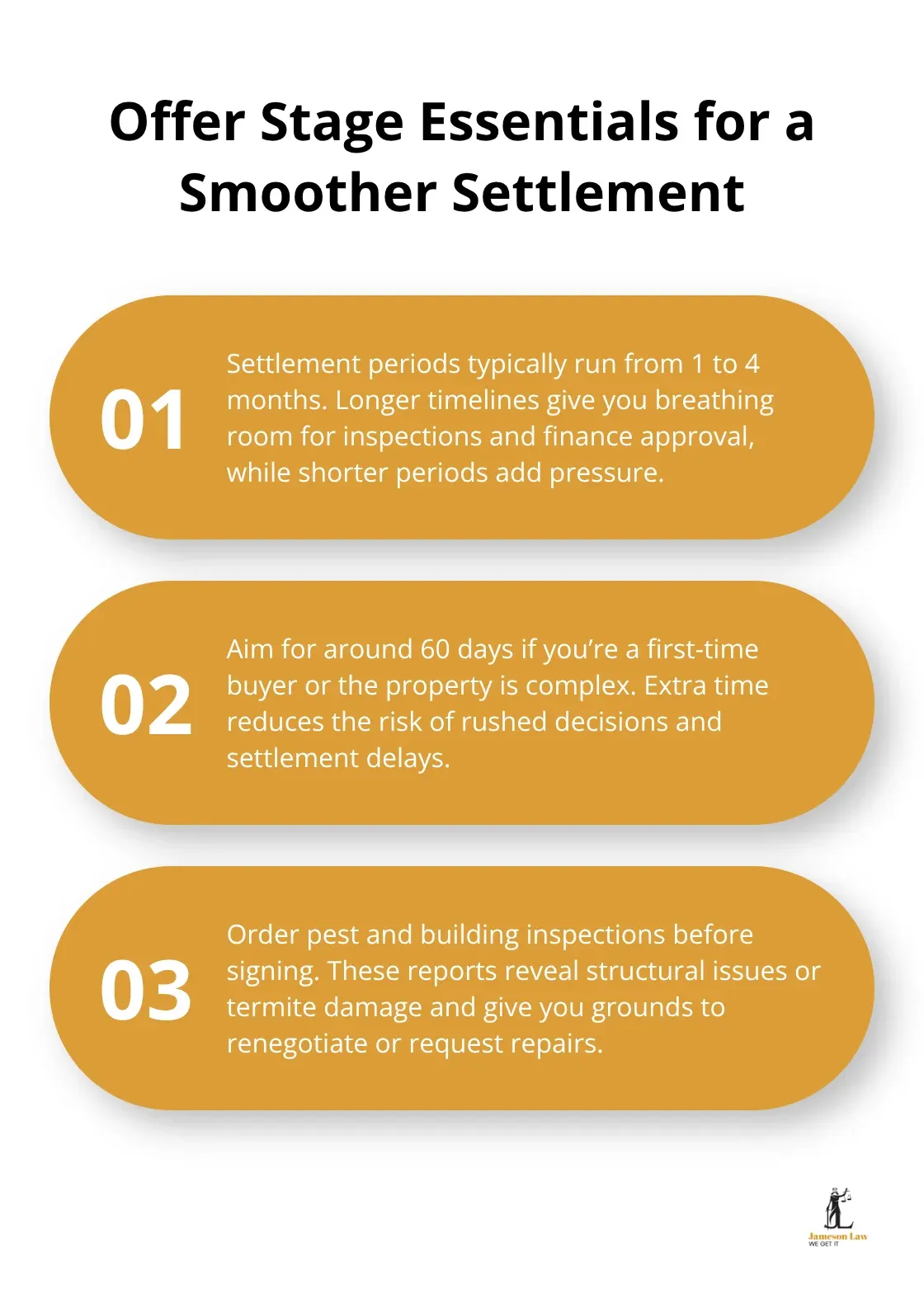

Negotiate Settlement Terms and Inspect Early

The first decision that matters happens before you exchange contracts. The contract of sale specifies the settlement period, which typically runs from 30 to 90 days. Longer periods give you breathing room for inspections and finance approval.

Before you sign anything, order a pest and building inspection. These reports reveal structural issues or defects that could derail your finance.

Use the Cooling-Off Period Strategically

Once you exchange contracts, you enter the cooling-off period (usually 5 business days). Use this time to complete your due diligence. Order a title search immediately to check for easements or caveats.

Securing Your Finance and Managing Costs

Start Your Mortgage Application Immediately

Start your mortgage application immediately after exchanging contracts. Lenders typically need 2 to 4 weeks to process applications. Incomplete applications stall in verification loops.

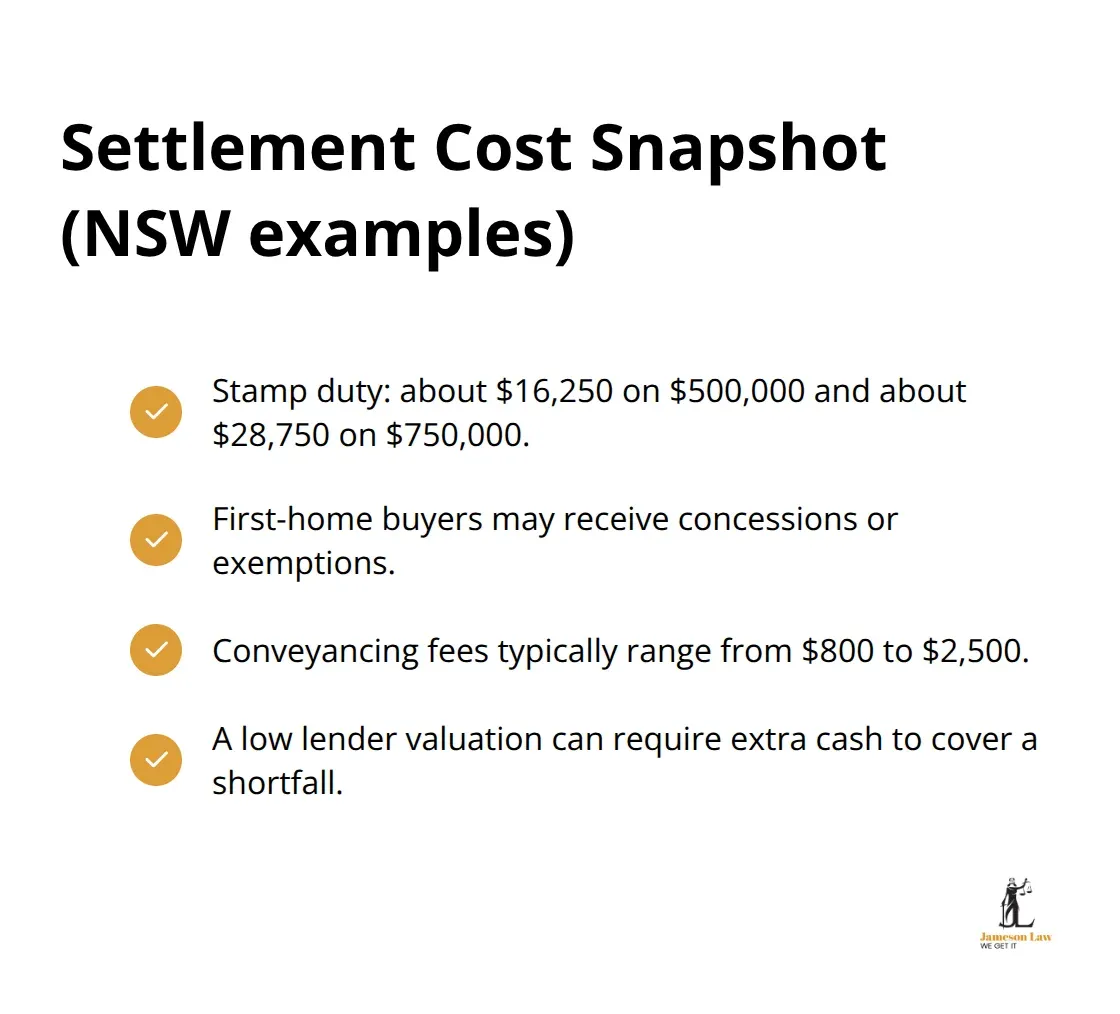

Understand Your Settlement Costs

Stamp duty (transfer duty) represents the largest expense. First-home buyers may qualify for the First Home Buyers Assistance Scheme. Conveyancing fees typically range from $1,200 to $2,500.

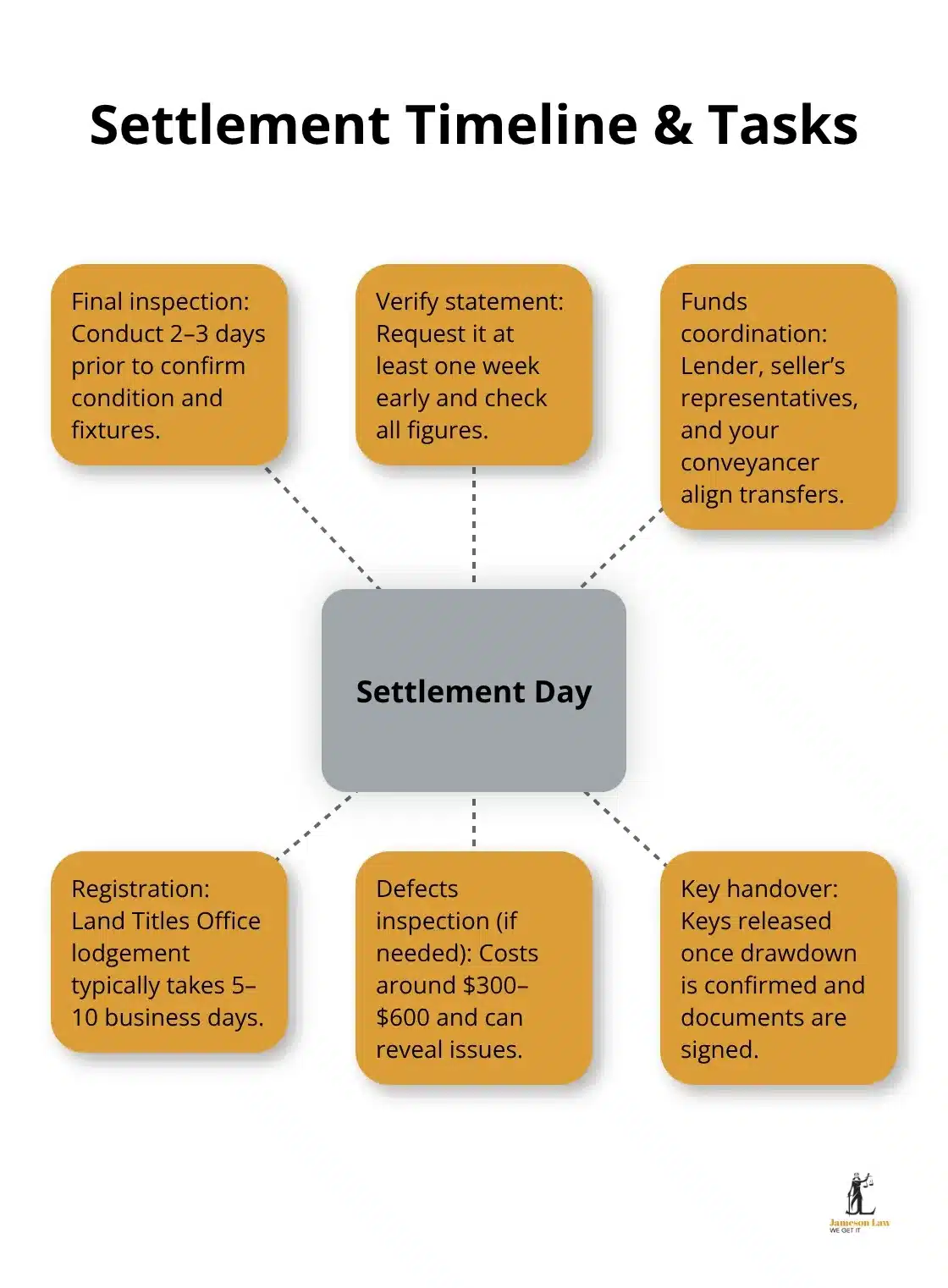

Review Your Settlement Statement

Your settlement statement itemises stamp duty, council rates adjustments, and water charges. Request this statement at least one week before settlement to verify every figure.

Settlement Day: What Happens?

Final Inspections Before Settlement

Arrange a final inspection 2 to 3 days before settlement. Confirm the property remains in the condition specified in your contract and that all fixtures are present.

Coordinating Funds on Settlement Day

Settlement day involves transfers between your lender, the seller, and your conveyancer via PEXA (Property Exchange Australia). You do not need to attend in person.

Completing Registration

Once funds are received, your conveyancer arranges registration with NSW Land Registry Services. After registration, the title transfers to your name, and you can collect the keys.

Final Thoughts

The conveyancing settlement process involves multiple critical stages. Missing even one step creates delays. Start your due diligence immediately during the cooling-off period.

We at Jameson Law have supported clients through hundreds of transactions. Contact Jameson Law to discuss your conveyancing needs and ensure your settlement runs smoothly.