Property settlement applications under Section 79A of the Family Law Act require strict compliance with complex procedural requirements. Missing deadlines or incomplete documentation can derail your entire case.

We at Jameson Law see families struggle with these technical requirements daily. This guide breaks down the mandatory steps to meet Section 79A compliance and avoid costly mistakes.

What Section 79A Actually Covers

Section 79A of the Family Law Act 1975 enables the courts to reconsider final property settlement orders in specific circumstances. This provision applies to property matters, not parenting arrangements, and has corresponding provisions for de facto relationships under Section 90SN.

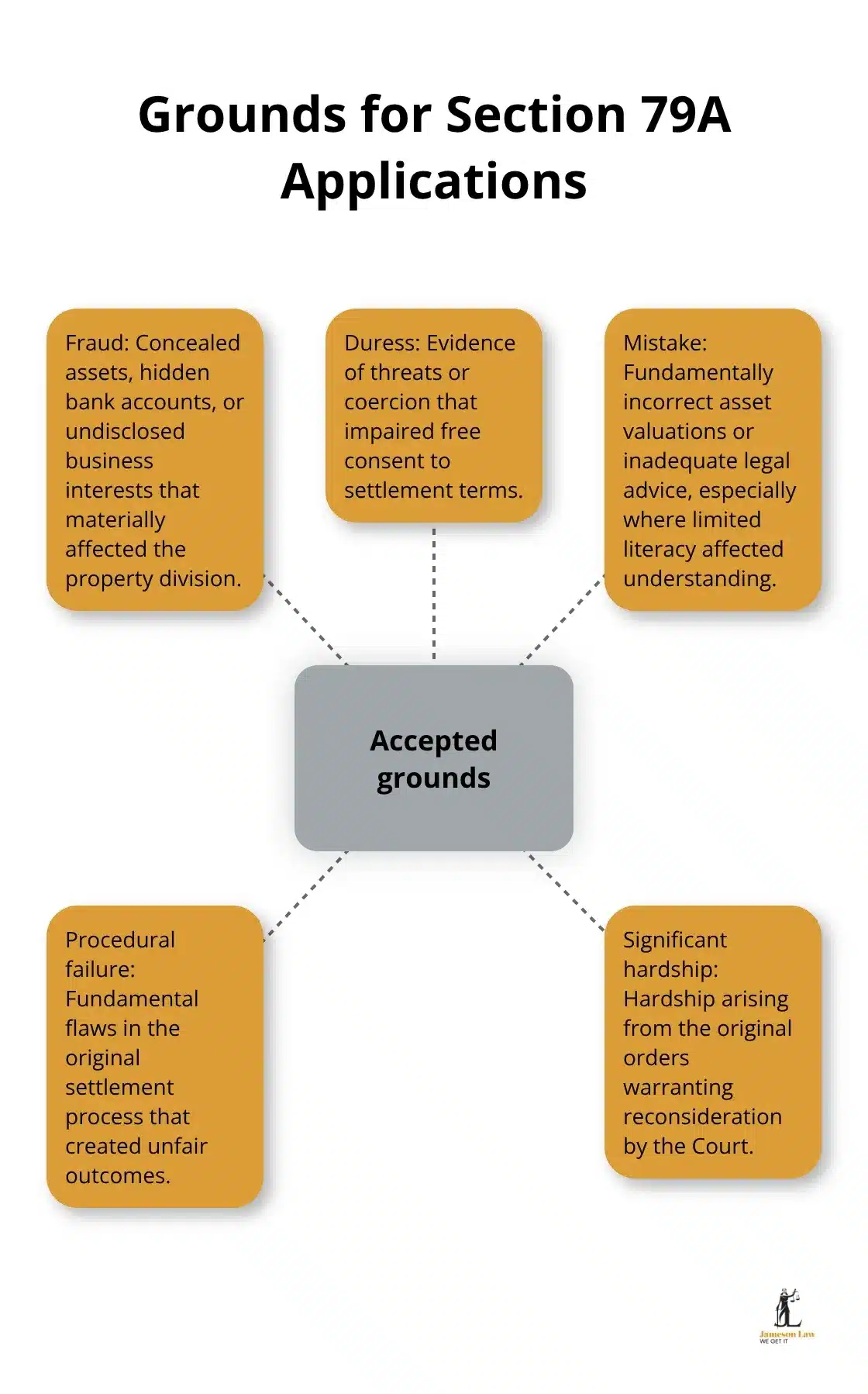

The section addresses situations where original orders contain fundamental issues that created unfair outcomes. Unlike standard appeals that focus on legal error and short time limits, Section 79A applications target procedural failures, fraud, duress, mistake or significant hardship that affected the original settlement process.

Legal Grounds That Courts Accept

Courts accept Section 79A applications based on specific grounds that must be proven on the balance of probabilities. Typical examples include concealed assets, undisclosed bank accounts or business interests, incorrect valuations, duress that undermined consent, or hardship that makes it impracticable to carry out the orders. For de facto matters see the equivalent pathway under Section 90SN.

Evidence Requirements and Burden of Proof

The burden of proof rests with the applicant, which makes thorough documentation essential. Financial statements, emails, messages, sworn affidavits and expert valuations are usually required. Case management and disclosure expectations are set in the Central Practice Direction and the general duty of disclosure and financial disclosure rules.

Key Differences from Standard Appeals

Appeals focus on legal error and tight time frames. Section 79A focuses on the fairness of the process that led to orders. If parties agree that orders should be set aside, you may be able to proceed by Application for Consent Orders rather than a contested hearing.

Meeting Section 79A Compliance Requirements

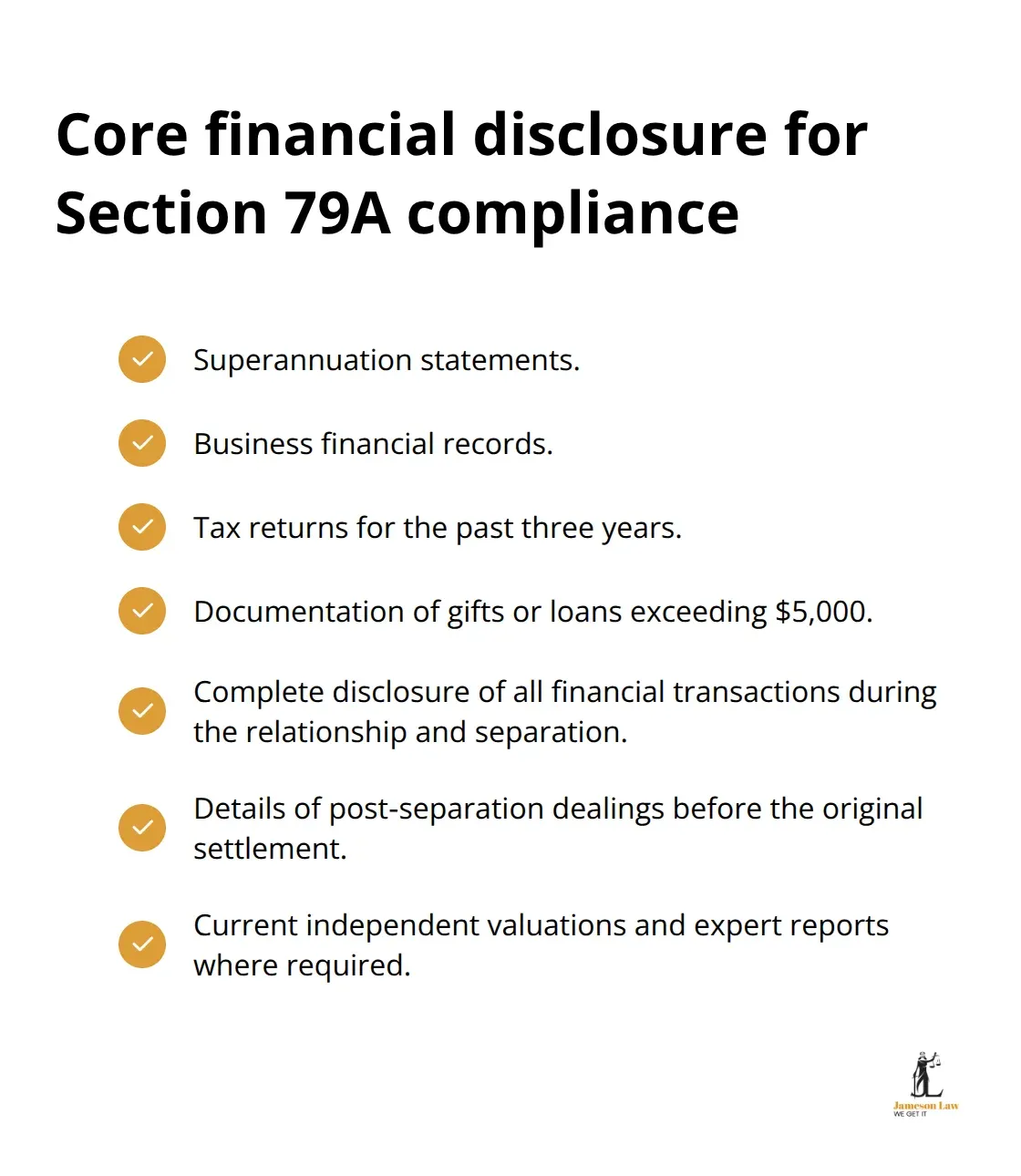

Section 79A applications demand comprehensive financial documentation that extends well beyond basic bank statements. Courts expect full and frank disclosure across the relationship and separation period. See expert evidence guidance and the rules for single expert appointments and expert questions.

Complete Financial Disclosure Standards

Courts expect disclosure of superannuation interests, business records, tax returns, loan and gift documentation, and any significant transactions after separation but before orders. For tax and capital gains implications, refer to the ATO’s guidance on relationship breakdown and CGT and when the rollover applies.

Asset Valuation and Expert Evidence Requirements

Independent valuations are expected for significant assets such as real estate, businesses and vehicles. Expert reports should be current and methodologically sound. You can search official judgments via the Court’s Judgments page and legislation on AustLII when researching comparable issues.

Court Documentation and Procedural Requirements

Applications are supported by affidavits and evidence, and managed under the Court’s case management framework. If you need procedural orders within ongoing proceedings, see Application in a Proceeding. For agreed variations, use the Consent Orders kit. For plain-English background, see our primers: Family Law 101 and Property and Financial Settlements.

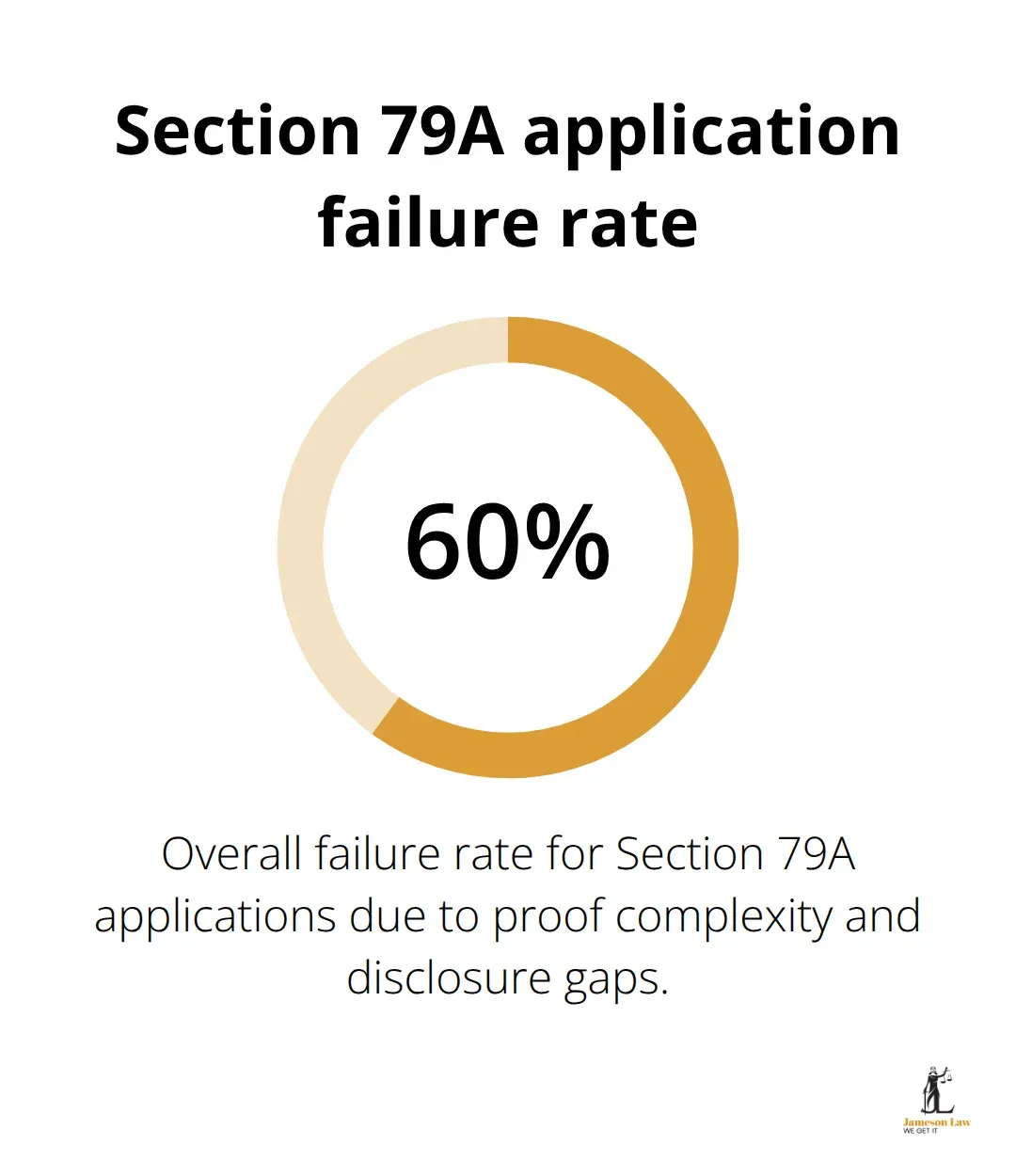

Why Do Section 79A Applications Fail

Common pitfalls include incomplete disclosure, inadequate or outdated valuations and gaps in documentary proof. Ensure your material aligns with the disclosure rules and the Court’s practice directions. Where tax, superannuation or trust issues arise, obtain specialised advice early.

Final Thoughts

Section 79A applications demand meticulous preparation, complete disclosure and credible valuations. If you need guidance, our Sydney team can help with strategy, evidence and filing. Start with our resources on Binding Financial Agreements, Spousal Maintenance and Family Law, or speak with a solicitor today.

Call (02) 8806 0866 or contact us to book a confidential consultation in Sydney.