Section 90C Family Law Act applications can feel overwhelming when you’re dealing with property settlements after separation. The legal requirements are strict, and one mistake can delay your case for months.

We at Jameson Law see families struggle with these complex procedures daily. This guide breaks down the essential steps to navigate Section 90C requirements successfully.

What Is Section 90C and When Do You Need It

Section 90C of the Family Law Act 1975 governs binding financial agreements between married couples, giving you the power to determine how property and assets split before problems arise. These agreements cover all property types acquired before, during, or after marriage, including real estate, business interests, investments, and personal assets. The Federal Circuit and Family Court processed over 8,200 property applications in the 2023-24 financial year, showing how common these disputes become without proper planning.

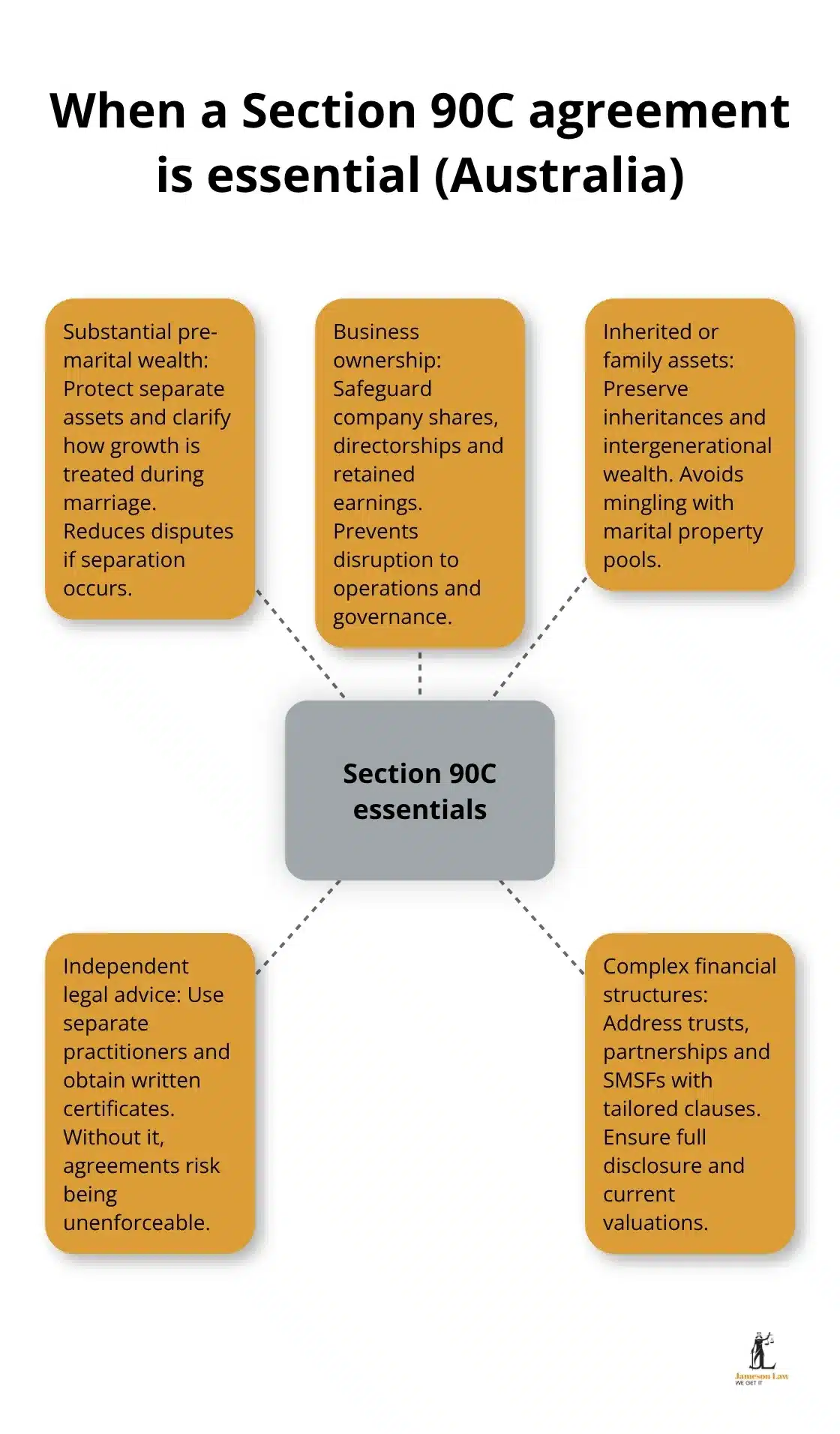

When Section 90C Becomes Essential

You need a Section 90C agreement when significant assets or complex business structures require protection during potential separation. The agreement works best for couples who enter marriage with substantial individual wealth, business owners who want to protect company interests, or those with inherited family assets. Courts have consistently ruled that agreements which lack proper independent legal advice become unenforceable, as demonstrated in the Abrum & Abrum case where inadequate counsel invalidated the entire agreement.

Mandatory Legal Requirements You Cannot Ignore

Both parties must receive independent legal advice from separate practitioners before they sign any Section 90C agreement. Your legal adviser must explain the rights you would have without the agreement and the specific effects of signing it (per Section 90G requirements). Complete financial disclosure remains mandatory, including current property valuations from Certified Practising Valuers (see API: CPV) and comprehensive asset listings. The agreement must be written, signed by both parties, and include certificates from legal practitioners who confirm independent advice was provided. For the statutory text, see s 90C and s 90G.

Common Enforcement Challenges

Courts can set aside agreements under Section 90K for fraud, failure to disclose material facts, or inadequate legal representation. The Chetri v Thapa case highlights how failure to use separate legal practitioners can invalidate agreements entirely. Rushed consultations or inadequate legal representation often result in court rejections (as seen in Adame & Adame). Property valuations must be current and properly prepared to satisfy disclosure requirements, with courts vigilant about detailed asset descriptions. See the Court’s overview on financial agreements and when they can be set aside.

Understanding these requirements sets the foundation for success, but the actual application process involves specific documentation and strict procedural steps that demand careful attention.

The Application Process for Section 90C

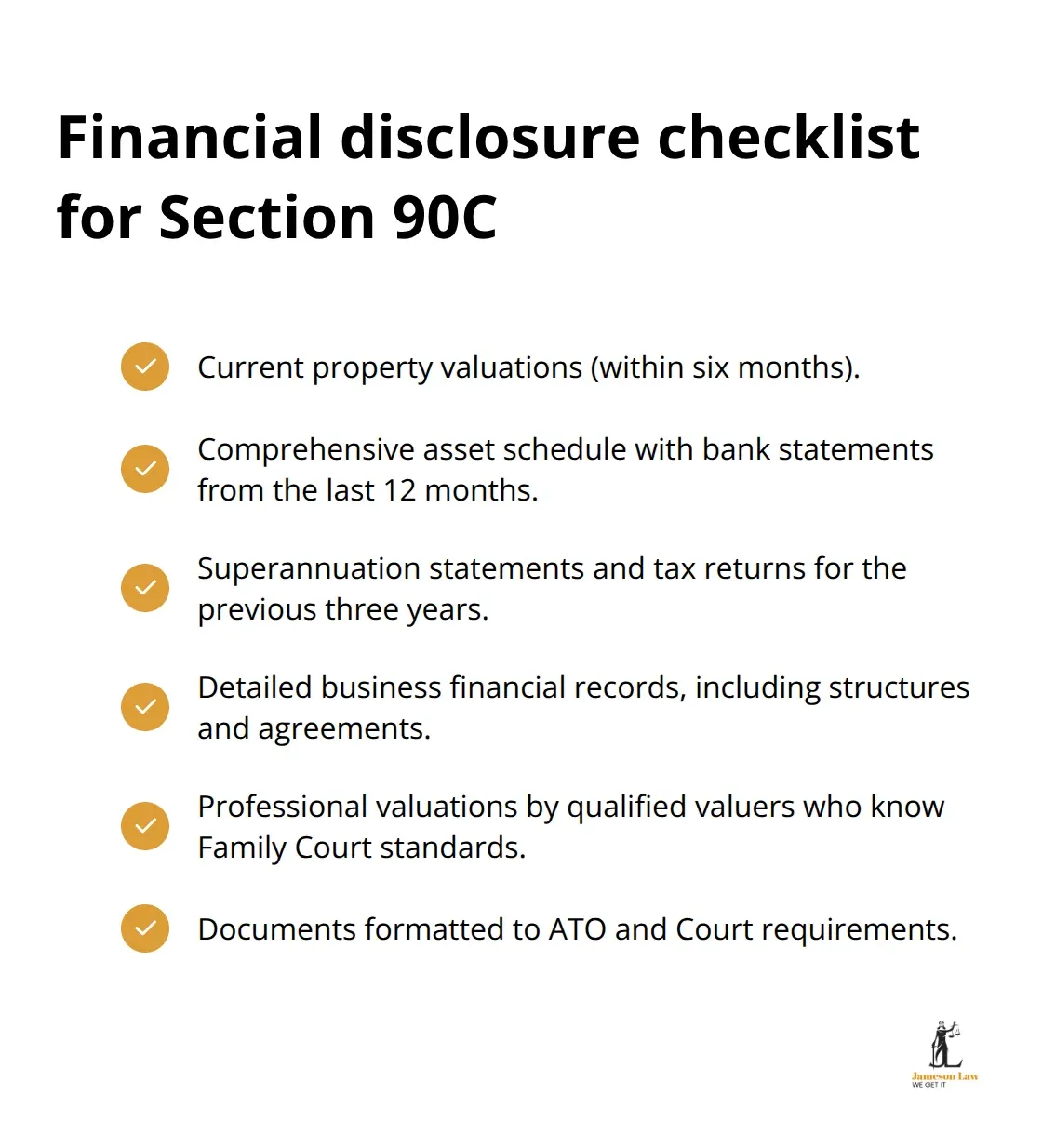

Financial Disclosure Requirements That Courts Demand

Your financial disclosure forms the backbone of any Section 90C application, and courts reject incomplete submissions without hesitation. You must provide current property valuations completed within six months of filing, comprehensive asset schedules that include bank statements from the past 12 months, superannuation statements, tax returns for the previous three years, and detailed business financial records if applicable. Courts particularly scrutinise property valuations and business interests, and they demand professional assessments from qualified valuers who understand Family Court requirements.

Required Forms and Supporting Documents

Applications require an Initiating Application form (see the Court’s official form and DIY kit), supporting affidavits that detail your relationship history and financial contributions, and certificates that confirm independent legal advice was provided to both parties. You must submit witness statements that establish the genuine nature of your relationship, joint bank statements, utility bills, lease agreements, and any correspondence that demonstrates shared financial responsibilities. Courts expect comprehensive documentation that covers the entire relationship period, and incomplete affidavits often result in requests for additional information that extend processing times significantly.

Filing Procedures and Associated Costs

Filing fees are set by regulation and updated annually. As at 1 July 2025, typical family law filing fees for a Financial (property) Initiating Application range from $435 to $860 depending on whether interim orders are also sought. Check the current schedule on the Court’s Family law fees page. You must lodge documents via the Court registry or eFile through the Commonwealth Courts Portal. Applications are processed in order of receipt, and any errors in documentation or fee payments can delay your matter.

Court Processing Timeline and Expectations

In non-urgent matters, it commonly takes one to two years for a matter to progress to a Final Hearing, though urgent interim hearings can be listed sooner depending on the registry. See the Court’s guidance on financial/property matters and the structured approach to property orders (often referred to as the “four-step process”). You can also review our overview of recent family law changes.

Common Challenges and How to Overcome Them

Documentation Failures That Courts Reject Immediately

Courts consistently reject applications when financial disclosure fails to meet their strict standards, and the most common failure involves outdated property valuations or incomplete asset schedules. Applications fail when couples submit bank statements that are not current, or when they provide business financial records that exclude partnership agreements or trust structures. The Chetri v Thapa decision shows how inadequate independent advice and documentation can unravel an agreement. Courts demand witness statements that specifically address shared financial responsibilities, and generic statements about cohabitation will not meet their evidence standards.

Procedural Errors That Destroy Your Case

Incorrect forms and procedures account for the majority of Section 90C application delays, particularly when applicants submit wrong documentation or fail to include required legal practitioner certificates. Courts will not accept applications where both parties used the same adviser, as this breaches the independent advice requirement (s 90G). The most expensive mistake involves applications without proper signatures or missing pages, which pushes your case back to the start of the queue.

How to Transform Court Rejections Into Approvals

When courts reject your Section 90C application, you typically have 28 days to address their concerns and refile with corrected documentation. The Adame & Adame case shows that vague language in agreements leads to problems with enforcement, so rewritten applications must include precise terms about property division and maintenance obligations. Where appropriate, seek advice on whether the Court may set aside an agreement under s 90K scenarios and reframe your evidence accordingly. Professional representation is recommended to ensure compliance at every step.

Final Thoughts

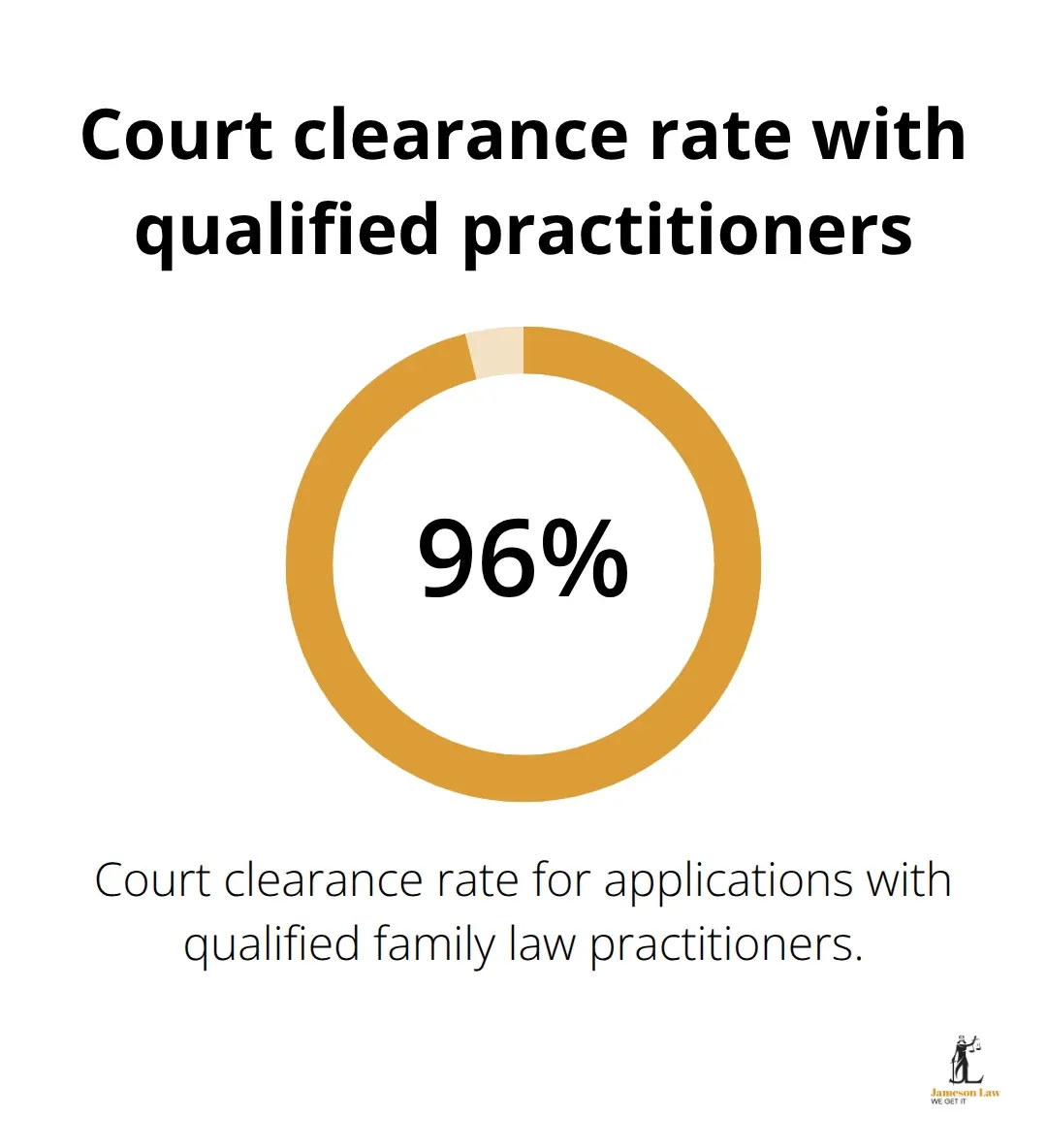

Section 90C Family Law Act applications require meticulous attention to detail and strict adherence to court procedures. Courts expect comprehensive financial disclosure, independent legal advice for both parties, and precise documentation that meets Federal Circuit and Family Court standards.

The complexity of Section 90C applications makes professional legal representation essential rather than optional. We at Jameson Law provide end-to-end guidance for binding financial agreements and property settlements. Speak with our Sydney family law team on (02) 8806 0866 or contact us to protect your interests and streamline your Section 90C application.