Property settlements after separation can feel overwhelming, especially when Section 75 of the Family Law Act comes into play. This provision gives courts significant power to adjust property distributions based on specific circumstances.

We at Jameson Law see many clients struggle with understanding how S 75 Family Law Act applications work in practice. The key lies in knowing what factors courts prioritise and how to present your case effectively.

What Does Section 75 Actually Cover

Section 75 of the Family Law Act 1975 addresses financial support needs after courts divide property between separated couples. Unlike Section 79 which handles asset division, Section 75 focuses specifically on spousal maintenance when one party cannot support themselves adequately.

Courts Order Regular Payment Arrangements

Courts use this provision to order regular payments from one spouse to another. These payments typically occur monthly and can range from hundreds to thousands of dollars based on individual circumstances. The Australian Bureau of Statistics reports that divorces frequently involve children under 18, which makes childcare responsibilities a significant factor in these maintenance decisions. See also the Court’s overview of spousal maintenance.

Specific Circumstances Receive Priority Treatment

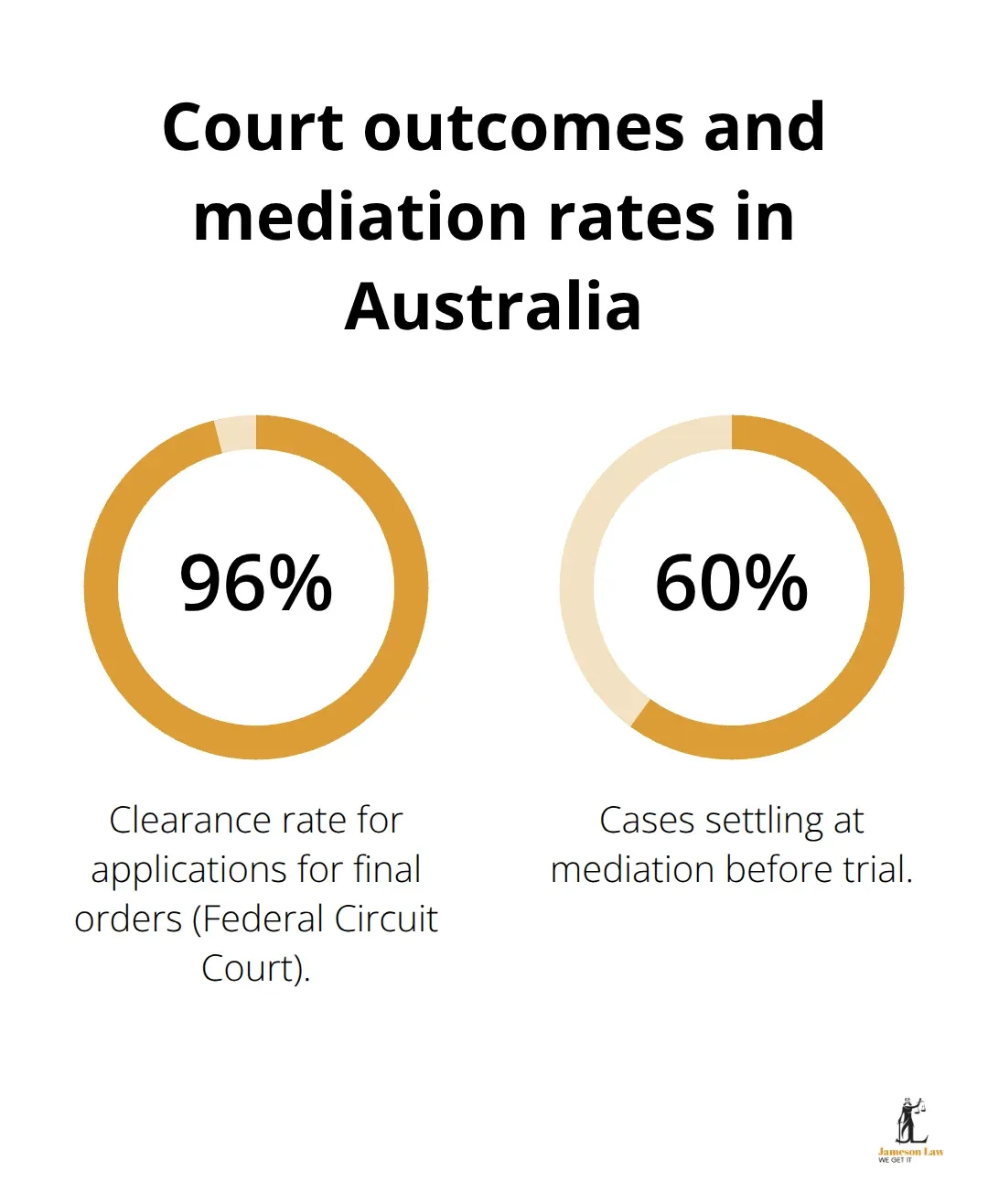

Federal Circuit Court data shows successful Section 75 applications typically involve parties over 50 years old, primary carers of dependent children, or individuals with chronic health conditions that limit work capacity. A 2019 Federal Circuit Court case awarded $2,100 monthly maintenance to a spouse who spent 15 years out of the workforce for childcare. A Victorian case granted $1,800 monthly support due to severe arthritis that prevented employment.

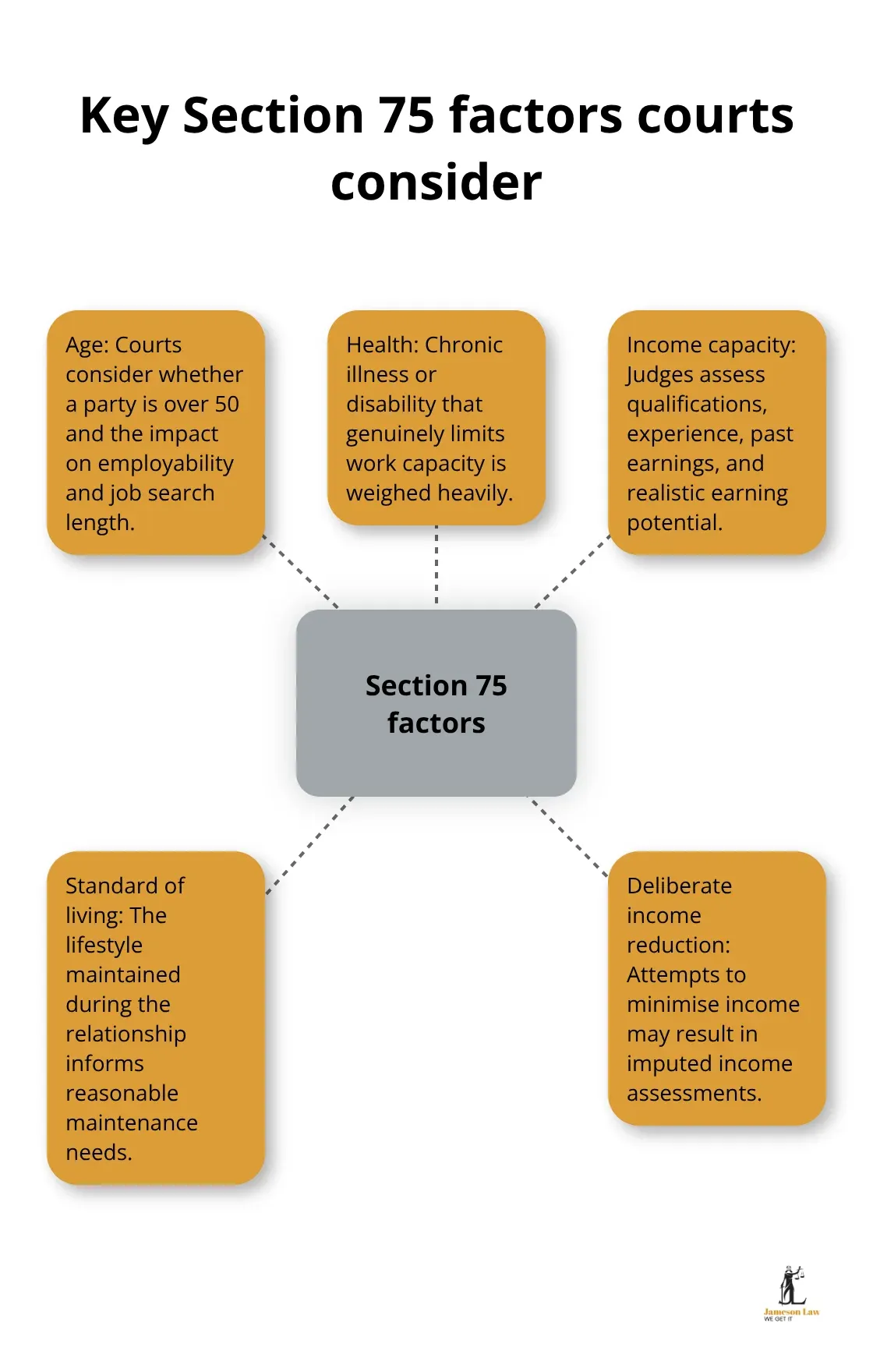

Courts examine your age, health status, income capacity, standard of life during the relationship, and any deliberate attempts to reduce income to avoid maintenance obligations.

Section 75 Operates Differently Than Property Division

The major distinction lies in timing and flexibility. While Section 79 property settlements create final asset divisions that rarely change, Section 75 maintenance orders can be modified when financial situations change significantly. Courts can order maintenance payments even after equal property division (this counters the common misconception that asset division eliminates all financial obligations). For more on the factors in play, read our Section 75(2) guide and the child support assessment framework where relevant.

What Evidence Do Courts Actually Examine

Courts systematically evaluate three core areas when they determine Section 75 maintenance awards. Financial capacity takes precedence in every assessment. Judges examine current income, investment returns, rental properties, government benefits, and realistic potential to earn based on age and qualifications. The Australian Bureau of Statistics data shows approximately 1 in 2 divorces involve children under 18, which makes childcare responsibilities the second most significant factor courts analyse.

Courts Scrutinise Income Capacity Beyond Current Pay

Courts reject claims of reduced income when evidence suggests deliberate manipulation to avoid maintenance obligations. Records often show successful challenges to artificially lowered wages, particularly in cases that involve self-employed individuals or business owners. Judges assess historical patterns of pay, qualifications, work experience, and local employment markets to determine realistic income potential.

Age becomes critical for parties over 50, as Australian Human Rights Commission research confirms longer unemployment periods for older job seekers. Health conditions receive equal weight when chronic illnesses or disabilities genuinely limit work capacity.

Childcare Arrangements Create Strong Maintenance Claims

Primary carers of dependent children consistently receive favourable Section 75 outcomes due to limited work opportunities and ongoing expenses. A 2019 Federal Circuit Court case that awarded $2,100 monthly maintenance specifically recognised a 52-year-old former teacher who left work for 15 years to raise children.

Courts calculate both direct childcare costs and lost capacity to earn when one parent assumes primary care duties. Career interruptions carry substantial weight, particularly where one spouse supported the other’s career advancement while sacrificing their own professional development.

Courts Examine Financial Resources Comprehensively

Judges review all sources of income and assets when they assess maintenance needs. This includes superannuation funds, investment portfolios, rental income, and potential government benefits. Courts also consider whether parties deliberately reduced assets or income to avoid maintenance obligations (which can result in imputed income assessments). For how courts run these cases, see Family Law in NSW: what you need to know.

How Do You Build a Winning Section 75 Case

Success in Section 75 applications depends on systematic preparation rather than hope. The documentation process typically requires several months to compile comprehensive financial records, medical reports, and employment history that courts demand. Our team can guide you through each step—start with our spousal maintenance overview and Family Law Handbook.

Start Financial Documentation Six Months Before You File

Courts require complete financial disclosure that spans the past five years. This includes bank statements, tax returns, superannuation statements, and investment portfolios. Document every source of income, including government benefits, rental properties, and business income. Medical professionals should provide detailed reports about health conditions that limit work capacity, with specific assessments of functional limitations and treatment costs.

Employment specialists can evaluate your realistic income capacity based on age, qualifications, and local job markets. Courts reject vague claims about reduced income without evidence from qualified professionals.

Legal Representation Changes Outcomes Dramatically

Legal representation often improves outcomes in family law matters. Experienced family lawyers understand the evidence courts prioritise and how to present complex financial situations effectively. If you are ready to progress, contact Jameson Law to map the best path forward.

Court Process Expectations and Timeline Requirements

Cases that proceed to final court appearances require extensive preparation. This includes witness statements, expert reports, and detailed financial analysis. The family court expects parties to attempt resolution through family dispute resolution before filing (except in cases involving family violence or urgent financial hardship). See the Court’s family law hub for current practice materials: FCFCOA family law.

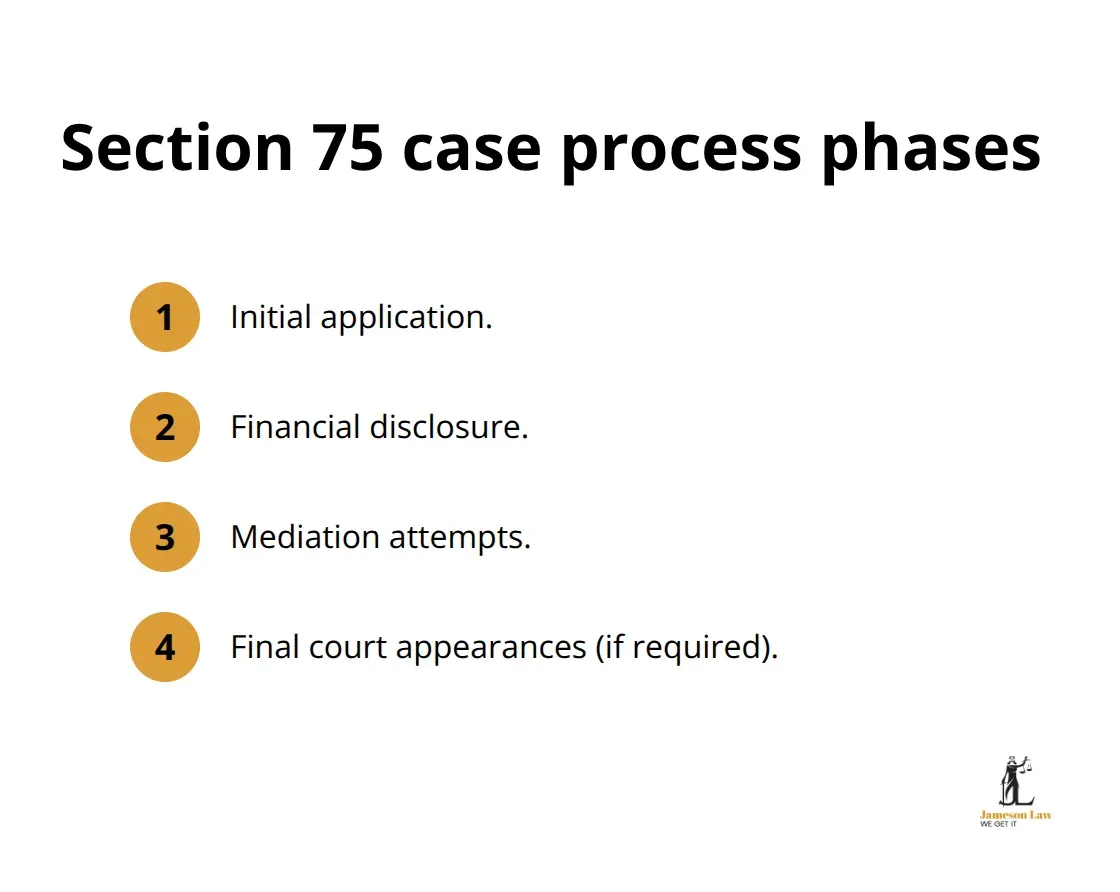

The process moves through distinct phases: initial application, financial disclosure, mediation attempts, and potential final court appearances. Each phase has strict deadlines that courts enforce rigorously.

Section 75 orders adapt to changing circumstances (unlike property settlements that remain final), which provides flexibility for both parties.

Final Thoughts

Section 75 Family Law Act applications demand strategic preparation and comprehensive documentation to succeed. Courts prioritise financial capacity, childcare responsibilities, and health limitations when they determine maintenance awards.

Professional legal guidance proves essential given the complexity of disclosure and court procedure. If you need tailored advice on Section 75 spousal maintenance, speak with our family team today. Contact Jameson Law or call (02) 8806 0866.