Property settlement disputes can devastate families both emotionally and financially. The S79 Family Law Act provides a structured framework for dividing assets, but navigating its complexities requires careful planning.

We at Jameson Law see countless couples struggle with property division because they don’t understand the four-step process courts follow. This guide breaks down everything you need to know about Section 79 applications.

Understanding Section 79 of the Family Law Act

What Section 79 Covers in Property Settlement

Section 79 of the Family Law Act 1975 grants courts broad power to redistribute property between married couples and their de facto counterparts during relationship breakdowns. This section covers all assets acquired before, during, and after the relationship, including real estate, vehicles, bank accounts, investments, business interests, and superannuation. The Act defines property extensively under section 4, encompassing tangible assets, financial instruments, and even future income rights.

Courts examine the entire property pool at the time of final trial to determine accurate asset division. This comprehensive approach means that assets purchased years before the relationship began can still form part of the settlement calculations.

When Section 79 Applications Can Be Made

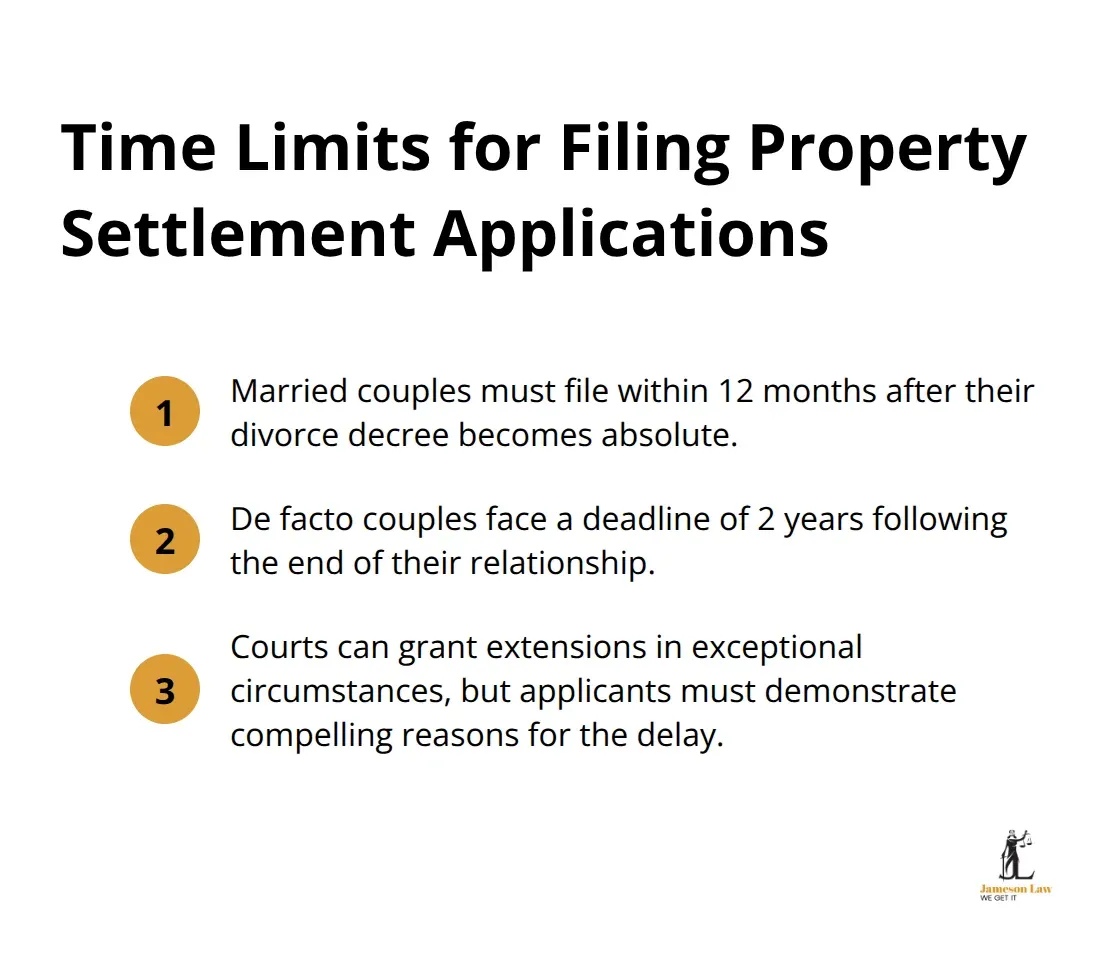

The Family Law Act imposes strict time limits that catch many couples off guard. Married couples must file their property settlement application within 12 months after their divorce decree becomes absolute. De facto couples face a deadline of 2 years following the end of their relationship.

Courts can grant extensions in exceptional circumstances, but applicants must demonstrate compelling reasons for the delay. Missing these deadlines often means you lose your right to property adjustment forever. The courts rarely show sympathy for parties who simply forgot about the time limits or delayed action without valid reasons.

Key Requirements for Filing Under Section 79

Full and frank disclosure stands as the cornerstone of any successful Section 79 application. Courts require complete financial transparency, including overseas assets, trust interests, and potential inheritances. The High Court’s decision in Kennon v Spry established that discretionary trusts can form part of the property pool if one party exercises significant control.

Courts view non-disclosure harshly and often make adverse inferences against parties who hide assets. Professional asset searches and forensic accounting frequently uncover hidden wealth (particularly in complex business structures), which makes honest disclosure the smartest strategy from day one.

The court must also consider whether both parties have received independent legal advice before finalising any property orders. This requirement protects against situations where one party might agree to unfavourable terms without understanding their legal rights.

Now that you understand what Section 79 covers and the basic requirements, let’s examine the systematic four-step process courts follow to determine fair property settlements.

The Four-Step Process Under Section 79

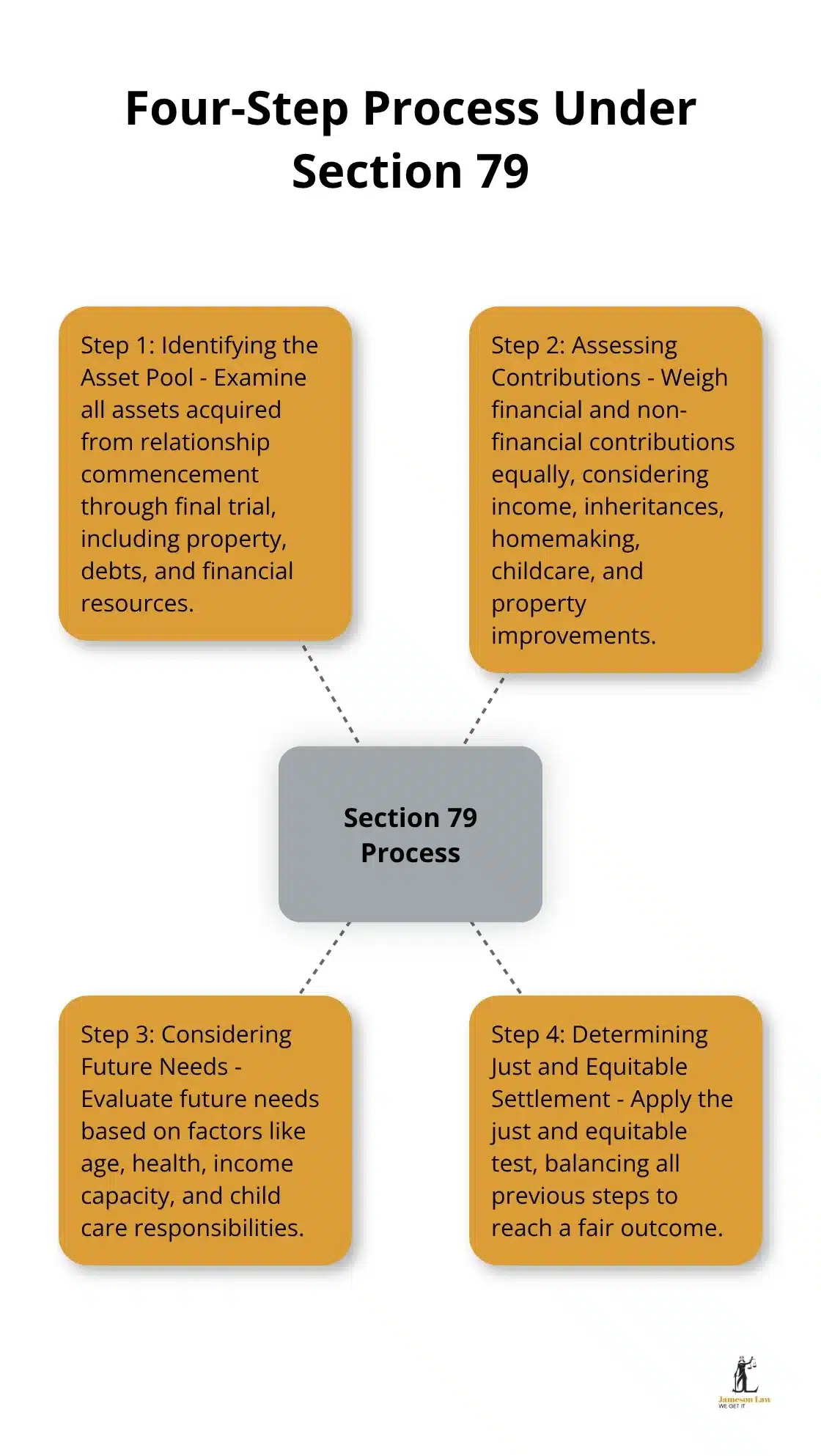

Courts apply a systematic four-step methodology that determines every property settlement outcome under Section 79. Step one requires identification and valuation of the complete asset pool at trial date, which includes all property, debts, and financial resources. Property adjustment cases frequently involve disputes over asset identification and valuation, as courts must determine what constitutes the matrimonial property pool.

Step One – Identifying the Asset Pool

Courts examine every asset acquired from relationship commencement through final trial. Real estate valuations must reflect current market conditions, not historical purchase prices. Business interests require expert assessment, with courts often appointing single expert witnesses to avoid conflicting reports.

Superannuation forms a separate pool under specific splitting rules established in 2002. Hidden assets must be discovered to ensure fair settlements, with forensic accountants playing crucial roles in complex cases. Courts view non-disclosure as a serious breach that can significantly impact final orders.

Step Two – Assessing Contributions by Each Party

This step weighs financial and non-financial contributions equally under sections 79(4)(a) through 79(4)(c). Financial contributions include income, inheritances, and direct asset purchases made throughout the relationship. Non-financial contributions encompass homemaking, childcare, and property improvements that add value to the asset pool.

Courts typically find equal contributions in relationships that exceed 10 years. The length of the marriage significantly affects how initial financial contributions are weighted, with longer relationships often diluting the impact of pre-relationship assets.

Step Three – Considering Future Needs and Circumstances

Step three evaluates future needs under section 75(2) factors including age, health, income capacity, and child care responsibilities. Courts examine each party’s ability to support themselves post-separation and consider factors like career interruptions due to child-rearing responsibilities.

The presence of dependent children often creates additional adjustments in favour of the primary carer. Health issues that affect earning capacity also influence this assessment, particularly when one party faces long-term medical expenses or reduced work capacity.

Step Four – Determining if the Settlement is Just and Equitable

Step four applies the just and equitable test, which rarely results in equal division despite equal contributions. Courts must begin consideration of whether it is just and equitable to make a property settlement order by identifying property according to established legal principles, with each case requiring individual assessment based on specific circumstances and relationship dynamics.

Courts must balance all previous steps to reach a fair outcome that considers both past contributions and future needs. This final step often involves complex calculations that can shift the percentage split significantly from the initial contribution assessment.

While this four-step process provides structure, several common challenges can complicate even straightforward property settlements.

Common Challenges and Pitfalls in Section 79 Cases

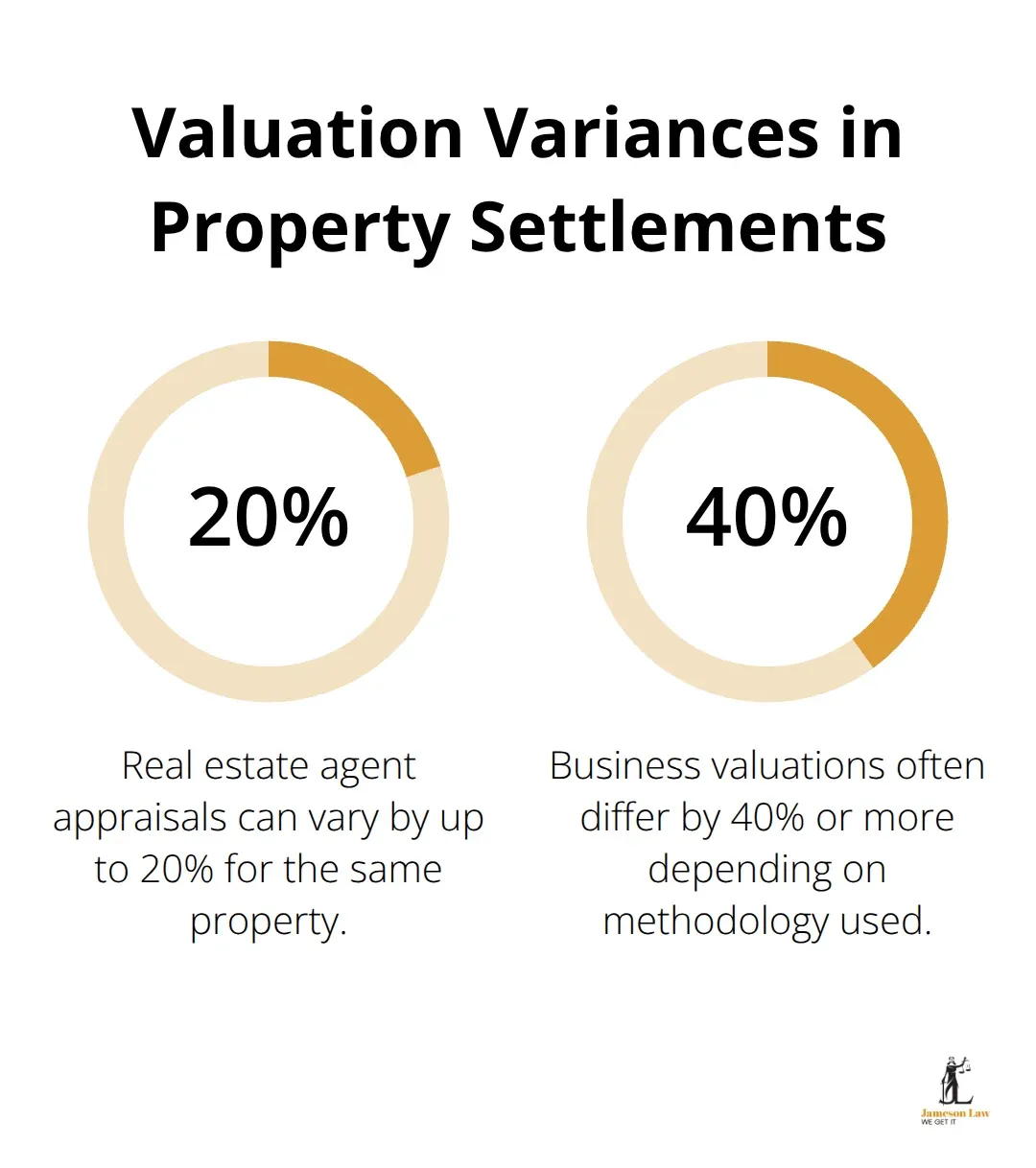

Property settlement cases collapse most often due to valuation disputes and deliberate asset concealment. Research shows that complex property cases involve disagreements over asset values, with business interests and superannuation creating the biggest headaches. Courts frequently order independent valuations, but parties waste thousands fighting over expert reports that differ by substantial margins.

Valuation Disputes Drain Resources

Real estate agents provide market appraisals that can vary by 15-20% for the same property, while business valuations often differ by 40% or more depending on methodology used. Courts must choose between competing expert opinions, which creates uncertainty and drives up legal costs. Property markets fluctuate rapidly, making timing critical for accurate assessments. See market insights from ABS price indexes, property valuation guides and CoreLogic data services.

Asset Concealment Triggers Harsh Penalties

Forensic accountants investigate high-net-worth separations to uncover hidden assets and ensure fairness in property settlements. Common hiding spots include overseas accounts, cryptocurrency wallets, and complex trust structures designed to obscure beneficial ownership. Courts impose harsh penalties for non-disclosure, often awarding additional percentages to the innocent party as punishment. The Federal Circuit and Family Court approach disclosure seriously—see its guidance on duty of disclosure.

Business Valuations Create Complex Battles

Small business owners face unique challenges because their enterprises often represent their primary asset and income source simultaneously. Courts must determine whether businesses should be sold or retained by one party, with significant implications for ongoing support obligations. Professional practices present added complexity because goodwill valuations depend heavily on the practitioner’s continued involvement. Independent resources like CA ANZ forensic programs can help parties understand expert methodologies.

Superannuation Rules Add Complexity

Superannuation splitting requires separate applications and specialist knowledge of complex regulations that changed significantly in 2017. Courts treat superannuation as a distinct asset class with specific splitting mechanisms that differ from other property divisions. For practical guidance, see the ATO’s overview of splitting super after separation and ASIC Moneysmart separation finances.

Time Limits Trap Unwary Parties

Missing statutory deadlines remains the most preventable disaster in family law. The Family Law Act framework for resolving property and financial aspects of relationship breakdown includes strict time limits. Parties often assume they have unlimited time to resolve property matters, particularly when negotiations continue amicably post-separation. De facto couples face particular risks because proving the relationship end date can be disputed, affecting when the two-year limitation period begins running. Understanding how to navigate Family Law Act Section 79 requirements helps avoid these costly mistakes. Useful plain-English help is also available via LawAccess NSW.

Final Thoughts

Section 79 Family Law Act applications require strategic preparation and expert legal guidance to secure fair outcomes. The four-step process looks simple on paper, but valuation disputes, hidden assets, and business complexities destroy many cases before they reach resolution. Time limits pose the greatest threat to separating couples, with courts showing no sympathy for missed deadlines.

Professional legal representation becomes necessary when substantial assets, business interests, or suspected concealment complicate your case. Complex property settlements demand complete financial transparency and careful case preparation from the outset. Courts penalise parties who attempt to hide wealth or provide incomplete disclosure during proceedings.

We at Jameson Law help clients navigate these complex property matters through our experienced legal team. The S79 Family Law Act framework demands thorough preparation and strategic approach to achieve favourable settlements. Speak to our property settlement team or call (02) 8806 0866 for guidance across NSW, including disclosure, valuations and superannuation splitting.