Rule 6.06 Family Law Rules govern critical procedural requirements in Ontario family court proceedings. These rules dictate how parties must handle document disclosure, case management, and court appearances.

We at Jameson Law see many litigants struggle with these complex requirements. Understanding and following Rule 6.06 properly can make the difference between a smooth legal process and costly delays.

What Does Rule 6.06 Actually Require?

Rule 6.05 of the Family Law Rules 2021 mandates comprehensive financial disclosure in property settlement cases. This rule requires parties to file a Financial Statement within specific timeframes and provide extensive supporting documentation. The Federal Circuit and Family Court of Australia processes financial applications annually, with disclosure compliance affecting virtually every case outcome. See the Court’s duty of disclosure overview and forms here: duty of disclosure, Financial Statement form, and the rule text at legislation.gov.au (Rule 6.06).

Financial Documentation Requirements

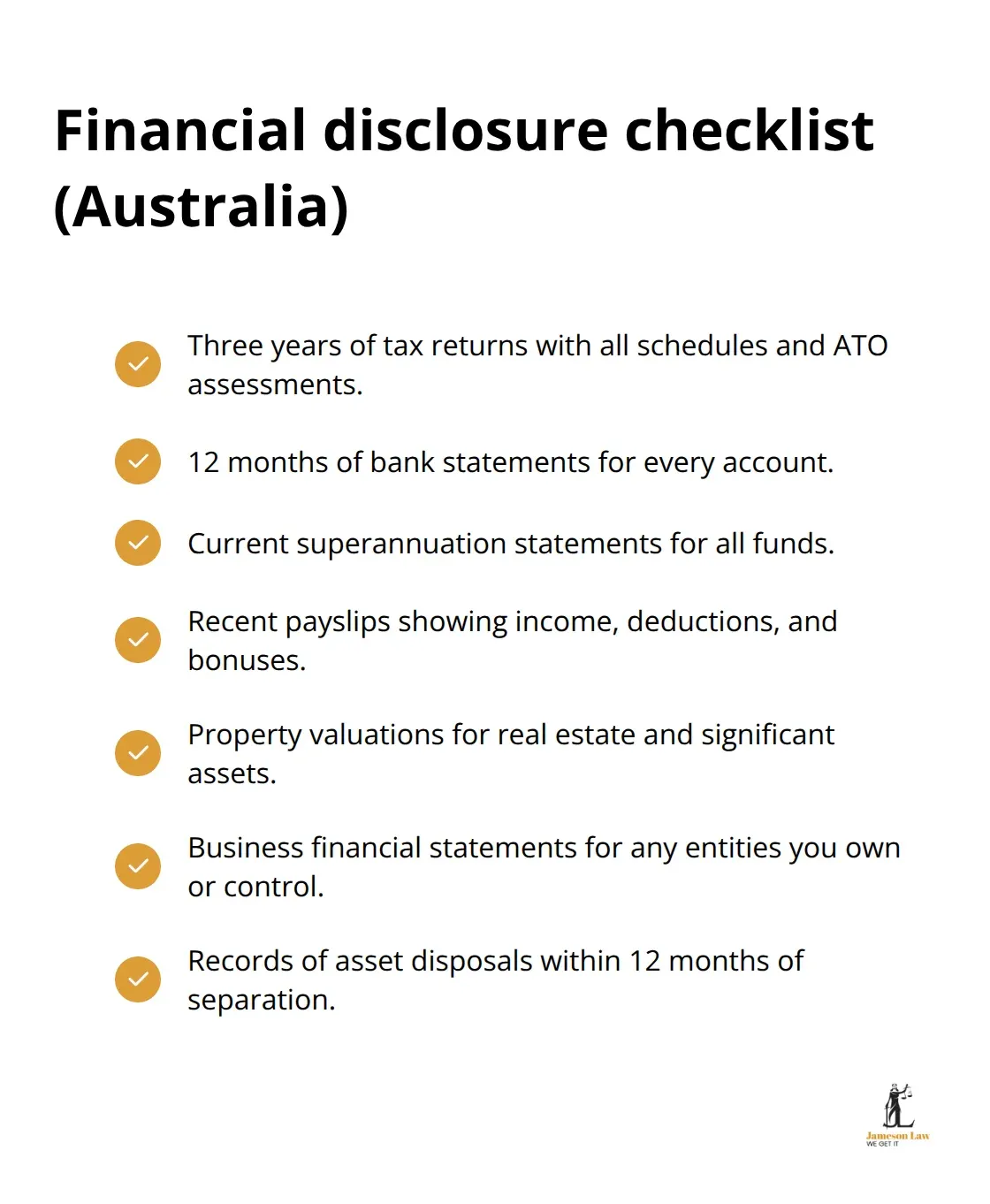

Rule 6.05 demands parties provide three years of tax returns, 12 months of bank statements, current superannuation statements, and recent payslips before their first court appearance. Property valuations, business financial statements, and documentation of any asset disposals within 12 months of separation must also be disclosed. The Court receives Financial Statements regularly, yet non-compliance remains the primary cause of case delays. For help retrieving ATO records, see copies of tax documents and notices of assessment.

Continuous Disclosure Obligations

Financial circumstances change during proceedings, which triggers Rule 6.05’s continuous disclosure requirement. Parties must file amended Financial Statements within 21 days of any material change that exceeds $10,000 in value. This includes new employment, property acquisitions, or significant debt changes. The Court imposes penalties on parties annually for failure to update their disclosure, which results in costs orders. Filing guidance: preparing documents for eFiling and how to file.

Application Beyond Property Matters

Rule 6.05 extends to spousal maintenance applications and cases where financial capacity affects parenting arrangements. Child support assessments often trigger disclosure requirements when parties dispute income levels or claim financial hardship. For general Child Support information, see Services Australia – Child Support. Separated couples often have property disputes that require disclosure compliance, making proper understanding essential for most family law participants.

Practical Implementation Steps

Courts expect parties to exchange sufficient disclosure before dispute resolution events to facilitate agreement efforts. The Statement of Truth in an Application for Consent Orders requires confirmation that no undisclosed property or financial interests exist. These requirements form the foundation for successful case management and set the stage for understanding the specific steps you must take to achieve full compliance. If you need help, our property settlement lawyers and consent orders team can assist.

How to Execute Rule 6.06 Compliance

Document Collection Strategy

Collect your required documents immediately after separation or before you file any financial application. The Federal Circuit and Family Court mandates specific documents within tight timeframes, and late submissions trigger automatic penalties. Your three most recent tax returns must include all schedules and assessment notices from the Australian Taxation Office. Bank statements need complete 12-month records for every account you hold (including savings, cheque, credit cards, and business accounts). Superannuation statements must show current balances and contribution histories from all funds. Employment documents require your current contract plus three months of payslips that show gross income, deductions, and any bonuses or allowances. If you’re choosing representation, see our guide: how to choose the best family law lawyer.

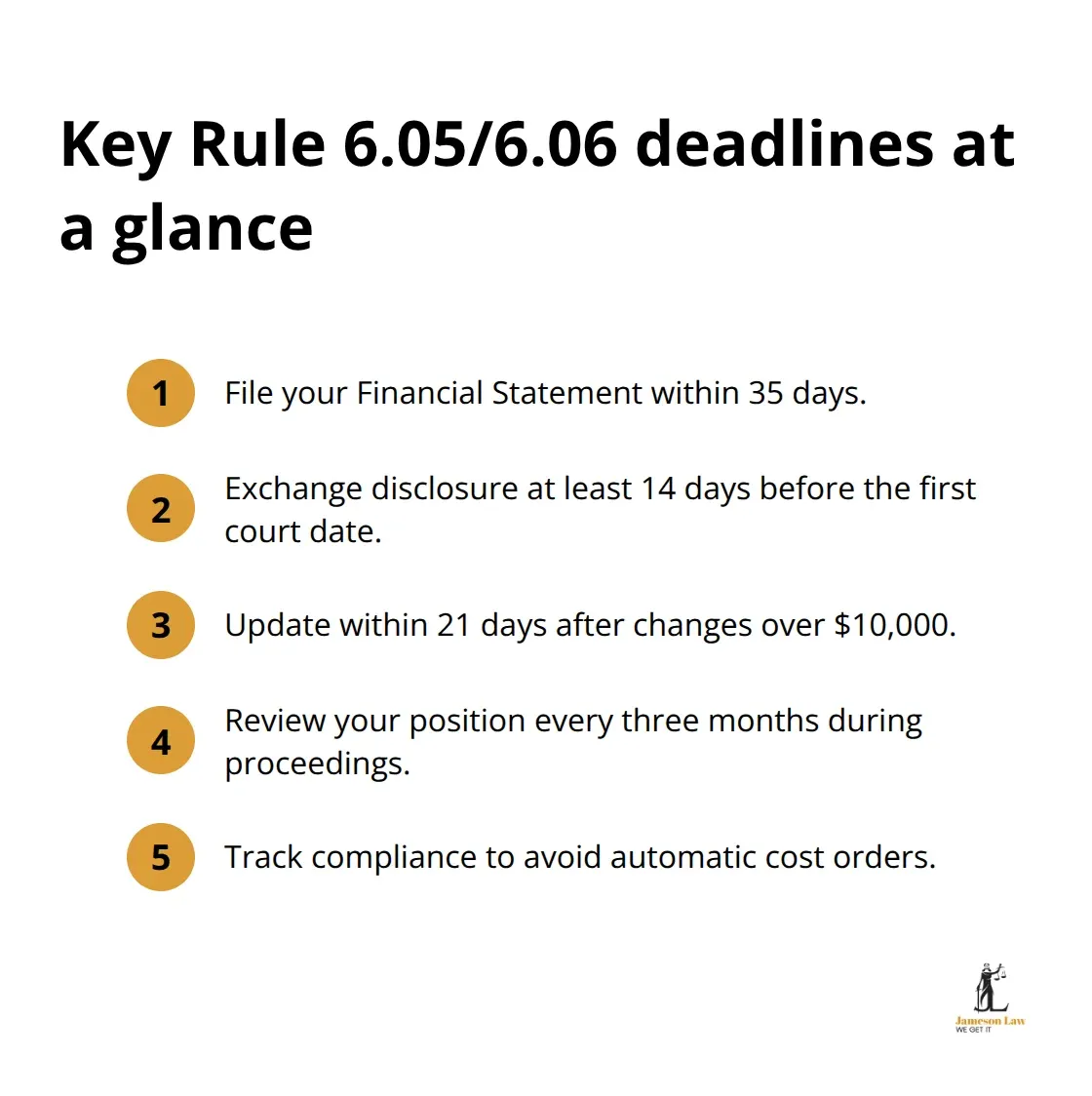

Court Deadline Management

File your Financial Statement within 35 days of receipt of an Application or within 35 days of your own Application for property settlement. Exchange disclosure documents with the other party at least 14 days before your first court date to avoid adjournments. In 2022–23, 15,782 applications for consent orders were filed in the Federal Circuit and Family Court of Australia (Division 2), with 15,974 applications processed overall. Update your Financial Statement within 21 days whenever your circumstances change more than $10,000 in value. Lodge via the Court’s portal: filing information.

Court registries track compliance electronically, and missed deadlines result in automatic cost orders against non-compliant parties. Schedule regular reviews of your financial position every three months during proceedings to identify changes that require disclosure updates.

Legal Team Coordination

Your legal representative must verify document completeness before they file, as incomplete disclosure triggers Court sanctions. Schedule monthly disclosure reviews with your lawyer to track circumstances that change and upcoming deadlines. Court staff cannot provide legal advice but will confirm whether your filed documents meet technical requirements. Registry staff process thousands of Financial Statements monthly and immediately identify common errors like missing signatures, incomplete asset valuations, or outdated bank statements (which cause immediate rejection). Establish clear communication protocols with your lawyer about document collection responsibilities and deadline management.

These compliance steps form the foundation for successful case management, but even experienced parties make critical errors that can derail their entire case.

Common Pitfalls and How to Avoid Them

Self-Represented Litigants Face Predictable Failures

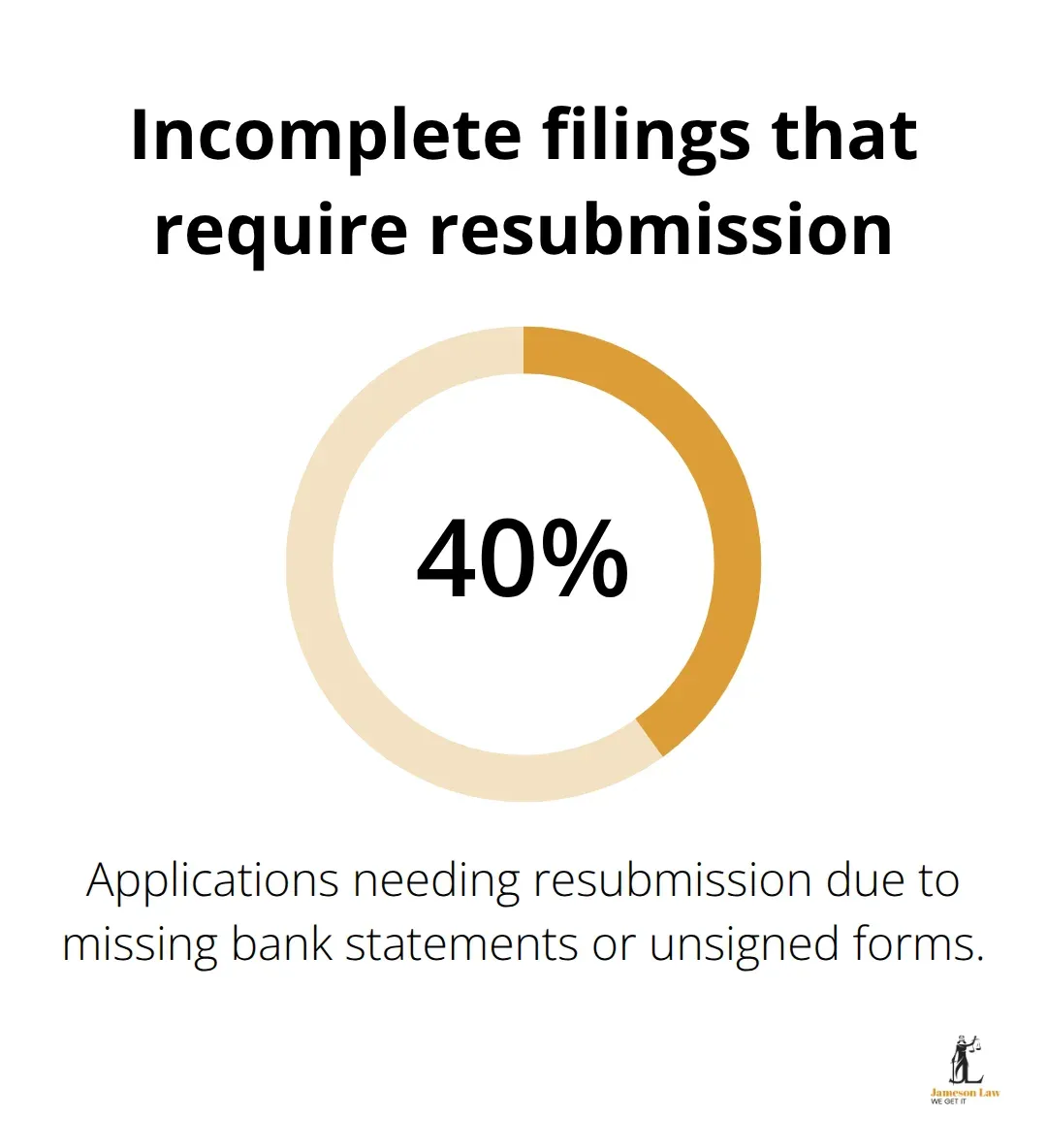

Self-represented parties consistently make three fatal errors that destroy their cases before they reach trial. They submit incomplete Financial Statements without required documents, which triggers automatic rejection by court registry staff. The Federal Circuit and Family Court processes thousands of incomplete applications monthly, with 40% requiring resubmission due to missing bank statements or unsigned forms.

Court Penalties Hit Hard and Fast

Non-compliance with Rule 6.06 triggers severe financial penalties that can exceed the value of disputed assets. Courts routinely order cost penalties between $5,000 and $15,000 against parties who breach disclosure obligations. Courts also dismiss applications entirely when parties repeatedly fail to provide required documentation. The Australian Federal Police investigate cases involving document falsification, which can lead to criminal charges separate from family law penalties. If you need tailored strategy, speak with our family law team.

Prevention Requires Systematic Document Management

Establish monthly calendar reminders to review your financial position and identify changes exceeding $10,000 that require disclosure updates. Create digital folders for each document category and update them immediately when new documents arrive. Photograph or scan all physical documents within 24 hours of receipt to prevent loss during proceedings.

Hidden Asset Discovery Creates Permanent Damage

Courts take a dim view of parties who attempt to conceal assets or provide misleading financial information. Hidden assets discovered after settlement can lead to the reopening of cases and additional legal complications. The Court draws negative inferences against parties suspected of concealing financial information during proceedings.

Final Thoughts

Rule 6.06 Family Law Rules demand meticulous attention to detail and strict adherence to court deadlines. The continuous disclosure obligations require ongoing vigilance throughout your proceedings, not just initial compliance. Professional legal assistance proves invaluable when you manage these complex requirements. If you face family law proceedings, Jameson Law provides expert guidance across all aspects of family law matters. Call (02) 8806 0866 or contact us for a confidential consult in Sydney.