Superannuation is often one of the most valuable assets in Australian marriages, yet many couples are unsure how it is divided when they separate. Family law superannuation rules can feel complex, but knowing your rights is essential to protect your financial future. At Jameson Law we frequently meet clients who wish they had understood these rules earlier.

What Superannuation Property Gets Split in Divorce

Superannuation is treated differently in family law because it is held on trust rather than owned like cash in a bank account. The Family Law Act 1975 treats super as a distinct asset class, so you cannot simply withdraw funds. Recent disclosure rules require detailed information about all super interests, including fund names, balances and whether the interest is in accumulation or retirement phase. See general guidance from the Federal Circuit and Family Court of Australia.

Accumulation Fund Valuations

Accumulation interests are usually valued by the current account balance. Trustees can provide up-to-date figures directly. This streamlines settlement and reduces delays and costs. For basic super checks, see the ATO’s tools at ato.gov.au and ASIC’s MoneySmart.

Defined Benefit Scheme Complexities

Defined benefit schemes require actuarial assessment because they involve future pension entitlements. Inputs can include salary growth and service. Many public sector schemes fall into this category. Useful primers are available from APRA and major government funds such as CSC. Get tailored advice from our team: super and section 79.

Self-Managed Super Fund Requirements

SMSFs have extra compliance obligations. Trustees must act in the best interests of all members during a separation. The ATO strictly monitors SMSF compliance and breaches during settlement can attract penalties, including loss of concessions. See the ATO’s SMSF guidance at ato.gov.au/SMSF. For strategy, read our note on superannuation settlements.

Super Split Implementation Methods

Payment splits transfer a specified amount or percentage to the non-member spouse, creating a clean break. Flag and split arrangements defer access until final orders. Super can be split by consent orders or by court order. Non-member spouses can open a new account or roll into an existing fund. See the court’s Superannuation Information Kit at the FCFCOA and the ATO’s splitting overview at ato.gov.au.

How Do Courts Split Superannuation

If agreement is not reached, the court can make superannuation orders. The court exercises a broad discretion, taking into account contributions, future needs and each party’s financial resources. Orders become mandatory where sought and where it is just and equitable to do so. Trustees must be notified before orders are made to avoid procedural delays.

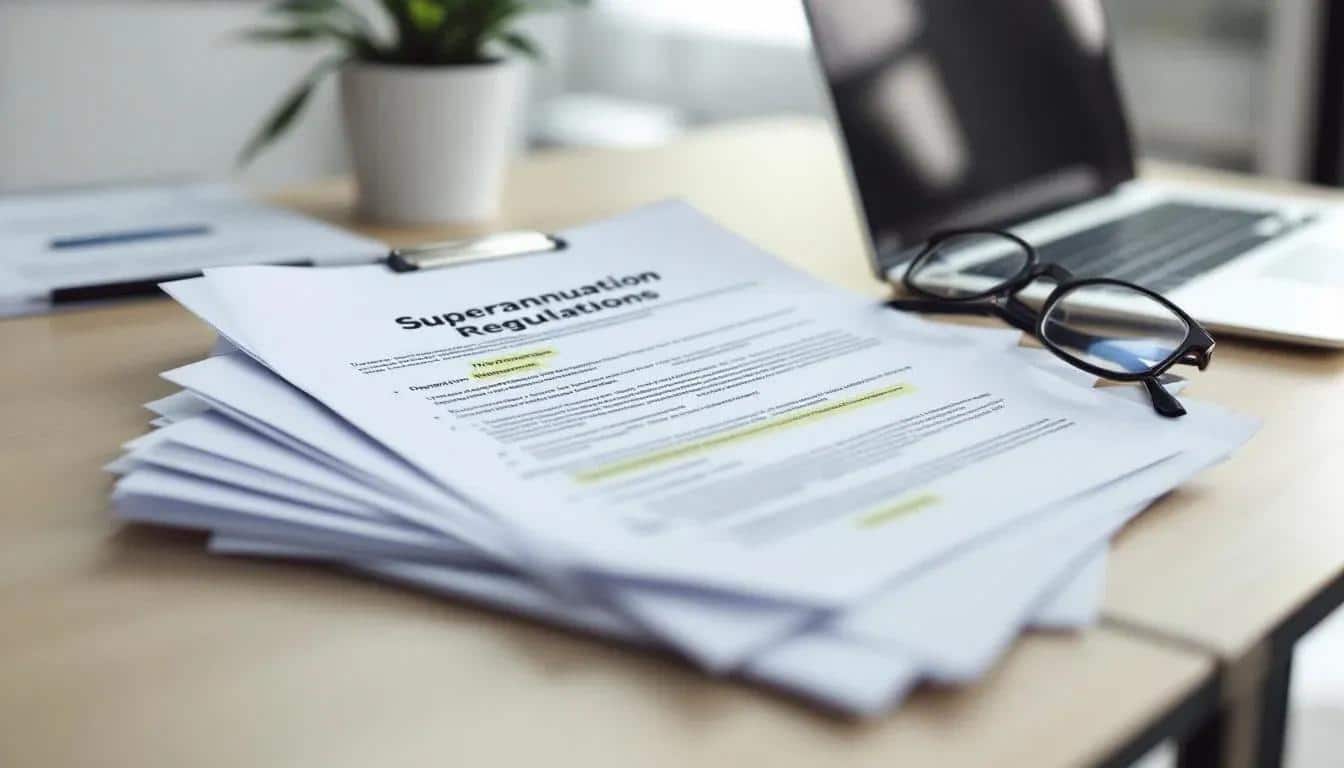

Fair Distribution Calculations

Fair distribution is more than a simple percentage. The court considers relationship length, direct and indirect contributions and the parties’ future capacity. Homemaking and childcare are recognised. Women retire with significantly lower super balances than men, commonly 20 to 25 percent lower, and this can be relevant to outcome. See our overview of equitable divisions.

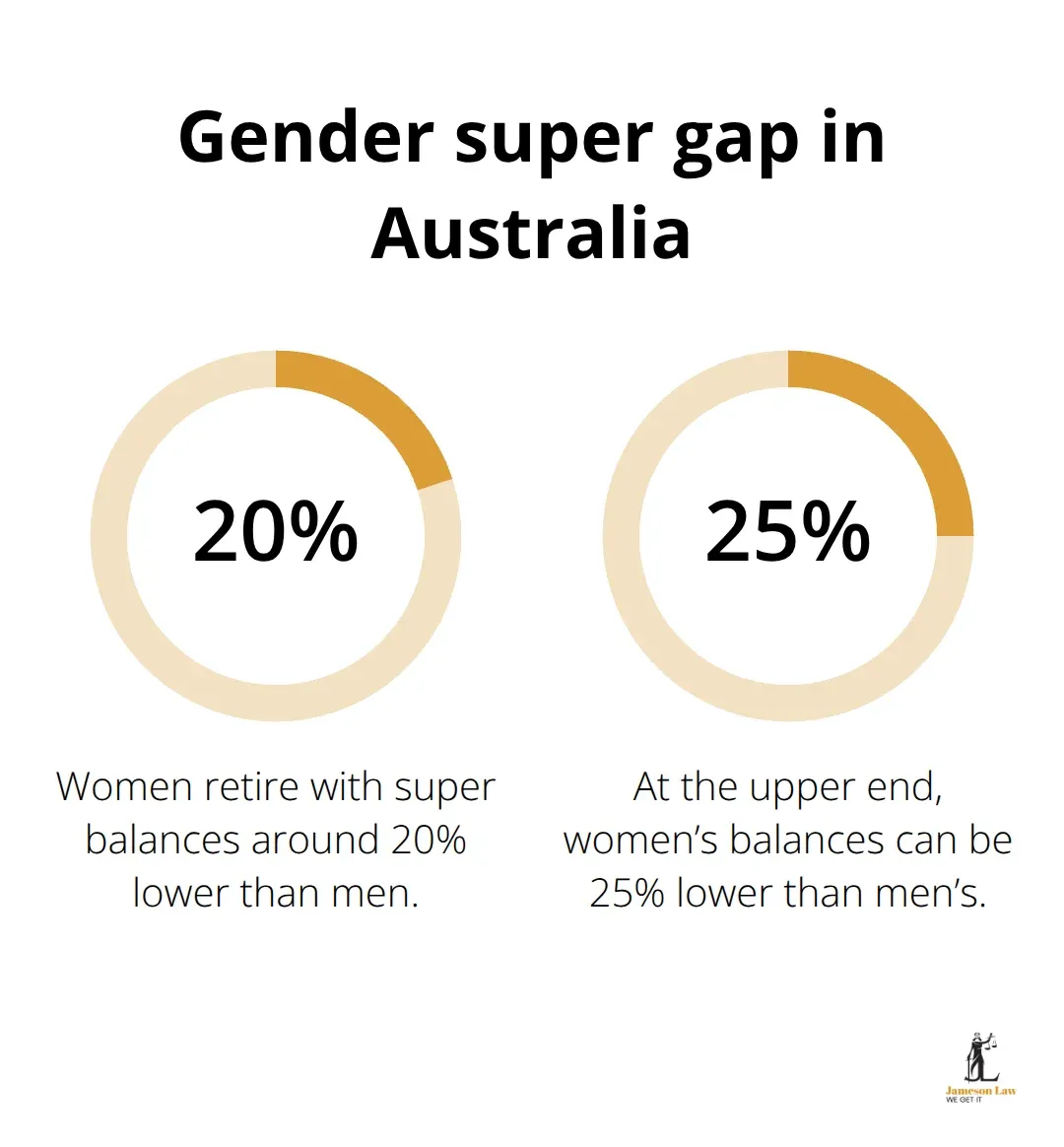

Implementation Timeline Requirements

Once a trustee receives valid notice and documents, a split usually becomes operative shortly after. Retail and industry funds often process within 30 to 60 days; defined benefit schemes can take longer due to calculations. Missing documents commonly cause 3 to 6 month delays. Non-member spouses cannot access the split until a condition of release is met, usually retirement. See APRA and the ATO’s conditions of release at ato.gov.au.

Documentation Requirements for Court Orders

Use the Superannuation Information Request Form to obtain current balances, fund details and valuation inputs. Trustees must receive written notice of proposed terms and be given a chance to respond. These steps are essential to a successful superannuation settlement. Useful resources: FCFCOA forms and kits and MoneySmart separation guides.

How to Navigate Super Settlement Documentation

The Superannuation Information Request Form should specify what is needed: balances, contribution history and any insurance. Funds may charge admin fees. Incomplete requests are rejected and cause delay. Our team can manage requests and liaise with trustees. Start here: contact Jameson Law.

Direct Communication with Fund Administrators

Fund administrators follow strict processes. Formal written notice must be given before a hearing and must include the proposed split. Processing differs between retail, industry and SMSF structures. SMSFs also have ATO notification obligations when implementing orders or consent orders.

Tax Consequences and ATO Reporting

Transfers made under binding financial agreements or court orders usually attract rollover treatment. The non-member receives the same tax-free and taxable components as the member’s interest. Withdrawals are taxed as normal super payments and must be reported to the ATO. See the ATO’s guidance on splitting super on divorce and tax on benefits.

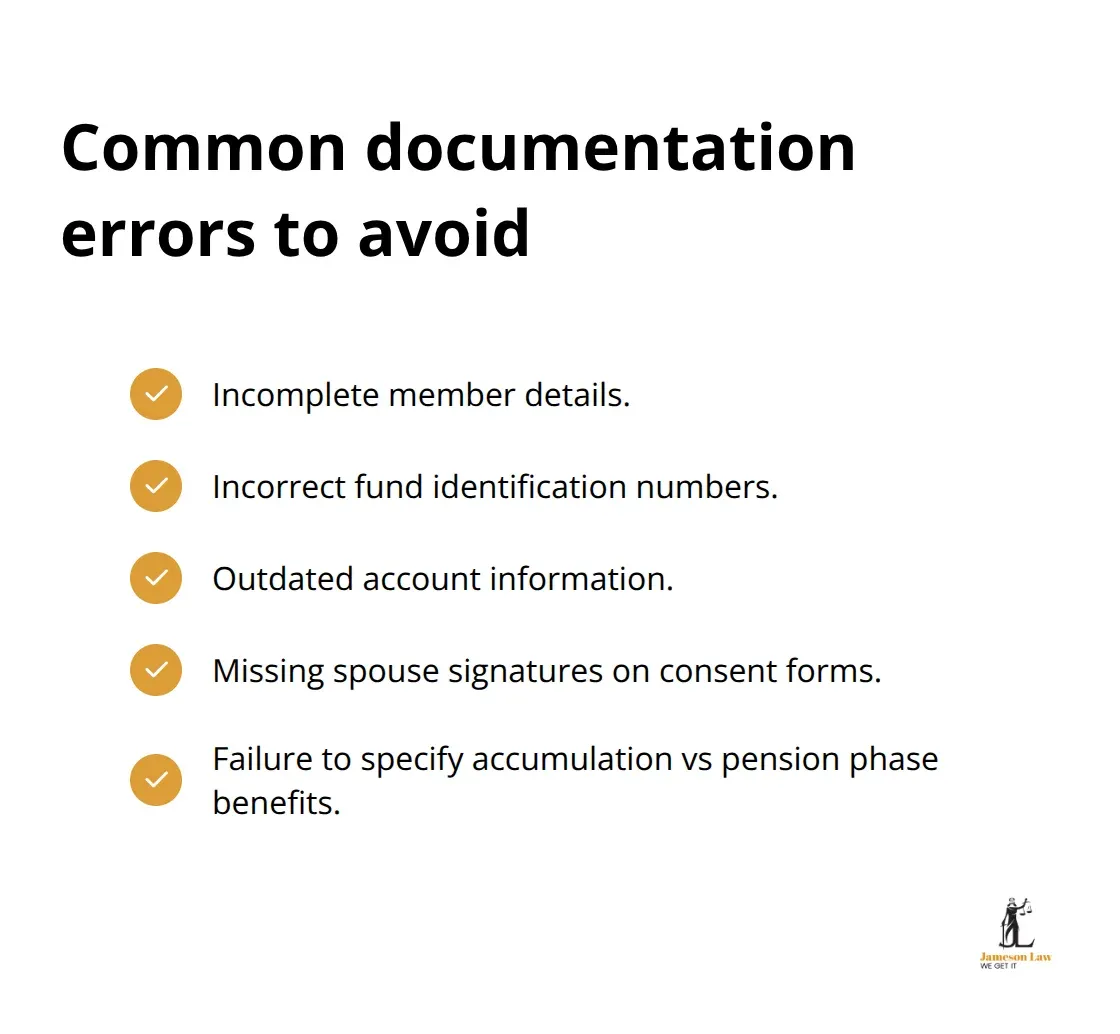

Common Documentation Errors

Missing or incorrect details delay settlements and increase costs. Frequent issues include wrong fund identification numbers, outdated account information, missing spouse signatures and failing to specify whether the split applies to accumulation or pension phase benefits.

Final Thoughts

Superannuation rules aim to protect your long term financial security during separation. Disclosure and process changes can reduce delays, but compliance is critical. Missing steps can extend timelines by months and inflate fees.

Get professional help where super assets are significant, where defined benefit schemes are involved or where SMSFs need restructuring. Cross-border pension issues also require specialist input. Plan for preservation age and conditions of release. The tax-free and taxable components retain their character after a split, which affects future withdrawals. For clear, practical advice, call (02) 8806 0866 or visit Jameson Law for superannuation division and full family law support.