Superannuation division remains one of the most complex aspects of property settlements in Australian family law. The Family Law Superannuation Regulations 2025 have introduced significant changes that affect how couples split retirement savings during separation.

We at Jameson Law see many clients struggle with these intricate rules and procedures. Understanding your options early can save thousands in legal fees and protect your financial future.

Understanding Family Law Superannuation Rules in 2025

What Changed in Superannuation Law This Year

The Family Law Superannuation Regulations 2025 introduced sweeping changes that commenced on April 1, 2025, and replaced regulations that had not seen updates since 2001. These new rules modernise how courts value and split superannuation during separations, with trustees now required to share detailed information about superannuation interests to facilitate fair division.

The regulations expand the types of super interests eligible for approved valuation methods and introduce flexibility for non-member spouses when they provide information after parties establish agreements. A transition factor (currently set at one) maintains existing values from prior methods, which prevents disruption to pre-April 2025 agreements.

Super Fund Types That Face Division

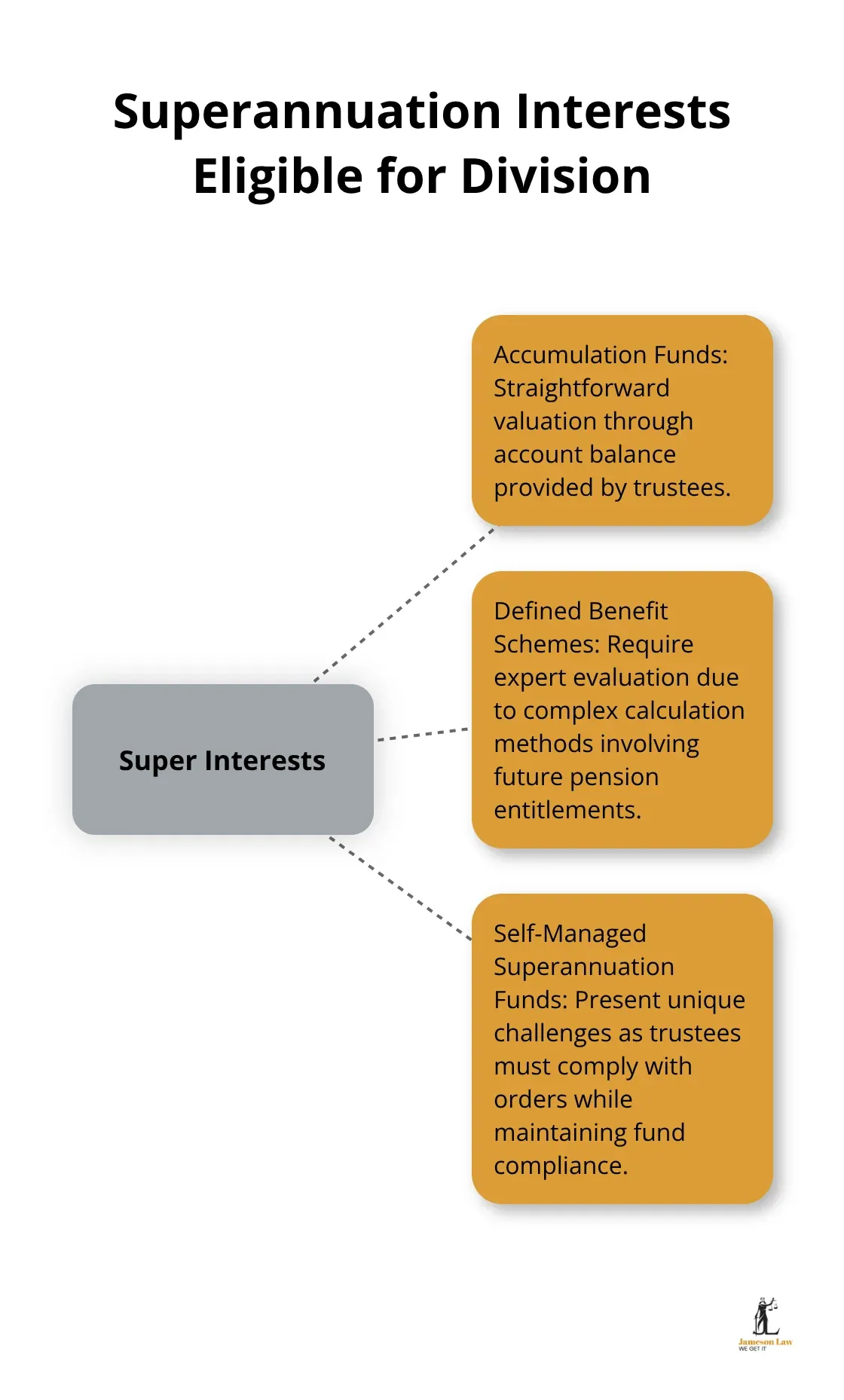

All superannuation interests qualify as property under the Family Law Act 1975, which means accumulation funds, defined benefit schemes, and self-managed superannuation funds all fall within the asset pool during separation. Courts treat each type differently based on their structure and complexity.

Accumulation interests receive simple valuation through the account balance that trustees provide, which makes them straightforward to handle. Defined benefit schemes require expert evaluation due to their complex calculation methods that involve future pension entitlements and demographic assumptions. Self-managed super funds present unique challenges as trustees must comply with orders while they maintain fund compliance.

Valuation Methods That Courts Accept

The 2025 regulations updated valuation methods to reflect current demographic and economic assumptions, which replaced outdated calculations that undervalued many superannuation interests. Courts now accept trustee-provided account balances for accumulation funds without independent valuations in most cases.

Defined benefit interests must undergo actuarial assessment that uses approved methods. These methods factor in life expectancy, inflation rates, and benefit formulas specific to each scheme. The Australian Taxation Office provides guidelines on transfer balance caps and contribution limits that affect valuation calculations.

Administrative Changes That Affect Your Case

The new regulations introduce enhanced information-sharing requirements between trustees and separating parties. Trustees must now provide comprehensive details about superannuation interests within specified timeframes, which streamlines the division process significantly.

Non-member spouses gain additional flexibility in how they provide information to trustees after agreements or court orders are established. This change reduces administrative burdens and allows for more efficient processing of superannuation splits. The regulations also expand eligibility criteria for approved valuation methods, which gives couples more options when they negotiate settlements.

These regulatory changes set the foundation for how couples can approach superannuation division, but the actual splitting process involves several distinct options and procedures that require careful consideration.

Superannuation Splitting Options and Procedures

Payment Splits Create Immediate Division

Payment splits transfer a specified amount or percentage of superannuation directly from the member spouse to the non-member spouse. This method works best for accumulation funds where trustees deduct the agreed amount and allow non-member spouses to roll it into their chosen superannuation fund.

Non-member spouses gain immediate ownership of their portion but cannot access benefits until they meet a condition of release (typically at retirement age). Courts prefer this approach because it creates clean separation with no ongoing financial ties between former partners.

Flag and Split Arrangements Delay Division

Flag and split arrangements prevent member spouses from accessing their superannuation benefits until courts make final property orders. Trustees place a flag on the account, which freezes payments while parties negotiate settlement terms.

This option suits cases where immediate valuation proves difficult or where one spouse might dissipate assets before settlement. However, flag arrangements create ongoing administrative burdens and keep former partners financially connected until the flag lifts. Flag arrangements should be avoided unless immediate splits pose genuine risks to asset preservation.

Documentation Requirements Determine Success

Superannuation agreements must specify the exact division method, whether by fixed dollar amount or percentage, and require independent legal advice for both parties to become legally binding. Courts accept consent orders as alternatives to private agreements, which provide stronger legal protection and eliminate trustee discretion in implementation.

Superannuation trustees must receive written notice of any proposed agreement or court order to verify compliance with fund rules. Agreements become effective on the fourth business day after trustees receive proper notification, while court orders take effect on dates specified by the judge.

Administrative Timeframes Affect Your Settlement

The Family Law Act and the Family Law (Superannuation) Regulations 2025 allow superannuation payments to be split when a couple separates. Trustees must provide comprehensive information about superannuation interests within prescribed periods, which streamlines the division process significantly.

Missing documentation or incorrect procedures can delay superannuation splitting by months and increase legal costs substantially. Trustees may charge reasonable fees for administrative actions related to implementing superannuation agreements or orders.

While these procedures appear straightforward, separating couples often encounter complex challenges that require specialised knowledge and strategic planning to overcome effectively.

Common Challenges and How to Overcome Them

Self-Managed Super Funds Require Special Handling

Self-managed superannuation funds create the most complex division scenarios because trustees must maintain fund compliance while they implement court orders. SMSFs often hold illiquid assets like property or shares that trustees cannot easily split, which forces them to sell assets or restructure holdings to accommodate division orders.

The Tax Office is actively targeting SMSF trustees over a range of super breaches during major structural changes. This highlights why professional guidance becomes essential during separation proceedings. SMSF trustees face additional complications when they must value unique assets or when fund members disagree about asset disposal methods.

Defined Benefit Schemes Present Valuation Challenges

Defined benefit schemes create valuation challenges because future pension entitlements depend on variables like salary growth, years of service, and fund performance that change constantly. The Commonwealth Superannuation Corporation manages schemes for federal employees, and their actuarial calculations can differ between initial and final valuations during lengthy court proceedings.

These schemes require expert actuarial assessment that factors in complex benefit formulas specific to each fund. Courts must consider whether to split the benefit at the time of separation or when the member spouse retires, which can significantly affect the final division amount.

Cross-Border Superannuation Adds Complexity

Cross-border superannuation adds another layer of complexity when one spouse holds overseas pension rights or moves abroad during proceedings. Australian courts cannot enforce orders against foreign pension schemes, and international conventions create additional complications for superannuation division.

Tax treaties between Australia and other countries may trigger unexpected tax liabilities when superannuation transfers occur across borders. This particularly affects arrangements with the United States and United Kingdom where different tax treatment applies to retirement savings. Couples must consider currency fluctuations and foreign tax obligations when they negotiate international superannuation splits.

Documentation Gaps Create Delays

Missing or incomplete documentation frequently delays superannuation division proceedings by months. Trustees require specific information formats and may reject applications that fail to meet their administrative requirements. Some funds impose additional fees for complex division arrangements or require multiple valuations throughout extended court proceedings.

Parties must maintain accurate records of all superannuation contributions and changes to provide proper financial disclosure during family law proceedings. Courts impose sanctions on parties who fail to comply with disclosure requirements, which can negatively impact their property settlement outcomes.

Final Thoughts

The Family Law Superannuation Regulations 2025 have fundamentally changed how couples approach retirement savings division during separation. These reforms create opportunities for fairer outcomes but require careful navigation to avoid costly mistakes that could impact your financial security for decades. Superannuation division demands immediate attention during separation proceedings because delays often result in reduced settlement values and increased legal costs.

The complexity of different fund types means that generic advice rarely applies to your specific circumstances. Professional legal assistance becomes essential when superannuation assets exceed $100,000, when you deal with defined benefit schemes, or when cross-border complications arise. We at Jameson Law have experience with these intricate processes and focus on protecting retirement savings while minimising legal expenses through strategic early intervention.

Your financial future depends on how well you understand these regulations and act promptly. Document all superannuation interests immediately, obtain current valuations, and seek expert family law guidance before you make any binding agreements. The decisions you make today will determine your financial security throughout retirement.