Will disputes can tear families apart and drain estate resources quickly. At Jameson Law, we’ve seen how disagreements over wills create lasting conflict and financial strain.

This guide walks you through will disputes resolution in NSW, from understanding your options to taking action. You’ll learn what claims are valid and how much disputes cost.

What Makes Wills Disputed in NSW?

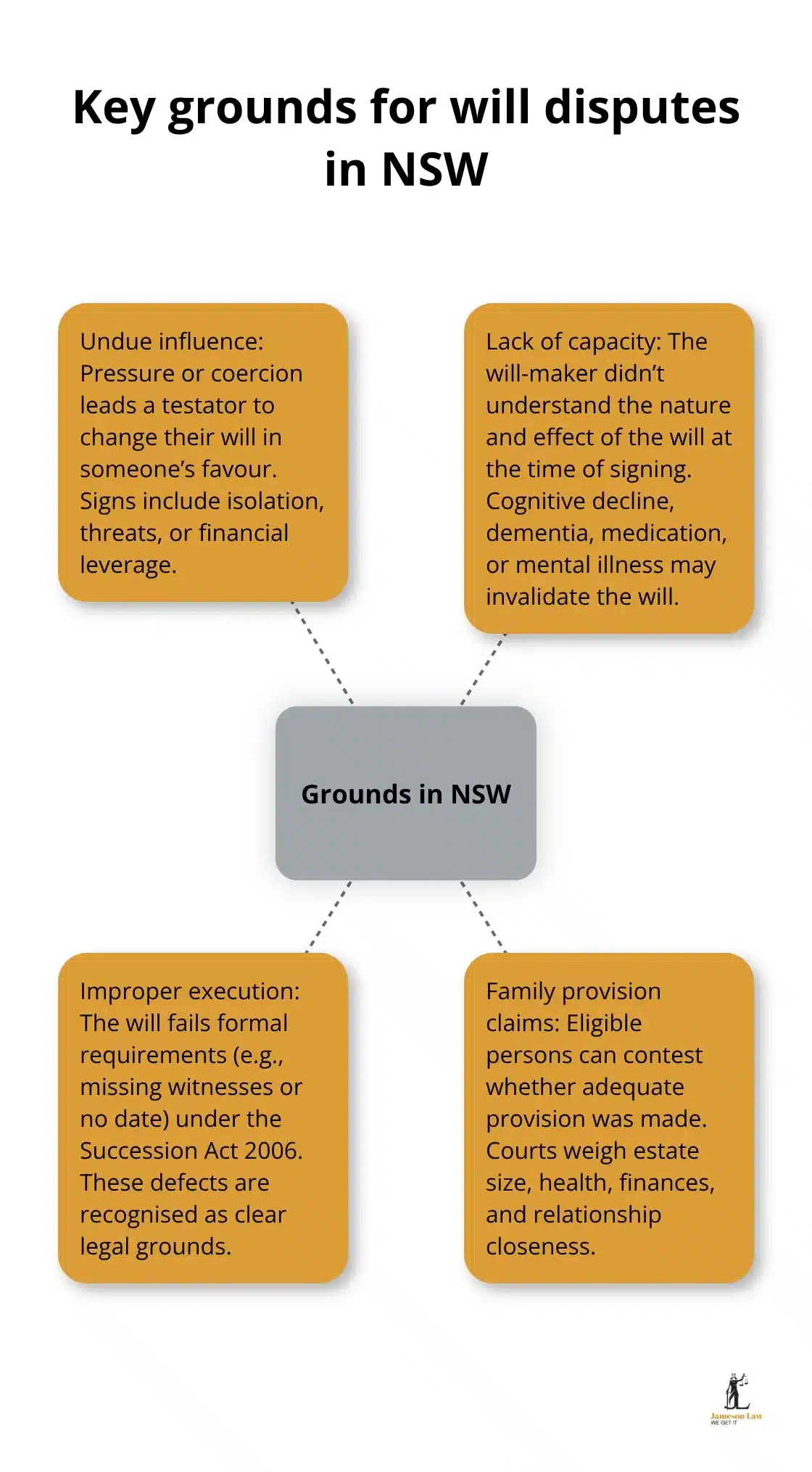

Undue Influence and Lack of Capacity

Will disputes often stem from specific grievances. Undue influence occurs when someone pressures the deceased to alter their will. Testamentary capacity is another common ground—the deceased must have been mentally fit to understand the document.

Improper Execution and Formal Requirements

Under the Succession Act 2006 (NSW), wills must meet formal requirements (e.g., witness signatures). Breaches here are concrete legal grounds for a challenge.

Family provision claims allow eligible persons (spouses, children) to challenge a will if they were not adequately provided for. The Court considers financial need and the relationship with the deceased.

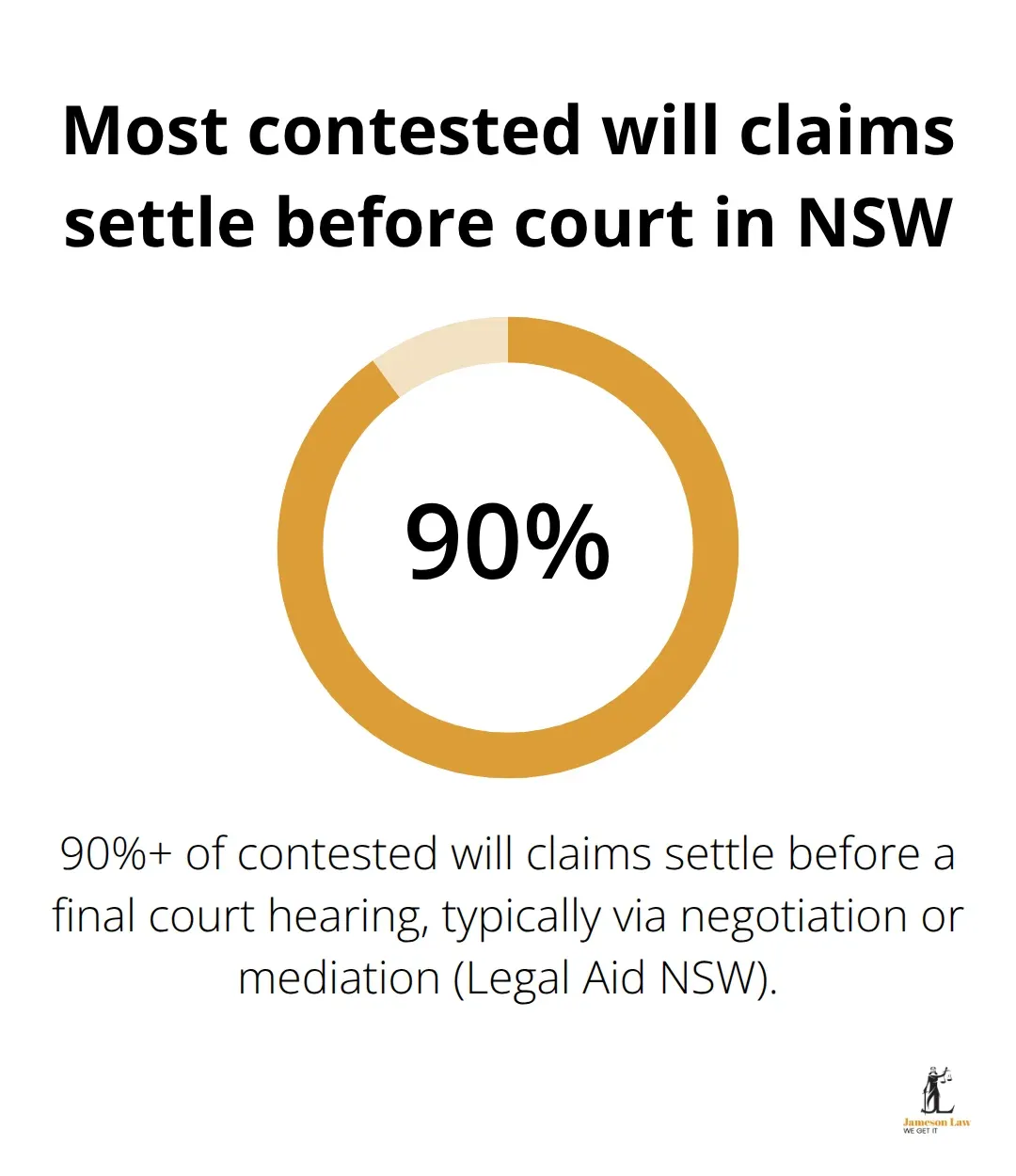

Settlement Rates and Early Resolution

Legal Aid NSW data shows over 90% of claims settle before a final hearing. Negotiation and mediation are the primary resolution paths.

The 12-Month Deadline and Caveat Protection

In NSW, you must file a family provision claim within 12 months of the date of death. If probate is imminent, filing a caveat stops the grant for 6 months, buying time to gather evidence.

How to Resolve Will Disputes?

Start with Negotiation

Direct negotiation is often the fastest route. Suggesting a settlement forces the other party to assess their risk. If they have weak evidence, they may settle to avoid court costs.

Use Mediation to Bridge the Gap

Mediation involves a neutral third party helping both sides reach an agreement. It is far cheaper than litigation and typically resolves disputes within weeks.

Pursue Court Proceedings Only as a Last Resort

Litigation is expensive. The Supreme Court of NSW manages contested probate matters. Be prepared for disclosure obligations under Practice Note SC Eq 7.

What Will Disputes Cost You?

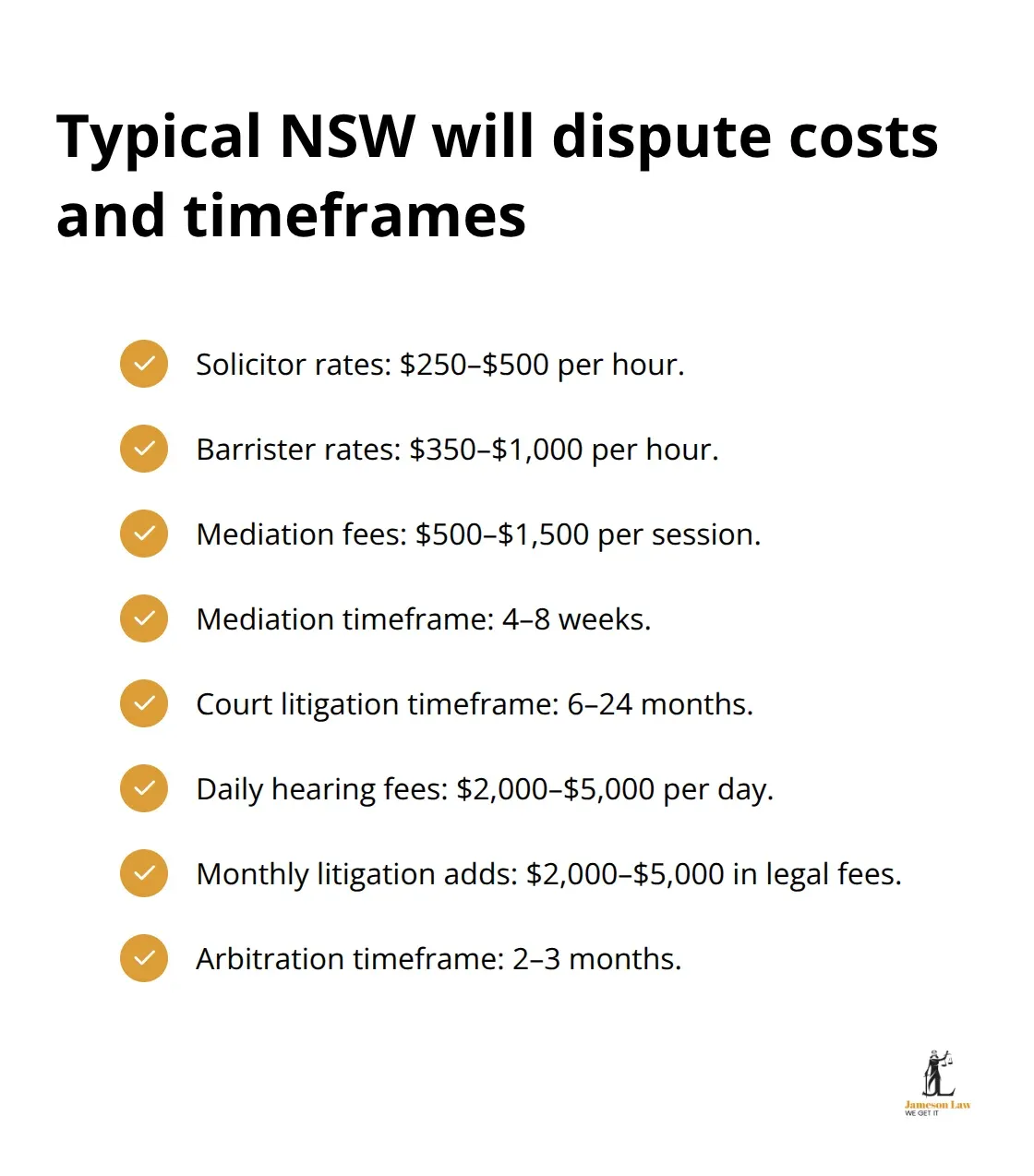

Legal Fees Form Your Largest Expense

Solicitor rates vary, but a straightforward claim through mediation may cost $5,000–$15,000. Contested court hearings can exceed $100,000. Estate assets deplete quickly if disputes drag on.

Early Filing Protects Your Position

Filing early preserves evidence. Delays weaken your case. Estate size matters—spending $30,000 to fight over a $50,000 claim is rarely wise. Executors may also face personal liability if they distribute assets prematurely.

Final Thoughts

Will disputes resolution in NSW requires decisive action. The 12-month deadline is absolute. Most cases settle via mediation, avoiding the high costs of trial.

We at Jameson Law guide clients through this complex process. Contact Jameson Law immediately if you suspect a will is invalid or need to defend a claim.