Homeowners insurance is a vital safety net for property owners, but many are unsure about its coverage for personal injuries. At Jameson Law, we often encounter clients wondering, “Will homeowners insurance cover personal injury?”

This blog post will explore the types of injuries typically covered, important limitations, and steps to take when filing a claim. Understanding your policy’s scope can make a significant difference in protecting yourself and your guests.

What Injuries Does Homeowners Insurance Cover?

Homeowners insurance provides coverage for various personal injuries that occur on your property. Understanding these coverages is essential for protecting yourself and your guests.

Slip and Fall Accidents

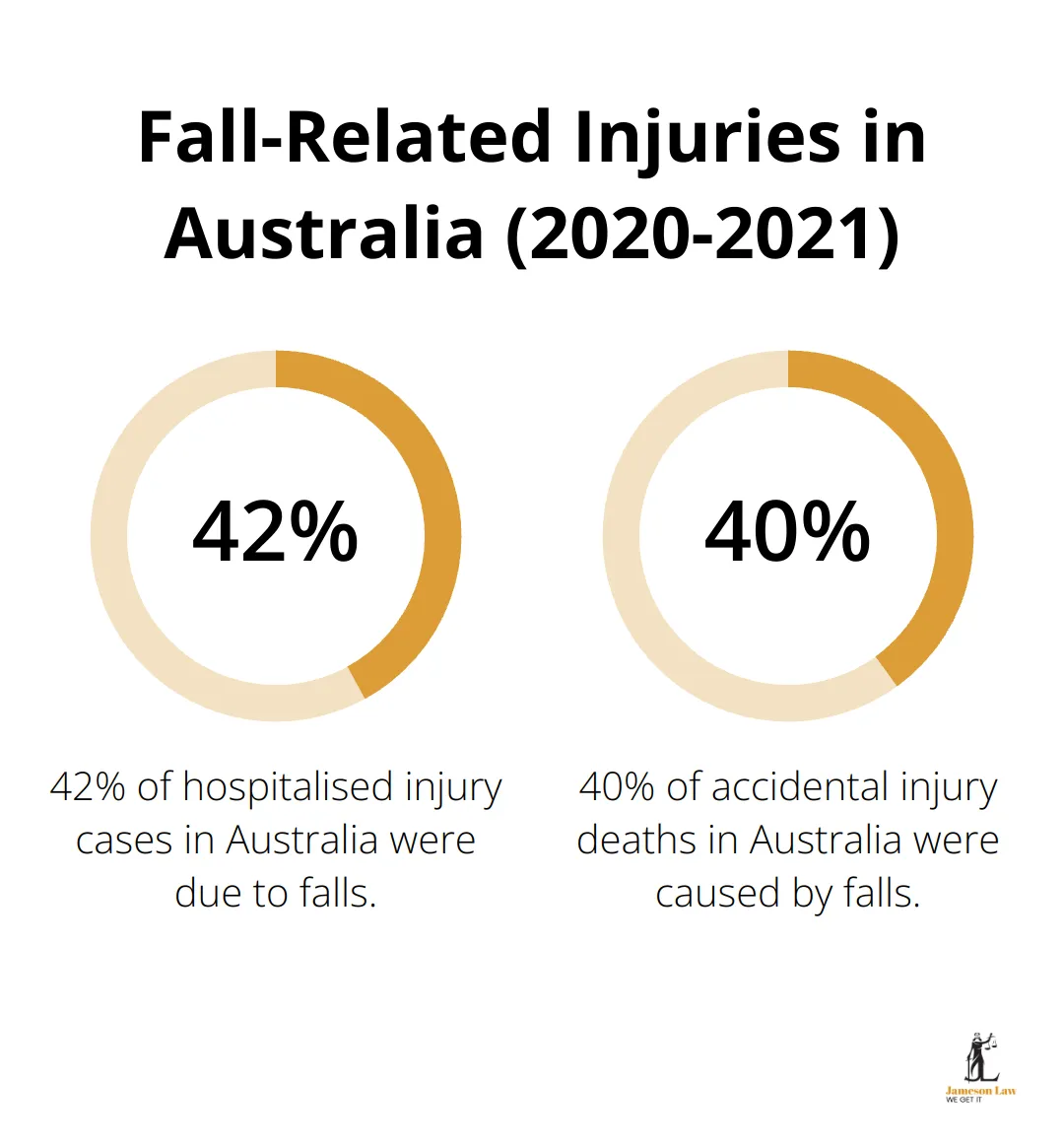

Slip and fall accidents top the list of personal injury claims covered by homeowners insurance. These incidents can result from hazards such as wet floors, icy walkways, or uneven surfaces. In 2020-2021, 42% of hospitalised injury cases and 40% of accidental injury deaths in Australia were due to falls, underscoring the importance of this coverage.

To minimise the risk of slip and fall accidents, you should:

- Inspect your property regularly for potential hazards

- Ensure proper lighting in all areas

- Maintain even walkways

- Address spills or icy conditions promptly

Animal-Related Injuries

Dog bites and other animal-related injuries typically fall under homeowners insurance policies. Recent data shows that crossbred companion dogs, particularly designer breeds, are leading pet insurance claims for common health conditions.

Pet owners must understand their policy’s specific coverage and any breed-specific exclusions. Some insurers require additional coverage for certain dog breeds they consider high-risk.

Structural Issues and Falling Objects

Homeowners insurance generally covers injuries caused by structural issues or falling objects on your property. This can include incidents such as:

- A tree branch falling on a visitor

- A loose railing causing someone to fall

- A ceiling fan detaching and injuring a guest

Regular inspections, proper maintenance of tools and equipment, comprehensive record-keeping, effective use of warning signs, and appropriate insurance are key to preventing these types of accidents. You should conduct periodic inspections of trees, railings, and other potential hazards to identify and address issues before they lead to injuries.

It’s important to note that while homeowners insurance provides coverage for these types of injuries, the specifics can vary between policies. Reviewing your policy carefully (and consulting with a legal professional) will help you fully understand your coverage and potential liabilities.

As we move forward, it’s equally important to understand the limitations and exclusions in homeowners insurance coverage. These can significantly impact your ability to file a successful claim in certain situations.

Understanding Homeowners Insurance Exclusions

Homeowners insurance offers valuable protection, but it doesn’t cover every incident on your property. You must understand the limitations and exclusions in your policy to avoid unexpected financial burdens.

Intentional Acts and Gross Negligence

Homeowners insurance typically doesn’t cover injuries from intentional acts or gross negligence. If you deliberately harm someone on your property or fail to address a known hazard that causes an injury, your insurance likely won’t cover the resulting claims.

It is important to de-risk the strata sector now to help lower the insurance claims costs associated with building repairs. To protect yourself, always prioritise safety on your property and address potential hazards promptly.

Injuries to Household Members

Most homeowners insurance policies exclude coverage for injuries to people who live in your household. This includes family members, long-term guests, and sometimes even domestic workers.

Hospitalisations increased from 28 in 2019/2020 to 128 in 2020/2021. Many of these injuries likely involved household members, which highlights the importance of understanding this exclusion.

To reduce risks:

- Consider separate health and disability insurance for family members

- Implement robust safety measures in your home

- Educate household members about potential hazards

Business-Related Injuries

Standard homeowners insurance usually won’t cover injuries related to your business activities if you run a business from your home. This exclusion can catch many home-based business owners off guard.

There were 2,506,012 small businesses operating in Australia in June 2022. If you’re part of this group, consider these steps:

- Obtain separate business liability insurance

- Clearly define business areas in your home

- Inform your insurer about your home-based business activities

Understanding these exclusions is vital for comprehensive protection. Insurance policies can vary widely, so always review your specific policy details and consult with a legal professional to ensure you have appropriate coverage for your unique situation.

Now that we’ve covered the main exclusions in homeowners insurance, let’s explore the steps you should take when filing a personal injury claim. This knowledge will help you navigate the claims process more effectively and increase your chances of a successful outcome.

How to File a Personal Injury Claim

Document Everything

The first step in filing a personal injury claim is thorough documentation. Gathering the proper evidence following a motor vehicle accident is crucial for a successful insurance claim. Take photos of the accident scene, your injuries, and any property damage. Collect contact information from witnesses and write down your recollection of the incident as soon as possible.

Keep all medical records, including bills, prescriptions, and treatment plans. These documents will serve as crucial evidence for your claim.

Notify Your Insurer Promptly

Contact your insurance company as soon as possible after the incident. Most policies have specific timeframes for reporting claims. Delays in notification might put your claim at risk.

Be honest and provide all the necessary information, but avoid admitting fault or speculating about the incident. Stick to the facts you’re certain about. The Insurance Council of Australia advises policyholders to familiarise themselves with their policy’s Product Disclosure Statement (PDS) to understand the claim process and coverage limits.

Seek Professional Legal Advice

Not every personal injury claim requires legal representation, but consulting with a personal injury lawyer can prove invaluable, especially for complex cases or severe injuries. A lawyer can help you navigate the claims process, negotiate with insurance companies, and ensure you receive fair compensation.

In Australia, many personal injury lawyers (including Jameson Law) offer a No Win No Fee arrangement, which makes legal representation more accessible. This arrangement means you only pay legal fees if your claim succeeds. However, it’s important to understand the terms of this agreement before you proceed.

Insurance companies have teams of lawyers working to minimise payouts. Having your own legal representation levels the playing field and often leads to better outcomes.

Follow Medical Advice

Adhere to all medical advice and treatment plans provided by your healthcare professionals. This not only supports your recovery but also strengthens your claim. Insurance companies may interpret non-compliance with medical advice as a sign that your injuries are not as severe as claimed.

Keep a detailed record of all medical appointments, treatments, and how your injuries affect your daily life. This information can help demonstrate the full impact of the injury on your quality of life and support your claim for compensation.

Be Cautious with Social Media

In today’s digital age, it’s important to be mindful of your social media activity during a personal injury claim. Insurance companies may monitor your online presence for evidence that contradicts your claim. Avoid posting about your accident, injuries, or activities that might suggest your injuries are less severe than reported.

Final Thoughts

Homeowners insurance will cover personal injury in many cases, but policy details matter. You must review your policy regularly and understand its specific terms and exclusions. Proper property maintenance and prompt hazard resolution can prevent accidents and subsequent claims.

Document everything thoroughly if a personal injury occurs on your property. Notify your insurer immediately, follow medical advice strictly, and monitor your social media activity during the claims process. These actions can significantly impact your claim’s outcome.

Complex cases or severe injuries often require professional legal advice. Jameson Law offers expert guidance in personal injury matters (operating on a No Win No Fee basis for plaintiff personal injury claims). Our team’s experience can help you navigate the complexities of personal injury claims related to homeowners insurance.