Being named as an executor or administrator is a significant responsibility. You’re tasked with managing someone’s estate, handling their assets, and ensuring beneficiaries receive what they’re entitled to.

At Jameson Law, we’ve guided countless people through executor duties in NSW. This guide breaks down your legal obligations under the Probate and Administration Act 1898.

What You’re Actually Responsible for as an Executor?

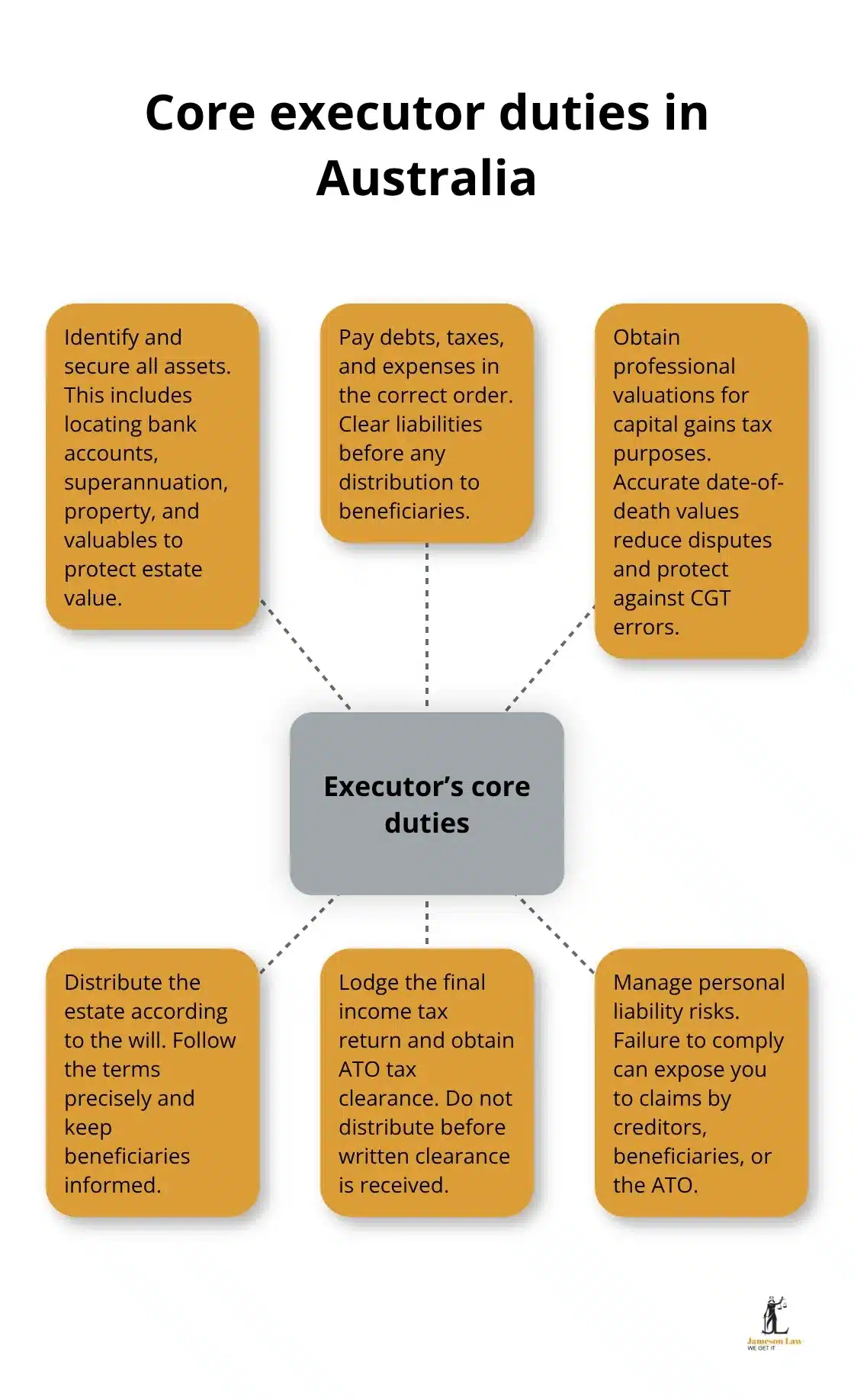

Your Fiduciary Duty and Core Obligations

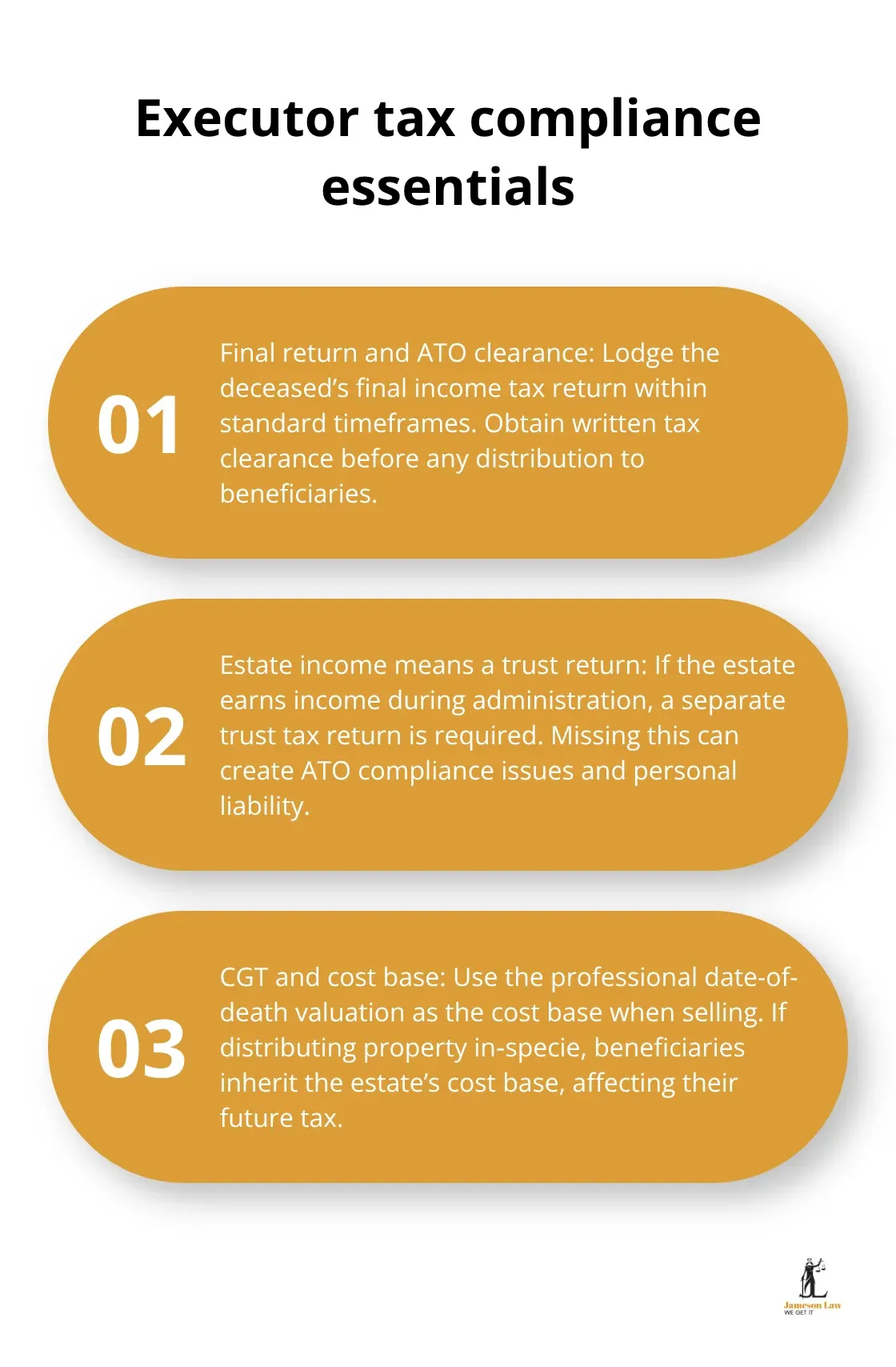

An executor holds a fiduciary duty, meaning you must prioritise the estate above your own interests. Under the Succession Act 2006 (NSW), your core responsibilities include identifying assets, paying debts, and obtaining valuations for Capital Gains Tax (CGT) purposes.

You must also lodge a final income tax return with the Australian Taxation Office (ATO). Failing to meet these obligations creates personal liability, meaning creditors can pursue you personally for unpaid debts.

The 6-Month vs. 12-Month Rule in NSW

There is a critical distinction in NSW law:

- Family Provision Claims: Eligible persons have 12 months from the date of death to contest the Will.

- Executor Protection: Under Section 93 of the Succession Act 2006, you are protected from personal liability if you distribute assets 6 months after death, provided you published a notice and received no claims.

Many prudent executors wait until the 12-month window closes or seek legal advice before distributing to avoid estate disputes.

What to Do First: Locating and Securing Assets

Freeze Accounts and Identify All Assets

Your first job is to secure the assets. Open a dedicated estate bank account immediately. Contact banks to freeze accounts. The ATO recommends searching for lost superannuation, as beneficiaries often overlook these funds.

Value Real Estate Correctly

You must hire a professional valuer—not a real estate agent—to determine the property’s value as at the date of death. This valuation is essential for the ATO and prevents disputes among beneficiaries later.

Settle Debts and Tax Obligations

Debts must be paid in a specific order: funeral expenses first, followed by administration costs and taxes. Only then can you distribute the remainder. Obtain a tax clearance from the ATO to protect yourself.

Estate Disputes and Tax Pitfalls

Handling Disagreements Among Beneficiaries

Disputes often arise from confusion. Mediation is often faster and cheaper than court proceedings. Keep clear records of every decision to defend against potential misconduct claims.

Valuing Complex and Disputed Assets

Do not attempt to value complex assets (like crypto or businesses) yourself. Independent valuations are your legal shield. Be aware that Family Provision Claims can be made against the “notional estate” in NSW, which includes assets transferred shortly before death.

Final Thoughts

Executor duties in NSW demand strict compliance with the Succession Act 2006. The risk of personal liability for unpaid debts or premature distribution is real.

We at Jameson Law have guided countless people through these duties. If you are dealing with complex assets or potential disputes, contact Jameson Law for a confidential consultation to ensure you are fully protected.