When someone passes away in NSW, their estate must often go through probate—a legal process that can feel overwhelming for families. At Jameson Law, we’ve guided countless executors through NSW wills probate, and we know the process doesn’t have to be complicated.

This guide walks you through each step, from obtaining a Grant of Probate to distributing assets. We’ll also show you how to sidestep common pitfalls that delay estates.

What is Probate in NSW and When You Actually Need It?

Understanding a Grant of Probate

A Grant of Probate is a formal order from the Supreme Court of NSW. It verifies the Will is valid and authorises the executor to distribute the estate. Without it, banks often refuse to release funds.

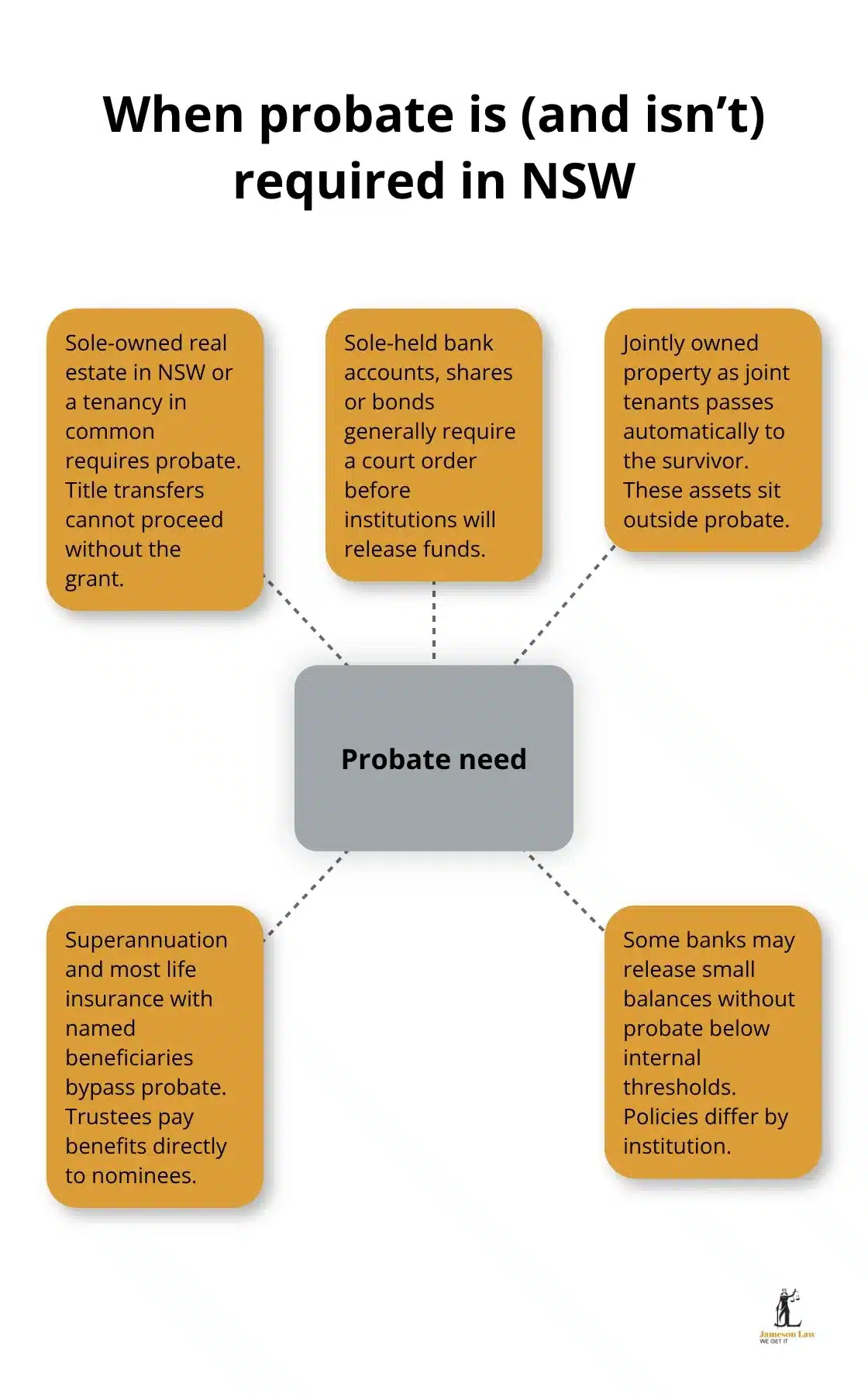

When Probate Becomes Mandatory

Probate is non-negotiable if the deceased owned real estate in their sole name or as a “tenant in common.” It is also required for high-value assets like shares or bonds.

However, assets owned as “joint tenants” pass automatically to the survivor. Superannuation often bypasses probate if there is a binding nomination.

How Intestacy Changes the Rules

If there is no valid Will, Letters of Administration are required instead. The estate is then distributed according to the Succession Act 2006 (NSW) intestacy rules, which prioritise spouses and children.

Getting Your Probate Application Lodged

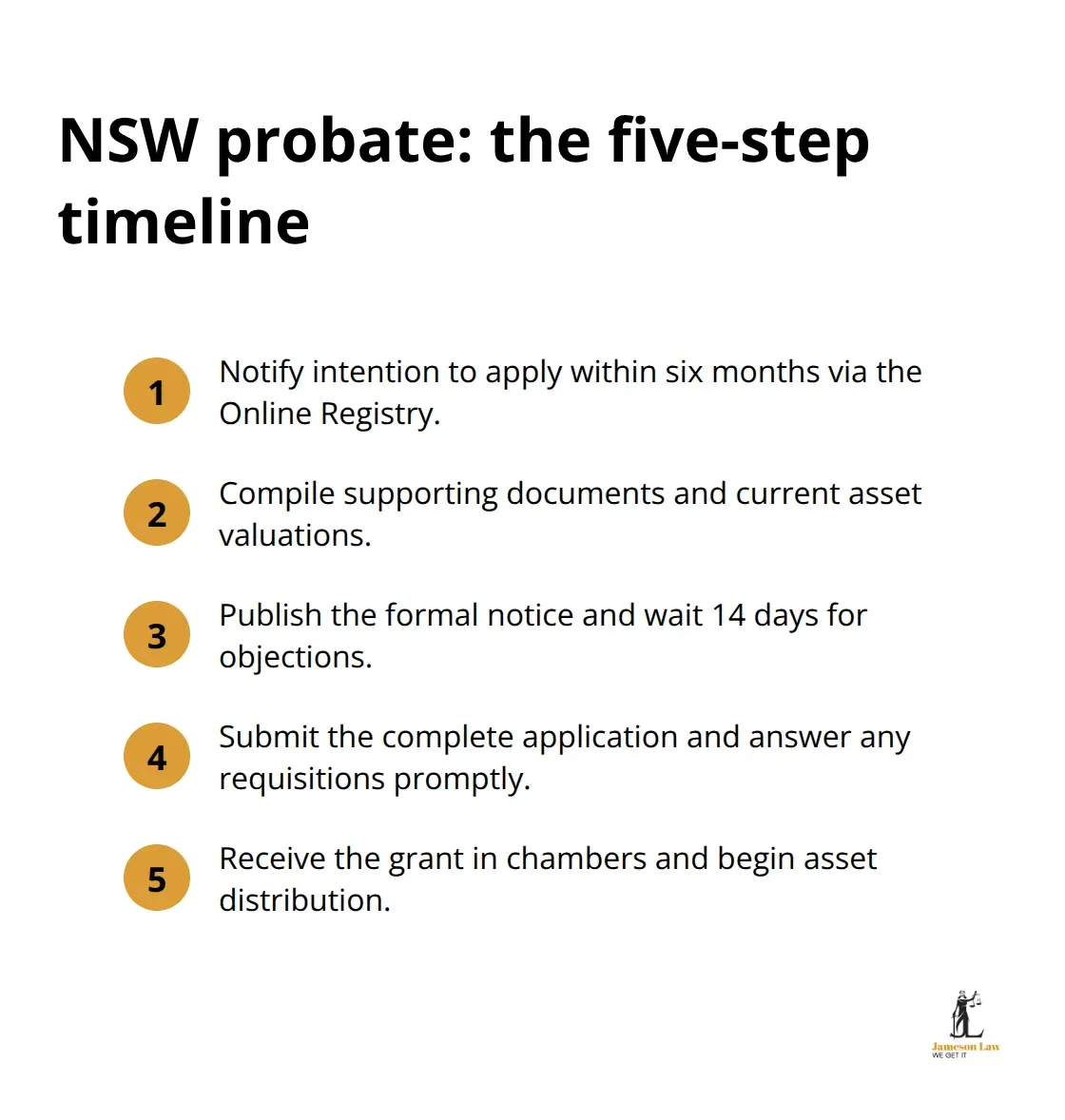

The Five-Step Timeline to a Valid Grant

The process involves notifying the Court via the NSW Online Registry, gathering documents, and waiting 14 days for creditor objections before filing.

Compiling Your Asset Inventory and Understanding Fees

You must identify every asset. Fees are tiered: estates valued between $100,000 and $250,000 typically pay around $899 (check the current fee schedule). Estates under $100k pay no filing fee.

Filing and Managing Court Requisitions

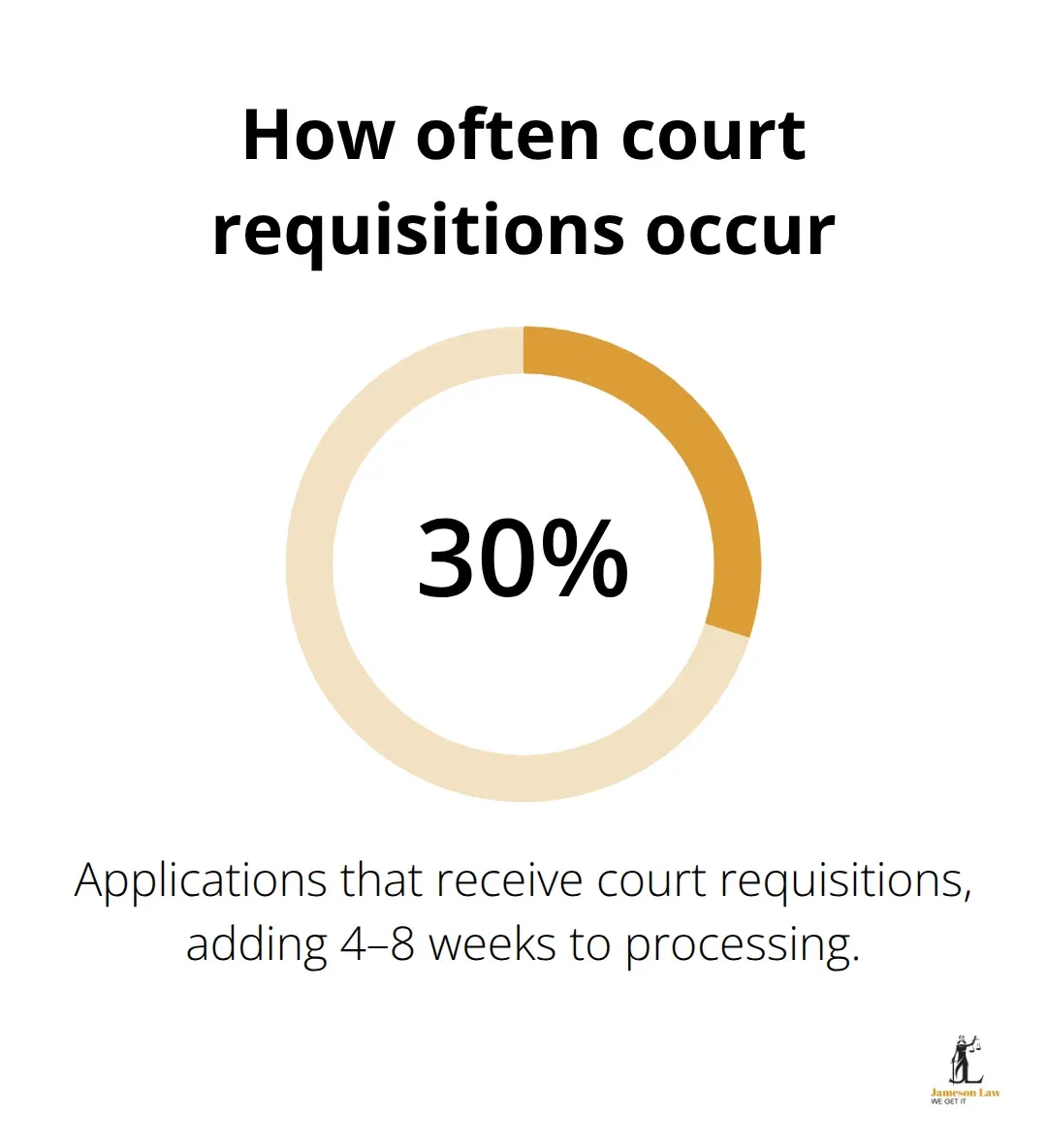

You must file the original Will. If the Court issues requisitions (questions), respond promptly. Delays often occur when documentation is incomplete.

Common Challenges That Derail Probate Applications

Incomplete Applications

Roughly 30% of applications receive requisitions. Missing the original death certificate or incorrect asset valuations are common errors. Always complete your asset inventory carefully.

Estate Debt and Tax Obligations

Executors are personally liable for unpaid debts. You must obtain tax clearance from the Australian Taxation Office (ATO) before distributing assets. Be aware of potential family provision claims which must be filed within 12 months.

Final Thoughts

NSW wills probate demands precision. The 6-month deadline and strict documentary requirements leave no room for error. Professional guidance protects you from personal liability.

If you need assistance with probate or estate administration, contact Jameson Law. We can help you navigate the legal requirements and ensure the estate is distributed correctly.