Estate planning is a critical process that safeguards your assets and ensures your wishes are respected after you’re gone. At Jameson Law, we’ve seen firsthand how effective estate planning strategies can provide peace of mind and financial security for families.

This guide will explore key components of estate planning in Australia, essential documents, and strategies to protect your assets and minimise tax implications.

What Is Estate Planning in Australia?

The Essence of Estate Planning

Estate planning in Australia involves the arrangement of your affairs to ensure the distribution of your assets according to your wishes after death. This process extends beyond the creation of a will. Estate planning protects your loved ones, minimises taxes, and prevents potential legal disputes.

Key Components of an Effective Estate Plan

An effective estate plan in Australia comprises several essential elements:

- Will: The foundation that details asset distribution

- Powers of Attorney: Vital legal instruments allowing a trusted person to act on your behalf in financial, personal, or medical matters

- Advance Care Directives: Outlines healthcare preferences

- Superannuation Death Benefit Nominations: Directs super fund distribution (often outside the will)

- Trusts: Powerful tools for asset protection and tax minimisation

- Life Insurance Policies: Provides liquidity for estate taxes and expenses

Recent Legal Developments

Australian estate planning laws have undergone significant changes. In 2018, New South Wales introduced legislation allowing courts to treat certain property as part of a deceased person’s estate, even if not technically owned at death. This change aims to prevent the avoidance of family provision claims through pre-death asset transfers.

The increasing recognition of digital assets in estate planning marks another important development. The rise of cryptocurrencies and online accounts necessitates their inclusion in estate plans. The Australian Taxation Office provides guidance on the tax treatment of crypto assets, including how to work out and report Capital Gains Tax on crypto.

The Value of Professional Advice

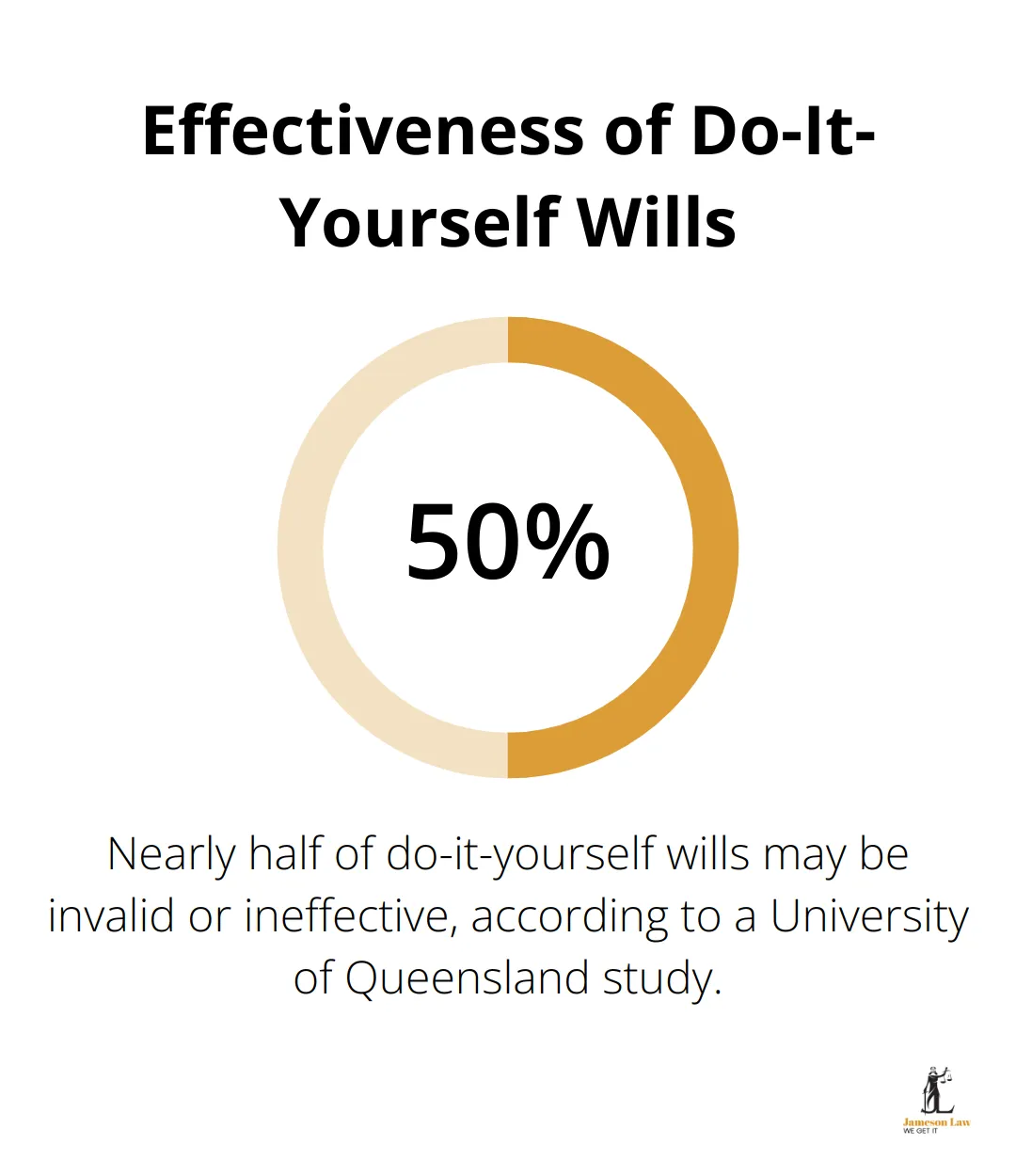

Online will kits often fail to address the complexities of individual situations. A University of Queensland study found that nearly 50% of do-it-yourself wills may be invalid or ineffective. Professional legal advice can help avoid costly disputes and unintended outcomes.

Estate planning requires regular reviews to maintain currency and effectiveness. Major life events (marriage, divorce, childbirth) should trigger a review of your estate plan. Professional guidance ensures your legacy remains protected and your loved ones provided for as intended.

As we move forward, let’s explore the essential documents that form the backbone of a comprehensive estate plan in Australia.

Key Estate Planning Documents in Australia

Wills: The Cornerstone of Your Estate Plan

A will forms the foundation of any estate plan. This legal document outlines how you want your assets distributed after your death. The NSW Trustee & Guardian reports that over 45% of Australians don’t have a valid will, which can lead to significant complications for loved ones.

To create a valid will in Australia, you must:

- Be over 18 years old

- Be of sound mind

- Put the will in writing

- Sign it in the presence of two witnesses

While DIY will kits exist, they often fail to address complex situations. A University of Queensland study found that nearly half of DIY wills may be invalid or ineffective. Professional drafting ensures your will is legally binding and reflects your true intentions.

Powers of Attorney: Safeguarding Your Interests

Powers of Attorney (POA) allow someone to make decisions on your behalf if you’re unable to do so. In Australia, different types of POA exist, each granting specific powers and having different legal requirements.

The Australian Guardianship and Administration Council reports that only 13% of Australians have appointed a POA. This low uptake leaves many vulnerable if they become incapacitated.

Advance Care Directives: Expressing Healthcare Preferences

An Advance Care Directive (ACD) outlines your preferences for future medical treatment. It activates when you can’t make or communicate decisions about your healthcare.

The prevalence of advance care planning in primary care is vastly lower than in aged care and acute hospitals, signalling a major policy challenge for enabling end-of-life care preferences.

Testamentary Trusts: Securing Your Legacy

A testamentary trust is created within your will and activates after your death. It offers several benefits:

- Asset protection for beneficiaries

- Potential tax advantages

- Control over inheritance distribution

The Australian Taxation Office notes that testamentary trusts can be an effective strategy in estate planning, particularly for developing an effective strategy, preparing a valid will, and administering a deceased estate.

Creating a comprehensive estate plan involves more than drafting these documents. It requires careful consideration of your assets, family situation, and long-term goals. Regular reviews and updates maintain the effectiveness of your plan as circumstances change.

As we move forward, we’ll explore strategies to minimise tax and maximise asset protection within your estate plan.

How to Minimize Tax and Maximize Asset Protection in Estate Planning

Superannuation Death Benefit Nominations

Superannuation often represents one of the largest assets in an estate, yet many Australians overlook its importance in estate planning. Without a nomination, there is no control over the potential for beneficiaries to be taxed and an unnecessary reduction in the overall benefit.

A binding death benefit nomination ensures your super payment to your chosen beneficiaries, bypassing your estate. This can offer tax advantages, as super paid directly to dependents is typically tax-free. Non-dependents, however, may face a tax of up to 32% on the taxable component.

To maximise the tax efficiency of your super:

- Review and update your nominations regularly

- Split your super between tax-dependent and non-dependent beneficiaries

- Convert your super to a pension before death (this potentially reduces the tax payable by non-dependent beneficiaries)

The Power of Family Trusts

Family trusts offer asset protection and tax benefits, but come with some drawbacks. They can help protect assets from creditors and offer flexibility in income distribution among family members.

Family trusts can provide:

- Asset protection (by separating personal and trust assets)

- Tax efficiency (through income splitting among beneficiaries)

- Generational wealth transfer (by allowing for controlled distribution over time)

However, trusts are complex structures. Professional advice ensures your trust’s correct setup and management to avoid potential drawbacks.

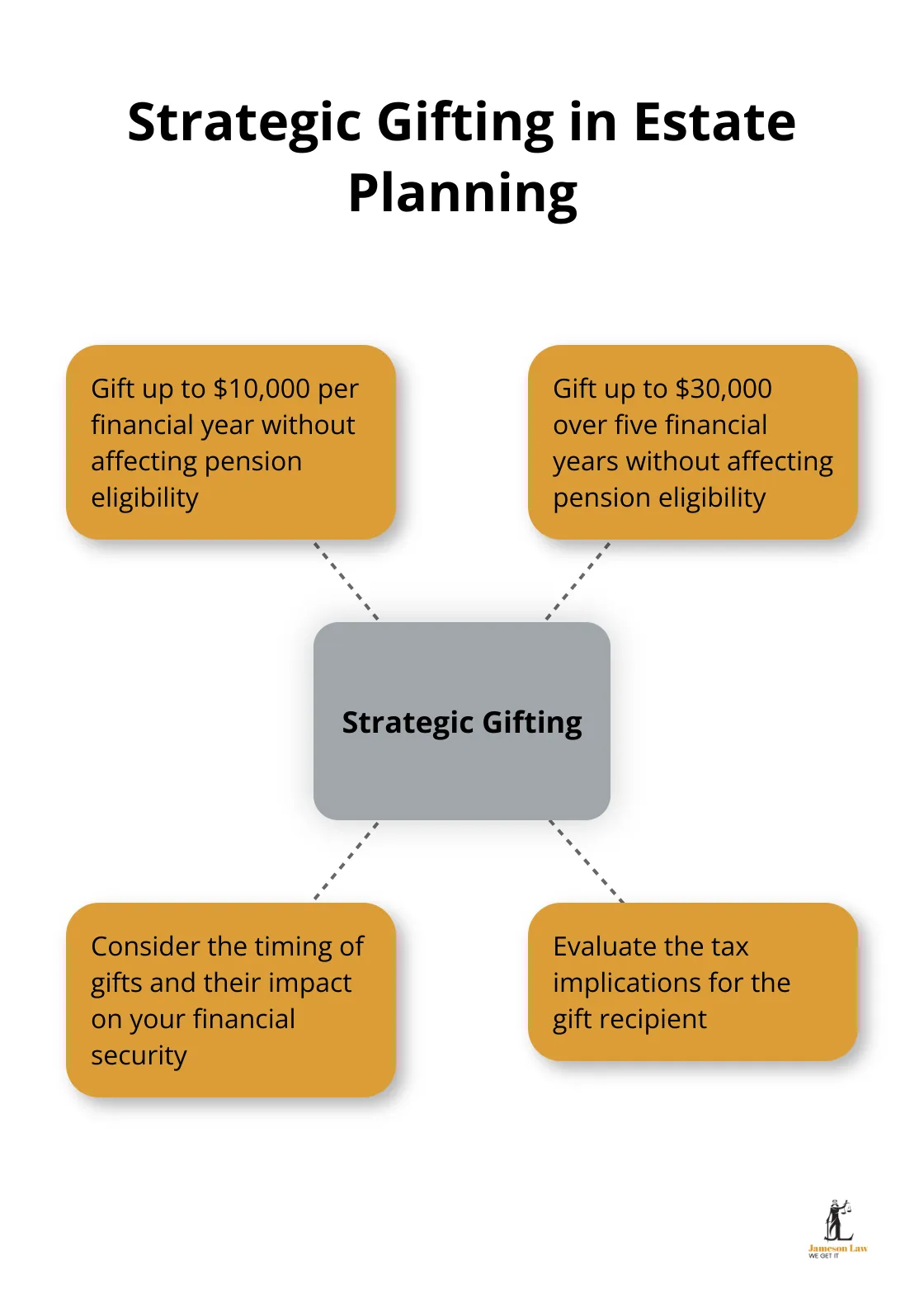

Strategic Gifting

Gifting assets during your lifetime can effectively reduce your taxable estate. However, understanding the rules prevents unintended consequences.

In Australia, you can gift up to $10,000 per financial year and up to $30,000 over five financial years without affecting your pension eligibility. Exceeding these limits may result in the excess treatment as a deprived asset, potentially affecting your pension for up to five years.

Consider:

- The timing of gifts

- The impact on your own financial security

- The tax implications for the recipient

Navigating Capital Gains Tax

Capital Gains Tax (CGT) can significantly impact your estate’s value. While Australia has no inheritance tax, CGT may apply when beneficiaries sell inherited assets.

A trust tax return is required for each financial year until the deceased estate is fully administered and is no longer deriving income.

To minimise CGT impact:

- Consider selling high-growth assets during your lifetime, especially if you have carry-forward capital losses

- Use testamentary trusts to provide flexibility in asset distribution and potential tax benefits for beneficiaries

- Seek professional advice on the CGT implications of different asset types within your estate

Final Thoughts

Estate planning strategies protect your financial legacy and safeguard your loved ones’ future. Essential documents like wills, powers of attorney, and advance care directives form the foundation of an effective plan. Maximising asset protection and minimising tax through superannuation nominations, family trusts, and strategic gifting further strengthen your estate plan.

Life changes necessitate regular reviews and updates to maintain your plan’s effectiveness. Marriage, divorce, childbirth, or significant financial shifts should prompt a reassessment of your estate planning strategies. Professional guidance proves invaluable in navigating the complexities of estate planning and adapting your strategy to current circumstances.

Jameson Law offers expert legal services to create a comprehensive estate plan tailored to your unique situation. Our team provides accessible and personalised legal support to protect your legacy (and ensure your loved ones are provided for as intended). Take control of your estate planning today and secure peace of mind for tomorrow.