Divorce proceedings often hinge on accurate asset valuations that determine fair property settlements. Family law valuation requires professional expertise to assess everything from real estate to business interests.

We at Jameson Law see couples struggle with valuation disputes that can derail negotiations and increase legal costs. Understanding the valuation process helps protect your financial interests during separation.

What Assets Must Be Professionally Valued in Divorce

The Family Court generally follows a five-step process when deciding how assets and liabilities will be divided, though courts often mandate expert assessments for any significant asset where parties disagree. Professional valuation becomes essential rather than optional when substantial assets are contested between separating parties.

Assets That Always Need Expert Valuation

Real estate properties, family businesses, professional practices, and substantial investment portfolios require independent valuation. Business valuations represent the most contentious asset type, with business-owning couples frequently disagreeing on fair market value. Superannuation interests typically need actuarial assessment, particularly for defined benefit schemes where calculation complexity exceeds standard formulas.

Valuable personal property (including art collections, antiques, or luxury vehicles) also warrants professional appraisal when contested values are substantial. These assets often carry emotional significance that clouds objective assessment, making expert opinion necessary for fair distribution.

When Courts Mandate Joint Expert Appointments

Disputing expert valuations can be challenging, and it is important to obtain legal advice so that you can act promptly and in accordance with the Rules. This single expert approach prevents costly duelling valuations that previously extended proceedings significantly. Courts reject separate expert appointments unless exceptional circumstances exist, such as conflicts of interest or highly specialised asset types that require multiple expertise areas.

The joint expert must remain independent from both parties and cannot receive direct instructions from either side, which maintains valuation integrity throughout proceedings. Property valuations must be current and professionally prepared, especially for complex assets like business interests or investment portfolios. This process leads directly to understanding how different asset types require specific valuation approaches and methodologies.

How Are Different Assets Valued in Divorce Cases

Property valuations require registered valuers who assess current market conditions and comparable sales within the local area. Residential properties typically take 5-7 business days for completion, while commercial properties may require 10-14 days due to complexity. Valuers examine property condition, location factors, recent renovations, and local market trends to determine fair market value.

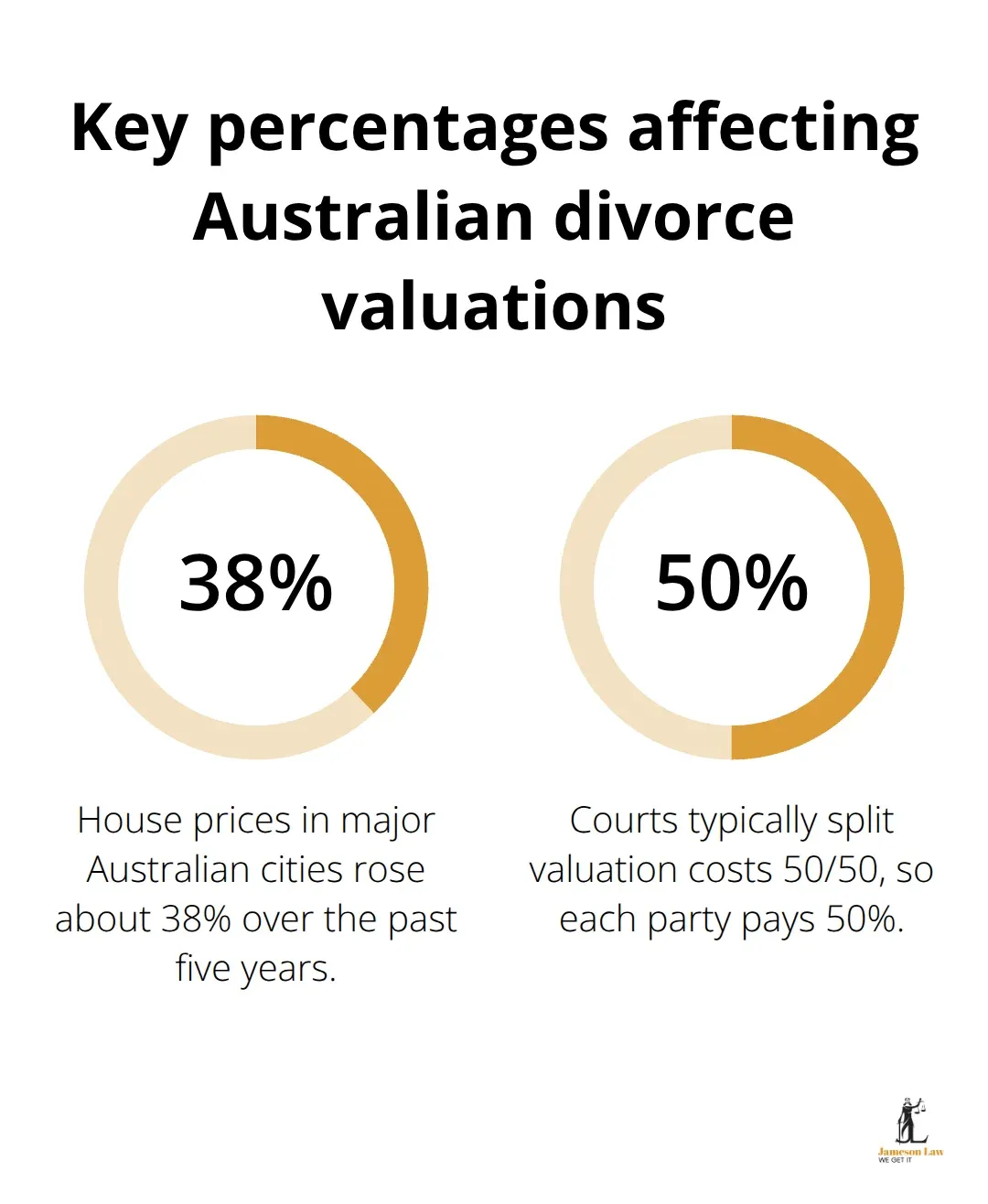

The valuation date matters significantly, as property markets can fluctuate rapidly. Major Australian cities have seen house prices rise about 38% in the past five years, which demonstrates how timing affects final settlement amounts.

Business Valuation Complexity

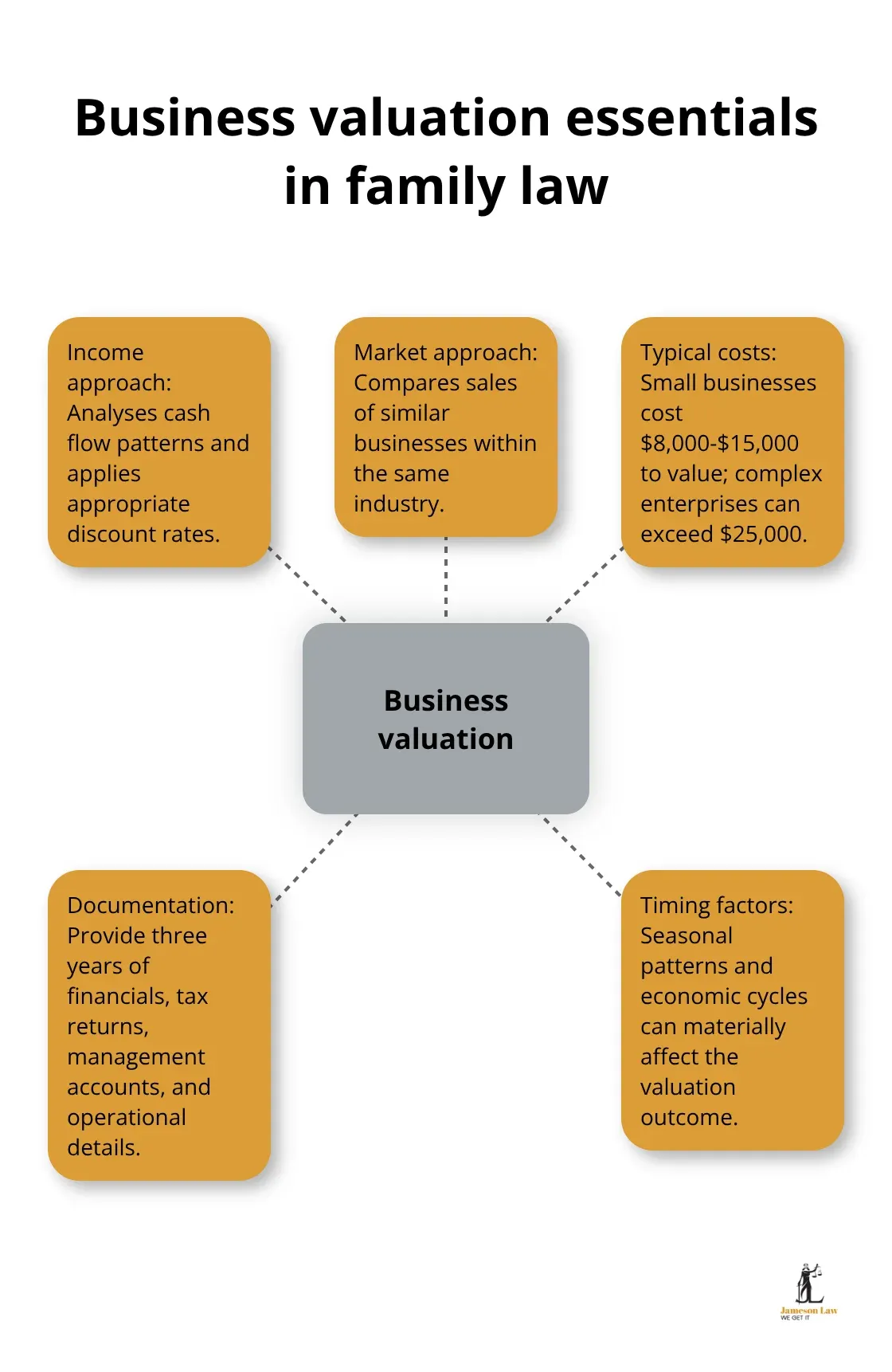

Business valuations present the most complex asset type and often require forensic accountants with specialised expertise. The income approach method analyses cash flow patterns and applies appropriate discount rates, while the market approach compares similar business sales within the industry.

Small businesses typically cost $8,000-$15,000 to value professionally, whereas complex enterprises may exceed $25,000. Documentation requirements include three years of financial statements, tax returns, management accounts, and operational details. Timing affects business values dramatically, particularly for seasonal operations or those impacted by economic cycles.

Superannuation Assessment Methods

Superannuation calculations depend on fund types, with defined benefit schemes requiring specialised valuation methods as set out in the Family Law (Superannuation) Regulations 2025. Accumulation funds use simpler valuation methods based on account balances at separation date.

Investment portfolios need current market valuations for listed securities, while unlisted investments require specialised appraisal. Valuation frequency matters for volatile investments, as share portfolios can fluctuate significantly between separation and settlement dates. See general market guidance at the ASX.

Managing Valuation Costs and Timing

Professional valuations represent substantial expenses that couples must factor into their separation budget. Courts typically order parties to share valuation costs equally (50/50 split), though this arrangement can strain finances during an already expensive process.

Strategic timing of valuations can protect your interests, particularly for volatile assets like shares or seasonal businesses. Market conditions change rapidly, and a valuation completed six months ago may no longer reflect current asset values. Understanding these cost and timing factors becomes essential when deciding whether to accept or challenge valuation reports.

How Can You Control Valuation Costs and Disputes

Joint expert appointments represent the most cost-effective approach for most couples, with shared expenses typically ranging from $8,000-$15,000 per asset rather than duplicate fees. Courts strongly favour this single expert model and reject separate valuations unless extraordinary circumstances exist. The joint approach eliminates costly expert battles that previously extended proceedings by months and inflated legal bills substantially.

Strategic Timing Protects Your Interests

Market volatility demands careful valuation timing, particularly for shares and seasonal businesses that fluctuate significantly. Property markets in Sydney and Melbourne have shown significant variations during volatile periods, making timing decisions worth thousands in final settlements. Track trends via Domain property news and ABS price indexes.

We recommend you schedule valuations close to settlement dates for volatile assets, while stable assets like established businesses can be valued earlier in proceedings. Try to negotiate valuation terms with firm positions on methodology and timing rather than accepting your former partner’s preferred approach.

Negotiation Tactics That Work

Courts expect parties to attempt resolution through expert conferences before they allow challenges, which makes initial negotiations critical for cost control and outcomes. You should prepare specific questions about methodology rather than general objections to valuation figures.

Document your concerns in writing before conferences begin (this creates a clear record for potential court proceedings). Focus negotiations on factual errors or missing information rather than subjective disagreements about market conditions. Consider independent frameworks such as the ASIC small business resources and RBA economic updates to contextualise assumptions.

When Challenges Make Financial Sense

Challenge valuations only when mathematical errors, outdated comparisons, or missing critical information substantially affect outcomes. Courts require concrete evidence rather than mere disagreement, with successful challenges typically involving calculation mistakes or factual oversights worth more than $50,000.

Expert conferences can resolve disputes without court intervention, while shadow reports from second experts range from $5,000-$12,000. Challenge timing matters significantly, as Family Law Rules impose strict deadlines for requesting conferences or presenting alternative evidence.

Cost-Effective Dispute Resolution

Most valuation disputes resolve through clarification rather than wholesale replacement, making targeted questions more effective than broad challenges. You can request specific explanations about methodology, comparable sales data, or calculation methods without commissioning entirely new valuations.

Consider mediation before formal challenges, as mediators often help parties identify specific valuation concerns that experts can address efficiently. This approach typically costs less than $3,000 compared to formal court challenges that can exceed $15,000 in legal fees alone.

Final Thoughts

Successful family law valuation demands proactive asset documentation and strategic expert co-ordination throughout divorce proceedings. You must gather comprehensive financial records before separation begins, as incomplete information delays valuations and escalates costs substantially. Professional legal representation co-ordinates expert appointments, manages court deadlines, and negotiates favourable terms with your former partner.

Courts base property distribution decisions on professional evidence rather than emotional attachments to specific assets. Focus on factual accuracy when you review expert reports, as qualified professionals use established methodologies to determine fair market value. Strategic valuation timing protects your interests, particularly for volatile assets that fluctuate with market conditions.

We at Jameson Law guide clients through complex property settlements while minimising valuation disputes and associated costs. Our family law expertise protects your financial interests from initial asset identification through final settlement negotiations. Fair asset distribution requires accurate professional assessments that reflect current market conditions and appropriate valuation standards. For confidential help, call (02) 8806 0866 or contact our team in Sydney.