NSW participation rules for electronic conveyancing have transformed how property transactions operate across the state. Since 2019, most property settlements must go through the PEXA platform.

We at Jameson Law see clients navigate these requirements daily. Understanding when electronic conveyancing applies and the specific compliance obligations can save time and prevent costly delays in your property transaction. Our property lawyers in Sydney can help.

Legal Framework and Regulatory Requirements

The Electronic Conveyancing National Law NSW and NSW Participation Rules Version 7 establish the foundation for electronic property transactions in New South Wales. These rules became mandatory for all land dealings from October 11, 2021, which means every conveyancer and solicitor who handles property transactions must participate through approved Electronic Lodgment Network Operators like PEXA. The Australian Registrars National Electronic Conveyancing Council publishes Model Participation Rules that NSW adopts with specific local modifications.

Registration Requirements for Legal Practitioners

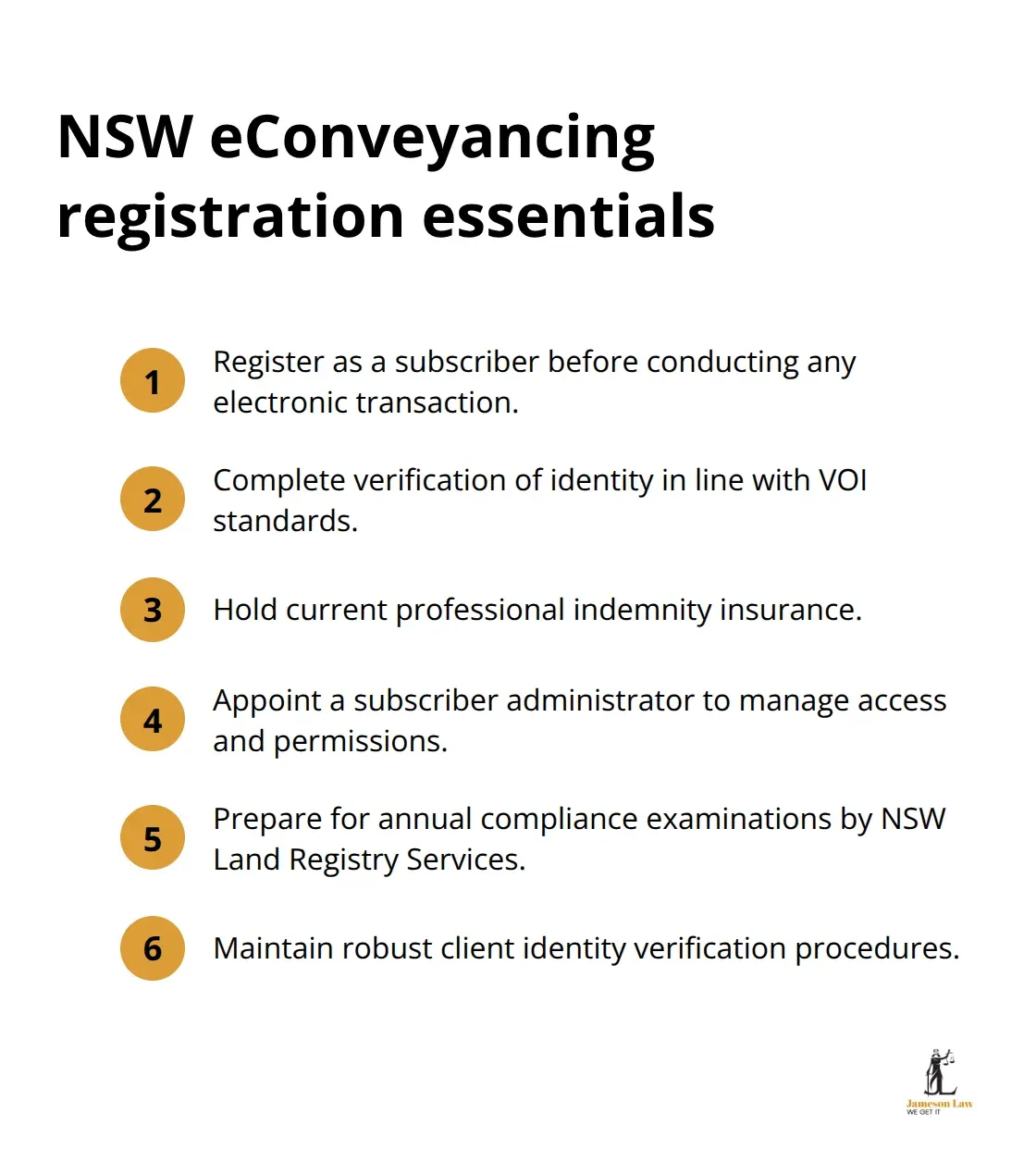

All NSW conveyancers and solicitors must register as subscribers before they conduct electronic transactions. The registration process requires identity verification, professional indemnity insurance confirmation, and appointment of a subscriber administrator.

NSW Land Registry Services conducts annual compliance examinations to verify adherence to participation rules, with heavy focus on client identity verification procedures outlined in ARNECC MPR Guidance Note 2. Non-compliance results in suspension from the electronic system, which forces practitioners back to slower paper-based processes where still permitted.

Client Authorisation and Transaction Evidence Standards

Every electronic transaction requires a signed Client Authorisation before practitioners can act on behalf of clients. The authorisation must specify the exact scope of work and practitioners must retain it for seven years alongside all transaction evidence. Digital signatures replace traditional witness methods, but practitioners bear full responsibility for signature security maintenance. The verification of right to deal requirements means conveyancers must confirm clients have legal authority to complete transactions before they proceed with electronic lodgment.

Compliance Monitoring and Enforcement

NSW Land Registry Services performs regular audits on subscribers to monitor compliance and reduce fraud risks within the system. These examinations focus on identity verification procedures and proper retention of transaction evidence (which must span seven years). The digital approach allows multiple stakeholders, including lawyers, conveyancers, and financial institutions, to interact seamlessly online while maintaining strict regulatory compliance. Understanding these registration and compliance requirements becomes essential as we examine the specific technical requirements for PEXA participation.

How Do You Meet PEXA Technical Requirements

Digital Identity Setup and Authentication Process

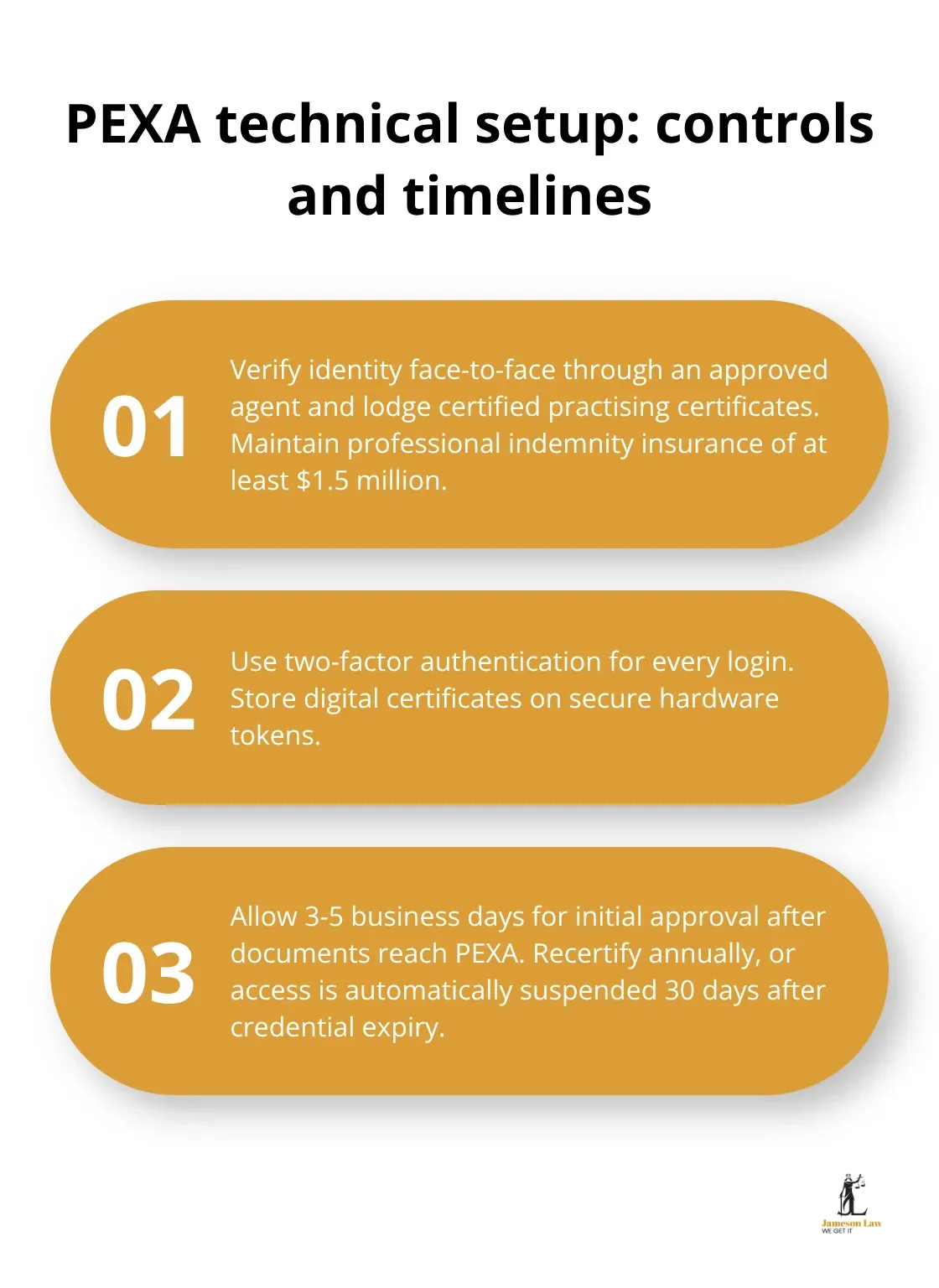

PEXA participation requires rigorous digital identity establishment that extends beyond basic registration. Practitioners must complete face-to-face verification with approved identity agents, submit certified copies of professional certificates, and maintain current professional indemnity insurance of at least $1.5 million. The system requires two-factor authentication for every login, with digital certificates stored on secure hardware tokens.

Most practitioners underestimate the initial setup time, which typically takes 3-5 business days for approval once all documentation reaches PEXA. The platform mandates annual recertification of digital identities, with automatic suspension occurring if practitioners fail to update expired credentials within 30 days.

Document Formatting and Digital Signature Standards

PEXA accepts only PDF documents that meet strict formatting requirements, with file sizes capped at 10MB per document. Digital signatures must comply with Advanced Electronic Signature standards, requiring practitioners to use approved signing software like DocuSign or Adobe Sign integrated with PEXA workspaces.

The platform automatically rejects documents with embedded passwords, corrupted files, or non-standard fonts. Settlement statements require specific field formatting with monetary amounts displayed to two decimal places, and contract dates must follow DD/MM/YYYY format (ensuring consistency across all transactions).

Transaction Processing and Settlement Timeframes

Document preparation errors cause transaction delays averaging 2-3 days, making precise formatting compliance essential for meeting settlement deadlines. Major banks usually post PEXA proceeds within two to four hours compared to 5-7 days for paper transactions, but only when documents meet these exact technical specifications.

The system processes payments and document lodgement simultaneously, which significantly reduces the time from transaction initiation to completion. This streamlined approach eliminates the multi-day clearance time associated with cheques in traditional paper systems (creating faster outcomes for all parties involved).

While these technical requirements may seem complex, understanding exemptions and special circumstances helps practitioners identify when alternative approaches remain available for specific property and commercial law transaction types.

When Can You Still Use Paper Conveyancing

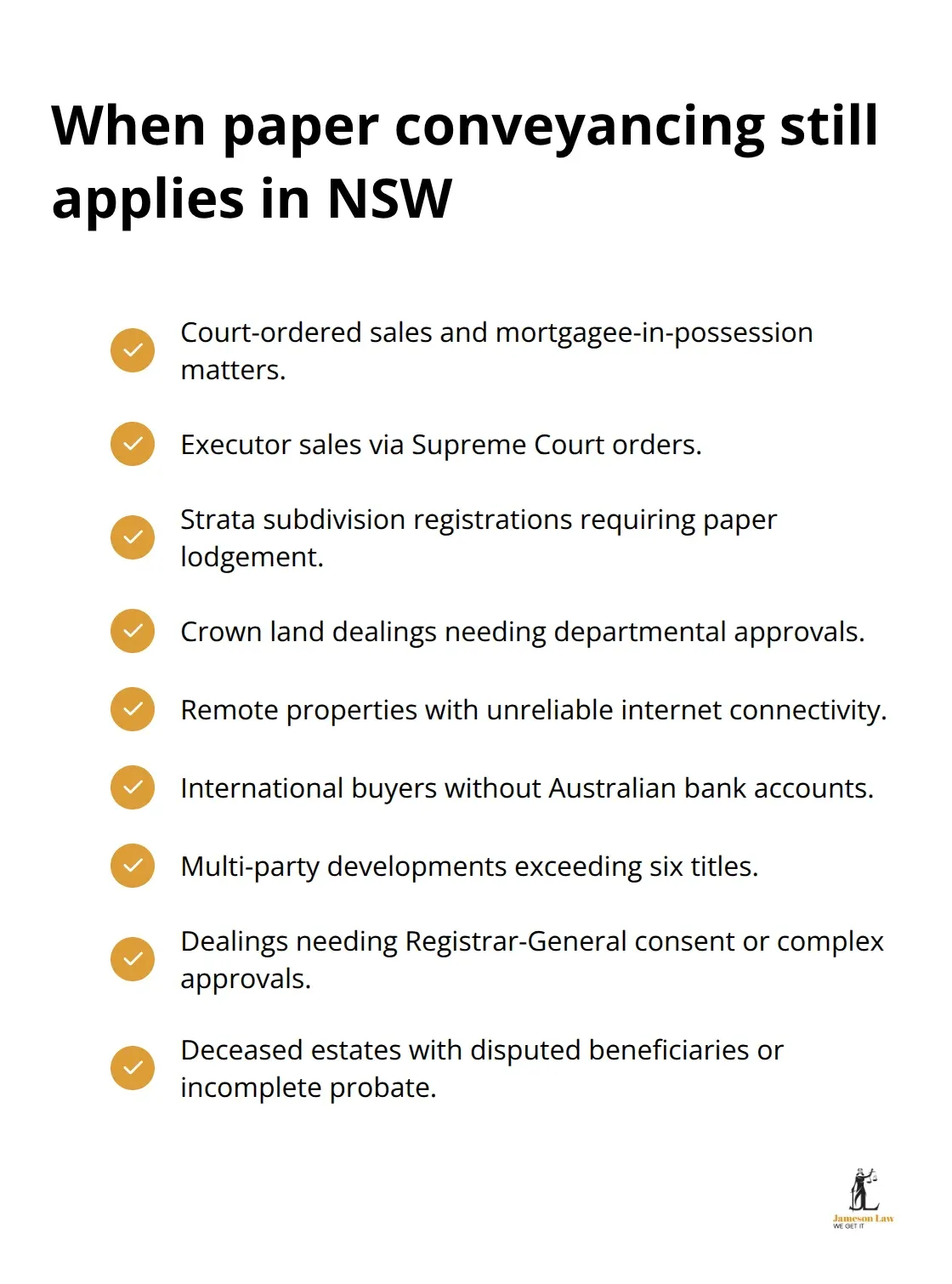

Paper-based conveyancing remains available for specific transaction types that fall outside mandatory electronic requirements. Court-ordered sales, including mortgagee-in-possession sales and executor sales through Supreme Court orders, cannot process through PEXA due to their complex approval chains. Strata sub-division registrations also require paper lodgement because the system cannot handle the simultaneous creation of multiple titles with shared common property arrangements.

Court-Ordered and Crown Land Transactions

Crown land dealings that involve the Department of Planning and Environment continue to use paper processes. These transactions require additional government approvals that electronic systems cannot accommodate within their standard workflows.

Supreme Court-ordered sales present unique challenges because they involve judicial oversight that extends beyond standard conveyancing procedures. The court must approve each step of the transaction, which creates timing conflicts with PEXA’s automated settlement processes.

Geographic and Technical Exemptions

Remote properties in areas with unreliable internet connectivity qualify for paper-based processing through specific applications to NSW Land Registry Services. Properties in designated rural zones where telecommunications infrastructure cannot support real-time PEXA transactions receive automatic exemptions (though practitioners must provide evidence of connectivity issues).

International purchasers without Australian bank accounts face significant barriers in PEXA settlements because the platform requires domestic financial institutions for fund transfers. These buyers often need paper processes to accommodate overseas banking arrangements, with settlement periods extending to 14-21 days compared to same-day electronic settlements.

Complex Multi-Party Developments

Multi-party developments that involve more than six separate titles in a single transaction exceed PEXA workspace limitations and revert to paper processing. The platform cannot manage the complex cross-referencing required when multiple titles transfer simultaneously with interdependent conditions.

Transactions that require Registrar-General consent, such as dealings with contaminated land or heritage-listed properties, need paper lodgement because electronic systems cannot accommodate the additional approval workflows. Deceased estate transfers with disputed beneficiaries or incomplete probate documentation cannot proceed electronically until all legal challenges resolve through court processes.

Final Thoughts

NSW participation rules for electronic conveyancing have transformed property transactions across the state. Legal practitioners must register as subscribers, maintain digital signatures, and complete annual compliance examinations to operate within the PEXA system. These obligations affect every property settlement, from basic residential transfers to complex commercial transactions.

The shift from paper to electronic processes has reduced settlement times from 5-7 days to just 2-4 hours for most transactions. However, practitioners face strict compliance requirements that include seven-year record retention, client identity verification, and proper authorisation documentation. Non-compliance results in system suspension and forces practitioners back to slower paper processes (where still permitted).

Professional compliance remains non-negotiable in this digital environment. The NSW Land Registry Services conducts regular audits, and the consequences of non-compliance extend beyond individual practitioners to affect entire property transactions. We at Jameson Law help clients navigate these complex electronic conveyancing requirements through our expert conveyancing services, providing expert guidance from a dedicated property solicitor in Sydney.