Section 12 of the Conveyancing Act creates specific obligations for property transactions that many buyers and sellers overlook. This legislation impacts disclosure requirements and can significantly affect settlement timelines.

We at Jameson Law, as expert property lawyers in Parramatta and Sydney, regularly see clients struggle with S12 Conveyancing Act compliance, leading to costly delays and potential penalties. Understanding these requirements upfront protects your property transaction from unnecessary complications.

What Does Section 12 Actually Require

Legal Framework and Assignment Rules

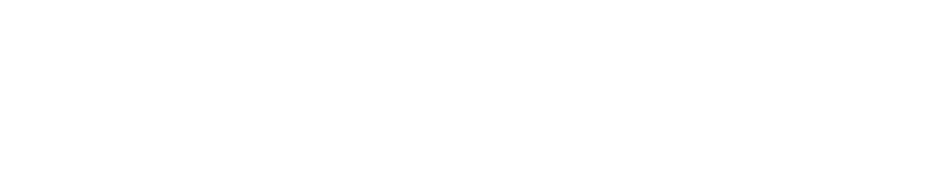

Section 12 of the Conveyancing Act 1919 NSW establishes the legal framework for debt assignment and choses in action in property transactions. This provision requires any assignment to be absolute, in writing, and signed by the assignor. Most importantly, written notice must be provided to the debtor after assignment occurs.

Without proper notice, the assignment remains equitable only, meaning legal title stays with the original assignor rather than transfers to the assignee.

Property transaction volumes in NSW have increased significantly, which makes S12 compliance more important than ever. When notice requirements are not met, legal complications arise during settlement processes. Courts consistently rule that debtors retain all defences against assignees that they would have held against original assignors, which protects their position under equity principles.

Disclosure and Documentation Requirements

Property sellers must provide comprehensive disclosure documentation under S12, which includes property disclosure statements and details about any legal encumbrances. The Act mandates that all contracts be in writing with accurate property descriptions, sale prices, and transfer terms. Cooling-off periods (a key part of NSW conveyancing) are specified (allowing buyers to withdraw within defined timeframes after they receive proper documentation).

Professional conveyancers must maintain compulsory insurance under the Act, which protects clients from negligence-related losses. The legislation requires that all documentation be registered appropriately with the Land Registry Services (NSW LRS) to complete legal transfers.

Consequences of Non-Compliance

Missing deadlines or providing inadequate documentation can void contracts entirely, which leaves both parties exposed to significant financial losses and extended legal disputes that often take months, or even civil litigation, to resolve. The Act establishes specific penalties for non-compliance (including potential contract invalidation and financial exposure for all parties involved).

These compliance requirements directly impact how property settlements proceed, which creates specific challenges that buyers and sellers must navigate carefully.

What Problems Arise with Section 12 Compliance

Documentation Gaps Create Settlement Delays

Missing or incomplete disclosure documentation represents the most frequent S12 compliance failure in NSW property transactions. Property sellers often submit disclosure statements that lack required details about easements, covenants, or building approvals, which forces settlements to be postponed while parties gather additional documentation.

Sellers discover they need council certificates or building compliance reports just days before settlement, yet these documents typically require 10-15 business days to obtain from local councils. This creates immediate pressure on all parties and often results in settlement postponements that affect financing arrangements and moving plans.

Assignment notice requirements under S12 create additional complications when property transactions involve debt transfers or mortgage assignments (which can be common in divorce property settlements). Financial institutions frequently fail to provide proper written notice to debtors within the required timeframes (leaving assignments in equitable status rather than legal status). This creates uncertainty about who holds enforceable rights during settlement processes.

Financial Penalties and Contract Risks

Non-compliance with S12 provisions triggers automatic contract voiding in many circumstances, which exposes both parties to significant financial losses beyond simple penalty fees. Buyers lose deposit amounts (often held in a solicitor’s trust account) and face additional costs for temporary accommodation when settlements fail. Sellers must restart marketing processes and potentially accept lower sale prices in changing market conditions.

Courts consistently refuse to grant extensions or relief when S12 deadlines are missed without exceptional circumstances.

Professional Liability Increases

Professional indemnity requirements for conveyancers reflect the complexity of modern property transactions and the strict nature of S12 requirements. Licensees must maintain appropriate insurance coverage when carrying out conveyancing work to protect against potential claims. This is why working with a qualified property solicitor in Sydney is crucial.

These compliance challenges highlight why proper legal guidance becomes essential for successful property settlements and effective risk management strategies.

How to Avoid S12 Compliance Problems

Start Documentation Collection Early

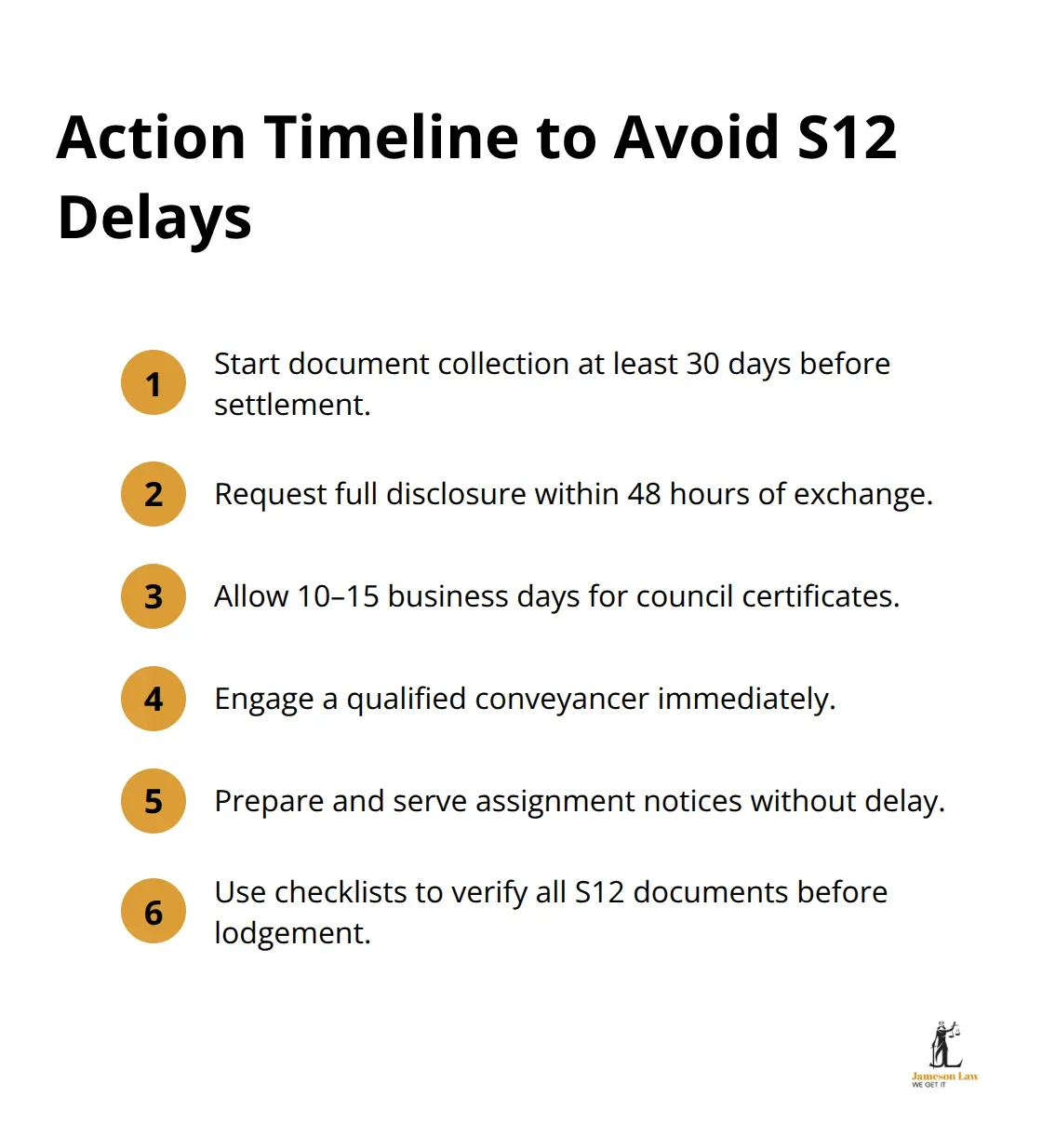

Property sellers must begin to gather S12 documentation at least 30 days before intended settlement dates to avoid common delays. Settlement postponements stem from incomplete documentation packages submitted close to settlement dates. Contract preparation requires council certificates, building compliance reports, and easement documentation that local councils typically take 10-15 business days to process.

Buyers should request all disclosure documentation within 48 hours of contract exchange and immediately engage qualified conveyancers to review materials. Early documentation review helps identify potential S12 compliance issues before they become settlement-blocking problems. Assignment notices must be prepared and served immediately when debt transfers occur (as courts refuse relief for missed notice deadlines under any circumstances).

Choose Experienced Conveyancing Professionals

Professional indemnity insurance requirements for NSW conveyancers have increased due to rising S12 non-compliance claims, which makes qualified legal representation essential for complex property transactions. Conveyancers must maintain current professional development certification and demonstrate specific S12 expertise when they handle assignment-related transactions. Select a conveyancing lawyer in Parramatta or Sydney with demonstrated track records in S12 compliance rather than choose based solely on fee structures.

Legal professionals should provide detailed compliance checklists and maintain regular communication throughout settlement processes. Properties handled by experienced conveyancers complete settlement faster than those managed by general practitioners. Timeline management becomes straightforward when qualified professionals coordinate documentation collection, notice requirements, and registry submissions according to established S12 protocols.

Implement Systematic Record Management

Property transactions require systematic documentation storage that allows quick access to all S12-related materials throughout the settlement process. Digital file management systems help track document expiry dates and submission deadlines (particularly important for council certificates that expire after 90 days). Maintain separate folders for disclosure statements, assignment notices, and registry documentation to prevent confusion during settlement preparation.

Create detailed checklists that outline specific S12 requirements for each transaction type, whether standard property sales or complex assignments involve debt transfers as outlined in the Conveyancing Act. This systematic approach reduces the risk of missed deadlines and incomplete submissions that commonly cause settlement delays and compliance failures.

Final Thoughts

S12 Conveyancing Act compliance demands proactive preparation and professional expertise to prevent costly settlement delays and contract failures. Property buyers and sellers who master documentation requirements, notice obligations, and strict deadlines shield themselves from financial losses and legal complications that frequently plague NSW property transactions. Courts refuse to grant relief when parties miss S1T2 deadlines, which makes early preparation non-negotiable for successful settlements.

Professional legal guidance proves essential when you navigate S12 requirements, particularly for complex transactions that involve debt assignments or mortgage transfers. Experienced conveyancers deliver systematic compliance management and spot potential issues before they transform into settlement-blocking problems. Properties handled by qualified professionals complete settlement processes faster than those managed without proper legal oversight.

We at Jameson Law recommend that you engage qualified legal professionals early in your property transaction process (ideally 30 days before settlement). Our property conveyancing team provides comprehensive S12 compliance support to help clients avoid common documentation gaps that cause settlement postponements. Start your compliance preparation early, maintain systematic record management, and work with professionals who understand current S12 Conveyancing Act requirements to achieve successful property settlements. Contact our Parramatta or Sydney lawyers today.