Section 66G of the Conveyancing Act sets specific requirements that property buyers and sellers must follow during transactions. These compliance obligations can make or break your property deal, especially when co-ownership disputes arise.

We at Jameson Law see clients struggle with these requirements daily. This guide breaks down the key compliance steps and practical strategies to help you navigate Section 66G successfully.

What Section 66G Actually Covers?

Legal Framework for Co-Ownership Disputes

Section 66G of the Conveyancing Act 1919 (NSW) provides co-owners with a legal pathway to force property sales when disputes arise. The provision allows any co-owner to apply to the Supreme Court of NSW for a trustee appointment to manage the sale. This mechanism addresses situations where co-owners cannot agree on the sale of shared property.

The Court typically shows a strong bias toward sale orders. The precedent set in Tory v Tory established that applications face denial only under specific conditions involving proprietary rights or contractual obligations (such as a prior agreement not to sell).

Common Triggers for Court Intervention

Property disputes trigger Section 66G applications in specific scenarios. Relationship breakdowns between domestic partners represent the most common trigger, followed by disagreements among siblings who inherit family property. Business partnership dissolutions frequently result in Section 66G proceedings when partners cannot agree on asset liquidation.

The Supreme Court processes these applications with high approval rates. Co-owners must demonstrate inequitable circumstances or significant hardship to prevent sale orders, which requires substantial evidence that courts rarely accept.

Documentation Requirements for Applications

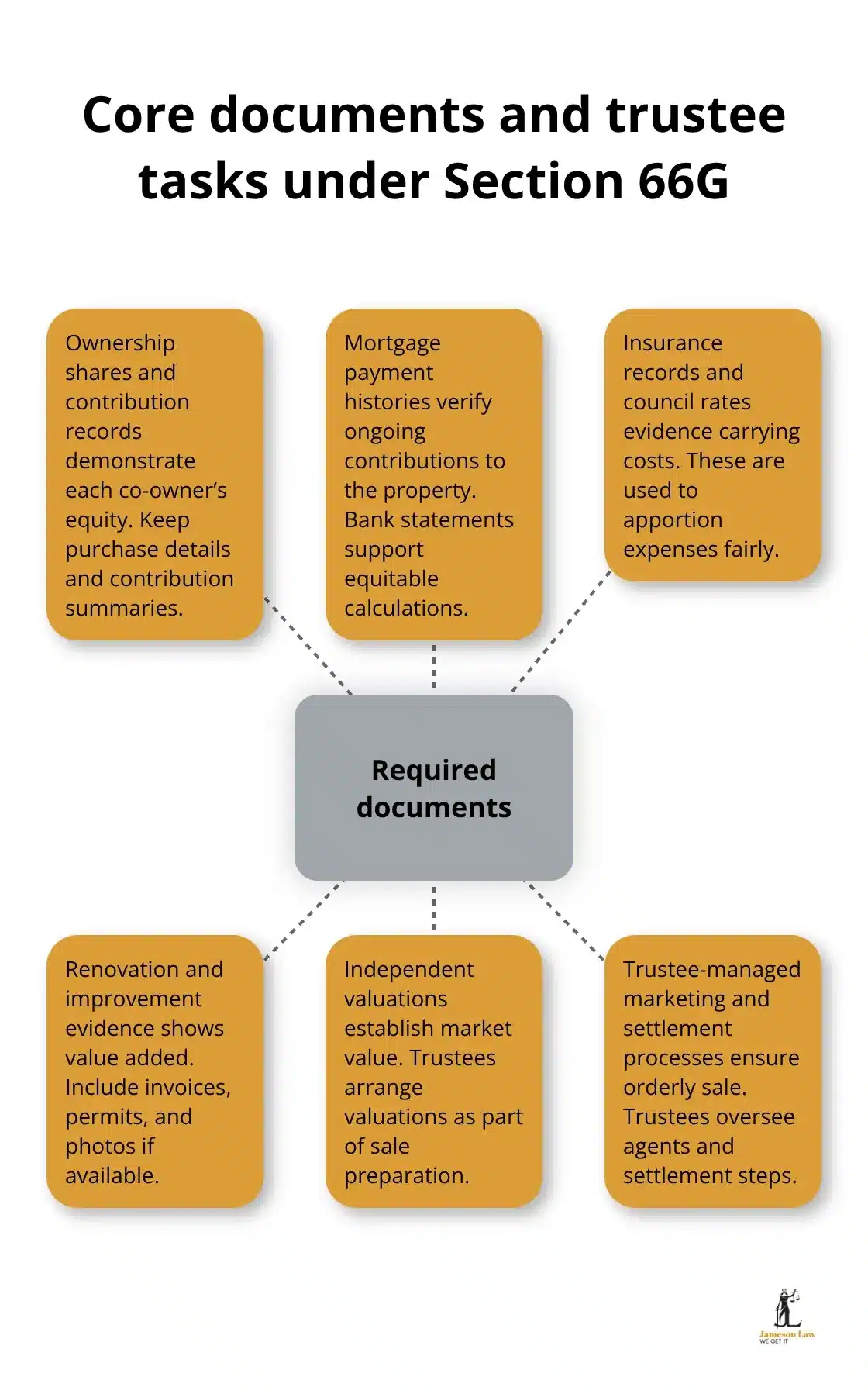

Applications require detailed documentation of ownership shares, contribution records, and property improvement investments. Applicants must provide mortgage payment histories, insurance records, and council rate payments to establish equitable distribution calculations.

The Court appoints trustees who manage property marketing, conduct independent valuations, and oversee settlement processes. Legal costs typically consume 15-20% of sale proceeds, with trustee fees adding another 3-5% to total expenses.

Evidence Standards and Record Maintenance

Courts factor renovation costs and maintenance contributions into final distribution calculations. Property owners should document all property-related expenses from the purchase date to support equitable accounting. The burden of proof falls on parties opposing the sale to demonstrate why the application would create inequitable outcomes.

What Compliance Challenges Derail Section 66G Applications?

Missing Financial Records Create Distribution Disputes

Property owners consistently fail to maintain adequate financial documentation throughout their co-ownership period. The Supreme Court requires comprehensive records of mortgage payments, insurance premiums, council rates, and property maintenance expenses to calculate equitable distribution. Missing bank statements can reduce your share of proceeds significantly.

Under Section 66G of the Conveyancing Act 1919, property owners can apply to the Supreme Court for the appointment of trustees. Those who document contributions from day one receive distribution calculations within 30 days, while those with incomplete records face delays.

Coordination Failures Between Multiple Stakeholders

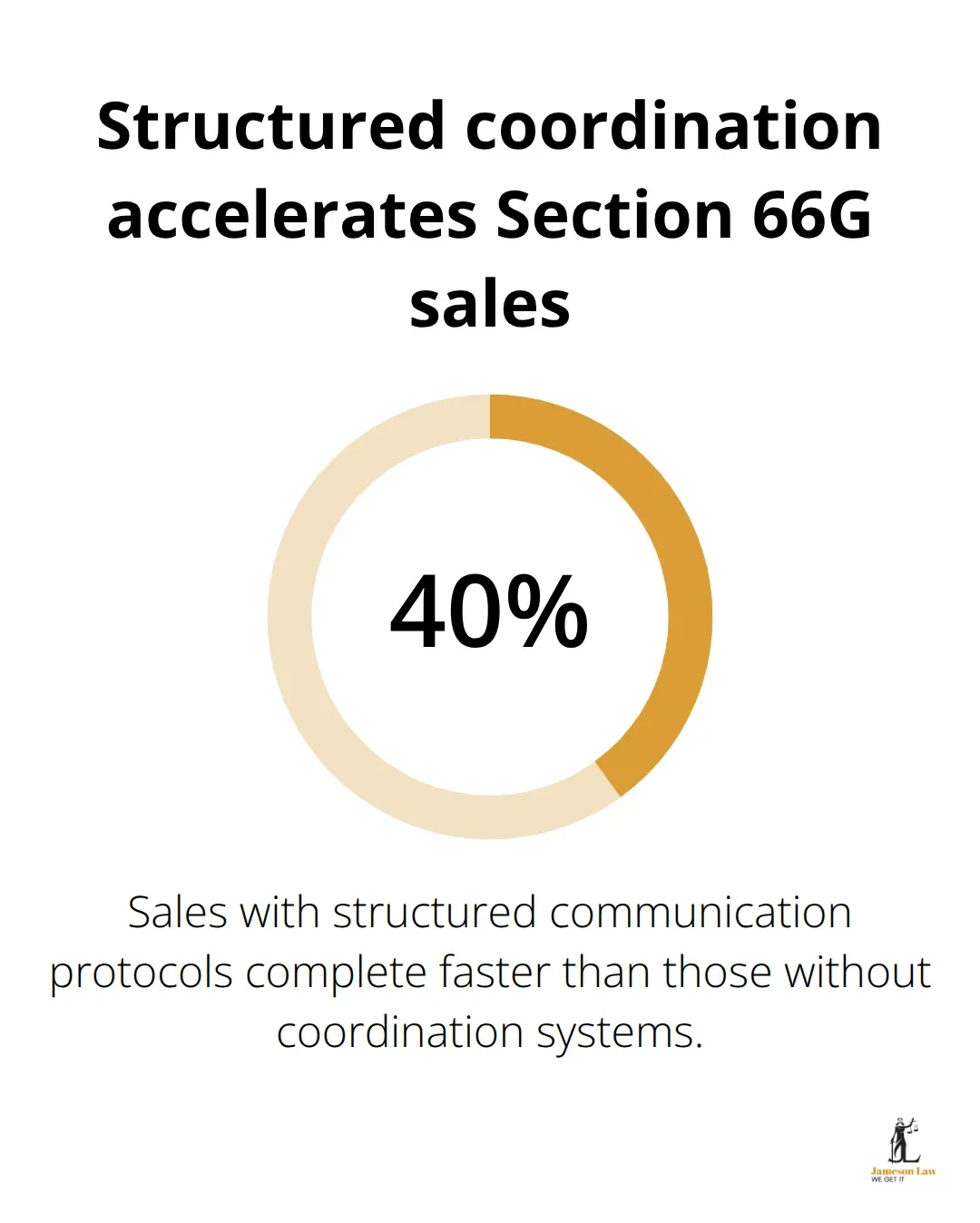

Section 66G proceedings involve trustees, real estate agents, valuers, solicitors, and multiple co-owners with conflicting interests. Communication breakdowns cause significant delays. Trustees typically manage numerous stakeholders, which creates coordination challenges.

The most effective approach involves the appointment of a single communication coordinator. Property sales under Section 66G that use structured communication protocols complete 40% faster than those without coordination systems.

Timeline Management and Court Deadlines

Courts impose strict deadlines for document submission and property valuations. The Supreme Court operates under the Conveyancing Act framework for property matters. Late submissions can result in application dismissals. Property valuations must occur within 90 days of trustee appointment.

How Do You Execute Successful Section 66G Applications?

Establish Documentation Systems Before Disputes Emerge

Property co-owners must create comprehensive record-keeping systems. Set up separate digital folders for mortgage statements and property maintenance receipts. Cloud-based accounting software tracks all property-related expenses with monthly reconciliation.

Select Specialists with Section 66G Track Records

Choose solicitors in Sydney who specialise exclusively in property disputes rather than general practice lawyers. Experienced Section 66G practitioners complete applications more efficiently. Property law specialists understand Supreme Court procedures and trustee selection criteria.

Deploy Technology Solutions for Stakeholder Management

Project management platforms coordinate communication between trustees and co-owners. Weekly progress meetings through video conferencing platforms maintain momentum. Digital document sharing through secure platforms reduces administrative delays compared to traditional processes.

Final Thoughts

Section 66G Conveyancing Act compliance requires meticulous preparation and strategic coordination. Property co-owners who maintain organised financial records from purchase date through dispute resolution achieve faster outcomes. The Supreme Court’s preference for sale orders makes successful applications highly probable when proper procedures are followed.

Professional legal guidance becomes indispensable given the complex requirements. Experienced property law specialists understand the documentation standards that general practitioners often overlook. We at Jameson Law handle property disputes and conveyancing matters throughout NSW.

Contact Jameson Law today to discuss your property dispute and develop an effective strategy for resolution.