Property division in a divorce can feel overwhelming, especially when significant assets are at stake. At Jameson Law, we’ve seen how the right approach to a divorce property settlement makes the difference between outcomes that protect your future and those that leave you disadvantaged.

NSW courts follow specific rules when dividing assets. This guide walks you through the legal framework and practical strategies to achieve a fair result.

How NSW Courts Divide Property in Divorce?

NSW courts follow a structured four-step process established under the Family Law Act 1975. The Federal Circuit and Family Court of Australia identifies the entire property pool, including assets acquired before, during, or after the relationship.

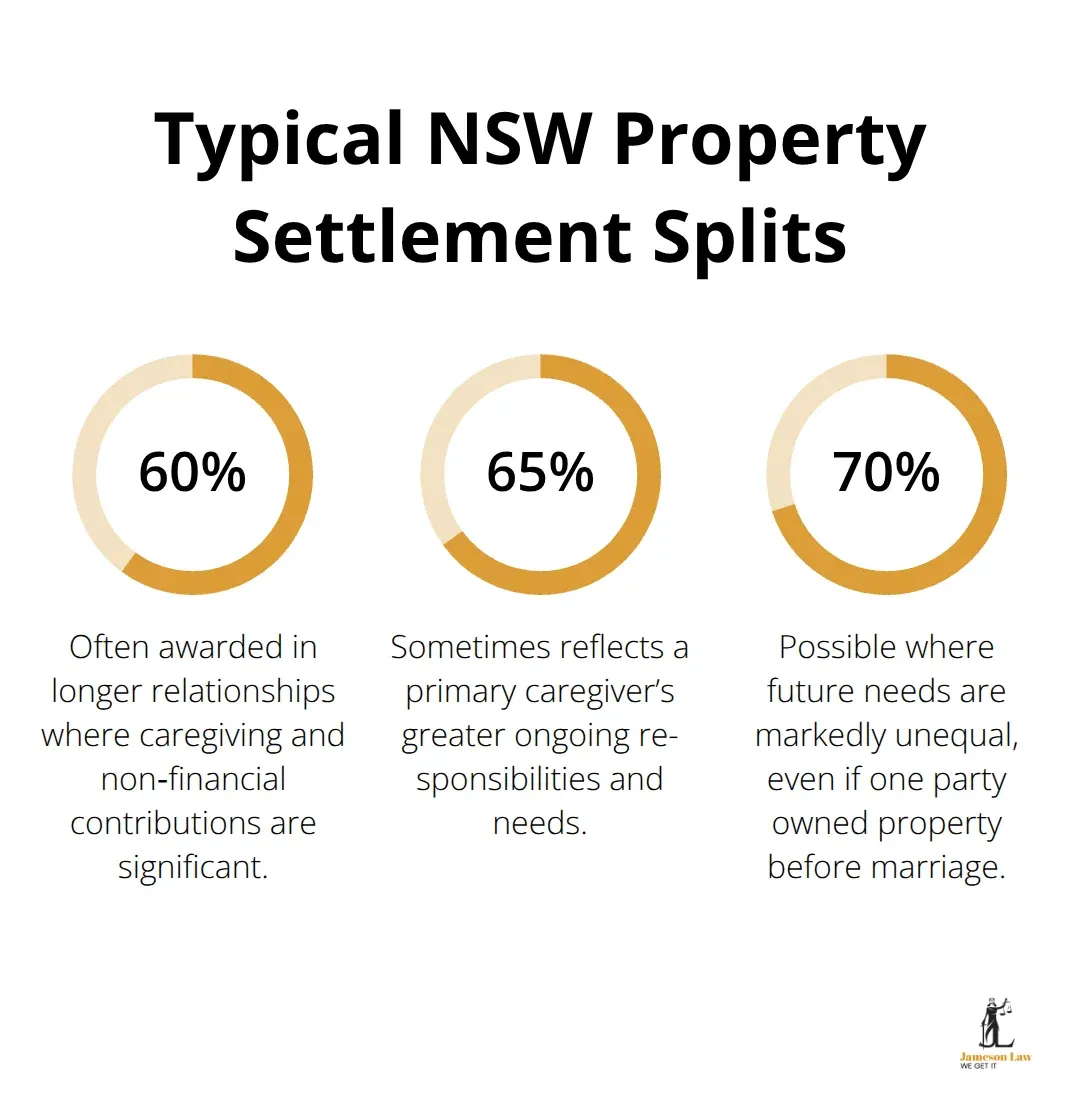

The court evaluates contributions (financial and non-financial) and assesses future needs. A 50/50 split is not automatic. Typical outcomes range from 60/40 to 70/30 depending on factors like care of children and earning capacity.

Complete Financial Disclosure Determines Everything

Complete transparency about income, assets, and debts is mandatory. Financial disclosure obligations apply equally to both parties. Hidden assets undermine fair settlements and can lead to penalties.

Superannuation splitting is a critical part of the process. Super is treated as property and can be divided to ensure retirement security for both parties.

Marital Versus Non-Marital Property

Assets owned before marriage are not automatically excluded. The court considers all property as one pool. However, the contributions made to bringing those assets into the relationship will be weighed against the other party’s contributions over time.

What Really Blocks Fair Property Settlements?

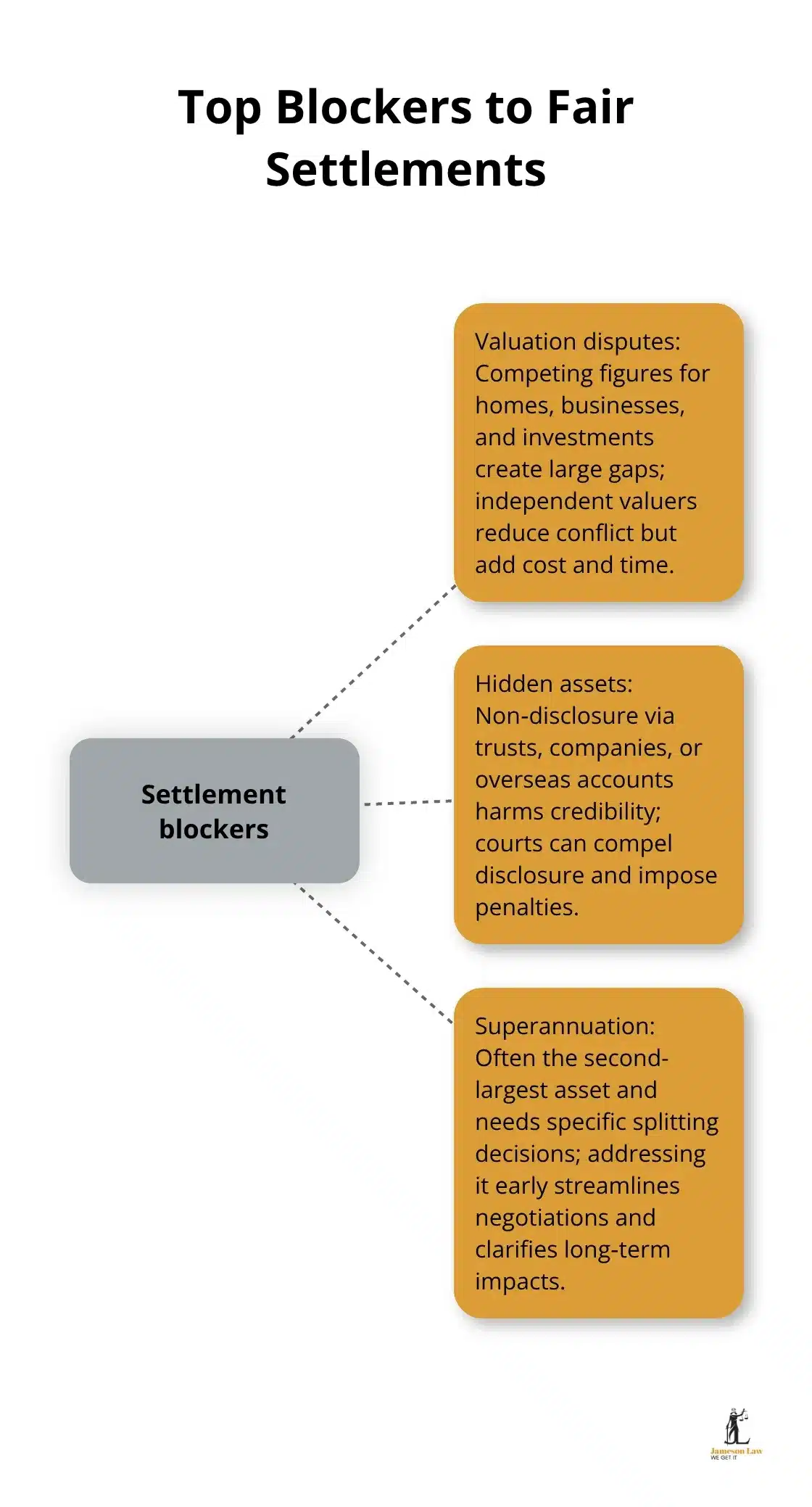

Valuation disputes, hidden assets, and superannuation complications stop settlements. Asset valuations create the first major sticking point. Independent valuations from accredited professionals eliminate guesswork.

Hidden Assets and Incomplete Disclosure

If you fail to comply with your duty of disclosure, the court can impose penalties. Full disclosure includes assets held in trusts, companies, or overseas. Hidden assets damage credibility and can lead to the court setting aside previous orders.

Securing Your Position Before Settlement Negotiations

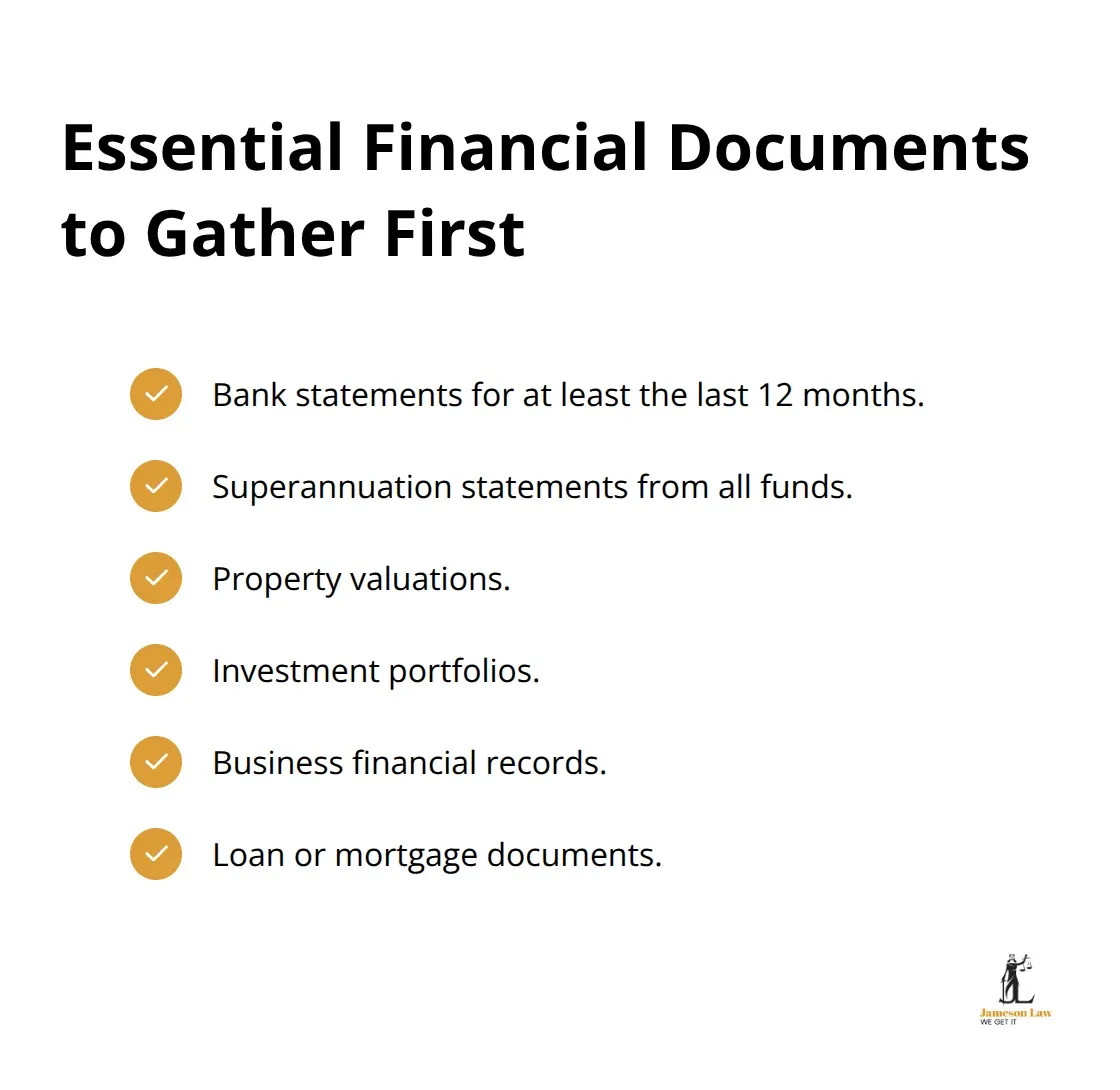

Gather Complete Financial Documentation First

Start by collecting every financial document: bank statements, tax returns, and loan documents. Calculate your net position by listing all assets and subtracting liabilities. This preparation prevents costly surprises.

Explore Mediation as Your First Negotiation Pathway

Mediation offers a practical path that avoids court expense. A trained mediator helps both parties communicate effectively. If you reach an agreement, formalise it through Consent Orders to make it legally binding.

Formalise Agreements Through Consent Orders

Consent orders convert your agreement into a binding court order. This protects both parties and allows for enforcement if terms are breached. Alternatively, a Binding Financial Agreement (BFA) can be used for more flexibility.

Final Thoughts

A fair divorce property settlement rests on financial transparency and understanding your entitlements. Start gathering documents immediately and explore mediation to keep costs manageable.

We at Jameson Law specialise in family law matters across NSW. If you need clarity on your property rights, contact Jameson Law today to discuss your situation and protect your financial future.