Selling property in NSW involves more than just finding a buyer. You need to navigate legal requirements, manage costs, and handle paperwork that can feel overwhelming.

We at Jameson Law have created this checklist to guide you through every stage of selling property conveyancing in NSW. This guide covers what you need to prepare, how the process works, and what expenses to expect.

Preparing Your Property and Documents for Sale

Gather Essential Property Documents Now

NSW law requires your conveyancer to prepare a contract and attach mandatory disclosure documents before you can sell. Start collecting these materials immediately because delays here directly delay your entire sale. You need the current title certificate, registered plan, any dealings recorded on the title such as easements or rights of way, a drainage diagram, and a zoning certificate issued by your local council under section 10.7. If your property has a pool or spa, obtain a valid certificate of compliance or occupation certificate issued within the past three years, plus evidence the pool is registered. If you cannot provide a compliance certificate, you need a certificate of non-compliance instead. Contact Revenue NSW to confirm whether any outstanding land tax exists on your property, as this must be cleared before settlement. Once an offer arrives, your conveyancer needs all these documents immediately to draft the contract. Waiting until the last minute creates unnecessary pressure and pushes back your settlement date.

Understand Mandatory Hazard and Risk Disclosures

NSW law requires you to disclose specific hazards and risks that could affect buyer safety or property value. If your property contains loose-fill asbestos insulation, you must disclose this. External combustible cladding requires disclosure even if you intend to rectify it. Flooding from natural events or bushfires in the past five years requires disclosure under NSW Fair Trading requirements. If the property has been at a scene of a serious crime such as extreme violence, murder, or homicide, disclosure is essential. Any building work rectification orders, prohibition orders, or stop-work orders must be revealed. When in doubt, disclose it-the financial penalty for non-disclosure far exceeds the cost of transparency upfront. Failure to provide required disclosures allows the buyer to terminate the contract within 14 days of exchange and potentially claim costs against you. Have your conveyancer review your property against the full NSW disclosure checklist before you list it.

Prepare for the Contract Exchange Process

Your conveyancer plays a vital role in preparing all documentation that protects your interests during the sale. They verify that you have collected every required document and that your disclosures are accurate and complete. This preparation phase determines how smoothly the contract exchange proceeds once you receive an offer. The next stage of your sale involves marketing your property and responding to buyer offers, which leads directly into the contract exchange and settlement timeline.

Moving Through Contract Exchange and Settlement

Your Conveyancer Takes Control After an Offer Arrives

Your conveyancer becomes your operational partner once an offer arrives. They manage the timeline, coordinate with the buyer’s solicitor, handle deposit arrangements, and flag issues before they become problems. When you select an offer, your conveyancer immediately drafts the contract using the documents you’ve already gathered, attaches all mandatory disclosures, and sends it to the buyer’s solicitor. This speed matters significantly. Delays in document preparation commonly push settlement dates back by two to three weeks, which costs you money in rates, water, and land tax adjustments that accumulate daily. Your conveyancer should provide you with a fixed price upfront so you know the total cost and avoid surprise fees at settlement.

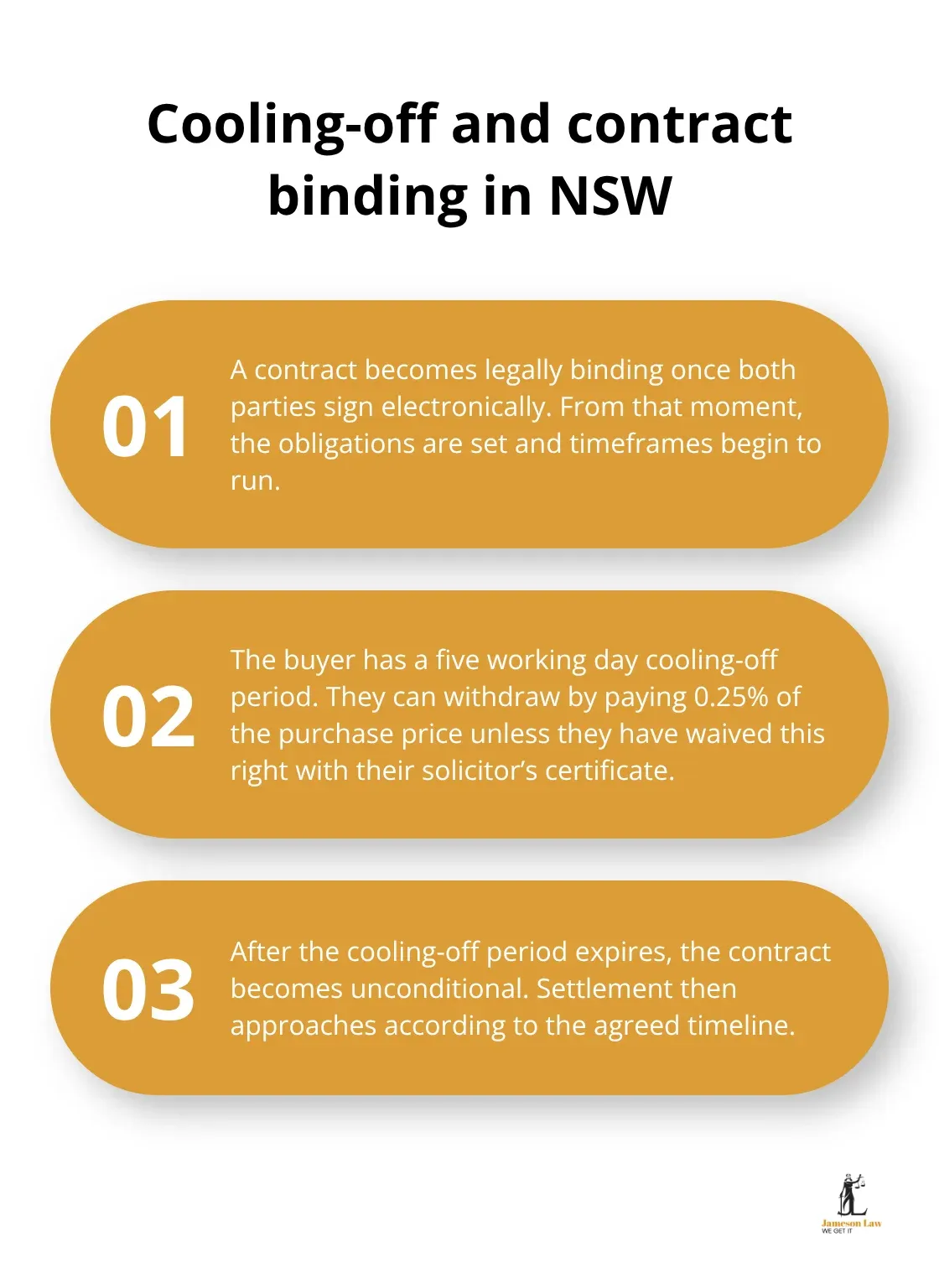

Understanding the Cooling-Off Period and Contract Binding

Once both parties sign the contract electronically, the sale becomes legally binding. The buyer then has a five working day cooling-off period where they can withdraw by paying 0.25% of the purchase price as a penalty, unless they’ve waived this right with their solicitor’s certificate. After this period expires, the contract becomes unconditional and settlement approaches. This stage protects both parties and establishes clear expectations about the transaction’s finality.

Pre-Settlement Searches and Documentation

Settlement usually takes place around 6 weeks after contracts are exchanged, though you and the buyer can negotiate different timeframes. During this pre-settlement phase, your conveyancer orders final searches from your local council and water authority to confirm current rates and utility charges, which are then adjusted between you and the buyer at settlement. They also produce a Section 66W certificate confirming statutory requirements have been met. Your conveyancer handles all communications with banks, agents, and the buyer’s solicitor throughout this period, removing the administrative burden from you entirely.

Settlement Through the PEXA Digital Platform

Most NSW settlements now occur through the PEXA digital platform, which replaces paper-based processes and reduces delays significantly. On settlement day, the buyer’s bank transfers funds electronically, your conveyancer receives confirmation, and the NSW Land Registry Services registers the new owner on the title within hours rather than days. The entire process from offer to registered ownership typically takes eight to nine weeks when documents are prepared properly from the start-which is why gathering everything before you list your property matters so much. Once settlement completes, your conveyancer provides you with final statements and confirmation that all funds have been received and transferred correctly. Understanding your financial obligations and tax implications during this period helps you plan for what comes after settlement.

Managing Costs and Financial Considerations

Conveyancing fees range from $1,050 to $1,875 depending on your state. Disbursements are separate from conveyancing fees and cover searches, certificates, and registrations that your conveyancer orders on your behalf. A zoning certificate typically costs $50 to $150 from your local council, drainage diagrams run $30 to $100, and title searches cost around $10 to $30. Pool compliance certificates cost $150 to $400 if required. Land tax clearance searches cost approximately $20 through Revenue NSW. These disbursement costs add up quickly, so request an itemised breakdown from your conveyancer before engagement so you can budget accurately.

Settlement Adjustments Affect Your Final Payment

Settlement adjustments apply because rates, water, and other outgoings are divided between you and the buyer based on the settlement date. If you settle mid-month, you’ll owe the buyer a proportional refund for the days they own the property. Your conveyancer calculates these adjustments precisely at settlement using council and water authority searches they’ve ordered during the pre-settlement phase. These adjustments can range from a few hundred dollars to several thousand dollars depending on your property’s location and the timing of settlement.

Capital Gains Tax Reduces Your Net Proceeds

If you’re selling an investment property, Capital Gains Tax applies to the profit you make above your purchase price plus any improvements you’ve added. Your main residence is typically exempt from CGT, but investment properties incur tax at your marginal tax rate on 50 percent of the capital gain if you’ve owned the property for more than 12 months. If you’ve owned it less than 12 months, you pay tax on the full gain. For example, if you purchased an investment property for $600,000 and sell it for $750,000, your capital gain is $150,000. At the 50 percent inclusion rate with a 45 percent marginal tax rate, you’d owe approximately $33,750 in tax. Consult a qualified accountant before settlement to understand your exact liability because CGT planning can reduce your tax burden through timing strategies or cost-base adjustments you might not be aware of.

Agent Commission and Removal Expenses

Agent commission typically runs 1.5 to 3 percent of the sale price depending on your agreement with the real estate agent, and this comes from your sale proceeds at settlement. For an $800,000 property with 2 percent commission, you’d pay $16,000 to the agent. Your removal costs depend on the size of your move and distance, typically ranging from $2,000 to $8,000 if you’re moving locally. These expenses significantly impact your net proceeds, so factor them into your financial planning before you accept an offer.

Create a Comprehensive Expense Spreadsheet

List agent commission, conveyancing fees, disbursements, and removal expenses in a single spreadsheet. This spreadsheet shows you exactly what you’ll net from the sale after all costs are deducted from the purchase price, allowing you to make informed decisions about whether the offer meets your financial expectations. Your conveyancer explains all settlement adjustments clearly so no surprises occur when funds transfer to your account.

Final Thoughts

Selling property conveyancing NSW requires preparation, attention to detail, and professional guidance at every stage. Start by gathering your documents before you list, understand your disclosure obligations, and plan for all expenses upfront. These actions directly determine whether your sale proceeds smoothly or encounters preventable problems.

The most common mistakes sellers make involve waiting too long to collect documents, underestimating costs, and failing to disclose hazards that NSW law requires. Your conveyancer handles the complex legal work, manages timelines, and coordinates with the buyer’s solicitor so you don’t have to. Settlement through PEXA typically completes within eight to nine weeks when preparation happens from the start, not at the last minute.

Your financial outcome depends on understanding every cost involved-agent commission, conveyancing fees, disbursements, settlement adjustments, and tax obligations all reduce your net proceeds. We at Jameson Law specialise in conveyancing across NSW and understand the complexities sellers face. Contact us for a consultation and let our experienced conveyancers handle the legal complexity while you focus on your next chapter.