Buying your first home in NSW is one of the biggest financial decisions you’ll make. First home buyers conveyancing might sound complicated, but it’s simply the legal process that protects you throughout the purchase.

At Jameson Law, we’ve guided hundreds of first home buyers through this journey. This guide breaks down everything you need to know, from offer to settlement.

What Conveyancing Actually Protects You From

The Legal Shield You Need

Conveyancing is the legal transfer of property ownership, and it protects your rights as a buyer by confirming the property is legally yours with no hidden issues. In NSW, a conveyancer or solicitor manages the entire process: they review your contract before you sign, check the title to confirm ownership history, meet all deadlines, and coordinate with the seller’s team, your bank, and other professionals. Without this legal framework, you purchase one of the most expensive assets you’ll ever own with virtually no protection against undisclosed problems. Over 28,000 first-home buyers across Australia took out loans in a single quarter in early 2025, and the vast majority used professional conveyancing support.

What You Risk Without Professional Help

The difference between buying with and without a conveyancer is substantial. A conveyancer identifies red flags in contracts before you’re legally bound, arranges essential searches like title checks and council zoning certificates, and handles stamp duty applications including your eligibility for the First Home Buyers Assistance Scheme. Without professional review, first-home buyers commonly overlook critical contract conditions, miss out on government grants worth thousands, and fail to identify easements or undisclosed council restrictions that affect the property’s value or your ability to develop it.

First-home buyers make critical errors because they rely solely on real estate agent advice, skip the cooling-off period to complete inspections, or rush through contracts without understanding key terms. One critical error is not obtaining building and pest inspection reports before exchange of contracts, which leaves you liable for expensive structural or pest damage after settlement. Another is overlooking additional costs beyond the purchase price: conveyancer fees typically range from $800 to $2,000, searches and certificates add $300 to $800, inspection reports cost $400 to $1,200, bank and loan fees apply, and moving expenses accumulate quickly.

Government Assistance You Could Lose

Stamp duty alone, depending on property price and your eligibility for exemptions or concessions under the First Home Buyers Assistance Scheme, can represent thousands in savings if you qualify. From 1 July 2023, first-home buyers receive a full transfer duty exemption on homes valued up to $800,000, and a concessional rate applies between $800,000 and $1,000,000. Many buyers don’t apply for these schemes because they haven’t engaged a conveyancer early enough to understand their eligibility.

The residence requirement is also frequently misunderstood: you must move into the home within 12 months after settlement and live there as your principal place of residence for 12 consecutive months to retain the exemption. Failure to meet this requirement triggers interest and penalties unless you notify Revenue NSW beforehand. Professional conveyancing removes these risks by managing timelines, coordinating with your lender, and ensuring all government assistance applications are lodged correctly before settlement.

Why Timing Matters in Your Purchase

The conveyancing process involves multiple moving parts that must align perfectly. Your conveyancer coordinates with your lender to confirm finance conditions, arranges all necessary searches and certificates, and prepares documentation for stamp duty applications. Each step has strict deadlines-miss one, and you risk losing your deposit, facing penalties, or losing eligibility for government assistance. This is where professional support transforms a stressful process into a structured, manageable journey toward settlement.

How the Conveyancing Process Works Before Settlement

Conducting Due Diligence Before You Exchange

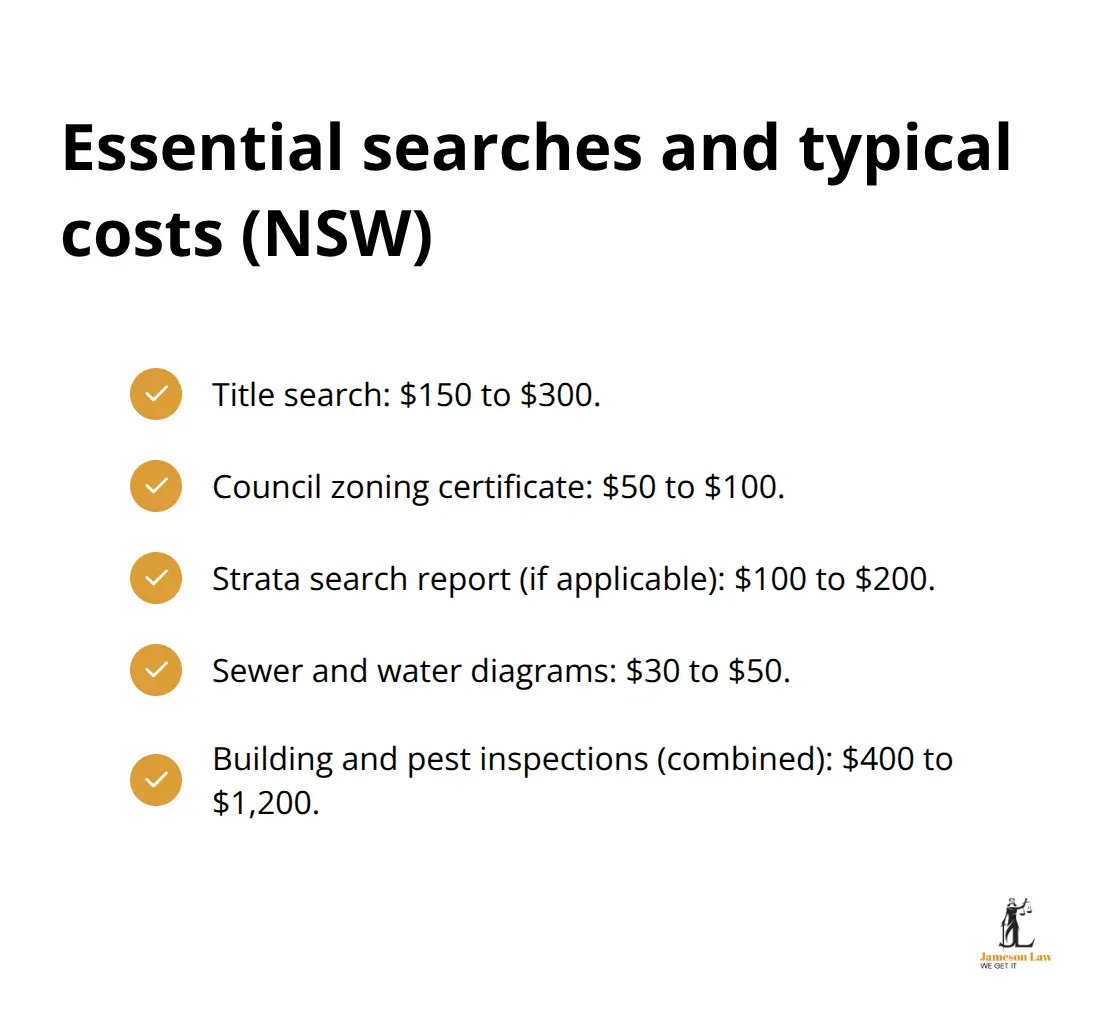

Before you exchange contracts, your conveyancer conducts thorough due diligence to protect you from costly surprises. This phase starts the moment you decide to make an offer. Your conveyancer obtains a title search to verify the seller actually owns the property and identifies any mortgages, easements, or restrictions attached to it. A title search typically costs $150 to $300 and reveals whether the property has a clear chain of ownership or carries legal burdens that affect your use of the land.

Council zoning certificates cost around $50 to $100 and confirm the property is zoned for residential use and complies with local building codes. If the property sits within a strata scheme, a strata search report costs $100 to $200 and shows whether disputes exist between residents, outstanding levies remain unpaid, or structural defects the body corporate knows about. Sewer and water diagrams cost $30 to $50 and confirm utilities connect properly to your property.

Timing Your Searches and Inspections

You should order these searches immediately after your offer is accepted and before you exchange contracts, because the cooling-off period in NSW gives you only five business days to complete inspections and due diligence (cooling-off does not apply to auction purchases, so contract review becomes even more critical). Your conveyancer also coordinates building and pest inspections, which cost $400 to $1,200 combined and are non-negotiable before exchange. Many first-home buyers skip inspections to save money, but a $500 inspection could prevent a $50,000 repair bill after settlement.

Reviewing and Negotiating Your Contract

Your conveyancer reviews the contract of sale line by line and identifies conditions that protect you, such as the property passing a building inspection or your finance remaining unconditional. If the contract contains unfavourable terms, your conveyancer negotiates with the seller’s agent or solicitor to modify them before you sign.

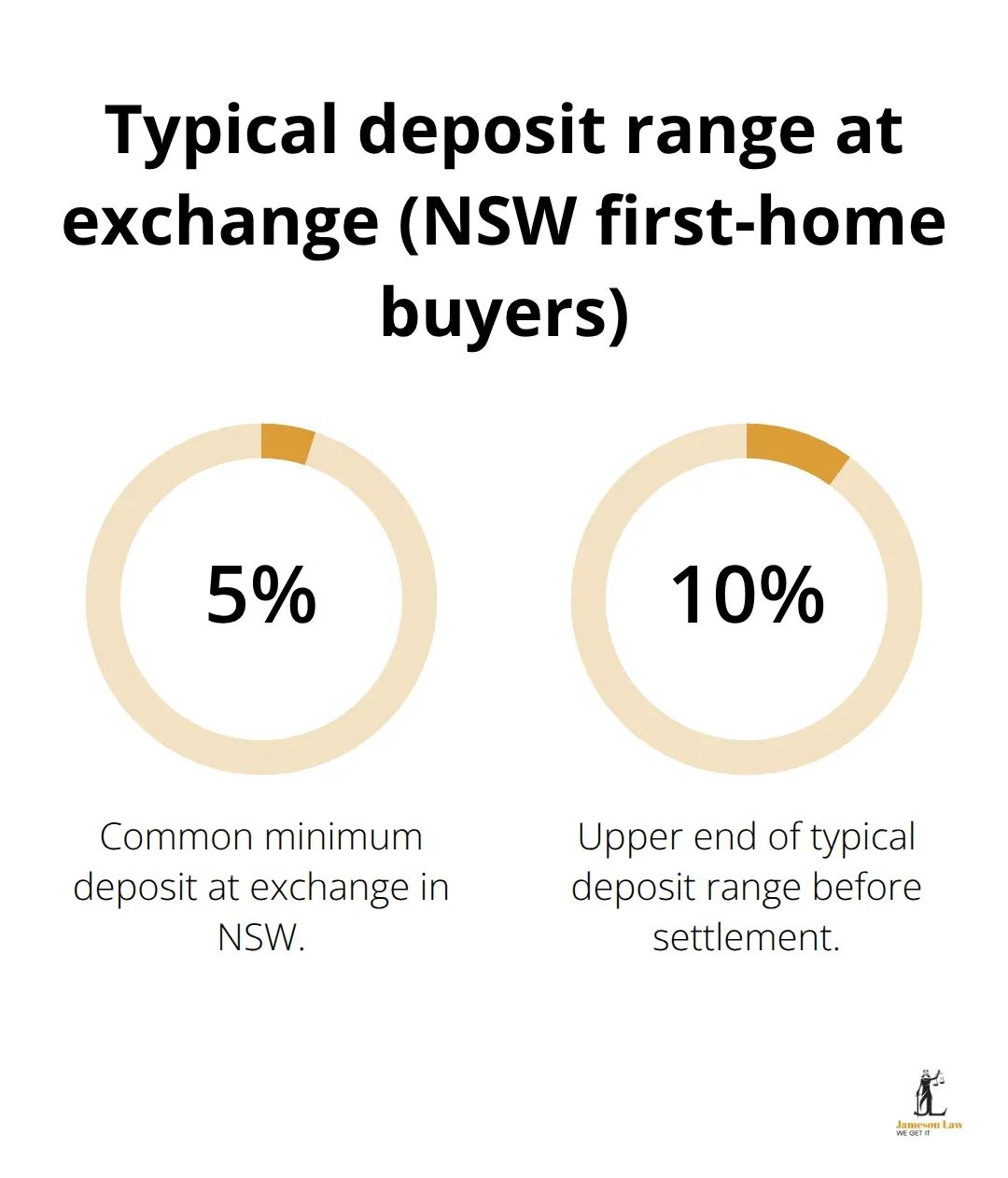

Managing Pre-Settlement Tasks After Exchange

Once you exchange contracts and pay your deposit (typically 5 to 10 percent of the purchase price), your conveyancer shifts focus to pre-settlement tasks and prepares for the final handover. Your conveyancer lodges your First Home Buyers Assistance Scheme application if you qualify, ensuring Revenue NSW receives it before settlement to secure your stamp duty exemption or concession.

From 1 July 2023, eligible first-home buyers receive a full exemption on homes valued up to $800,000, which saves thousands in upfront costs.

Your conveyancer calculates final adjustments for council rates, water bills, and body corporate levies, determining how much the seller owes you or vice versa up to settlement day. Your conveyancer also arranges mortgage registration with NSW Land Registry Services so your lender’s interest in the property is legally recorded, and confirms your lender has released funds on settlement day.

Settlement Day and Beyond

Settlement typically occurs 6 to 8 weeks after exchange of contracts, though this varies. On settlement day, your conveyancer transfers the purchase price to the seller’s solicitor or conveyancer, receives the title documents, and lodges the transfer of ownership with NSW Land Registry Services. You collect the keys from the real estate agent or seller once settlement is complete. Your conveyancer sends you a settlement statement itemising all costs, disbursements, and adjustments so you understand exactly where your money went.

With all the legal groundwork complete and ownership transferred, the next phase focuses on understanding the costs that accompany this process and the financial assistance available to first-home buyers in NSW.

What You’ll Actually Pay and How Long It Takes

Breaking Down Your Purchase Costs

First-home buyers consistently underestimate the total cost of purchasing property in NSW. The purchase price is only the beginning. Your conveyancer’s fees typically range from $1,050 to $1,875 depending on property complexity and location, but this is just one line item among many. Title searches cost $150 to $300, council zoning certificates run $50 to $100, strata search reports (if applicable) cost $100 to $200, and sewer and water diagrams add another $30 to $50. Building and pest inspections combined cost $400 to $1,200 and represent non-negotiable expenses. Bank and loan application fees vary by lender but commonly range from $300 to $600.

Stamp duty represents your largest additional expense after the purchase price itself. From 1 July 2023, first-home buyers receive a full stamp duty first-home buyers exemption NSW on homes valued up to $800,000, which saves thousands in upfront costs. Properties valued between $800,000 and $1,000,000 attract a concessional rate rather than full duty. For vacant land intended for building a home, the exemption applies up to $350,000 with a concessional rate between $350,000 and $450,000.

Without professional conveyancing guidance, most first-home buyers miss these exemptions entirely and overpay substantially. Moving costs, council rate adjustments, water bill prorations, and body corporate levies (for strata properties) add further expenses that accumulate before settlement day arrives.

Understanding Your Timeline

The conveyancing timeline typically spans 6 to 8 weeks from exchange of contracts to settlement, though this varies based on lender responsiveness and complexity of searches. The entire purchase process from initial offer to holding keys usually takes 8 to 12 weeks when you account for offer negotiation, cooling-off period inspections, and pre-settlement coordination. This timeline matters because the NSW First Home Buyers Assistance Scheme application must be lodged before settlement to secure your exemption or concession, and delays in any single step can jeopardise your eligibility.

Your conveyancer must coordinate with your lender to confirm all finance conditions are met, arrange mortgage registration with NSW Land Registry Services, and calculate final adjustments for rates and utilities. If your lender imposes additional conditions or requests further documentation late in the process, settlement can be delayed by weeks, which is why engaging a conveyancer early-ideally before you exchange contracts-prevents these bottlenecks.

Government Assistance Programs That Reduce Your Costs

The First Home Owner Grant for new homes offers a one-off payment to help with purchase or loan costs, and shared equity schemes allow the government to co-purchase a share of the property to reduce your loan size. Both require early planning and professional application. Eligibility for these programs depends on property price, your income, and occupancy requirements, which is why professional guidance matters from day one.

Your conveyancer lodges your First Home Buyers Assistance Scheme application before settlement to secure your stamp duty exemption or concession. From 1 July 2023, eligible first-home buyers receive a full exemption on homes valued up to $800,000, which saves thousands in upfront costs. Missing this application deadline costs you the entire benefit, so timing coordination with your conveyancer is essential.

Why Delays Cascade Through Your Purchase

Treat the conveyancing timeline as a project with interdependent tasks rather than a linear process. One delayed step cascades through the entire schedule and can cost you thousands in missed government assistance or delayed settlement. Your conveyancer manages these dependencies by coordinating with your lender, searches providers, and NSW Land Registry Services simultaneously rather than sequentially, which accelerates your path to settlement and protects your eligibility for first-home buyer assistance.

Final Thoughts

Buying your first home in NSW represents the largest financial commitment most people make, and first home buyers conveyancing protects that investment by managing legal risks, securing government assistance, and coordinating every step from offer to settlement. Without professional support, you face missed stamp duty exemptions worth thousands, hidden property defects, unfavourable contract terms, and missed deadlines that jeopardise your eligibility for first home buyer schemes. The conveyancing process involves multiple moving parts that must align perfectly, with each task carrying strict deadlines where delays in one area cascade through your entire purchase timeline.

We at Jameson Law have guided hundreds of first home buyers through this journey and understand the specific challenges NSW buyers face. We manage your contract review, coordinate all searches and certificates, lodge your First Home Buyers Assistance Scheme application before settlement, and handle every detail that protects your investment. Our experience across conveyancing, property law, and estate planning means we understand how your purchase fits into your broader financial and legal situation.

Contact Jameson Law for a free initial consultation to discuss your purchase timeline, eligibility for government assistance, and the specific costs you’ll face. We’ll review your contract, explain your options, and guide you through each phase of the conveyancing process so that buying your first home feels manageable, not overwhelming.