Commercial finance law is a complex and ever-evolving field that plays a vital role in business transactions and economic growth.

At Jameson Law, we understand the intricacies of this area and its impact on Australian businesses.

This blog post will explore the key elements, legal considerations, and emerging trends in commercial finance law, providing you with essential knowledge to navigate this dynamic landscape.

What is Commercial Finance Law?

Commercial finance law forms the foundation of business transactions in Australia. This area of law regulates the lending and borrowing of money for commercial purposes, shaping the financial landscape for businesses across the country.

Scope of Commercial Finance Law

Commercial finance law encompasses a broad range of transactions. These include:

- Secured and unsecured loans

- Asset-based lending

- Complex financial instruments

The scope extends to both domestic and international transactions, reflecting the global nature of modern business.

Types of Commercial Finance Transactions

Australian businesses have access to various financing options:

- Term loans: These are common for long-term investments.

- Lines of credit: They provide flexibility for short-term needs.

- Asset-based lending: Popular among small and medium enterprises, these loans are secured against business assets.

- Syndicated loans: Multiple lenders join forces to finance large projects.

The Australian Financial Markets Association reports that reduced M&A activity in the first half of 2024 impacted the volume of syndicated lending in the Asia-Pacific region.

Australia’s Regulatory Framework

Australia’s regulatory landscape for commercial finance is robust and multifaceted. Key elements include:

- Australian Securities and Investments Commission (ASIC): This body oversees financial services and enforces compliance.

- Corporations Act 2001: This legislation sets out rules for corporate governance and financial reporting.

- Personal Property Securities Act 2009 (PPSA): Proposed reforms are intended to simplify the PPSA regime by reducing unnecessary complexity and providing clearer and more accessible rules.

The Dynamic Nature of Commercial Finance

The Australian finance sector continues to evolve rapidly. New financial products and services constantly emerge, challenging traditional lending models. Fintech innovations are reshaping the industry, while environmental, social, and governance (ESG) factors increasingly influence lending decisions.

For businesses seeking finance in today’s market, staying informed about these changes is not just beneficial-it’s essential. As we move into the next section, we’ll explore the legal considerations that businesses must navigate in this complex landscape of commercial finance.

Navigating Legal Risks in Commercial Finance

The Cornerstone of Due Diligence

Due diligence forms the foundation of any successful commercial finance transaction. It requires a thorough investigation of a business or project’s financial, legal, and operational aspects. More than 3000 Aussie construction firms collapsed in 2024, highlighting the importance of adequate due diligence.

To conduct effective due diligence, businesses should:

- Examine financial statements and projections

- Review existing contracts and obligations

- Assess market conditions and competitive landscape

- Investigate regulatory compliance history

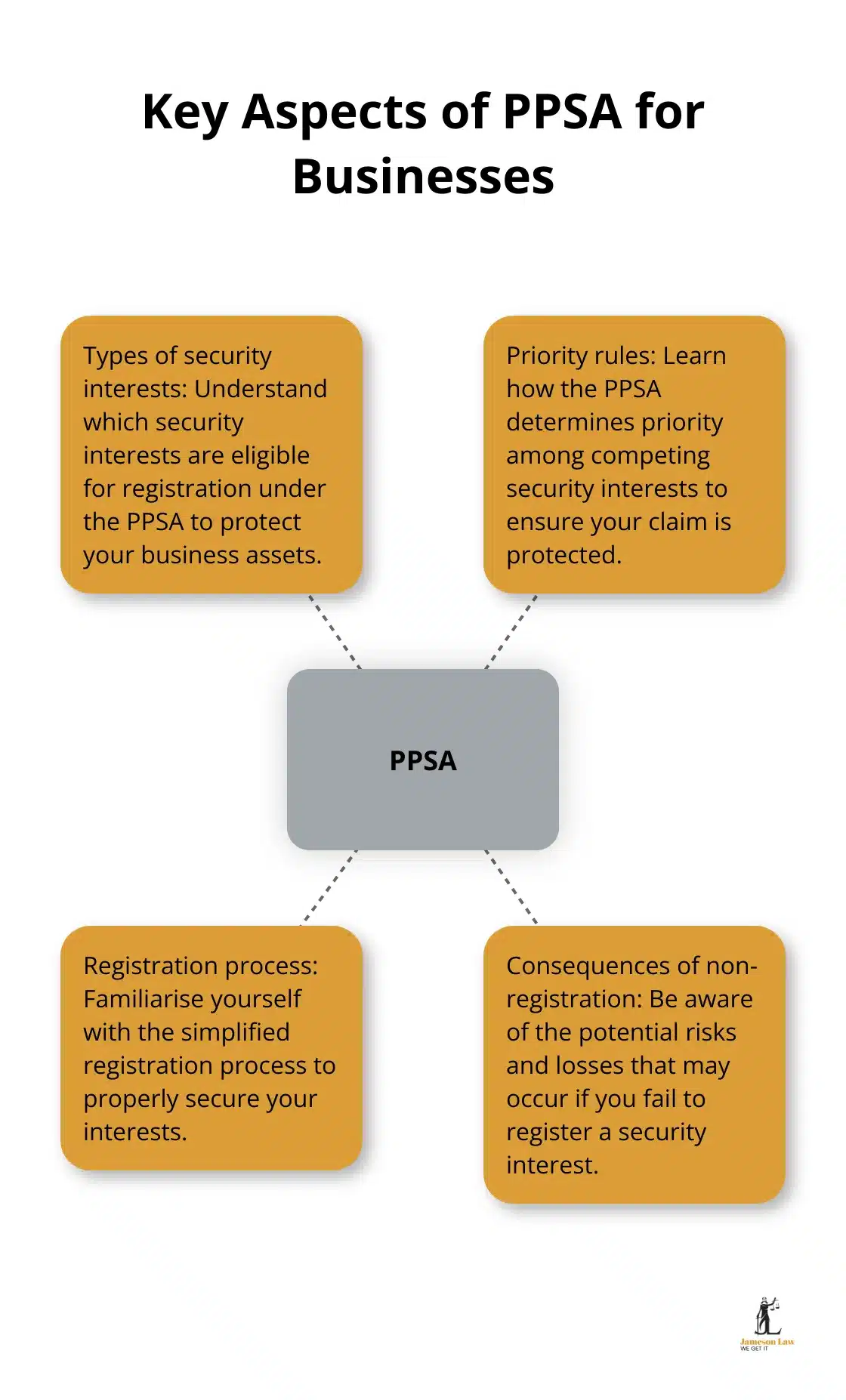

Protecting Interests through PPSA

The Personal Property Securities Act 2009 (PPSA) plays a pivotal role in safeguarding lenders’ interests in commercial finance transactions. Recent amendments have simplified the registration process, but it remains a complex area of law.

Key aspects of the PPSA that businesses need to understand include:

Construction sector insolvencies reached record highs in 2023-24, emphasizing the importance of the PPSR system in protecting business assets and mitigating financial risks.

The Art of Contract Crafting

Well-drafted contracts protect all parties involved in a commercial finance transaction. These documents should clearly outline the agreement terms, including:

- Loan amount and interest rate

- Repayment schedule

- Security arrangements

- Default provisions and remedies

Clear, comprehensive contracts drafted by experienced legal professionals are essential to avoid disputes in commercial finance transactions.

Mitigating Risks in Commercial Finance

Risk assessment forms an integral part of commercial finance transactions. Businesses must identify and evaluate potential risks (financial, operational, and legal) to develop effective mitigation strategies.

Common risk mitigation techniques include:

- Diversification of funding sources

- Implementation of robust internal controls

- Regular financial audits and compliance checks

- Engagement of expert legal counsel

As the commercial finance landscape continues to evolve, businesses must stay informed about legal considerations to secure funding and manage financial risks effectively. The next section will explore emerging trends that are reshaping the commercial finance sector in Australia.

How Technology Reshapes Commercial Finance Law

The Digital Lending Revolution

Digital lending platforms transform the commercial finance sector in Australia. These platforms streamline loan applications and approvals, making capital access easier for businesses. The ACCC’s litigation efforts faced significant challenges in 2024, particularly with ongoing cases involving Meta and other digital platforms.

These platforms use advanced algorithms and data analytics to assess creditworthiness, often providing faster decisions than traditional lenders. However, businesses must be aware of potential risks, including data security concerns and the need for clear terms in digital loan agreements.

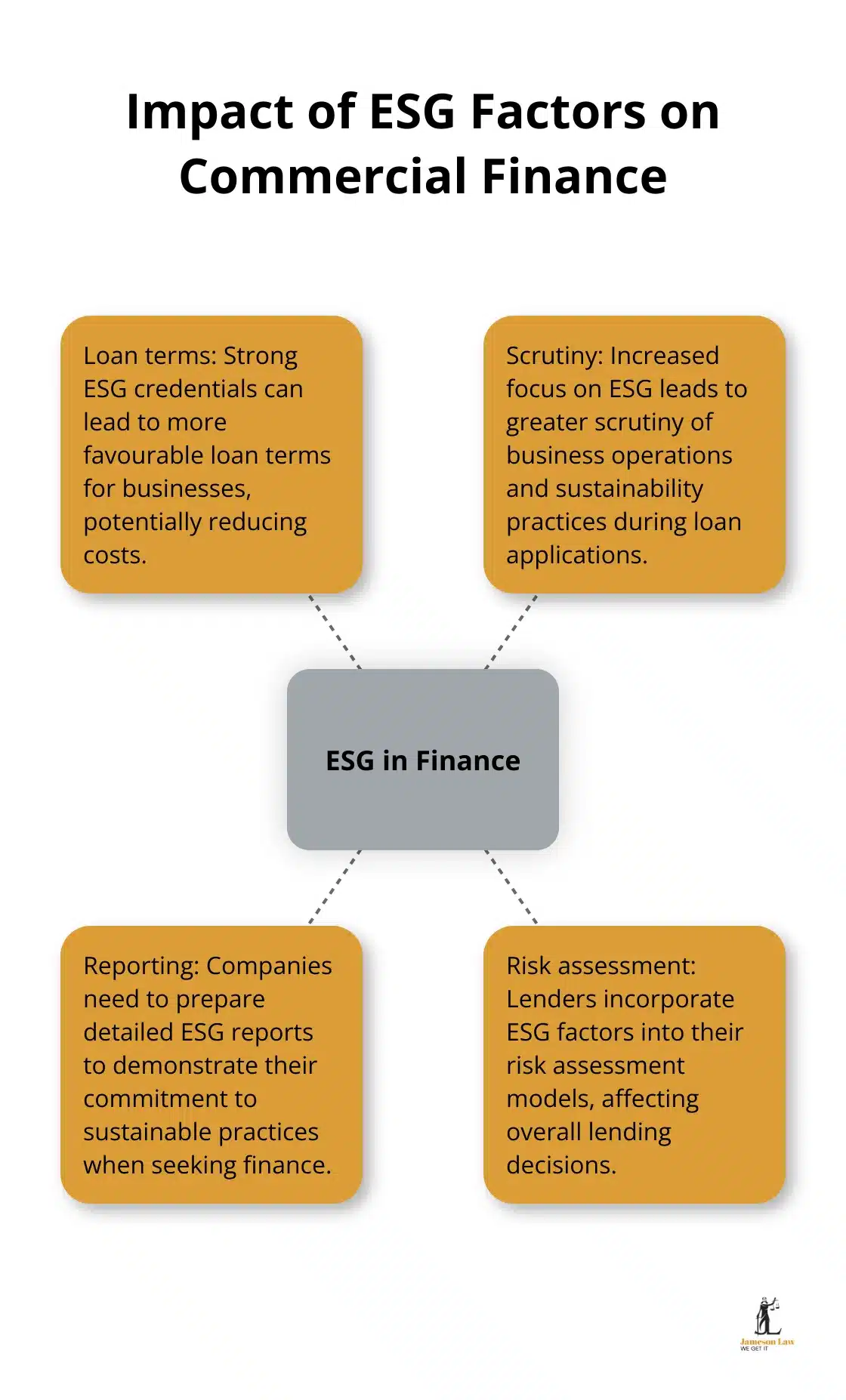

ESG Factors: A New Perspective on Lending

Environmental, Social, and Governance (ESG) considerations now influence commercial finance decisions. The rising prominence of ESG is explored in current and emerging trends in the mortgage and finance broking industry.

For businesses seeking finance, strong ESG credentials can lead to more favourable loan terms. However, this also means increased scrutiny of business operations and sustainability practices. Companies should prepare to provide detailed ESG reports and demonstrate their commitment to sustainable practices when applying for loans.

Navigating the Changing Regulatory Landscape

The regulatory framework for commercial finance in Australia continues to evolve, with a focus on enhancing transparency and protecting borrowers. The Australian Securities and Investments Commission (ASIC) introduced new design and distribution obligations for financial products in 2024, impacting how financial products are marketed and sold.

Businesses need to stay informed about these regulatory changes and ensure compliance. This may involve updating internal processes, enhancing disclosure practices, and seeking legal advice to navigate complex regulatory requirements.

The Role of Artificial Intelligence in Risk Assessment

Artificial Intelligence (AI) plays an increasing role in commercial finance, particularly in risk assessment and fraud detection. AI in fintech is transforming finance and accounting, impacting roles, fraud prevention, and risk management.

However, the use of AI in finance also raises questions about transparency and fairness. Businesses should understand how AI-driven decisions are made and ensure that these processes comply with regulatory requirements (including anti-discrimination laws).

Blockchain and Smart Contracts in Commercial Finance

Blockchain technology and smart contracts offer new possibilities for secure and efficient financial transactions. These technologies can automate contract execution, reduce intermediaries, and increase transparency in financial dealings.

While adoption is still in its early stages, businesses should monitor developments in this area. The potential for reduced transaction costs and increased security makes blockchain an attractive option for future commercial finance transactions.

Final Thoughts

Commercial finance law shapes the financial landscape for Australian enterprises. This dynamic field encompasses a wide range of transactions, all governed by a robust regulatory framework. Due diligence, risk assessment, and well-crafted contracts protect the interests of all parties involved in financial transactions.

Technological advancements transform the future of commercial finance in Australia. Digital lending platforms, AI in risk assessment, and blockchain technology revolutionise how businesses access and manage capital. The growing emphasis on Environmental, Social, and Governance factors reshapes lending decisions and corporate practices.

The regulatory landscape continues to evolve, and businesses must adapt. Jameson Law offers comprehensive legal services to help businesses navigate the intricate world of commercial finance law. Our extensive experience equips us to guide clients through the challenges and opportunities in this dynamic financial environment.