The Conveyancing (Sale of Land) Regulation 2018 transformed how property transactions operate in New South Wales. These changes introduced stricter disclosure requirements and updated professional standards that affect every buyer and seller.

We at Jameson Law have seen firsthand how these regulations impact property deals. Understanding these rules helps you navigate your transaction more effectively and avoid potential complications during settlement.

What Changed Under the Conveyancing Regulations 2018?

Mandatory Disclosure Requirements Transform Property Sales

The Conveyancing (Sale of Land) Regulation 2022 (which replaced the 2017/2018 regulations) introduced comprehensive disclosure obligations that fundamentally shifted responsibility onto vendors. Property sellers must now provide Section 10.7 certificates, property certificates, and detailed compliance reports before contract exchange.

Vendors who fail to disclose material information face significant liability exposure. Courts now hold professionals accountable when they fail to inform clients about special contract clauses or property defects.

Professional Standards and Record-Keeping Obligations

The Conveyancing Licensing Regulation mandates that conveyancers maintain detailed records of all client communications. This requirement stems from cases where lack of written confirmation contributed to professional liability claims. Conveyancers must now document their disclosure of special contract clauses to clients.

The regulation also requires continuous professional development to stay current with legislative changes. Proper documentation protects both clients and practitioners from future disputes.

Electronic Conveyancing and Technology Standards

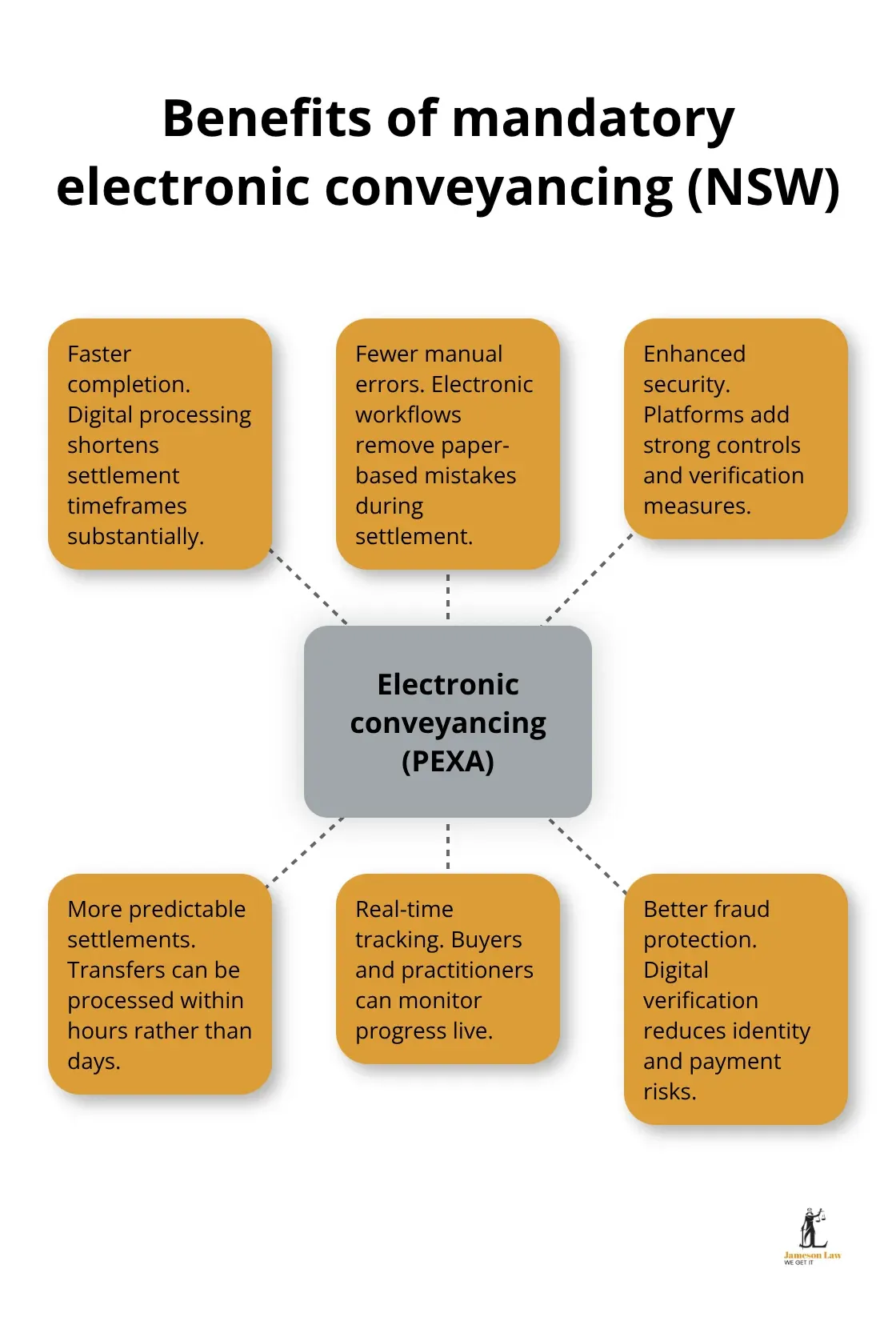

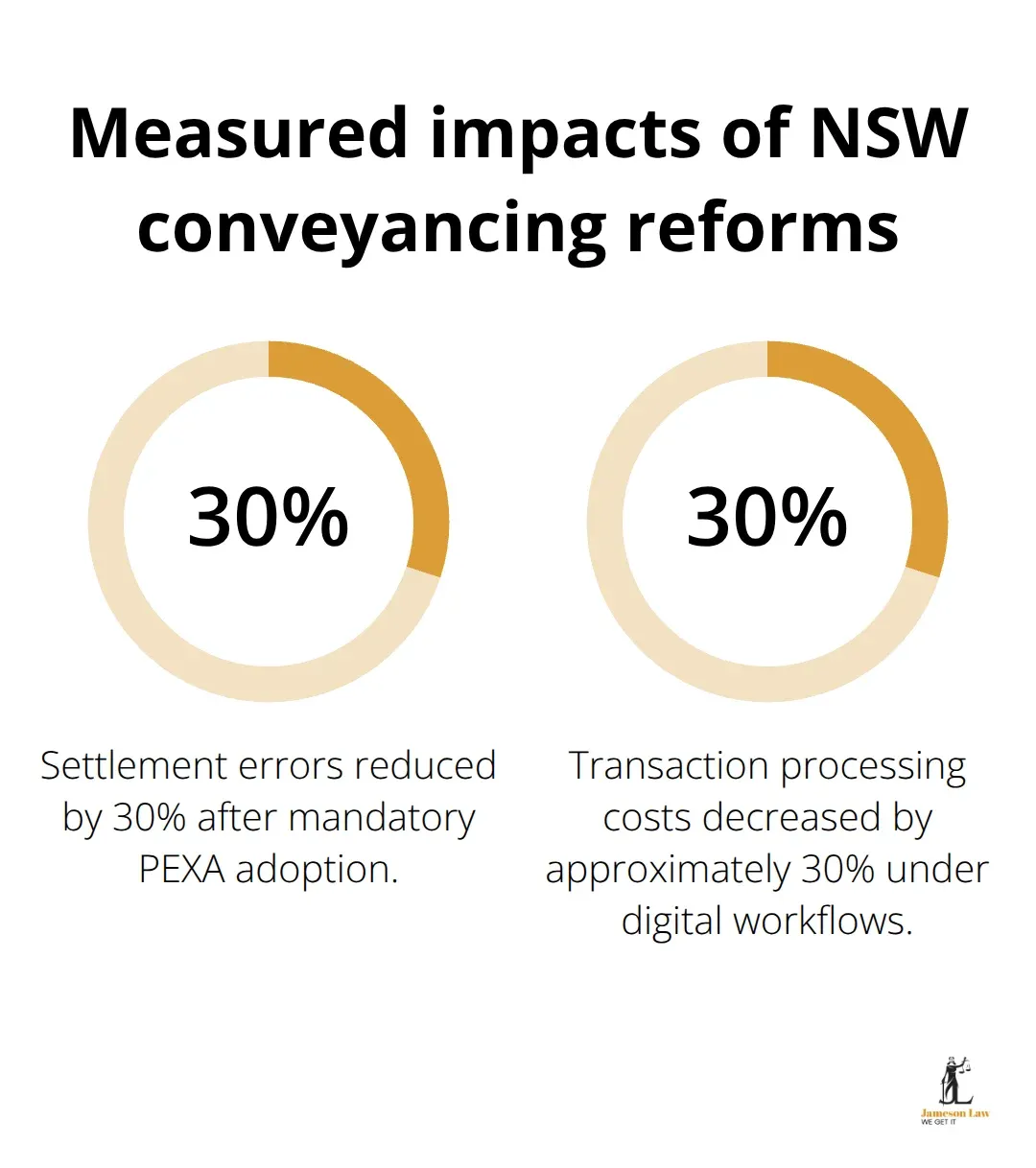

Electronic conveyancing became mandatory in New South Wales from October 2021. The PEXA platform now handles most settlements, requiring conveyancers to adapt their practices to digital workflows. This shift eliminated many manual errors that previously occurred during settlement processes.

How Do These Regulations Change Your Property Transaction?

Stronger Protection Through Enhanced Disclosure Requirements

Property buyers now receive significantly more protection through mandatory disclosure. Sellers must furnish Section 10.7 certificates that reveal unauthorised works and potential safety risks. This represents a major shift from previous practices where buyers often discovered problems after settlement.

Enhanced disclosure requirements now protect buyers in property transactions across Australia. Vendors who attempt to hide material defects face substantial liability exposure, particularly regarding unauthorised building works.

Settlement Timeframes and Electronic Processing Benefits

Electronic conveyancing through PEXA eliminated manual errors and reduced settlement timeframes. Digital processing now provides faster transaction completion. Settlement periods have become more predictable, with Electronic Lodgement Networks (ELNOs) processing transfers within hours.

Buyers benefit from real-time transaction tracking. The electronic system also provides better fraud protection through digital verification processes known as Verification of Identity (VOI).

Cost Structure Changes and Professional Fee Implications

Professional fees have increased due to enhanced compliance obligations. Conveyancers must maintain detailed records of client communications, adding administrative costs. However, these costs provide better protection against professional negligence claims.

Impact on Contract Terms and Conditions

The regulations have transformed how contracts address special conditions. Conveyancers must now explicitly advise clients about clauses relating to unauthorised works. Property contracts now include more detailed warranties from vendors about the property’s condition, shifting liability more clearly onto sellers who fail to disclose material information.

How Do These Regulations Change Conveyancing Practice?

Licensing Requirements Drive Professional Standards Higher

The NSW Fair Trading requirements mandate that conveyancers complete professional development annually. Conveyancers must document their training to maintain their licences. These requirements create measurably better outcomes for clients through enhanced competency.

Technology Integration Becomes Non-Negotiable

Electronic conveyancing became mandatory across New South Wales in 2021. This transition eliminated manual lodgement processes. Settlement times now average 2-3 days compared to previous weeks-long timeframes. Conveyancers who resisted digital adoption faced immediate compliance issues.

Client Service Standards Demand Documented Communication

The regulations mandate that conveyancers maintain comprehensive records. Practitioners must now document disclosure conversations about special contract clauses in writing. Quality assurance protocols have become mandatory, significantly reducing error rates.

Final Thoughts

The Conveyancing Regulations 2018 (and subsequent 2022 updates) have fundamentally strengthened property transaction security across New South Wales. Enhanced disclosure requirements now protect buyers from hidden defects, while mandatory electronic processing has reduced settlement errors.

Professional conveyancing services have become more important than ever. At Jameson Law, we provide expert conveyancing services across New South Wales while maintaining full compliance with all regulatory requirements. Contact us today to ensure your property transaction is secure and compliant.