Buying property in NSW involves multiple stages, legal requirements, and moving parts that can feel overwhelming without proper guidance. At Jameson Law, we’ve helped countless buyers navigate NSW property conveyancing steps smoothly from offer through to settlement.

This guide breaks down exactly what happens at each stage, who you’ll work with, and what to expect on the day you take possession of your new home.

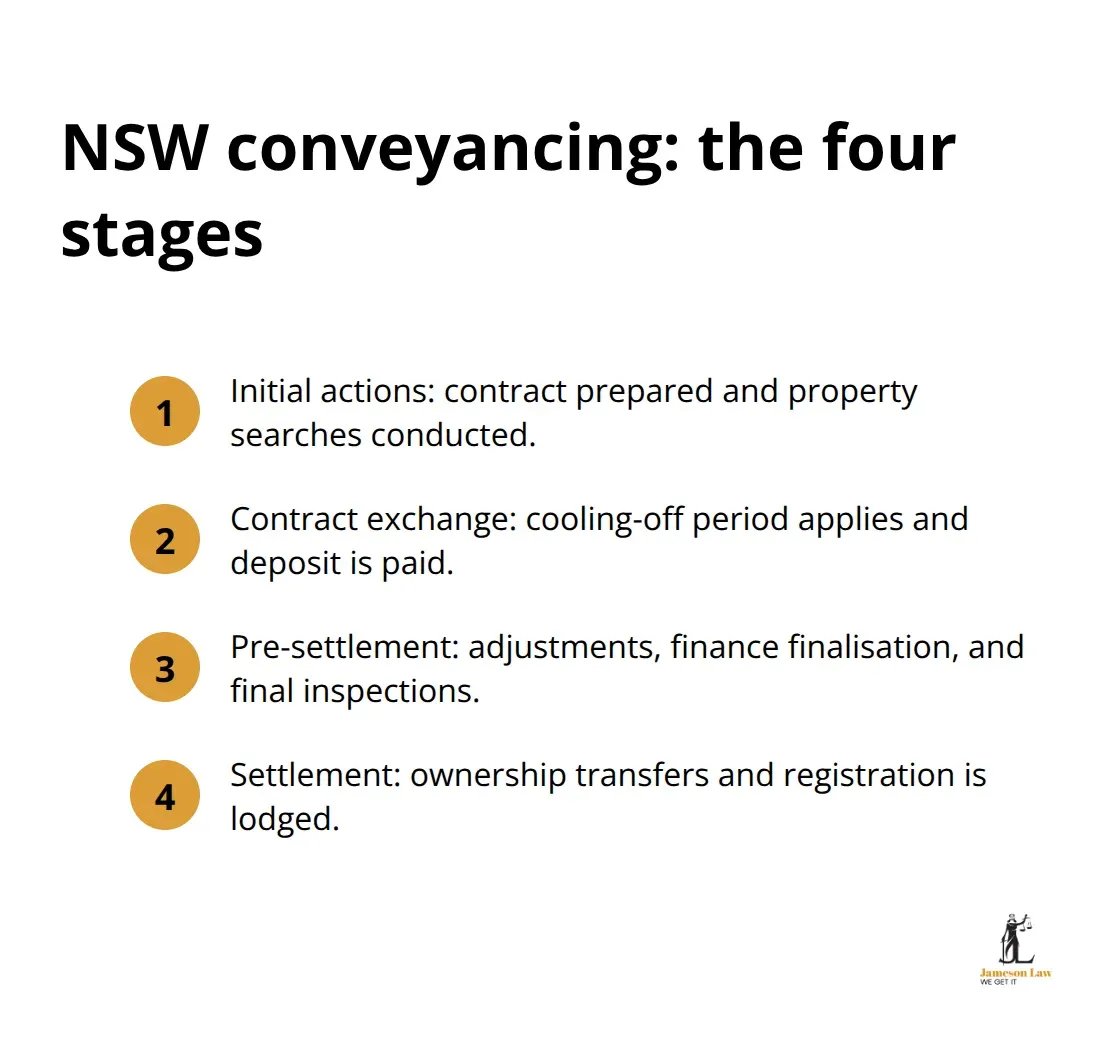

NSW Property Conveyancing: The Four-Stage Process

Conveyancing is the legal process that transfers property ownership. NSW Fair Trading requires that a residential contract be prepared by a legal practitioner or licensed conveyancer before marketing begins.

Most NSW conveyancing follows a four-stage structure: initial contract review, exchange, pre-settlement, and settlement. The entire process typically takes 30 to 90 days.

Understanding the Cooling-Off Period

The cooling-off period is a critical protection. You have five business days after exchange to reconsider. If you withdraw, you pay a penalty of 0.25% of the price. This period can be waived with a Section 66W certificate.

Who Coordinates Your Conveyancing?

You’ll work with either a licensed conveyancer or a solicitor. Both must carry professional indemnity insurance. Your lender also plays a key role by registering the mortgage against the title.

Settlement occurs electronically through the Electronic Lodgment Network (PEXA). This means funds are transferred securely without the need for physical cheques.

What to Check Before Settlement?

Order Inspections Immediately After Exchange

Don’t skip inspections. Order a building and pest inspection immediately. For apartments, a strata report is essential to check the building’s financial health.

Verify Title and Identify Hidden Issues

Your conveyancer conducts title searches to identify easements or caveats. They also check for government interests via Section 10.7 certificates from the local council.

Act Quickly on Defects

If inspections reveal defects, you have limited time to negotiate. While you generally buy the property “as is,” serious undisclosed issues might allow for negotiation before settlement.

Settlement Day: What Happens in the Final Hour?

The Settlement Process

Settlement typically takes 60 minutes. Your conveyancer ensures the mortgage is discharged and funds are transferred. The title is then lodged with NSW Land Registry Services for registration.

Managing Rates and Utilities

Adjustments for council and water rates are calculated so you don’t pay the seller’s arrears. You must notify electricity and gas providers yourself.

Your Final Walkthrough

Conduct a final inspection on the morning of settlement to ensure the property is in the same condition as when you exchanged contracts. Once settlement is complete, you can collect the keys.

Final Thoughts

NSW property conveyancing steps require attention to detail. Skipping inspections or ignoring title searches can lead to costly mistakes. Professional guidance ensures your rights are protected.

We at Jameson Law have guided countless buyers through this process. Contact Jameson Law today for a transparent quote and expert legal support for your property purchase.