Selling property in NSW involves more than just finding a buyer. You need to navigate legal requirements, manage costs, and handle paperwork that can feel overwhelming.

We at Jameson Law have created this checklist to guide you through every stage of selling property conveyancing in NSW. This guide covers what you need to prepare, how the process works, and what expenses to expect.

Preparing Your Property and Documents for Sale

Gather Essential Property Documents Now

NSW law requires your conveyancer to prepare a contract before you can sell. You need the current title certificate, registered plan, drainage diagram, and a zoning certificate (Section 10.7). If your property has a pool, obtain a valid certificate of compliance.

Contact Revenue NSW to confirm whether any outstanding land tax exists on your property, as this must be cleared before settlement.

Understand Mandatory Hazard and Risk Disclosures

NSW law requires you to disclose specific hazards. If your property contains loose-fill asbestos insulation or combustible cladding, you must disclose this. Failure to provide required disclosures allows the buyer to terminate the contract within 14 days of exchange.

Moving Through Contract Exchange and Settlement

The Contract Exchange and Cooling-Off Period

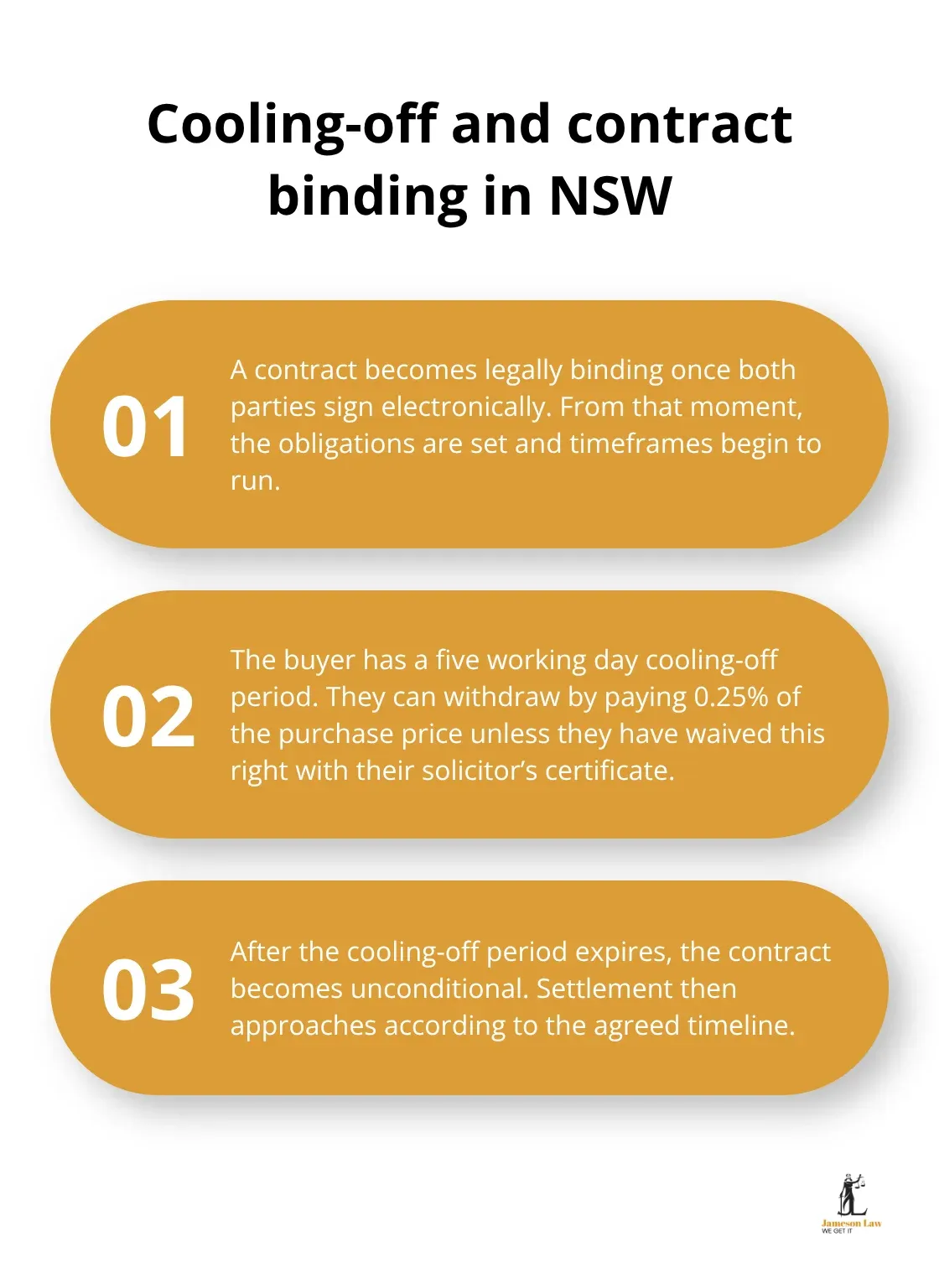

When you select an offer, your conveyancer drafts the contract and sends it to the buyer’s solicitor. Once both parties sign, the sale becomes legally binding. The buyer usually has a five working day cooling-off period where they can withdraw by paying 0.25% of the purchase price, unless waived via a Section 66W certificate.

Pre-Settlement Searches and Documentation

Settlement usually takes place around 6 weeks after exchange. Your conveyancer orders final searches from your local council and water authority to confirm current rates, which are adjusted at settlement.

Settlement Through the PEXA Digital Platform

Most NSW settlements now occur through the PEXA digital platform. On settlement day, the buyer’s bank transfers funds electronically, your conveyancer receives confirmation, and NSW Land Registry Services registers the new owner on the title.

Managing Costs and Financial Considerations

Conveyancing Fees and Disbursements

Conveyancing fees typically range from $1,050 to $1,875. Disbursements cover searches, certificates, and registrations. A zoning certificate costs $50 to $150, drainage diagrams run $30 to $100, and title searches cost around $10 to $30.

Settlement Adjustments and Agent Commission

Settlement adjustments ensure rates and water are divided fairly based on the settlement date. Agent commission typically runs 1.5% to 3% of the sale price.

Capital Gains Tax (CGT)

If you’re selling an investment property, Capital Gains Tax applies to your profit. If you’ve owned the property for more than 12 months, you receive a 50% CGT discount.

Final Thoughts

Selling property conveyancing NSW requires preparation, attention to detail, and professional guidance. Your conveyancer handles the complex legal work, manages timelines, and coordinates with the buyer’s solicitor so you don’t have to.

We at Jameson Law specialise in conveyancing across NSW. Contact us for a consultation and let our experienced property lawyers handle the legal complexity while you focus on your next chapter.