Family law disputes can drain your finances and leave you with outcomes you didn’t choose. A binding financial agreement gives you control over how assets, superannuation, and spousal support are divided without going to court.

At Jameson Law, we’ve seen how the right agreement protects families from years of litigation. This guide walks you through what BFAs are and how to avoid costly mistakes.

What Binding Financial Agreements Actually Are?

A binding financial agreement (BFA) is a legally enforceable contract under the Family Law Act 1975. It sets out how you will divide assets if the relationship ends. Crucially, it removes the court’s power to intervene.

You can enter one at any stage:

- Before: Often called a “prenup” (Section 90B).

- During: To protect specific assets (Section 90C).

- After: To finalise a property settlement without court orders (Section 90D).

The Legal Advice Requirement

This is not a casual formality. Under Section 90G, both parties must obtain independent legal advice. Your lawyer must provide a signed certificate confirming they explained the advantages and disadvantages. Without this, the agreement is not binding.

How They Differ from Court Orders

Consent Orders require a judge to verify that the deal is “just and equitable.” BFAs skip this step—you negotiate your own terms. However, courts can set aside agreements for fraud or unconscionable conduct, as seen in Thorne v Kennedy [2017].

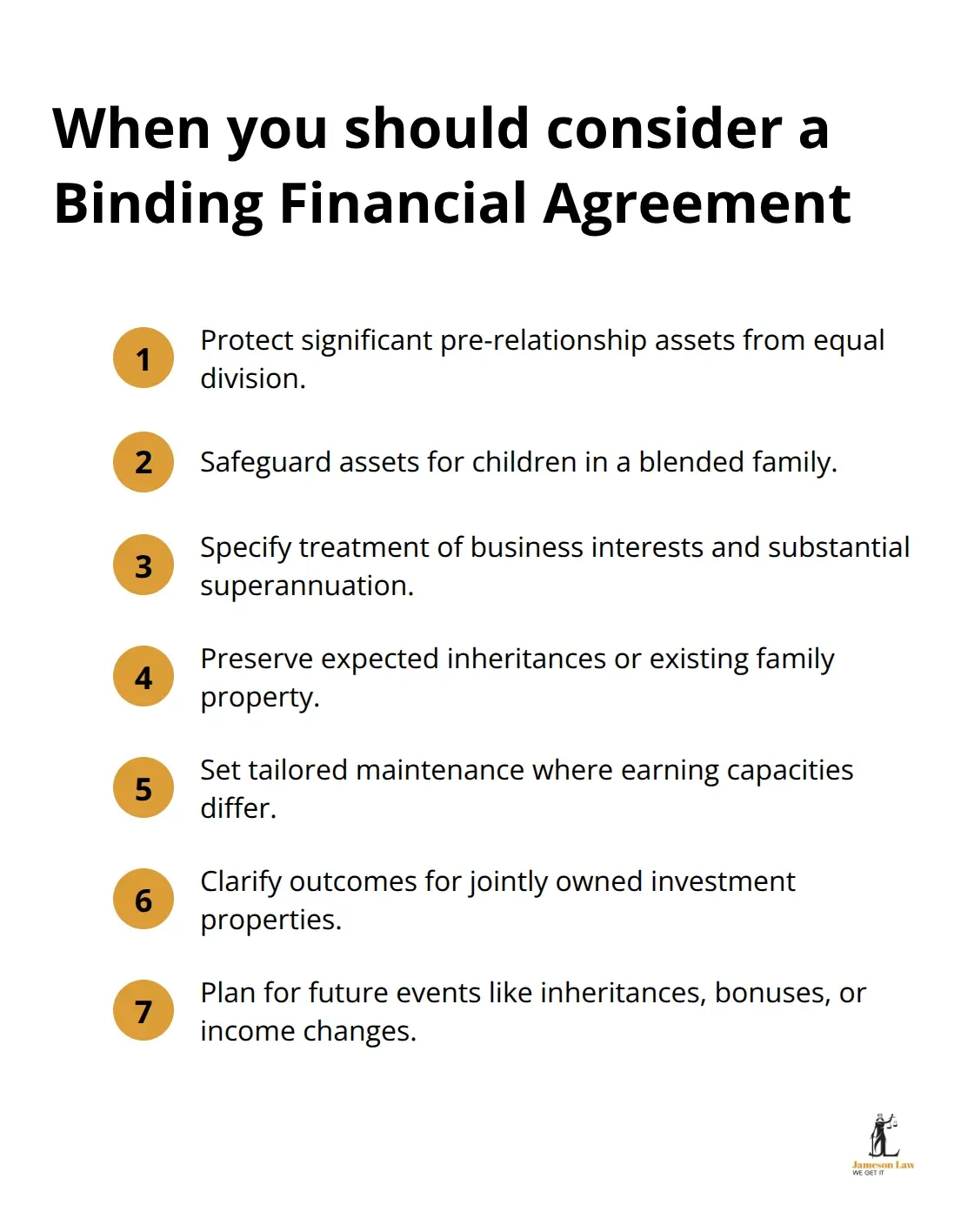

When You Actually Need One?

A BFA is essential if:

- You have significant pre-existing assets.

- You are in a blended family and want to protect inheritance for children.

- You own a business and want to prevent it from being sold in a settlement.

What a Binding Financial Agreement Actually Protects?

You Control Complex Asset Arrangements

Courts apply statutory formulas. A BFA allows you to tailor terms. If you want to keep your business while your partner keeps the house, a BFA secures that arrangement regardless of “fairness” tests applied by courts.

Court Proceedings Cost Far More

Litigation can cost $50,000 to $150,000. A BFA typically costs between $3,000 and $8,000. More importantly, it offers privacy—BFAs are private contracts, unlike court orders which are public records.

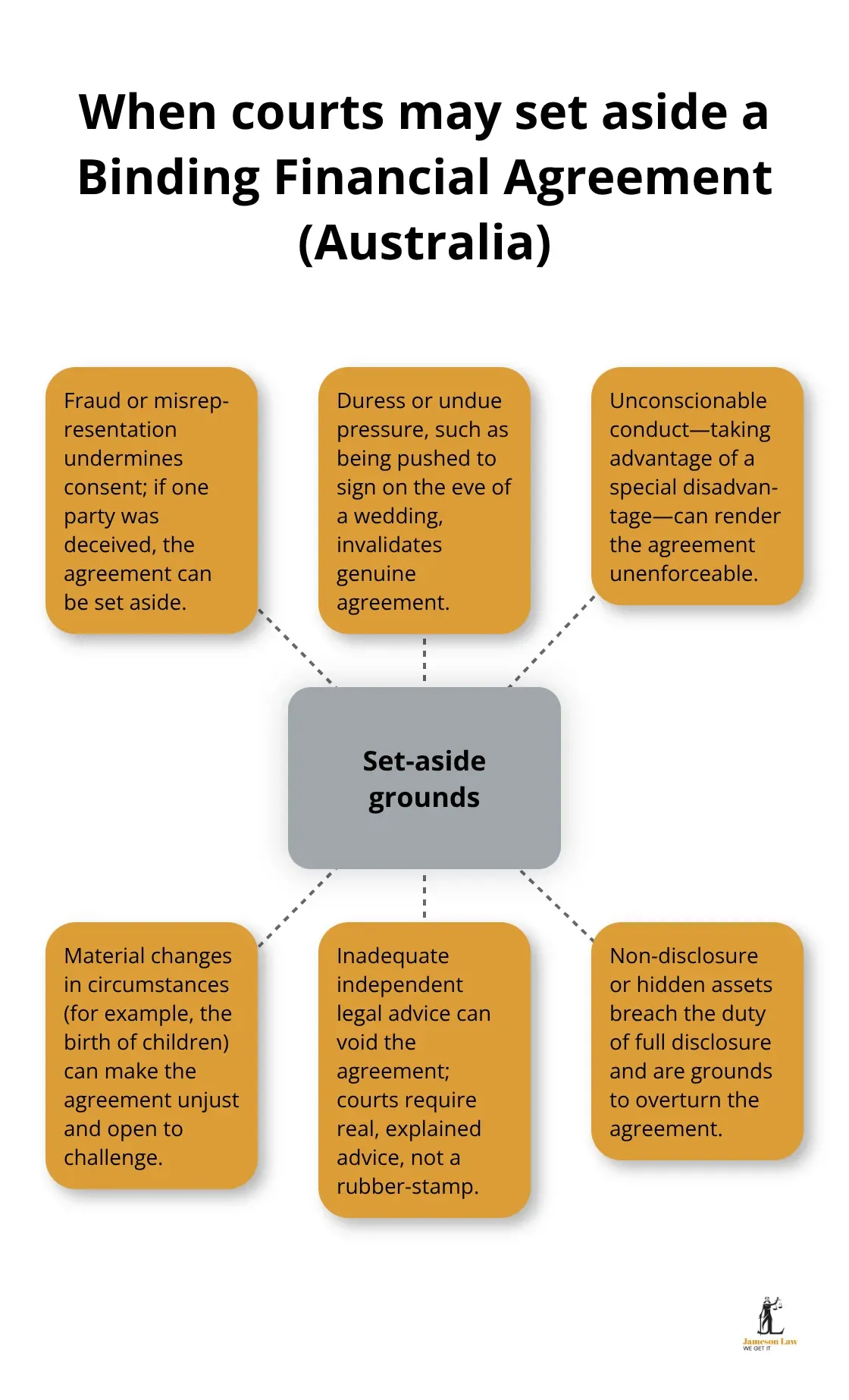

What Invalidates a Binding Financial Agreement?

Hidden Assets and Non-Disclosure

Full financial disclosure is non-negotiable. If you hide assets, the court can overturn the agreement later (Black v Black). You must declare all property, superannuation, and liabilities.

Pressure and Duress

If one party is pressured into signing (e.g., days before a wedding), the High Court may find the agreement unconscionable and void it. Both parties must enter the agreement freely.

Final Thoughts

A binding financial agreement puts you in control of your financial future. It eliminates the uncertainty of the Family Court.

However, it requires strict adherence to legal technicalities. We at Jameson Law help families navigate these decisions with confidence. Contact Jameson Law to draft an agreement that protects your interests effectively.