Family law financial agreements shape how assets, income, and liabilities are divided when relationships change. Getting these agreements right from the start protects both parties and prevents costly property disputes later.

At Jameson Law, we’ve seen how proper financial agreements give people clarity and control over their financial future. This guide walks you through the types available (often called Binding Financial Agreements or BFAs), what you need to know, and the steps to get it done properly.

What Financial Agreements Actually Cover?

A Financial Agreement under Australian family law isn’t a one-size-fits-all document. It addresses the specific financial matters you and your partner decide to include. The agreement can tackle property division, spousal maintenance, and superannuation splitting depending on your circumstances.

This flexibility matters because it lets you protect what’s important to you. The Family Law Act 1975 sets the framework for marriages under Part VIIIA and de facto relationships under Part VIIIAB.

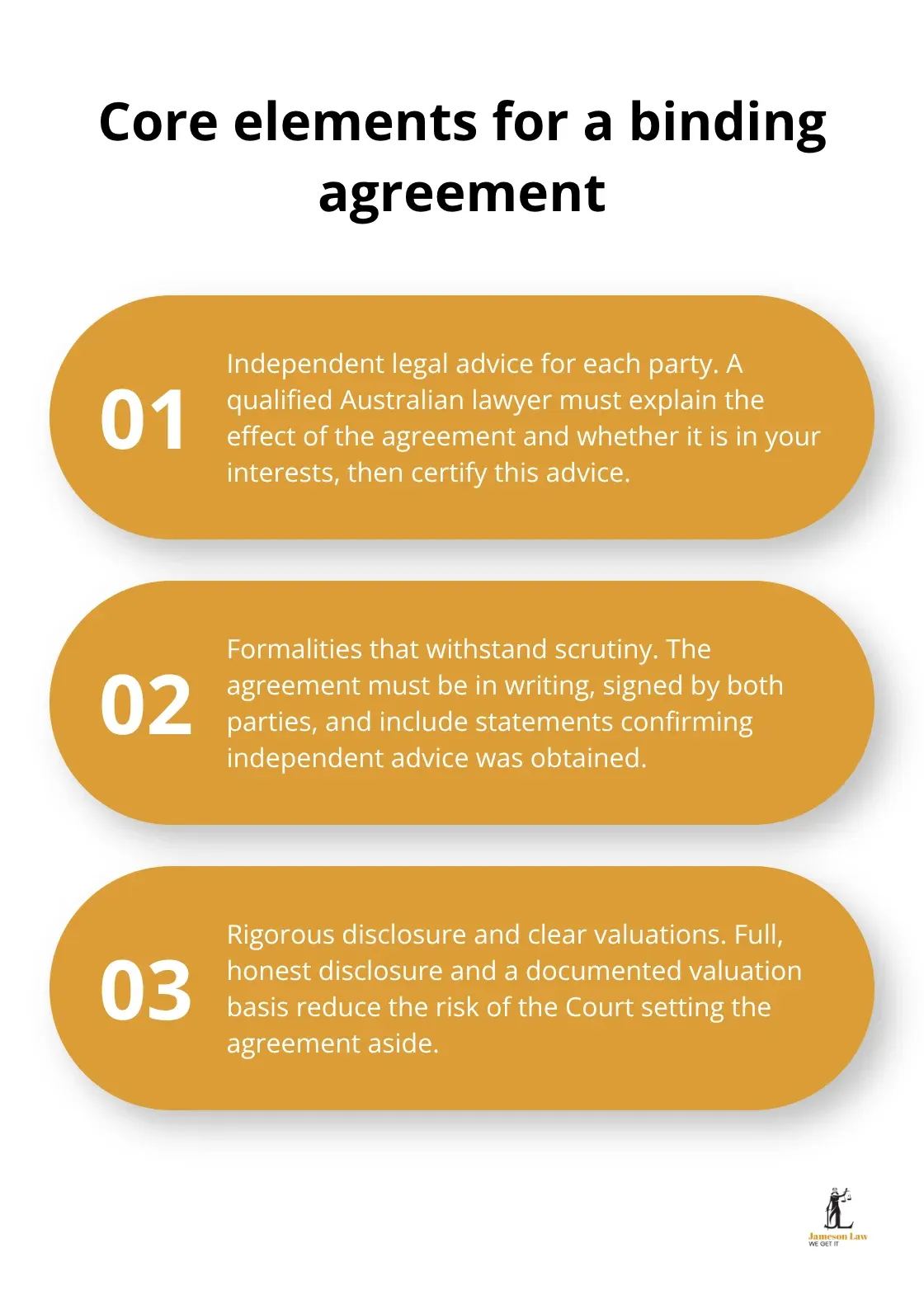

What Makes an Agreement Legally Binding?

For your agreement to hold up in court, it must meet strict technical requirements. Both parties must receive independent legal advice from an Australian legal practitioner. The lawyer must certify they’ve covered the prescribed matters with you. Courts have set aside poorly drafted agreements due to lack of proper advice or disclosure.

Why You Need Professional Help From the Start

Attempting to draft a Financial Agreement without a lawyer typically costs more money later. The independent legal advice requirement is your protection. A lawyer reviews the other party’s financial disclosure, identifies hidden liabilities, and checks whether future assets like inheritances are addressed.

When to Enter a Financial Agreement?

The timing of your Financial Agreement changes what you can protect. If you’re planning to marry, a “prenuptial agreement” (under Section 90B of the Act) locks in protections while both parties are still cooperative. This allows you to address asset protection and business interests without the emotional weight of conflict.

Financial Agreements During Your Relationship

During an active relationship, a Financial Agreement under Section 90C serves a different purpose. You might enter one when circumstances change significantly, such as receiving an inheritance. This prevents future disputes by documenting your intentions now. It is often simpler than renegotiating a Consent Order later.

Post-Separation Agreements and Your Deadline

After separation, you have a window to enter a Financial Agreement (under Section 90UD for de facto couples). Formalising your agreement immediately protects both parties. Delays introduce new variables—asset values shift, and the motivation to cooperate fades.

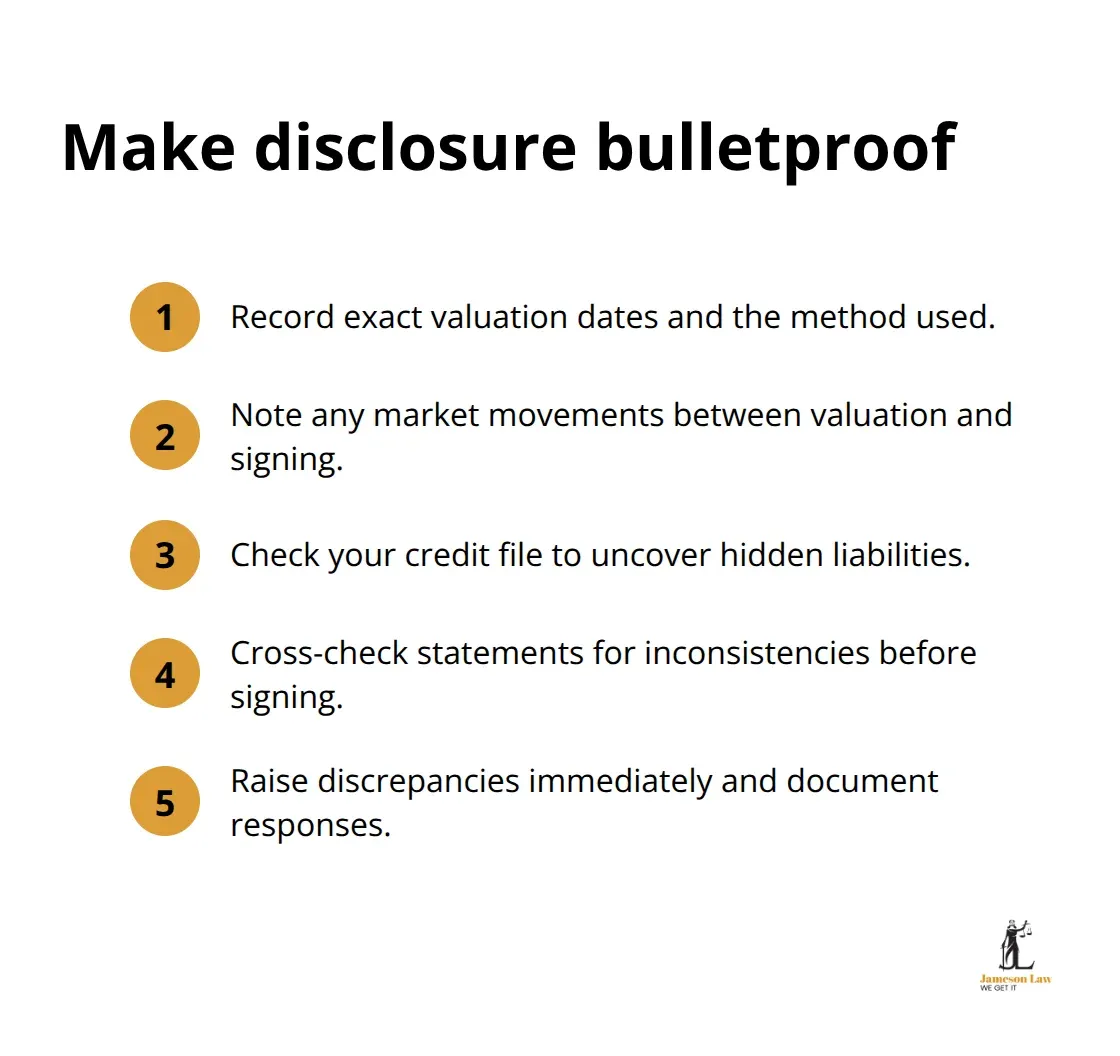

Making Financial Disclosure Work for You

Full financial disclosure is non-negotiable. The Family Law Act requires both parties to disclose everything honestly. When disclosure is incomplete, courts can set aside the agreement under Section 90K.

Gathering and Organising Your Financial Information

You need to collect tax returns, payslips, and bank statements. The valuation date matters enormously in volatile markets. Check your credit file to identify hidden liabilities. Our Sydney family lawyers can assist you in compiling this evidence to ensure full compliance.

Negotiating Terms That Reflect Your Reality

Negotiating terms requires separating emotional wants from financial reality. Courts divide property based on contributions and future needs. If one party made significant non-financial contributions (like raising children), this must be reflected. You can also agree on how to handle superannuation, which is optional to split but often crucial for retirement security.

Getting Independent Legal Advice Done Right

Independent legal advice isn’t a box-ticking exercise. Your lawyer must review the agreement to ensure it protects your interests. Section 90G requires your lawyer to provide a signed statement confirming they’ve advised you. Choose a lawyer who specialises in family law rather than a generalist to ensure your Binding Financial Agreement is watertight.

Final Thoughts

Getting a family law financial agreement right from the start saves you money and stress. The agreements work because they rest on honest disclosure and proper legal advice. Whether you are marrying, separating, or managing new assets, acting early gives you control.

Gather your financial documents and arrange independent legal advice. Contact Jameson Law for guidance tailored to your specific circumstances. Getting this right now protects your financial future and gives you genuine peace of mind.