Binding financial agreements under Section 90B of the Family Law Act offer couples a way to settle property and financial matters outside court. At Jameson Law, we’ve seen how these agreements can provide certainty and control when structured correctly.

Getting Section 90B right matters because mistakes can make an agreement unenforceable. This guide walks you through what you need to know to protect your interests with a Binding Financial Agreement (BFA).

What Section 90B Actually Protects?

Section 90B lets couples entering marriage formalise their financial arrangements before saying their vows. This is a binding financial agreement made under the Family Law Act 1975 that sits outside the court system. When you sign a valid 90B agreement, neither party can later bring a claim in the Federal Circuit and Family Court of Australia for property adjustment.

The agreement can cover how property is divided if the marriage ends, spousal maintenance obligations, and incidental matters. Courts won’t intervene once the agreement is binding, which means you control the outcome rather than leaving it to judicial discretion.

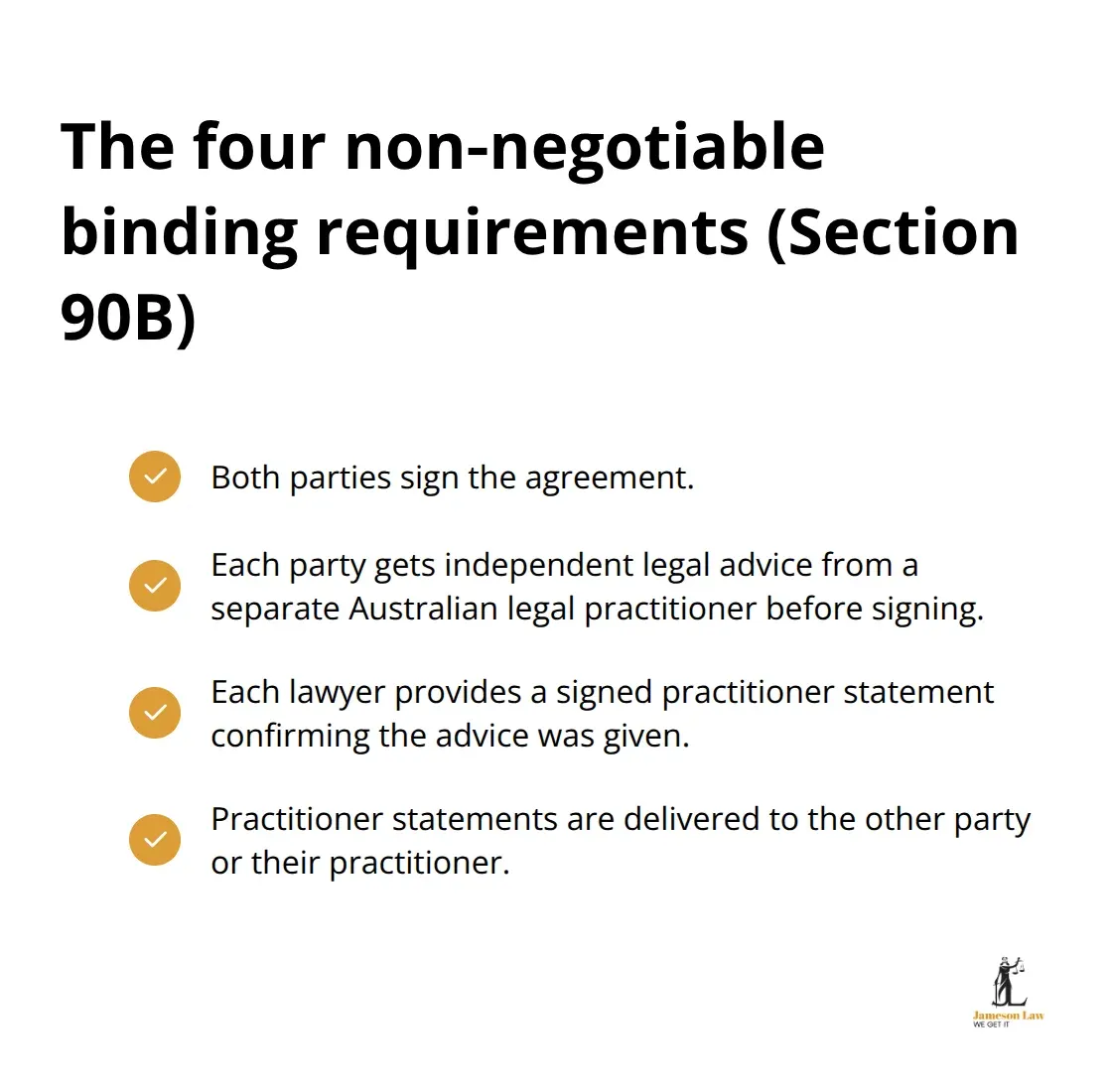

The Four Non-Negotiable Requirements

For a 90B agreement to actually bind both parties, four conditions must be met simultaneously:

- All parties must sign the agreement.

- Each party must receive independent legal advice from an Australian legal practitioner.

- Each party’s lawyer must provide a signed practitioner statement.

- The statements must be exchanged between parties.

In cases like Graham v Squibb, the court ruled that strict compliance is essential. If any of these four elements is missing, the agreement fails.

Disclosure and Valuation Standards

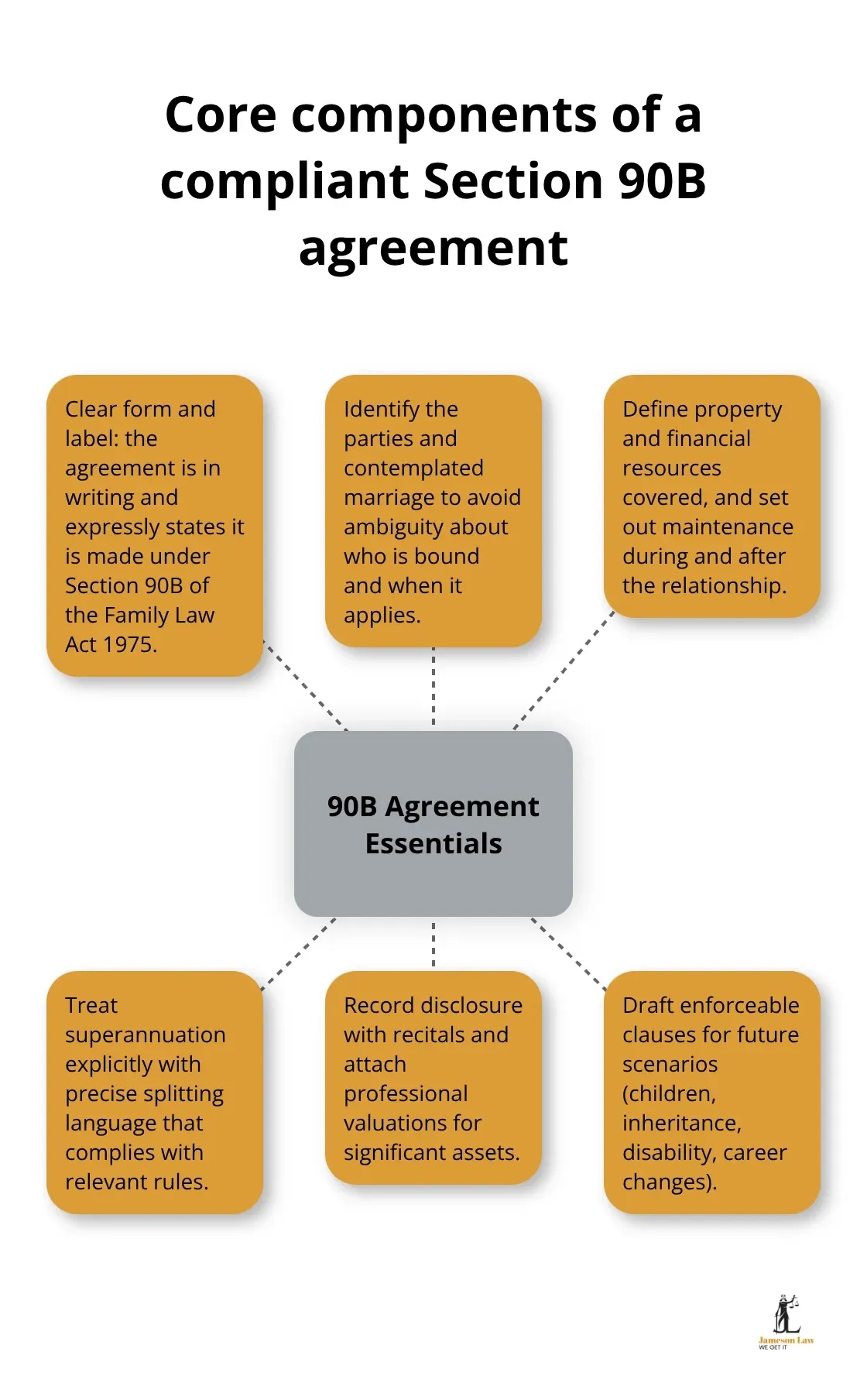

Disputes often arise from incomplete disclosure. Full and frank financial disclosure of all assets, liabilities, and superannuation is mandatory. Professional valuations for significant assets like businesses are essential. Courts scrutinise agreements where one party withheld material information.

Timing and Pressure Considerations

Presenting the agreement days before the wedding invites a court to find duress or undue influence. Negotiating several months in advance removes this risk. The High Court case of Thorne v Kennedy established that last-minute pressure can invalidate an agreement.

Getting Your Agreement Right Before Signing

A compliant 90B agreement requires specific structural elements. It must be in writing and expressly state it is made under Section 90B. Your agreement should identify each party, specify covered property, and address superannuation splitting explicitly.

Independent Legal Advice as Your Enforceability Backbone

Independent legal advice requirements operate as the backbone of enforceability. Each party must obtain advice from a separate lawyer before signing. The lawyer must explain the advantages and disadvantages of entering the agreement. This creates an audit trail that protects both parties.

Predictable Failures You Must Avoid

DIY templates fail because they don’t account for technical requirements. Incomplete disclosure gives the other party grounds to set the agreement aside under Section 90K. Failing to address superannuation leaves a major asset unprotected. Professional legal assistance at the drafting stage prevents these failures.

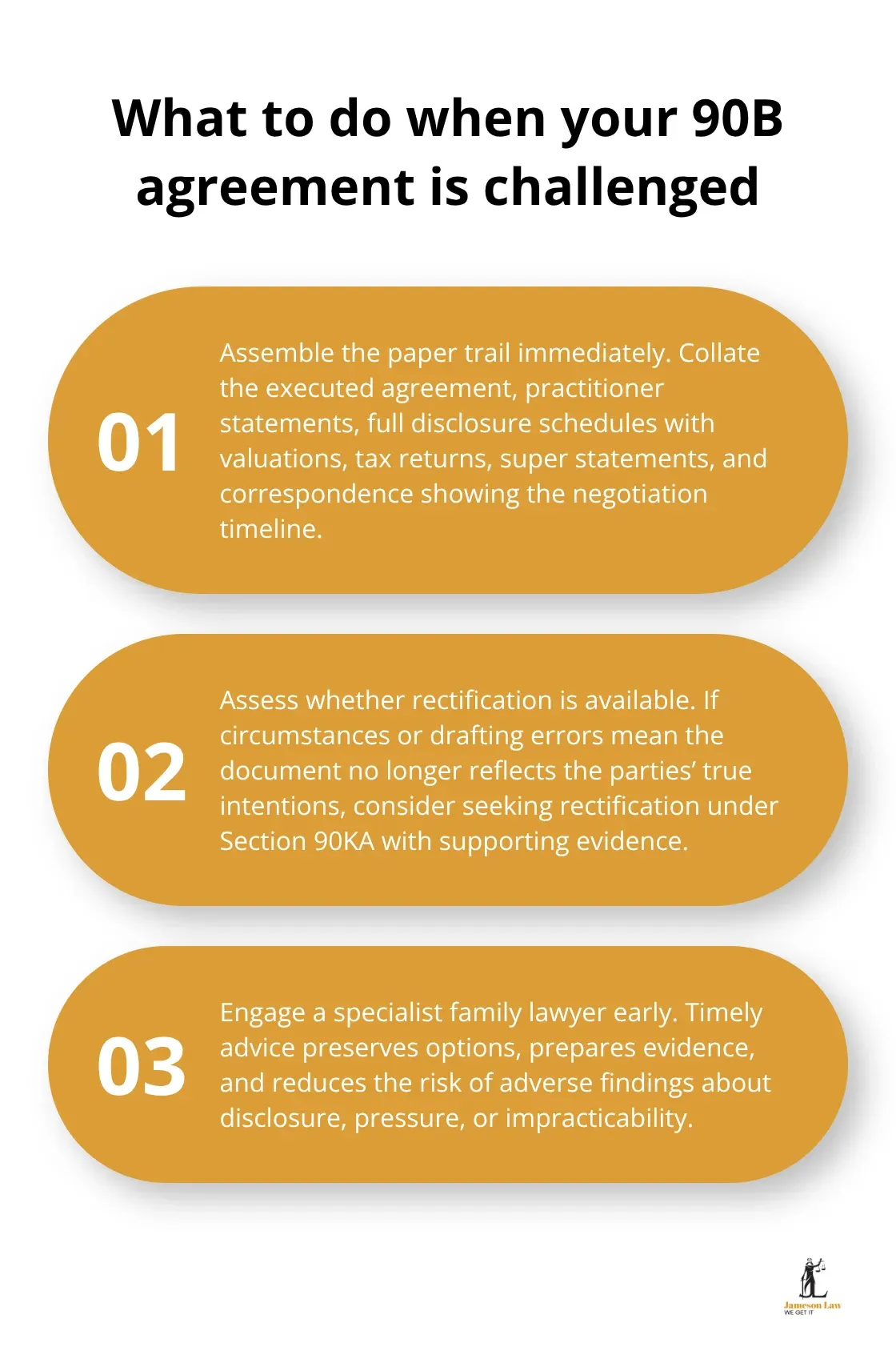

When Courts Reject a Section 90B Agreement

How Courts Assess Validity

Courts assess validity against strict criteria. If independent advice was merely a generic certificate without substantive discussion, the agreement may be rejected. This matters because courts treat independent legal advice as the safeguard against unfairness.

Disclosure Failures That Trigger Challenges

Courts scrutinise whether disclosure was full and frank. If a party omitted a rental property or understated business value, the other party has grounds to challenge the agreement under Section 90K. Incomplete disclosure is a common reason courts set aside agreements.

Specific Grounds for Setting Aside Under Section 90K

A party can apply to set aside the agreement if it was obtained by fraud, if it was entered to defeat creditors, or if there was unconscionable conduct. Understanding these grounds helps you defend your agreement.

Final Thoughts

Section 90B of the Family Law Act offers real protection when you structure your agreement correctly. The four binding requirements form the foundation that courts will examine. Full disclosure and professional valuations eliminate common grounds for challenge.

Litigation over property settlements costs tens of thousands of dollars. A properly drafted Section 90B agreement avoids that. We at Jameson Law provide expert family law services to ensure your agreement meets every requirement. Contact us today for tailored guidance on your prenuptial agreement.