Family law disputes can drain your finances and leave you with outcomes you didn’t choose. A binding financial agreement gives you control over how assets, superannuation, and spousal support are divided without going to court.

At Jameson Law, we’ve seen how the right agreement protects families from years of litigation and uncertainty. This guide walks you through what binding financial agreements are, why they matter, and how to avoid costly mistakes.

What Binding Financial Agreements Actually Are

A binding financial agreement is a legally enforceable contract that sets out how you and your partner will divide assets, superannuation, and financial obligations if the relationship ends. Under the Family Law Act 1975, these agreements apply to both married couples and de facto relationships, and they work by removing the court’s power to intervene in your financial settlement. You can enter one before marriage, during the relationship, or after separation, which gives you significant flexibility in timing. Each party must obtain independent legal advice from an Australian legal practitioner before signing, and your lawyer must provide a certificate confirming they have explained the agreement’s effects, advantages, and disadvantages to you. This is not a casual formality-the courts have consistently ruled that inadequate independent legal advice can invalidate an entire agreement, as shown in Hoult v Hoult [2013] FamCAFC 109, where insufficient advice led to the agreement being set aside. Full financial disclosure from both parties is non-negotiable; hidden assets or income are grounds for the court to overturn the agreement later, something demonstrated in Black v Black [2008] FamCAFC 7, where undisclosed overseas assets invalidated the arrangement.

How They Differ from Court Orders

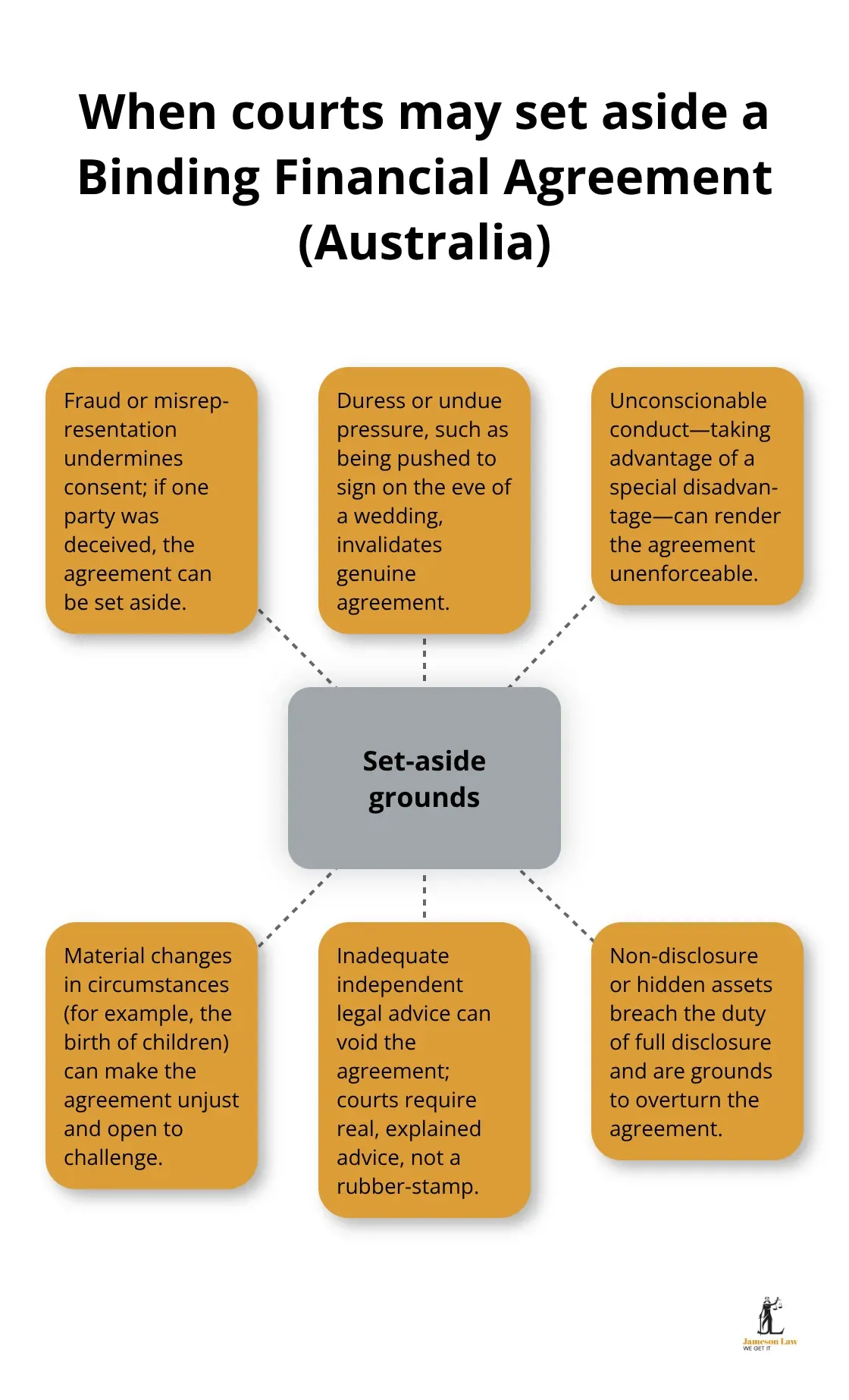

Court orders require judicial oversight and approval, meaning a judge assesses whether the proposed division is fair and in line with the Family Law Act’s principles. Binding financial agreements skip this step entirely-you and your partner negotiate directly and reach your own terms without court involvement. This means faster resolution, lower legal costs, and complete privacy, but it also means you do not have a judge checking whether the outcome is reasonable. The courts can still set aside a binding financial agreement if specific grounds are proven, such as fraud, duress, unconscionable conduct, or material changes in circumstances that make the agreement unjust, but the threshold for doing so is high. In contrast, court orders are subject to modification if circumstances change significantly, whereas binding financial agreements are much harder to alter once signed.

The practical advantage is that if your agreement is properly drafted and executed, you avoid the uncertainty and expense of litigation.

When You Actually Need One

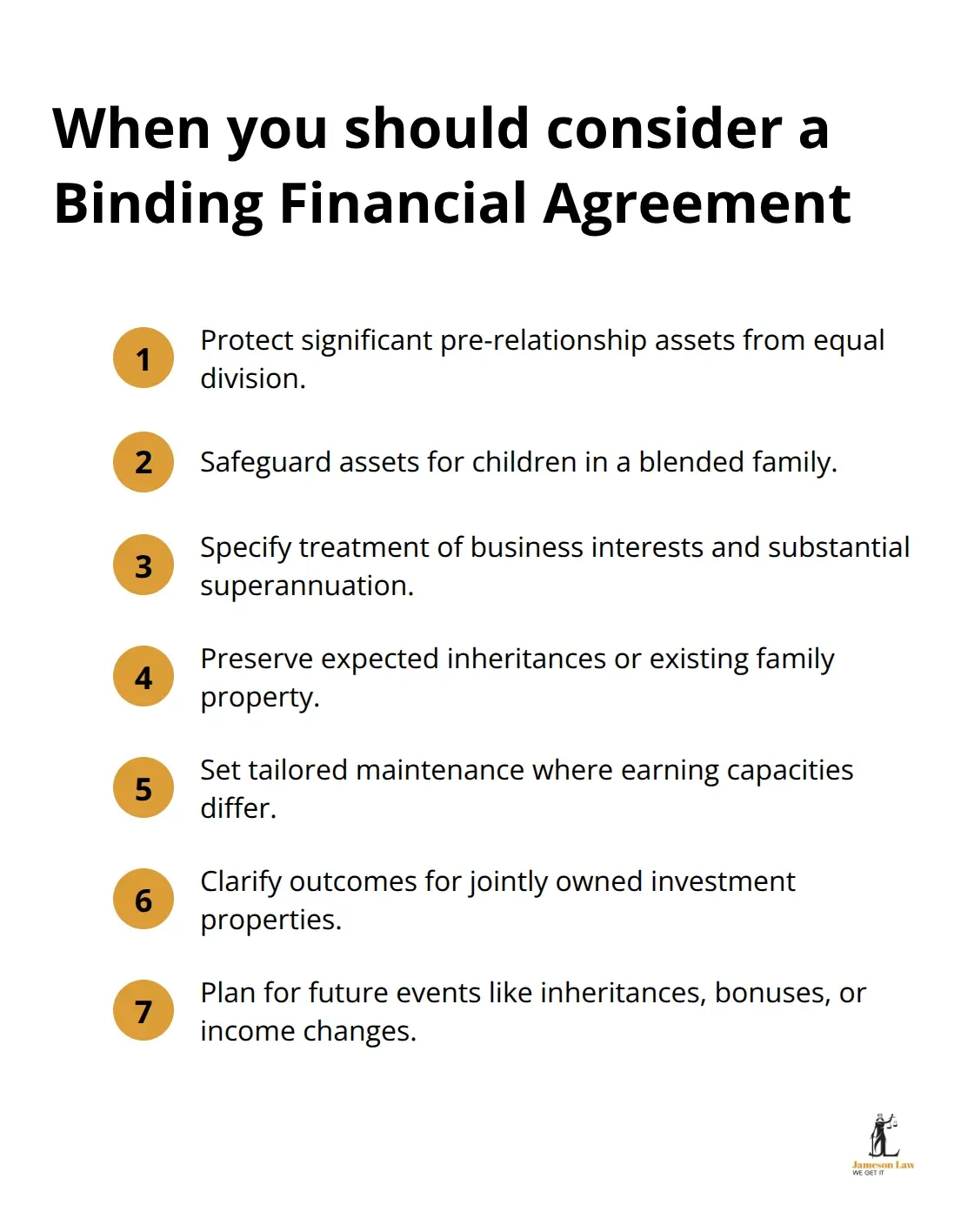

If you have significant assets before entering the relationship, a binding financial agreement protects those assets from being divided equally on breakdown. If you are in a blended family with children from previous relationships, you can use an agreement to protect assets intended for those children. If you run a business or hold substantial superannuation, an agreement lets you specify exactly how those complex assets are treated without court involvement. If you anticipate inheriting family wealth or already hold family property, an agreement can preserve that for your branch of the family.

You should also consider one if you and your partner have vastly different earning capacities or asset positions and want to lock in specific maintenance or support arrangements. The cost of obtaining proper legal advice now is significantly less than the expense of contested family law proceedings.

What Happens Next

The path forward depends on your circumstances and whether you already have a relationship in place. If you decide a binding financial agreement suits your situation, the next step is to seek independent legal advice from a family law specialist who can assess your financial position and explain your options. Your lawyer will help you understand the agreement’s implications before you sign, and they will prepare the necessary statutory certificates that make the agreement legally binding. Understanding the common pitfalls that invalidate these agreements-and how to avoid them-will help you protect your interests and ensure your agreement stands up to scrutiny if it is ever challenged.

What a Binding Financial Agreement Actually Protects

A binding financial agreement removes the guesswork from relationship breakdown. Instead of waiting for a court to decide how your assets will be divided, you control the outcome from the start. This matters because family law courts apply statutory principles that may not align with what you value most. If you own a family business, the court might order its sale to divide the proceeds equally, whereas your agreement could specify that you retain it in exchange for other asset transfers. If you have substantial superannuation, an agreement lets you determine exactly how that’s treated without a judge applying the Family Law Act’s general approach. The certainty extends to spousal maintenance too-you can agree on specific amounts and timeframes rather than leaving it to a court’s assessment of need and capacity to pay.

You Control Complex Asset Arrangements

Non-traditional asset arrangements require flexibility that courts struggle to provide. Investment properties in different states, overseas holdings, or complex business structures all benefit from clear contractual terms rather than judicial interpretation. Your agreement can specify exactly how each asset transfers or divides, which removes the anxiety that comes with unpredictable court outcomes. You know precisely what you’ll receive and what you’re giving up when you sign a properly drafted agreement.

Court Proceedings Cost Far More Than You Expect

Contested family law proceedings in Australia drain finances rapidly. A trial in the Family Court or Federal Circuit Court costs between $50,000 and $150,000 or more, depending on complexity and the number of court appearances required. A properly drafted binding financial agreement costs significantly less upfront-typically between $2,000 and $8,000 for independent legal advice and documentation-and eliminates the risk of spending six figures on litigation.

More importantly, you avoid the time drain. Court cases take months or years to resolve, during which you pay legal fees, gather documents, and attend multiple appointments. A binding financial agreement may be resolved within 3 to 6 months if both parties cooperate. This speed matters when you have children, because prolonged financial uncertainty affects family stability.

Privacy Protects Your Financial Details

Adversarial court proceedings expose your personal finances and relationship details to judicial scrutiny and potentially to public court records. A binding financial agreement keeps your financial arrangements confidential between you, your partner, and your respective lawyers. This privacy benefit matters significantly when you run a business, hold substantial assets, or simply prefer to keep your financial life private. Your agreement remains a private contract rather than a public document.

Tailored Terms Reflect Your Actual Circumstances

Standard court outcomes follow predictable patterns based on statutory formulas. A binding financial agreement lets you break those patterns and create arrangements that reflect your specific circumstances. If one partner sacrificed career advancement to raise children or manage a family business, you can weight the asset division to recognise that contribution without arguing it in court. If you’re in a second relationship and want to protect assets for your adult children from your first marriage, an agreement can specify exactly how much goes to them. If you have vastly different earning capacities (say, one partner earns $200,000 annually and the other earns $40,000), you can negotiate maintenance arrangements that reflect your actual financial needs rather than relying on a court’s assessment. If you own investment properties together but want different outcomes for each one, your agreement can detail that precisely. You can also build in flexibility for future scenarios, such as what happens if one partner receives an inheritance or bonus, or if either party experiences a significant income change.

This customisation is impossible in court, where judges apply the law to your facts rather than allowing you to design your own framework. The next section examines the common pitfalls that invalidate these agreements and shows you how to avoid them.

What Invalidates a Binding Financial Agreement

Inadequate Independent Legal Advice

Most binding financial agreements fail because one or both parties did not obtain genuine independent legal advice before signing. This is not a technicality-the courts treat it as a fundamental requirement. In Hoult v Hoult [2013] FamCAFC 109, the court set aside an entire agreement because the legal advice was inadequate. The lawyer had simply reviewed the document without explaining its implications, advantages, and disadvantages to the client. Your lawyer’s certificate is not just paperwork; it is evidence that you understood what you were giving up and what you were gaining.

A thorough advice conversation must happen before any certificate is signed. Your lawyer should spend time discussing your financial circumstances, explaining how the agreement affects your entitlements under the Family Law Act, and addressing your specific concerns. If your lawyer merely says the agreement looks fine without explaining these elements, you have grounds to challenge it later-and courts will overturn it.

Hidden Assets and Incomplete Financial Disclosure

Financial disclosure is equally non-negotiable, and hidden assets are the second most common reason agreements are overturned. Black v Black [2008] FamCAFC 7 involved undisclosed overseas assets that were discovered after the agreement was signed. The court set the agreement aside because one party had failed to disclose their full financial position. You must declare all assets, liabilities, income sources, and superannuation entitlements before signing.

Exchange detailed financial statements and supporting documents-bank statements, property valuations, superannuation statements, tax returns-before your lawyers draft the agreement. Do not rely on verbal assurances that someone’s financial position is fully disclosed. If you discover later that your partner concealed property, investments, or income, a settlement may be overturned.

Pressure, Duress, and Unconscionable Conduct

Thorne v Kennedy [2017] HCA 49 addressed another critical pitfall: duress or unconscionable conduct. One party signed an agreement under intense pressure just days before a wedding. The court found this was unconscionable and set the agreement aside. Do not rush into a binding financial agreement; both parties must genuinely agree to the terms without pressure or coercion. If you feel pressured to sign quickly, that is a red flag that the agreement may not be enforceable.

Dramatic Changes in Circumstances

Material changes in circumstances after signing can render an agreement unjust. Parker v Parker [2011] FamCA 94 involved an agreement made before children were born. Once children arrived, the agreement became unfair because it did not account for the financial impact of raising them. Courts will overturn agreements when circumstances change so dramatically that the original terms become unjust.

Build review points into your agreement-for example, agreeing to reassess the terms if children are born or if either party experiences a significant income change. This flexibility protects both parties if life takes an unexpected direction.

Tax and Superannuation Complications

Superannuation and tax implications are frequently overlooked, yet they can dramatically affect the real value of what you receive. Many agreements divide assets equally without considering that superannuation is treated as property under the Family Law Act but differs from other types of property because it’s held in a trust. If one partner receives $500,000 in superannuation and the other receives $500,000 in property, the net value differs because superannuation withdrawals are taxed differently depending on your age and whether you are retired.

Capital gains tax on investment properties, stamp duty on transfers, and the tax implications of spousal maintenance payments can substantially reduce the value of what you actually receive. Your lawyer must work with a tax accountant to model the real after-tax value of each asset before you agree to the division. Obtaining tax advice as part of the binding financial agreement process is essential, because a seemingly fair division of assets can become unfair once tax is factored in.

Final Thoughts

A binding financial agreement puts you in control of your financial future when relationships end, eliminating the uncertainty that court proceedings cannot avoid. Professional legal guidance from someone who understands family law and your specific circumstances is essential to get this right. Your lawyer must explain what you’re giving up and gaining, verify full financial disclosure, and flag tax and superannuation implications that affect the real value of your settlement.

The time to act depends on your situation. If you’re considering a binding financial agreement before marriage or entering a de facto relationship, start conversations with your partner about what matters most financially. If you’re already in a relationship and want to formalise arrangements, or if you’re separating and want to avoid court, seek advice now. We at Jameson Law help families across Australia navigate these decisions with clarity and confidence, and our family law team can assess your situation and guide you through creating an agreement that protects your interests.

Contact Jameson Law to discuss your binding financial agreement and take the first step toward securing your financial future without the uncertainty of court proceedings.