Buying property in NSW involves more than just finding the right home. The conveyancing process protects your investment and clarifies your legal rights before you hand over your money.

We at Jameson Law have guided hundreds of buyers through NSW conveyancing. This guide walks you through each stage, from offer to settlement, so you know exactly what costs to budget for.

How NSW Conveyancing Works From Offer to Settlement?

Conveyancing moves through three distinct phases. Once your offer is accepted, your conveyancer takes control while you handle finances. The Exchange of Contracts is the binding moment—this is when you pay your deposit and trigger the cooling-off period.

What Your Conveyancer Actually Does

Your conveyancer isn’t just a paperwork processor—they act as your risk manager. They examine the contract, liaise with your lender, and conduct title searches through NSW Land Registry Services to uncover easements or caveats.

On settlement day, electronic completion through PEXA ensures funds transfer instantly and the title moves to your name.

The Timeline That Matters

The timeline has hard deadlines. Exchange locks in the contract. Settlement typically runs 42 days (6 weeks) later. Your conveyancer must have all documents ready to avoid penalty interest.

Essential Searches and Inspections Before Purchase

Title Searches Reveal What You’re Actually Buying

Title searches are non-negotiable. They confirm the seller owns the land and identify easements or covenants that restrict how you use the property. Examples include rights of way for Sydney Water assets.

Council Certificates and Planning Checks

A Section 10.7 Planning Certificate reveals zoning and whether the property is affected by road widening or flood risks. Environmental searches can also identify contamination issues.

Building and Pest Inspections: Don’t Skip These

A building inspector examines structural integrity, identifying defects like rising damp or cracking. A pest inspection checks for termites. For apartments, always obtain a strata search report to check the scheme’s financial health.

What Conveyancing Actually Costs in NSW?

Breaking Down the Three Cost Buckets

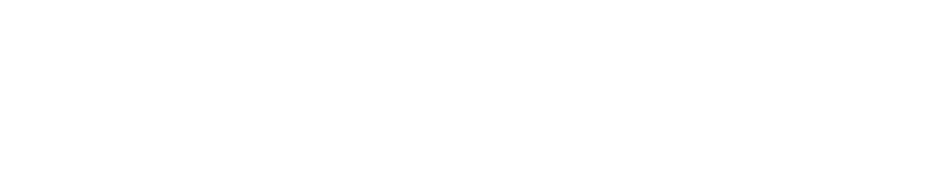

Conveyancing costs split into three buckets: professional fees, disbursements, and government charges. Professional fees typically range from $1,200 to $2,200. Disbursements (searches) often total $270 to $450.

Stamp Duty: The Largest Shock for Most Buyers

Stamp duty (transfer duty) is progressive. On a $750,000 property, you’ll pay around $28,000. However, the First Home Buyers Assistance Scheme provides exemptions for new and existing homes up to $800,000.

Choosing the Right Professional

Don’t choose solely on price. The cheapest option often cuts corners on searches. For complex properties, a solicitor provides broader legal oversight than a licensed conveyancer. Ensure they have professional indemnity insurance.

Final Thoughts

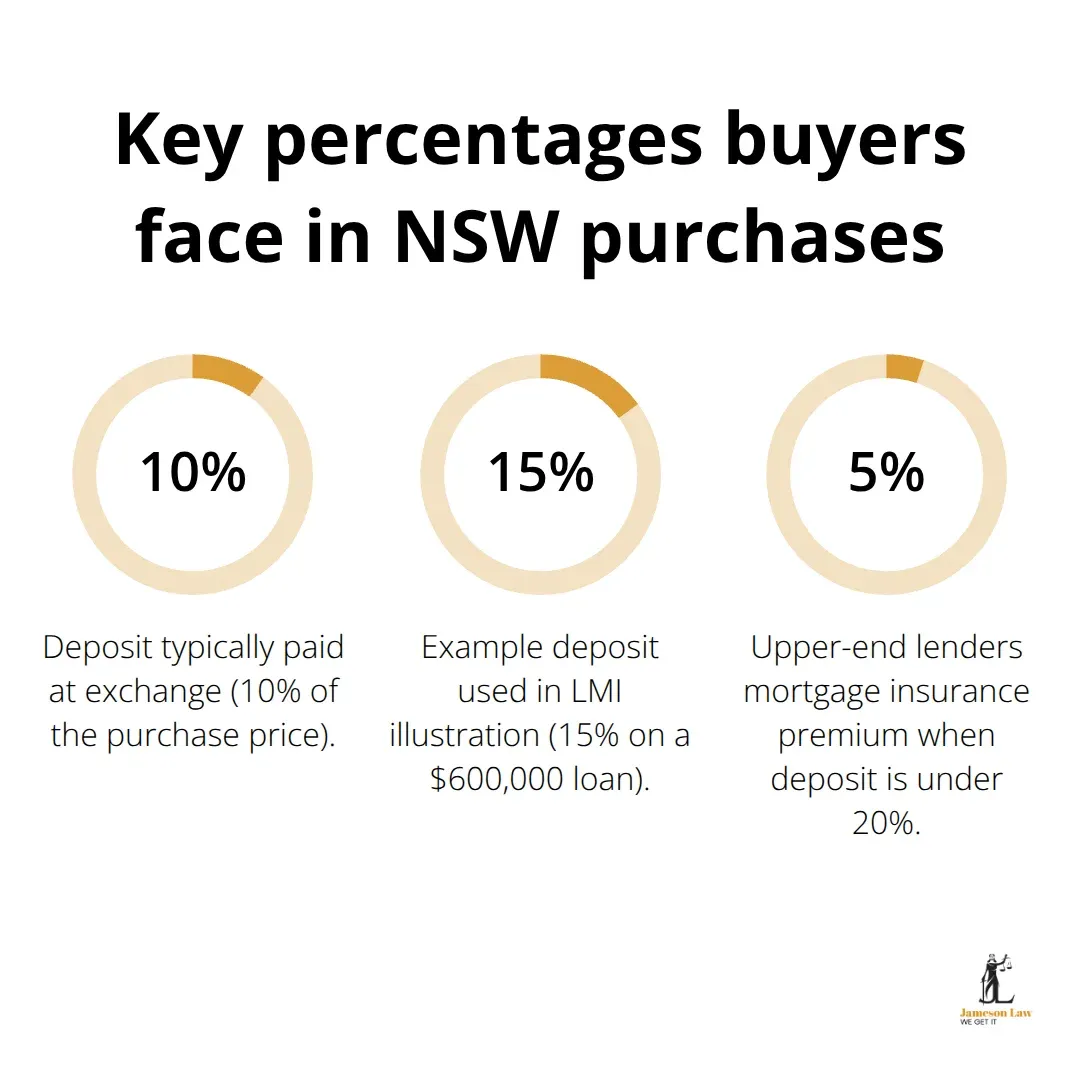

NSW conveyancing for buyers succeeds when you ask questions and engage professionals early. Exchanging without inspections locks you into defects you cannot escape. Underestimating costs like LMI or stamp duty leads to settlement stress.

We at Jameson Law have guided hundreds of buyers through this process. If you are ready to buy, contact Jameson Law for a transparent quote and expert guidance on your purchase.