Buying property in Australia involves more than just finding the right home and making an offer. Conveyancing for buyers is the legal process that protects your interests and confirms you own what you’re purchasing.

At Jameson Law, we’ve guided hundreds of buyers through this process. Understanding each stage-from title searches to settlement day-helps you avoid costly mistakes and move forward with confidence.

What is Conveyancing and Why Buyers Need It

Conveyancing is the legal process that transfers property ownership from seller to buyer in Australia. It’s not optional, not negotiable, and not something you should attempt without professional help. When you buy a property, conveyancing protects you by confirming the seller actually owns what they’re selling, identifying any restrictions on the land, and ensuring all documents are correct before settlement. The process starts the moment you sign a contract and continues until the ownership transfer is registered with the land titles office. Without conveyancing, you could inherit someone else’s mortgage, discover easements that limit your use of the property, or find yourself unable to sell because of title defects.

Contract review and title verification

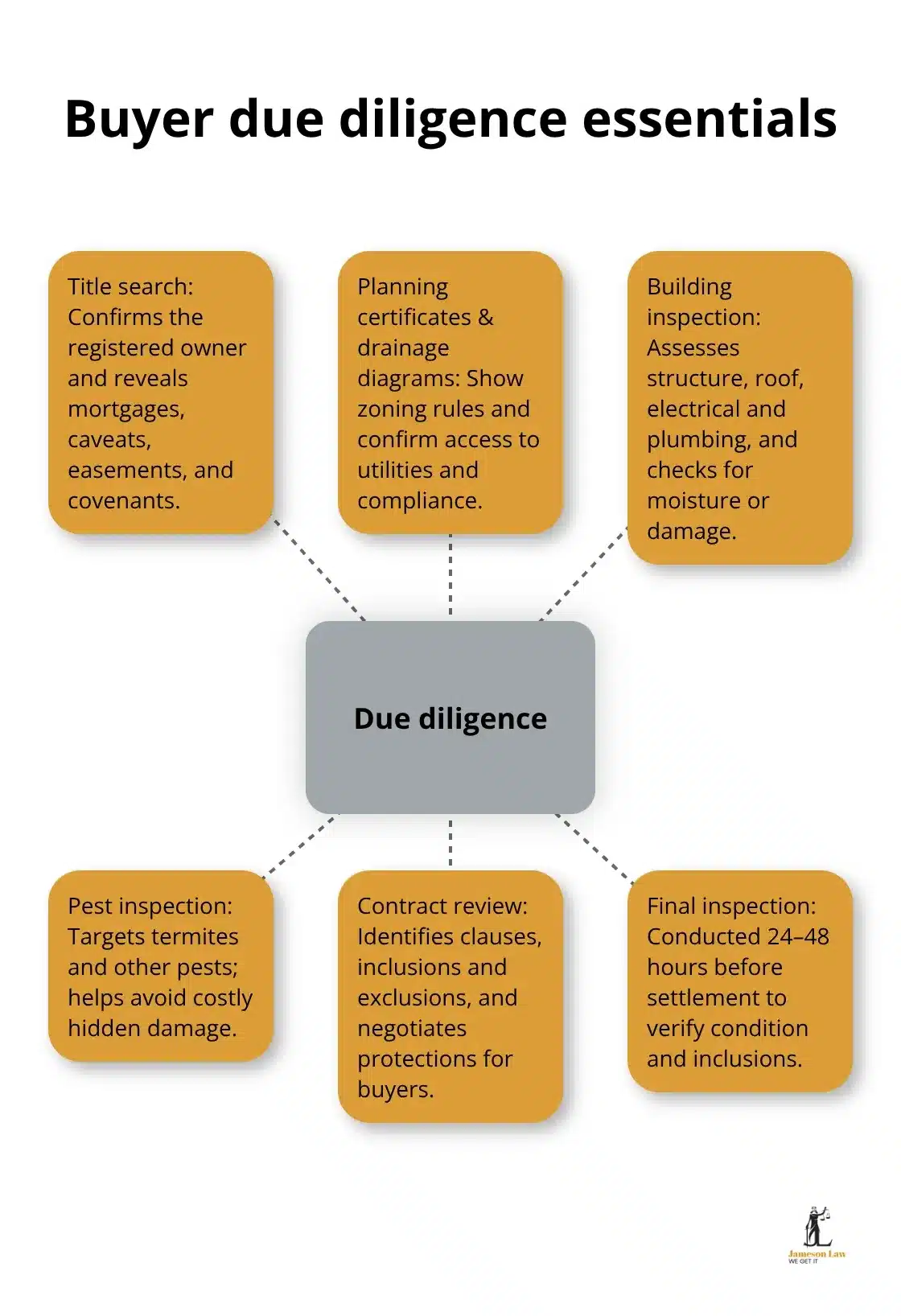

Your conveyancer’s first job involves reviewing the contract you’ve signed. They check for hidden conditions, unusual terms, and anything that might cost you money later. Next comes the title search, which reveals whether the seller has clear ownership and what encumbrances exist. Your conveyancer also orders planning certificates and drainage diagrams to confirm the property complies with local regulations and has proper access to utilities.

Coordination with your lender and exchange

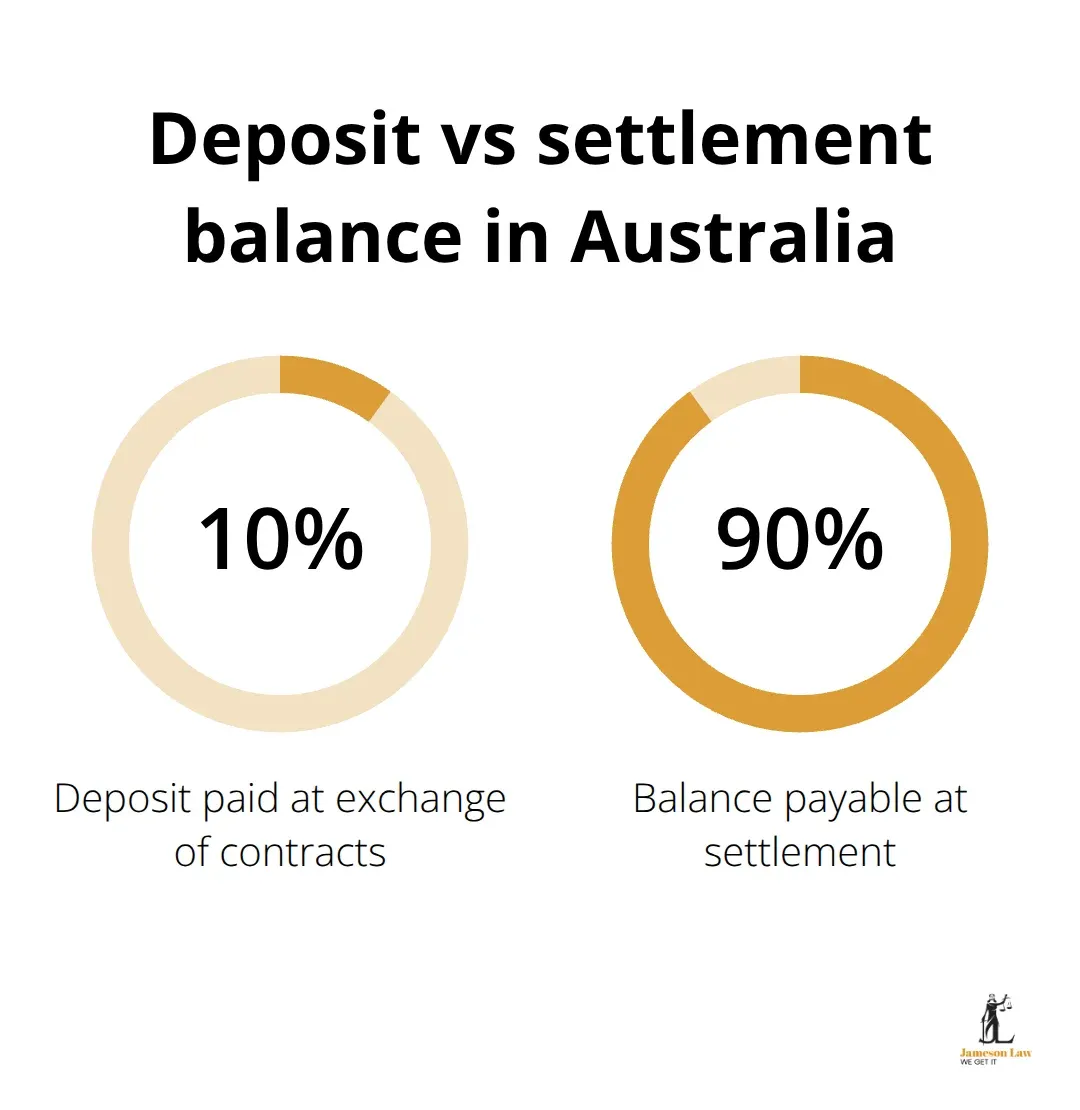

Your conveyancer coordinates with your lender’s legal team to confirm the bank will lend on the property. Then comes the critical step: exchange of contracts. At exchange, you pay your deposit (usually 10 per cent of the purchase price), both parties receive a signed copy, and the sale becomes legally binding. After exchange, your conveyancer prepares settlement documents, confirms all searches are complete, and coordinates the final settlement meeting where funds transfer and ownership officially changes hands. Settlement usually occurs within 30 to 60 days of exchange, though this varies by state and agreement.

Why professional expertise matters

Handling conveyancing yourself or using an unqualified person exposes you to significant risk. A conveyancer licensed in NSW, Victoria, or Queensland knows the specific rules, deadlines, and disclosure requirements for each state. They spot issues that buyers miss: unpaid rates that become your liability, body corporate levies that drain your budget, or zoning restrictions that prevent future renovations. Many conveyancers offer fixed-fee pricing, meaning you know exactly what you’ll pay upfront rather than facing surprise costs. Buyers who use professional conveyancers report higher satisfaction with the purchase process and fewer post-settlement disputes. Your conveyancer also handles communication between your bank, the seller’s solicitor, and the land titles office, keeping the transaction moving forward. This coordination prevents delays that could cost you thousands in mortgage interest or rental costs if you can’t access the property on time.

The next stage of your purchase involves thorough due diligence on the property itself-title searches reveal ownership, but building inspections and contract reviews uncover the physical and legal risks that could affect your investment.

Due Diligence and Property Inspections

Title searches reveal what you’re buying

A title search is non-negotiable before you exchange contracts. This search shows exactly what you’re buying: the registered owner, the property boundaries, and critically, any mortgages, caveats, easements, or covenants attached to the land. If the seller has an outstanding mortgage they haven’t disclosed, that debt becomes your problem at settlement unless your conveyancer catches it first. Easements are particularly important-a utility company might have the right to dig up your backyard for maintenance, or a neighbour might have a right of way across your property.

Planning certificates and drainage diagrams reveal zoning restrictions that could prevent future renovations or extensions. A property zoned for residential use only means you cannot operate a home business without approval, which many buyers discover too late. The cost of these searches is trivial compared to discovering after settlement that you cannot develop the land as planned or that rates bills include charges for services you didn’t know existed.

Building and pest inspections uncover hidden defects

A qualified building inspector should spend at least two hours on a residential property, checking roof condition, structural integrity, electrical compliance, plumbing, and signs of water damage or pest activity. Pest inspections specifically target termites, which cause an estimated $780 million in damage to Australian properties annually according to the Australian Pest Management Association. A thorough pest report includes a detailed diagram showing risk areas and treatment recommendations.

Many buyers treat these reports as optional extras, but they function as your technical due diligence-they identify defects that affect price negotiation or reveal deal-breakers before you’re legally committed. If the inspection uncovers rising damp, roof leaks, or structural cracking, your conveyancer can help you request repairs, renegotiate the price, or include special conditions in the contract that allow you to withdraw if issues aren’t resolved.

Contract review protects your rights

Contract review goes beyond checking the purchase price. Hidden conditions such as finance clauses, building inspection contingencies, and settlement timeframes directly affect your rights. Some contracts include clauses allowing the seller to remain in the property for weeks after settlement, or they might require you to accept the property in its current condition despite inspection findings. Your conveyancer identifies these traps and negotiates amendments that protect you.

What the contract includes and excludes in the sale-whether the curtains, appliances, or fixtures stay-prevents disputes at settlement and ensures you’re not paying for items the seller removes. These details matter far more than most buyers realise, and they shape your financial outcome long after you sign.

Once you understand what you’re buying and what protections the contract provides, the next stage focuses on arranging the funds and preparing for the final inspection before ownership officially transfers to your name.

Managing Finances and Settlement

Deposit and payment timeline

Your deposit locks in the purchase at exchange, but settlement requires additional funds that most buyers underestimate. At exchange of contracts, you’ll pay a deposit usually 10% of the purchase price, though some sellers negotiate higher deposits in competitive markets. This deposit sits in trust with your conveyancer until settlement, protecting both parties. If you withdraw after exchange without a valid cooling-off period, you forfeit this deposit entirely. The remaining balance of the purchase price-usually 90 per cent or less-becomes payable on settlement day, typically 30 to 60 days after exchange depending on your state and what the contract specifies.

Beyond the purchase price itself, settlement costs add up quickly. Stamp duty varies significantly by state and property value. In New South Wales, stamp duty on a $600,000 property runs approximately $24,000, whereas in Victoria the same property attracts roughly $23,500. Your conveyancer’s professional fees typically range from $800 to $1,500 for a standard residential purchase, though fixed-price options make budgeting straightforward. Title registration, electronic settlement fees, and council rate adjustments add another $500 to $1,000 to your final bill.

Many buyers arrive at settlement unprepared for these additional costs because they focus only on the purchase price and deposit.

Mortgage approval and valuation

Your lender will require a formal mortgage approval before settlement, not just a pre-approval letter. Pre-approval indicates the bank is willing to lend based on your income and credit, but formal approval comes only after the property valuation confirms the bank’s security. Request formal approval at least two weeks before settlement to allow time for the valuation and any additional documentation your lender requests. If the valuation comes in lower than your purchase price, the lender may reduce the loan amount, forcing you to find extra cash or renegotiate the purchase-situations that create genuine stress days before settlement.

Final inspection and settlement preparation

Conduct a final pre-settlement inspection 24 to 48 hours before the agreed settlement date to confirm the property remains in the condition you agreed to purchase and that all agreed inclusions remain in place. Sellers occasionally remove items or allow damage between exchange and settlement, and this inspection catches those problems before funds transfer. Coordinate with your conveyancer to confirm all settlement documents are prepared, funds are arranged, and your lender has approved the final mortgage documents.

Settlement day itself involves your conveyancer confirming funds have arrived, the seller’s conveyancer confirms the property is clear of encumbrances, and the land titles office records the ownership transfer to your name. Within one week of settlement, your conveyancer provides a settlement statement showing exactly where every dollar went, and you receive the title deed confirming ownership.

Final Thoughts

Conveyancing for buyers protects your investment at every stage, from contract review through to settlement day. Title searches reveal hidden encumbrances, building inspections uncover costly defects, and contract review prevents disputes that drain your finances long after you’ve moved in. Exchange of contracts locks in your purchase legally, but settlement is where ownership officially transfers to your name. Most buyers underestimate the costs beyond the purchase price itself-stamp duty, professional fees, and registration charges add thousands to your final bill.

Common mistakes cost buyers dearly. Skipping professional conveyancing advice leaves you vulnerable to undisclosed mortgages, easements, or zoning restrictions that affect your property’s value and usability. Delaying formal mortgage approval until days before settlement risks valuation shortfalls that force renegotiation or additional cash contributions. Failing to conduct a final pre-settlement inspection allows sellers to remove agreed inclusions or cause damage between exchange and settlement without consequence.

We at Jameson Law guide buyers through conveyancing with clear communication and fixed-fee pricing so you know exactly what you’ll pay. Our team handles the legal complexity while you focus on moving into your new home. Contact us for expert conveyancing support tailored to your purchase.