Conveyancing quotes NSW vary wildly depending on who you hire and what services they include. Most property buyers and sellers have no idea what they’re actually paying for, which leads to nasty surprises down the track.

At Jameson Law, we’ve seen countless clients overpay simply because they didn’t know how to read a quote properly. This guide breaks down exactly what should be in your quote and how to spot the conveyancers who are worth your money.

What’s Actually Included in Your Conveyancing Quote

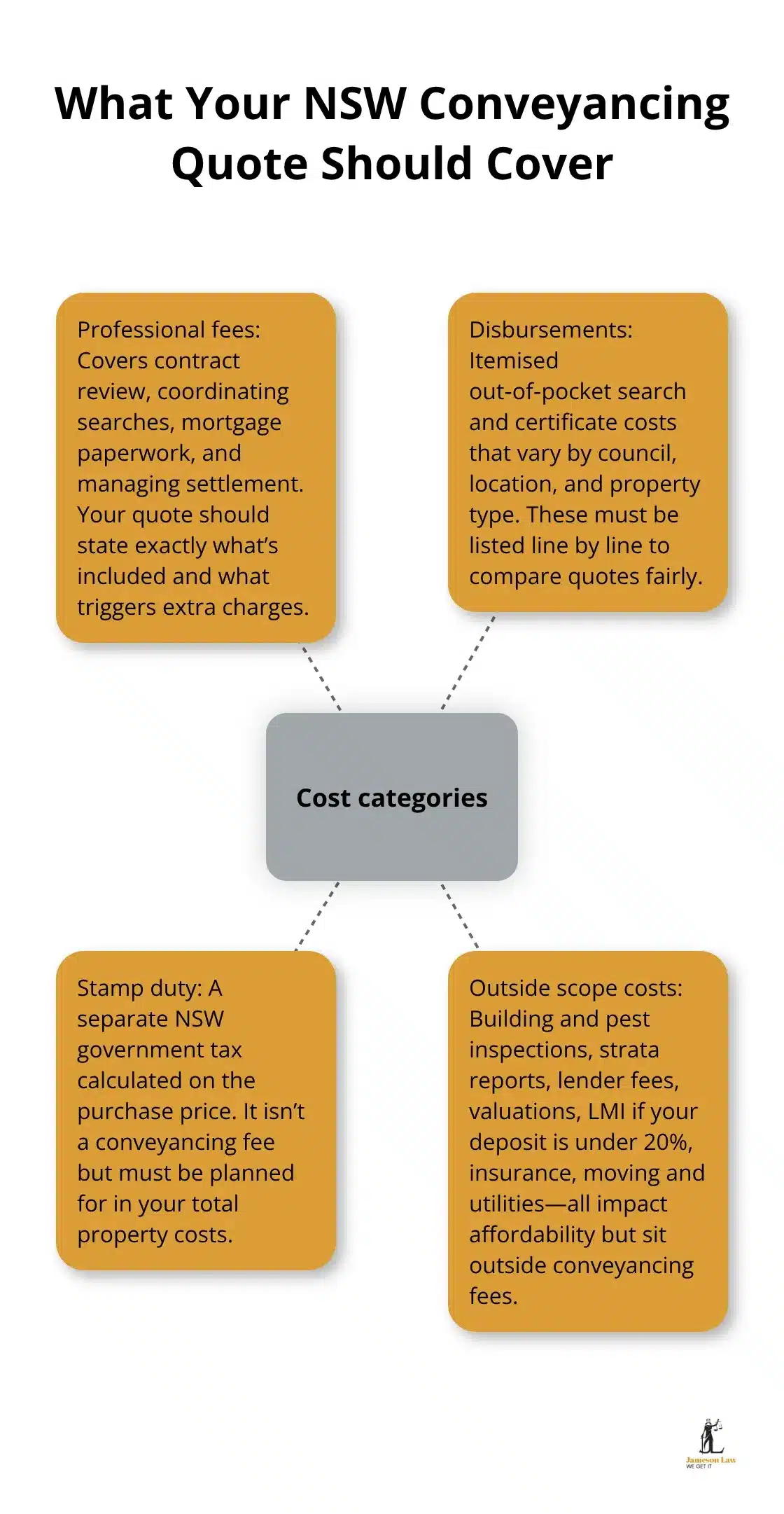

A conveyancing quote in NSW breaks down into three distinct cost categories, and understanding each one stops you from being blindsided at settlement. The professional fees cover the conveyancer’s time to review contracts, coordinate searches, manage your mortgage paperwork, and handle settlement itself. According to OpenAgent’s aggregated industry data, NSW conveyancing fees typically range from $500 to $2,200 excluding disbursements, though the exact amount depends on whether you’re buying or selling and the complexity of your property. Selling generally costs less than buying because the seller’s conveyancer drafts the entire contract of sale and vendor disclosure documents, which requires more labour.

Understanding Professional Fees

Your conveyancer’s professional fee covers specific work: reviewing contracts, coordinating searches, managing your mortgage paperwork, and handling settlement. The fee varies based on transaction type and property complexity. Buying a property typically costs more than selling because the buyer’s conveyancer reviews the seller’s contract and conducts extensive due diligence. Selling a property involves the seller’s conveyancer drafting the entire contract of sale and vendor disclosure documents, which is labour-intensive work. Your quote should clearly state what services the professional fee includes and what triggers additional charges.

The Disbursement Trap

Disbursements are out-of-pocket expenses that vary depending on your council, location, and property type. Your quote must itemise every single one so you know exactly what you’re paying for. Heritage-listed properties trigger extra searches that suburban apartments don’t need, and rural properties often require additional environmental or agricultural certificates that can add hundreds to your bill. According to OpenAgent data, disbursements commonly add roughly $270 or more for a purchase and $280 or more for a sale.

When you request a quote, ask specifically what council and government searches are included and whether the quote covers all potential searches or if additional ones might emerge. Some conveyancers bundle searches into a flat fee, while others charge per search, so comparing quotes becomes impossible unless you know what searches each one actually includes. Avoid vague language like miscellaneous fees or search costs to be confirmed. Stamp duty is separate again and is a NSW government tax calculated on the purchase price, not a conveyancing fee at all, but it absolutely belongs in your total property cost planning.

Hidden Costs That Wreck Your Budget

Building and pest inspections, strata reports for units or apartments, mortgage establishment fees from your lender, property valuation fees, and Lenders Mortgage Insurance (if your deposit is under 20%) all sit outside conveyancing fees entirely. Settlement adjustments for council rates, water rates, and strata levies can amount to several thousand dollars and catch buyers off guard because they’re not explained clearly in initial quotes. Insurance costs after contracts are exchanged should include building and contents cover, and you need those policies in place immediately. Moving costs, utilities connection fees, and potential temporary accommodation are commonly overlooked but genuinely impact your overall affordability.

Getting Transparency in Your Quote

Request a formal conveyancing quote that separates professional fees from disbursements, and ask your conveyancer to walk you through every line. If a firm promises a fixed price with no variation, misestimations may exist elsewhere in the bill or hidden costs may creep in later. Your quote should show exactly where your money goes and what services are included from start to finish. This transparency allows you to compare quotes accurately across different conveyancers and identify which firm offers genuine value for your specific transaction.

Now that you understand what makes up a conveyancing quote, the next step is learning how to compare multiple quotes effectively and spot which conveyancers are actually worth your money.

How to Compare Conveyancing Quotes

Getting multiple quotes is non-negotiable, but most people compare them wrong. You’ll ring three conveyancers, receive three wildly different numbers, and have no idea which one actually offers better value. The issue isn’t that quotes vary-it’s that you’re comparing apples to oranges because each conveyancer includes different services and disbursements in their base fee.

Request Itemised Quotes from Multiple Conveyancers

Request formal written quotes from at least two licensed conveyancers, and this is where specificity matters enormously. Don’t accept a quote over the phone or via email with vague descriptions. Ask each conveyancer to provide an itemised breakdown that separates professional fees, lists every single disbursement, and clearly states which services the base fee includes and which trigger additional charges. When you receive the quotes, create a simple spreadsheet and list the professional fee, each disbursement item, and the total. You’ll immediately spot which conveyancers charge $800 for title searches when others charge $150, or which ones have buried unexpected costs.

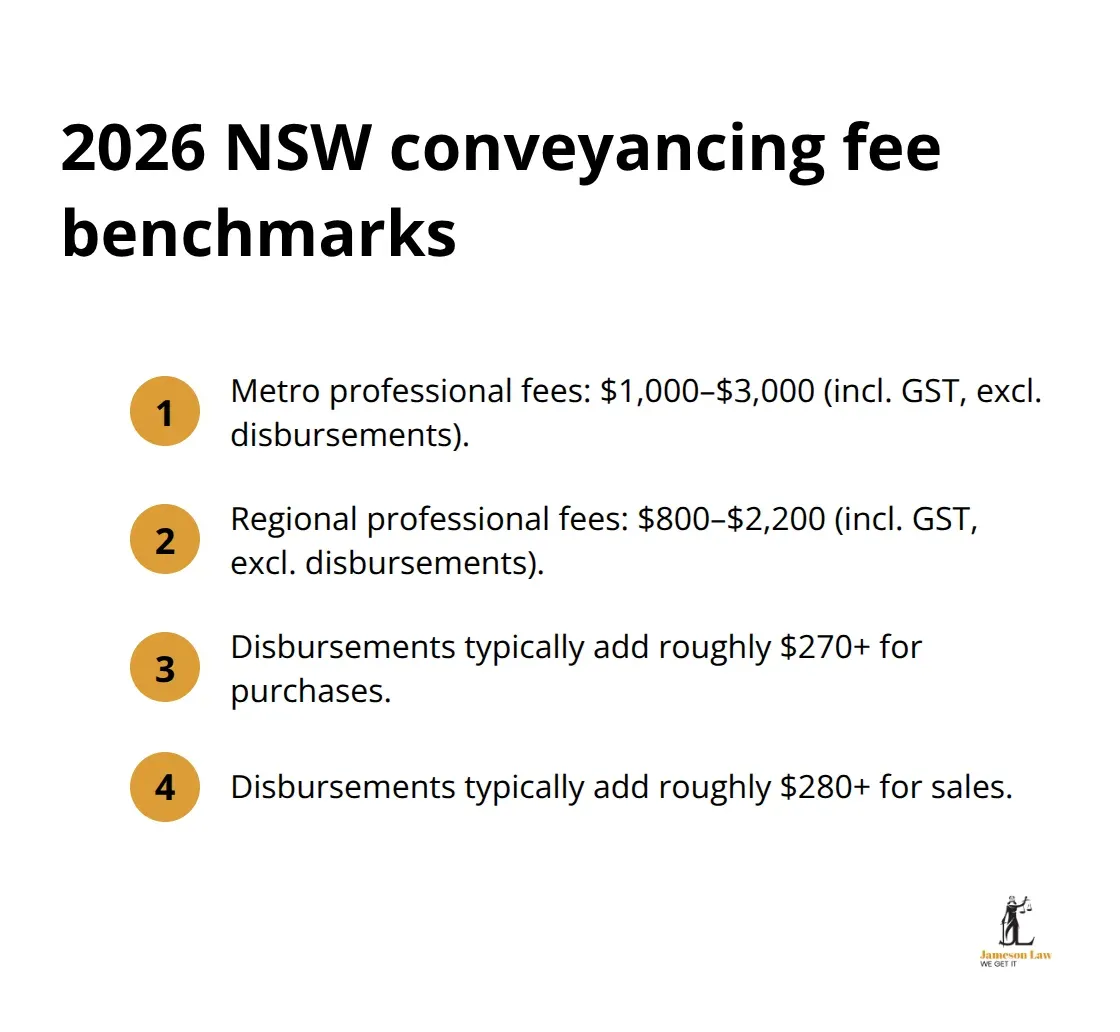

Typical 2026 NSW conveyancing fees (including GST) range from $1,000–$3,000 in metro areas and $800–$2,200 in regional areas, excluding disbursements, with disbursements adding roughly $270 or more for purchases and $280 or more for sales. If a quote falls significantly below these ranges or above them without clear justification based on property type or complexity, ask why. A suspiciously cheap quote often means essential services are missing, while an inflated quote might reflect inefficiency or unnecessary add-ons.

Evaluate Turnaround Times and Communication

Turnaround time and communication style matter more than most buyers realise because slow conveyancers cost you money through settlement delays, and poor communication creates stress during the most expensive transaction of your life. When you contact a conveyancer, note how quickly they respond-anything over 48 hours suggests they’re stretched thin. Ask directly how they keep clients updated: do they send regular progress emails, provide a client portal where you can check status, or require you to chase them for updates?

Ask each conveyancer how long they typically take from exchange of contracts to settlement, and get this in writing because delays cost real money. The standard period to completion in NSW is 42 days unless the contract specifies otherwise. Verify they hold a licence with NSW Fair Trading and maintain professional indemnity insurance-this protects you if they make mistakes.

Understand What Services Are Included

When you compare quotes, don’t just look at the price; evaluate whether the conveyancer answers your questions thoroughly, explains things clearly without jargon, and treats you like a valued client rather than a transaction number. The cheapest option often becomes the most expensive when you factor in delays, poor communication, and missing services that force you to hire additional help at settlement. Ask each conveyancer which services their base fee includes and what triggers additional charges. Some firms bundle searches into a flat fee, while others charge per search, so comparing quotes becomes impossible unless you know what searches each one actually includes. Avoid conveyancers who use vague language like miscellaneous fees or search costs to be confirmed.

Now that you understand how to compare quotes effectively, the next step is learning which red flags signal that a conveyancer isn’t worth your money.

Red Flags When Reviewing Conveyancing Quotes

Pricing That Falls Outside the Market Range

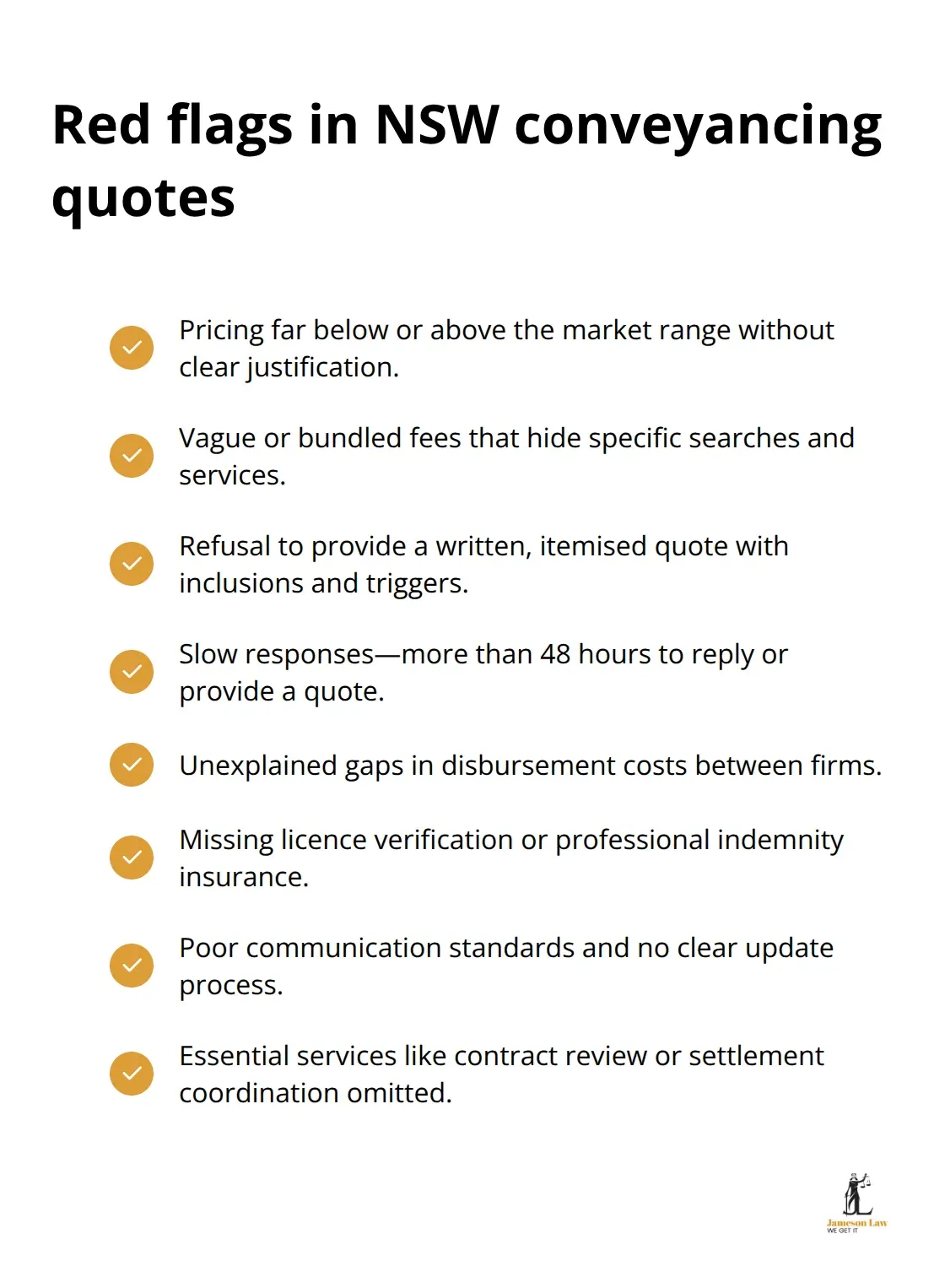

Conveyancers who quote significantly below or above the 2026 NSW market range deserve immediate scrutiny. If a quote falls below $700 for a purchase in a metro area or jumps above $2,500 without clear justification, ask the conveyancer to explain the discrepancy. A genuinely cheap quote often means essential services like contract review, title searches, or settlement coordination are missing entirely, leaving you exposed to contract errors, missed deadlines, or settlement disasters. Conversely, inflated quotes sometimes reflect inefficiency, unnecessary add-ons, or conveyancers who haven’t competed on price in years.

The sweet spot for metro NSW conveyancing typically sits between $1,200 and $2,000 for a straightforward purchase, so anything wildly outside that range warrants a direct conversation.

Vague Fee Breakdowns and Hidden Costs

Vague fee breakdowns signal either incompetence or deliberate obfuscation. When a conveyancer’s quote lumps searches into miscellaneous fees, describes costs as to be confirmed, or doesn’t specify which council searches are included, you cannot accurately compare quotes across different firms. This opacity often hides the fact that one conveyancer charges $150 for a title search while another charges $400, and you won’t discover the difference until settlement. Similarly, limited transparency about included services means you might discover mid-transaction that your quote didn’t cover mortgage paperwork coordination, settlement attendance, or post-settlement registration work.

Resistance to Written Documentation

Conveyancers who resist providing written itemised quotes or become defensive when you ask detailed questions are signalling they’re not worth your time. A reputable conveyancer will provide a detailed written breakdown, explain each line item clearly, confirm exactly what services the base fee covers, and specify which additional work triggers extra charges. If a conveyancer makes you feel like you’re being difficult for asking these basic questions, find someone else immediately. The best conveyancers welcome scrutiny because they have nothing to hide and understand that transparency builds trust with clients.

Lack of Clear Communication Standards

Poor communication practices often emerge during the quoting stage itself. If a conveyancer takes more than 48 hours to respond to your initial enquiry, takes days to provide a written quote, or avoids answering specific questions about their process, these habits will persist throughout your transaction. Ask each conveyancer how they keep clients updated-whether they send regular progress emails, provide a client portal where you can check status, or require you to chase them for updates. Conveyancers who hold a licence with NSW Fair Trading and maintain professional indemnity insurance demonstrate they meet industry standards and protect you if mistakes occur.

Unexplained Variations in Disbursement Costs

Disbursement costs vary across conveyancers, but extreme variations warrant investigation. If one conveyancer quotes $150 for a title search and another quotes $400, ask why. Some variation reflects genuine differences in council fees or search provider costs, but significant gaps often indicate one firm is padding costs or another is cutting corners. Request that each conveyancer itemise every single disbursement so you can compare apples to apples across different quotes. This comparison reveals which conveyancers charge premium prices for standard searches and which ones offer genuine value.

Final Thoughts

Comparing conveyancing quotes NSW requires discipline, but the effort saves you thousands of dollars and prevents settlement disasters. Request itemised quotes from at least two licensed conveyancers, compare professional fees against the 2026 market range of $1,000–$3,000 in metro areas, and scrutinise every disbursement line. Vague quotes, suspiciously cheap pricing, and poor communication signal that a conveyancer isn’t worth your money.

The best conveyancing quotes come from firms that separate professional fees from disbursements clearly, explain what services are included without jargon, and respond to your questions within 48 hours. Verify that your chosen conveyancer holds a licence with NSW Fair Trading and maintains professional indemnity insurance. Ask how they keep you updated throughout the transaction and confirm their typical timeframe from exchange to settlement, as slow communication and missed deadlines cost real money.

We at Jameson Law understand that conveyancing represents one of the largest financial commitments you’ll make, and getting the right support from the start makes all the difference. Contact Jameson Law to discuss your property transaction and receive a detailed quote tailored to your specific circumstances.