Buying a property involves multiple stages, and understanding each one helps you avoid costly mistakes. The conveyancing settlement process can feel overwhelming without proper guidance, but breaking it down into clear steps makes it manageable.

We at Jameson Law have guided hundreds of clients through this journey, and we know what questions matter most. This guide walks you through every phase, from your initial offer through to the moment you receive the keys.

Getting the Property Offer Right Before Signing Anything

Negotiate settlement terms and Inspect Early

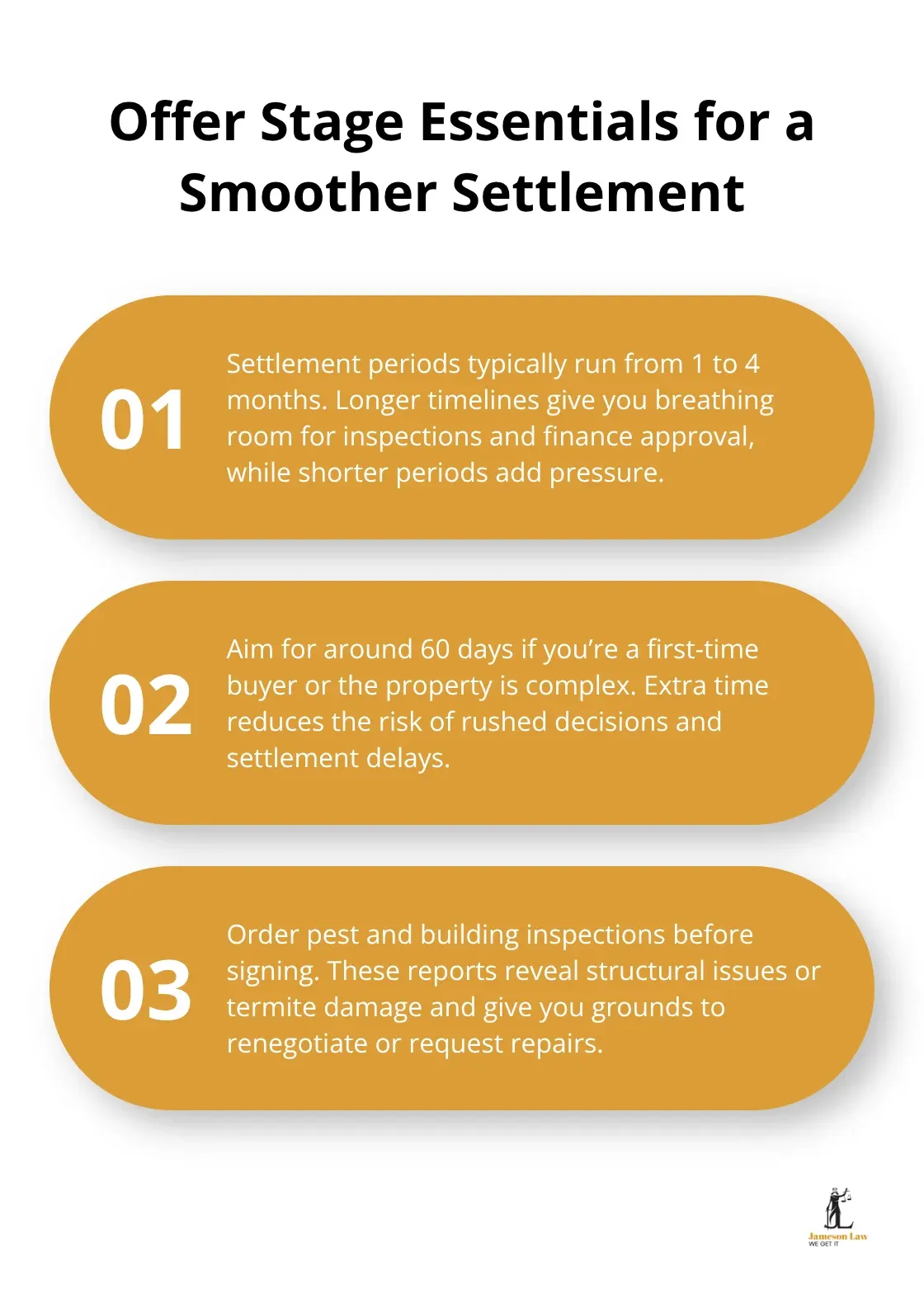

The first decision that matters most happens before you exchange contracts. When you find a property you want to buy, your initial offer sets the tone for everything that follows. Most buyers focus only on the purchase price, but the offer stage determines whether your settlement runs smoothly or hits problems later. The contract of sale specifies the settlement period, which typically runs from 1 to 4 months depending on what you negotiate. Longer settlement periods give you breathing room for inspections and finance approval, while shorter ones create pressure.

Try for at least 60 days if you’re a first-time buyer or dealing with a complex property.

Your offer should also address which fittings and fixtures stay with the property, because ambiguity here creates disputes right up until settlement day. Before you sign anything, order a pest and building inspection. These reports reveal structural issues, termite damage, or hidden defects that could derail your finance or leave you paying tens of thousands in repairs after you own the property. The inspection gives you genuine grounds to renegotiate price or request repairs, rather than accepting the property as-is.

Use the Cooling-Off Period Strategically

Once you exchange contracts, you enter the cooling-off period, which in most Australian states lasts 5 business days. This is your legal window to walk away without losing your deposit, though you’ll forfeit a small portion as a termination fee. Use this time to complete your due diligence properly. Order a title search immediately through your conveyancer or solicitor to check for easements, covenants, caveats that could restrict how you use the property.

Check Planning and Council Records

In NSW, the seller must provide a Section 10.7 Planning Certificate and a drainage/sewer diagram with the contract, but you need to review them carefully for zoning restrictions or potential future development that affects your plans. Check council records for any unapproved structures like pergolas or pool fences, because missing approvals create problems when you later try to sell or refinance. If you discover significant issues during this period, the cooling-off period is your exit strategy.

Act Fast to Protect Your Position

After the cooling-off period expires, you’re committed unless the seller agrees to release you. This is why starting your investigation immediately matters-waiting until week four of your settlement period to discover a title defect or building issue puts you in a weak negotiating position and risks delaying or derailing the entire transaction. The next phase involves arranging your mortgage approval and understanding exactly what costs you’ll face at settlement, so your financial planning aligns with your legal timeline.

Securing Your Finance and Managing Settlement Costs

Start Your Mortgage Application Immediately

Your mortgage approval and settlement costs run parallel during this phase, and mistakes in either area delay your settlement or leave you short of funds on the critical day. Start your mortgage application immediately after exchanging contracts, not weeks later. Lenders typically need 2 to 4 weeks to process applications, and delays here represent the most common reason settlements slip past their scheduled dates. You must provide your lender with all requested documents upfront-group certificates, tax returns, bank statements, and payslips-because incomplete applications stall in verification loops. Your lender will also conduct a valuation of the property, which sometimes comes in lower than your purchase price. If this happens, you’ll need extra cash to cover the shortfall, so knowing this early gives you time to arrange additional funds rather than discovering it days before settlement.

Understand Your Settlement Costs

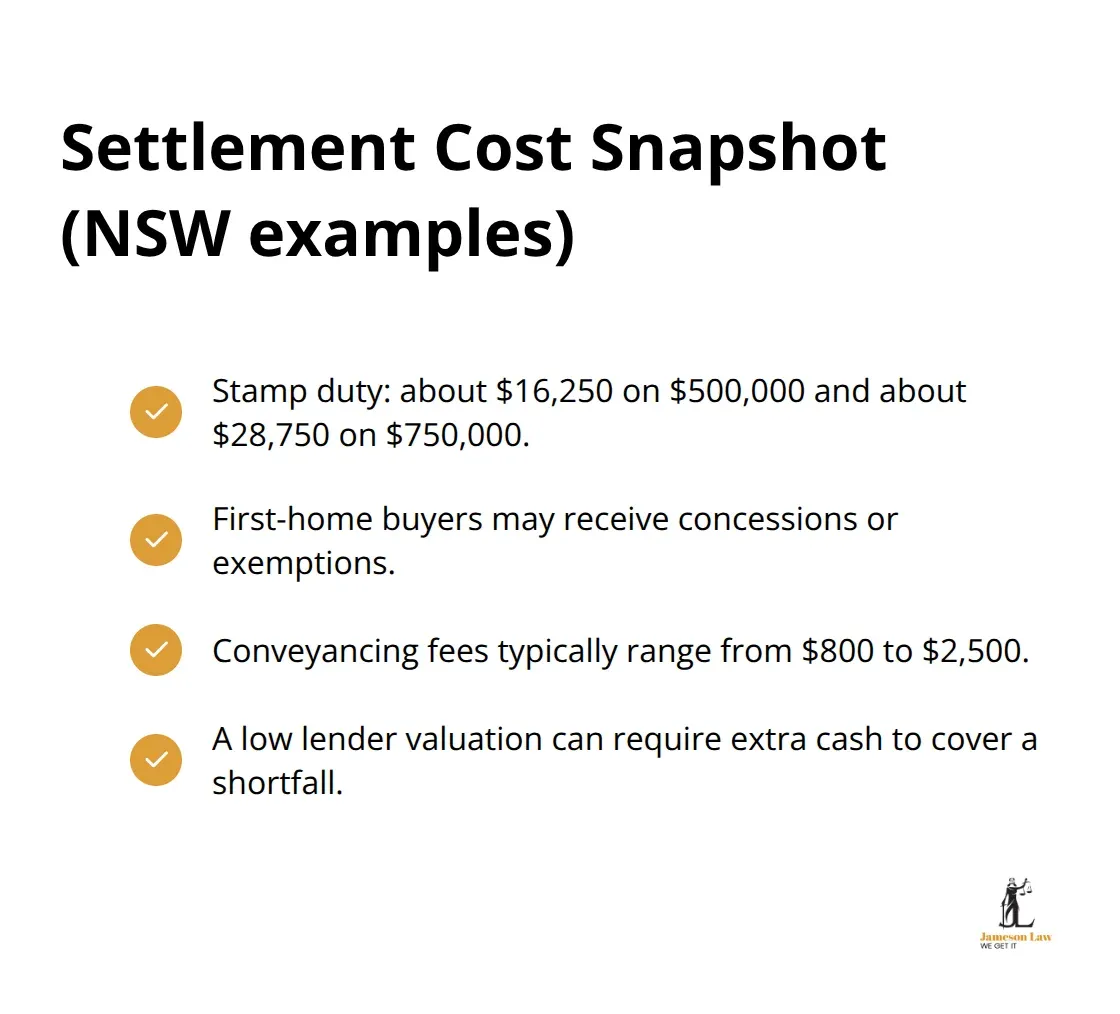

Settlement costs vary significantly based on property value and complexity, but understanding each component prevents surprises. Stamp duty represents the largest expense and varies by state and property price; in NSW, a property worth $500,000 attracts approximately $16,250 in stamp duty, while a $750,000 property costs around $28,750. First-home buyers may qualify for concessions or exemptions depending on the property value and your state, so confirm your eligibility with your conveyancer early. Conveyancing fees typically range from $800 to $2,500 for a straightforward purchase, though complex transactions cost more.

Review Your Settlement Statement Carefully

Your settlement statement, prepared shortly before final settlement, itemises stamp duty, any applicable concessions, the First Home Owner Grant if you qualify, and apportionments for council rates, water charges, and body corporate fees. You must request this statement at least one week before settlement so you can verify every figure and arrange funds accordingly. Lenders require proof that you have the cash available for all settlement costs and your deposit, and they’ll ask for bank statements showing these funds.

Manage Your Finances Before Settlement Day

Do not move money around in the days before settlement or make large withdrawals, because unexplained account activity triggers additional lender verification that delays drawdown. Your conveyancer coordinates with your lender to confirm funds will be available on settlement day, so maintain regular contact and flag any delays immediately. If your lender is slow responding or requesting additional documents, escalate to a manager rather than waiting passively-settlement delays cost you money through interest charges and can trigger contract termination penalties if you miss the agreed date. Once your lender confirms approval and you’ve arranged all settlement funds, the final phase begins: the critical days immediately before settlement when inspections, document preparation, and fund transfers converge.

Settlement Day: What Happens and What to Expect

Final Inspections Before Settlement

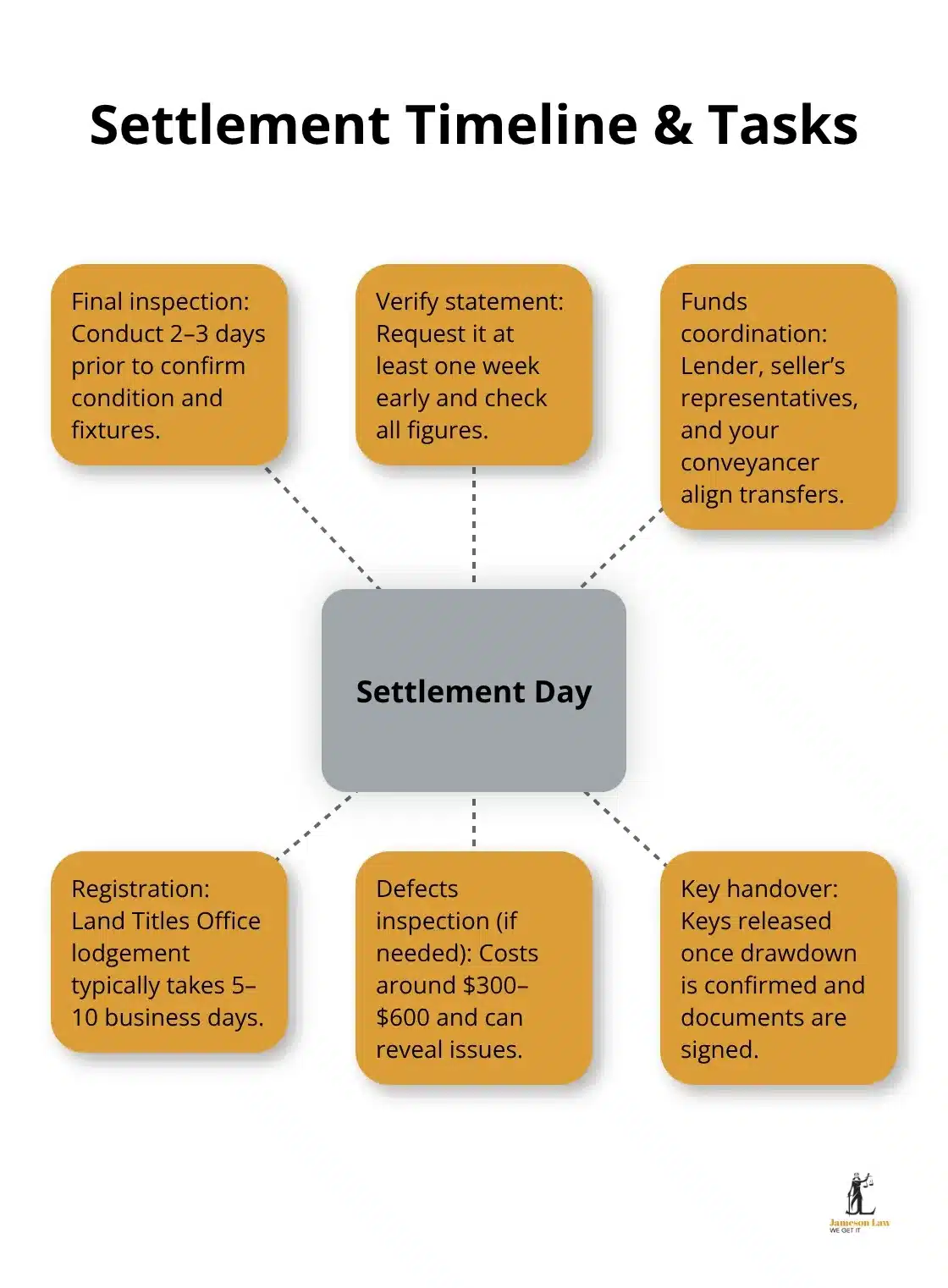

The week before settlement is when theory meets reality. Your conveyancer or solicitor will arrange a final inspection of the property, typically scheduled for 2 to 3 days before settlement day. This inspection confirms the property remains in the condition specified in your contract and that all agreed fixtures and fittings are still present. Check that appliances work, hot water and heating or cooling systems function, locks operate properly, and the property is clean with rubbish cleared. Take photos or video if you notice any damage that wasn’t there when you signed the contract, because this gives you grounds to request price adjustments or hold funds back at settlement.

For new builds, verify that all work is complete and appliances are installed. If you’re uncertain about the property’s condition, a defects inspection by a qualified inspector costs around $300 to $600 but reveals issues you might otherwise miss until after you own the property.

Verifying Your Settlement Statement

Your settlement statement arrives shortly before the final day, itemising every cost including stamp duty, council rates, water apportionments, body corporate levies if applicable, and conveyancing fees. Verify every figure against quotes you received earlier. If the seller prepaid council rates or water bills, your conveyancer calculates adjustments so you reimburse only your share from settlement day onwards.

Request this statement at least one week early so discrepancies can be corrected before funds are due. This timing allows your lender to review the figures and confirm drawdown amounts without last-minute surprises.

Coordinating Funds and Documents on Settlement Day

Settlement day itself involves coordinated transfers between your lender, the seller’s representatives, and your conveyancer. You do not need to attend in person. Your conveyancer liaises with your bank to confirm funds will be available, contacts the seller’s conveyancer to confirm they’re ready to exchange documents, and coordinates with the title office to lodge the transfer.

Your lender draws down your loan and pays the purchase price to the seller’s conveyancer. Once funds are received and all transfer documents are signed, your conveyancer arranges registration of the transfer with the Land Titles Office in your state. This registration process typically takes 5 to 10 business days, though during this period your conveyancer holds the keys and can arrange handover once your lender confirms drawdown is complete.

Completing Registration and Taking Possession

After registration completes and the title transfers to your name, you can collect the keys and take possession. The seller’s existing mortgage is discharged from the sale proceeds, removing their lender’s claim on the property. Your lender registers their mortgage against the title, securing their position as the mortgagee.

This registration protects both you and your lender by creating an official record of ownership and security interests. Settlement is the finish line where ownership legally transfers and the property becomes yours, but the administrative work continues for several days after the scheduled settlement date as registration finalises.

Final Thoughts

The conveyancing settlement process involves multiple critical stages, each with specific deadlines and requirements that demand your attention. From negotiating settlement terms in your initial offer through to registering ownership at the Land Titles Office, missing even one step creates delays, costs money, or jeopardises your deposit. You have five business days in the cooling-off period to investigate the title, check for easements and planning restrictions, and verify the property’s condition, so starting your due diligence immediately rather than waiting weeks into your settlement period protects your position.

Financial planning mistakes also derail settlements regularly. Your lender needs complete documentation upfront, not piecemeal submissions that trigger verification loops and delays. Stamp duty calculations must match your settlement statement at least one week before the final day, and you must confirm your First Home Owner Grant eligibility early if you qualify (moving money around in the days before settlement or making large withdrawals triggers additional lender scrutiny that can postpone drawdown).

We at Jameson Law have supported clients through hundreds of property transactions, and we understand that conveyancing involves legal, financial, and administrative complexity that benefits from professional guidance. Our conveyancing team manages title investigations, prepares all required legal documents, coordinates with your lender and the seller’s representatives, and handles settlement day logistics so you avoid costly mistakes. Contact Jameson Law to discuss your conveyancing needs and ensure your settlement runs smoothly from offer through to key handover.