Estate planning is a vital process that safeguards your assets and ensures your wishes are respected after you’re gone. At Jameson Law, we’ve created this comprehensive estate planning checklist for Australians to guide you through the essential steps.

Our checklist covers everything from creating a will to setting up powers of attorney and advance care directives. By following this guide, you’ll be well-prepared to protect your legacy and provide for your loved ones. If you need tailored help, you can book a consultation with our Sydney team.

What Is Estate Planning in Australia?

The Essence of Australian Estate Planning

Estate planning in Australia involves a proactive strategy to manage your assets and affairs for the future. It extends beyond drafting a will; it’s a comprehensive approach to ensure your wishes are carried out after your passing or if you become incapacitated. For general guidance about wills and deceased estates, see Moneysmart.

Key Components of an Australian Estate Plan

An effective estate plan in Australia typically includes several essential elements:

![]() Will: the legal document that sets out how you want your assets distributed after death. Learn the basics at the NSW Trustee & Guardian.

Will: the legal document that sets out how you want your assets distributed after death. Learn the basics at the NSW Trustee & Guardian.

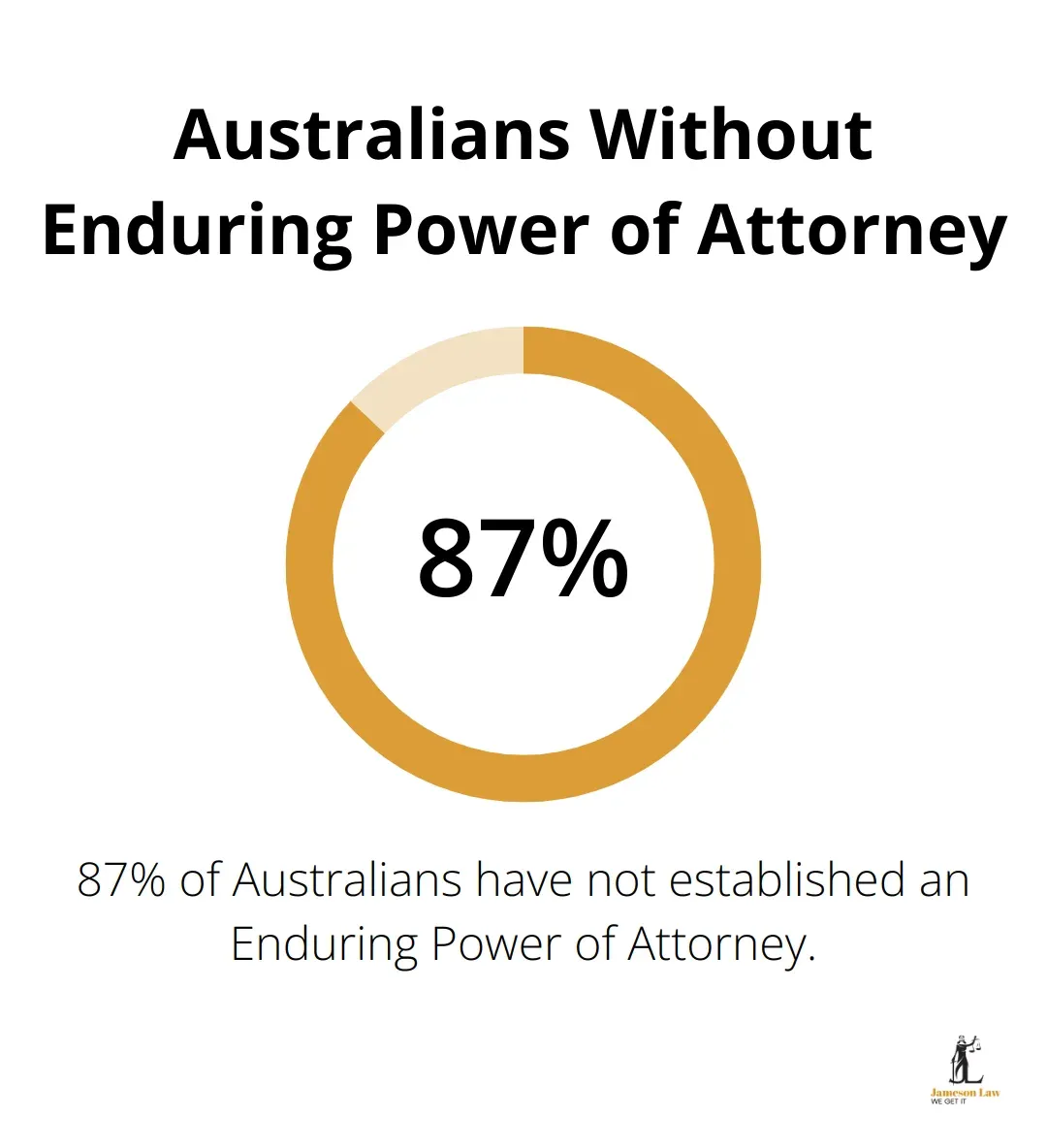

![]() Power of Attorney: authorises a trusted person to make financial decisions if you can’t. Many Australians haven’t put an enduring POA in place, which leaves them vulnerable if capacity is lost. See Service NSW for an overview.

Power of Attorney: authorises a trusted person to make financial decisions if you can’t. Many Australians haven’t put an enduring POA in place, which leaves them vulnerable if capacity is lost. See Service NSW for an overview.

![]() Advance Care Directive: records your medical treatment preferences if you’re unable to communicate. Helpful factsheets are available from ELDAC and Healthdirect.

Advance Care Directive: records your medical treatment preferences if you’re unable to communicate. Helpful factsheets are available from ELDAC and Healthdirect.

![]() Superannuation beneficiary nominations: ensure your super/death benefits go to the right people. See the ATO’s guidance on what happens to super when you die.

Superannuation beneficiary nominations: ensure your super/death benefits go to the right people. See the ATO’s guidance on what happens to super when you die.

Legal Requirements for Estate Planning in Australia

To create a legally binding estate plan in Australia, you must meet specific criteria:

![]() Age: generally 18+ to make a valid will (check your state’s rules via LawAccess NSW).

Age: generally 18+ to make a valid will (check your state’s rules via LawAccess NSW).

![]() Mental capacity: you must understand the nature and effect of the document.

Mental capacity: you must understand the nature and effect of the document.

![]() Witnesses: most wills require two independent witnesses who aren’t beneficiaries.

Witnesses: most wills require two independent witnesses who aren’t beneficiaries.

![]() Regular updates: review every 3–5 years or after major life events; here’s when to refresh your estate plan.

Regular updates: review every 3–5 years or after major life events; here’s when to refresh your estate plan.

The Value of Professional Guidance

DIY kits rarely cope with blended families, businesses, or complex super. Professional advice ensures your documents are valid and practical. Our team can help you set up testamentary trusts, review super nominations, and coordinate medical directives so your wishes are honoured.

As we move forward, let’s explore the critical steps in creating a comprehensive will, a cornerstone of any solid estate plan.

How to Create a Comprehensive Will

The Importance of a Well-Crafted Will

A will forms the foundation of your estate plan. More than half of Australians die without a will, which triggers intestacy rules and can fuel disputes. Keeping an up-to-date will protects your legacy and your family.

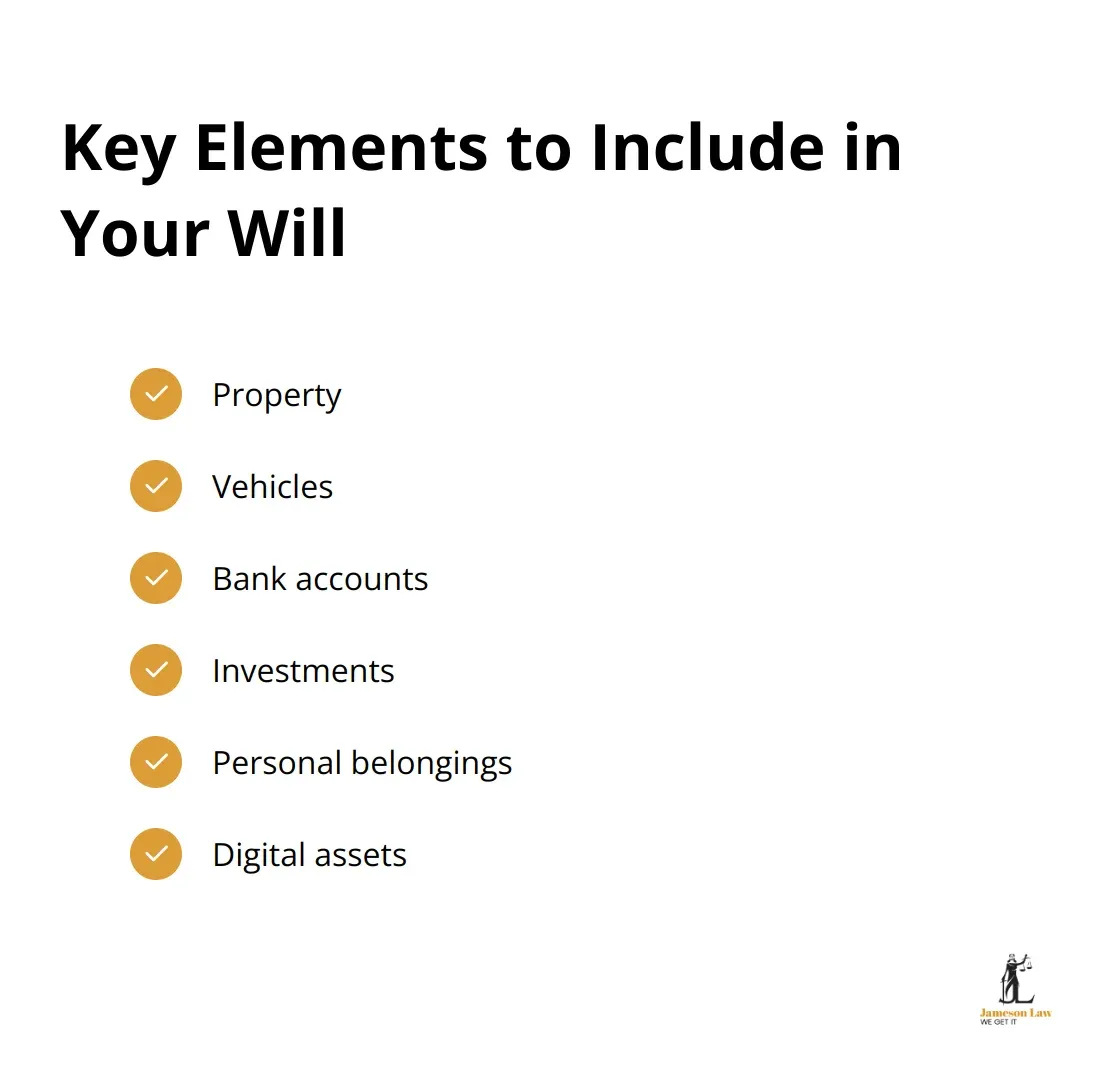

Key Elements to Include in Your Will

Your will should clearly state your wishes regarding asset distribution. Start with a comprehensive asset list:

![]() Property

Property

![]() Vehicles

Vehicles

![]() Bank accounts

Bank accounts

![]() Investments and shares

Investments and shares

![]() Personal belongings

Personal belongings

![]() Digital assets (e.g., cryptocurrency, domain names, social accounts)

Digital assets (e.g., cryptocurrency, domain names, social accounts)

Specify beneficiaries and include instructions for debts, taxes and any charitable gifts. A residuary clause covers assets not listed specifically. For safe storage options, see Will Safe storage by NSW Trustee & Guardian.

Selecting Your Executor

The executor carries out your wishes. Many people appoint a family member; others prefer a professional for complex estates. Choose someone organised and financially literate, and name an alternate. The NSW Trustee & Guardian explains duties here: executor duties.

Addressing Special Circumstances

Blended families often need additional structuring to balance competing needs. Consider testamentary trusts for minors or beneficiaries with special needs, and ensure your super nominations align with your will. Business owners should prepare a succession plan; the will alone may not transfer control. The ATO’s guidance on what happens to your business when you die is a practical starting point.

Review your will every 3–5 years or after major life events (marriage, divorce, a new child). This keeps the document aligned with your current wishes.

Power of Attorney and Advance Care Directives in Australia

Estate planning also protects your interests while you’re alive. Powers of Attorney and Advance Care Directives (ACDs) help you maintain control if decision-making capacity is lost.

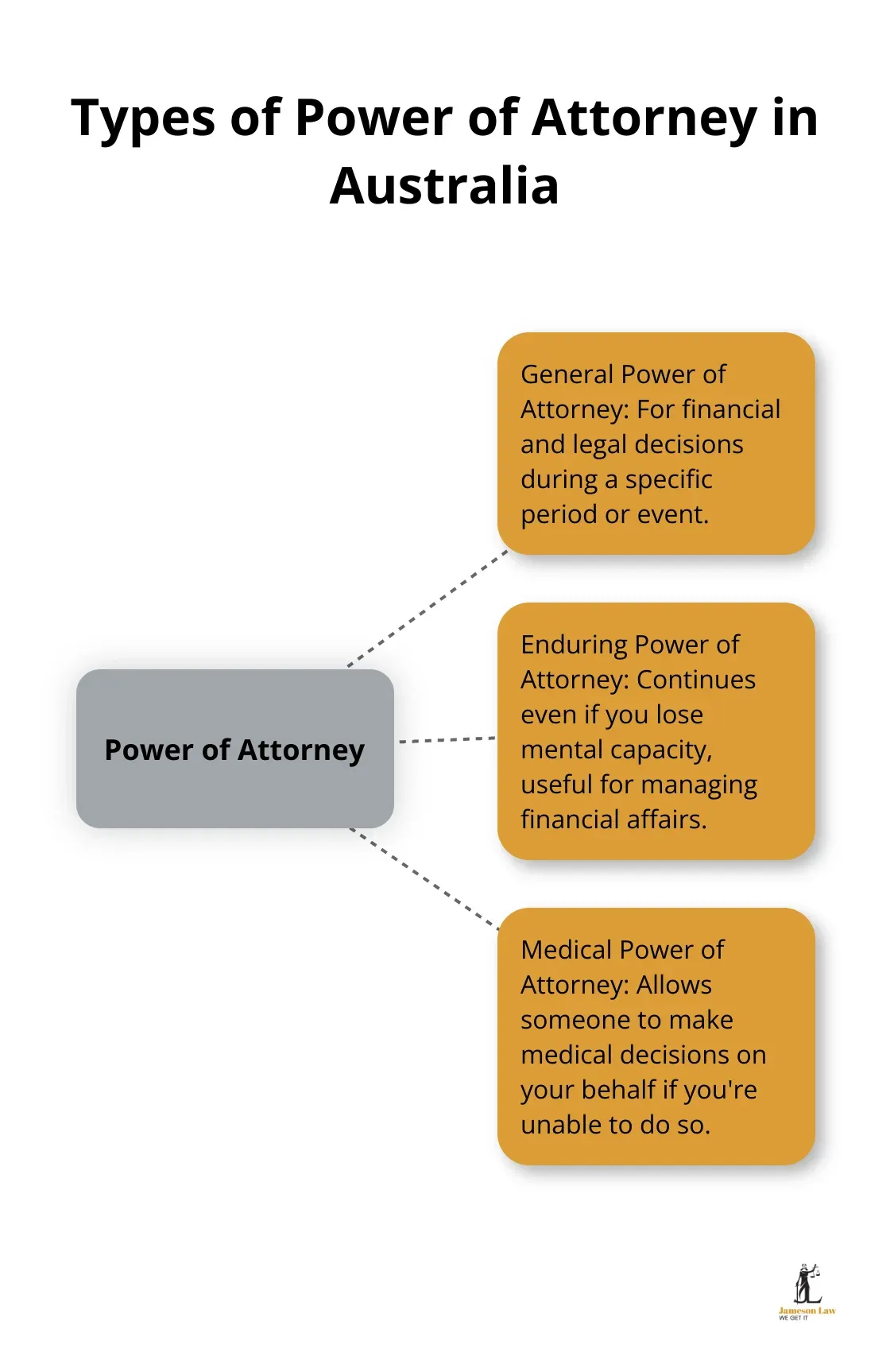

Types of Power of Attorney in Australia

A Power of Attorney lets someone you trust make decisions for you:

![]() General POA: financial/legal decisions for a set time or purpose (e.g., while overseas).

General POA: financial/legal decisions for a set time or purpose (e.g., while overseas).

![]() Enduring POA: continues if you lose capacity—critical for long-term protection. See Service NSW.

Enduring POA: continues if you lose capacity—critical for long-term protection. See Service NSW.

![]() Medical/health decision-maker: appoints someone to decide on treatment if you can’t (terminology varies by state—check ELDAC).

Medical/health decision-maker: appoints someone to decide on treatment if you can’t (terminology varies by state—check ELDAC).

The right choice depends on your needs. If you run a business, an Enduring POA can keep operations moving if you’re incapacitated.

Selecting Your Attorney

Choose someone you trust who:

![]() Handles money responsibly

Handles money responsibly

![]() Understands your wishes and values

Understands your wishes and values

![]() Can make difficult decisions under pressure

Can make difficult decisions under pressure

![]() Is willing and able to act

Is willing and able to act

Discuss expectations with your chosen attorney and consider appointing different people for financial and health decisions. For identity checks and witnessing options, see Australia Post – ID services.

Advance Care Directives Explained

An Advance Care Directive is a document you make while you have capacity that guides future health care when you can’t decide. It can also appoint a substitute decision-maker (state-based forms differ). Consider storing a copy with your GP and uploading to My Health Record.

Key Elements of an Advance Care Directive

When creating your ACD, think about preferences for:

![]() Life-prolonging treatments

Life-prolonging treatments

![]() Pain management and palliative care

Pain management and palliative care

![]() Organ and tissue donation (see DonateLife)

Organ and tissue donation (see DonateLife)

![]() End-of-life care preferences and place of care

End-of-life care preferences and place of care

Be specific so family and clinicians have clear guidance. Discuss your ACD with your loved ones and doctor so they can advocate for you.

Legal Considerations

Laws differ between states and territories, so get advice to ensure documents are valid. You can verify a practitioner via the NSW Solicitor Register. For probate and administration information, visit the FCFCOA probate page.

Final Thoughts

Estate planning protects your assets and ensures your wishes are respected. Our estate planning checklist for Australia provides a practical roadmap. Review and update your plan every 3–5 years or after major life events to keep everything current.

Estate planning can be complex, but you don’t have to navigate it alone. We at Jameson Law offer clear, cost-effective guidance to create robust, legally sound documents—from wills and trusts to powers of attorney and ACDs—so your loved ones are protected. Start now to secure your legacy and peace of mind. When you’re ready, speak with our Sydney team.