Estate planning is a critical process that safeguards your assets and ensures your wishes are respected after you’re gone. Yet, many Australians overlook this vital step in financial planning.

At Jameson Law, we’ve seen first-hand how proper estate planning strategies in Australia can provide peace of mind and protect loved ones from unnecessary stress and financial burden.

This guide will walk you through essential estate planning strategies, helping you secure your legacy and protect your family’s future.

What Is Estate Planning and Why Does It Matter?

The Essence of Estate Planning

Estate planning transcends the simple act of writing a will. It represents a comprehensive strategy to manage and distribute your assets according to your wishes, both during your lifetime and after your passing. At its heart, estate planning empowers you to take control of your legacy and safeguard your loved ones’ financial future.

Key Components of an Effective Estate Plan

A robust estate plan typically incorporates several essential elements:

![]() A Valid Will: This document outlines how you want your assets distributed after your death.

A Valid Will: This document outlines how you want your assets distributed after your death.

![]() Enduring Power of Attorney: This allows a trusted individual to make financial decisions on your behalf if you become incapacitated.

Enduring Power of Attorney: This allows a trusted individual to make financial decisions on your behalf if you become incapacitated.

![]() Advance Care Directive: This communicates your healthcare preferences if you’re unable to make medical decisions yourself.

Advance Care Directive: This communicates your healthcare preferences if you’re unable to make medical decisions yourself.

![]() Superannuation Considerations: It’s important to note that super doesn’t automatically form part of your estate. You must make a binding death benefit nomination to ensure your super goes to your intended beneficiaries.

Superannuation Considerations: It’s important to note that super doesn’t automatically form part of your estate. You must make a binding death benefit nomination to ensure your super goes to your intended beneficiaries.

Dispelling Common Estate Planning Myths

Many Australians hold misconceptions about estate planning that can lead to costly mistakes:

![]() “Estate planning is only for the wealthy”: In reality, anyone with assets, dependants, or specific wishes about their healthcare should have an estate plan.

“Estate planning is only for the wealthy”: In reality, anyone with assets, dependants, or specific wishes about their healthcare should have an estate plan.

![]() “Creating a will is a one-time task”: Life changes such as marriage, divorce, or the birth of children can significantly impact your estate plan. Regular reviews and updates are essential.

“Creating a will is a one-time task”: Life changes such as marriage, divorce, or the birth of children can significantly impact your estate plan. Regular reviews and updates are essential.

![]() “My family will automatically inherit everything if I die without a will”: Dying intestate (without a will) in Australia means your assets will be distributed according to a predetermined formula, which may not align with your wishes. This can result in lengthy legal battles and unnecessary stress for your loved ones.

“My family will automatically inherit everything if I die without a will”: Dying intestate (without a will) in Australia means your assets will be distributed according to a predetermined formula, which may not align with your wishes. This can result in lengthy legal battles and unnecessary stress for your loved ones.

The Impact of Proper Estate Planning

Effective estate planning prevents family disputes and preserves your legacy as you intend. It provides clarity and direction for your loved ones during a difficult time. The time you invest in creating a comprehensive estate plan now will pay dividends in your family’s future security and peace of mind.

As we move forward, let’s explore the cornerstone of any estate plan: creating a comprehensive will. This vital document serves as the foundation for ensuring your final wishes are respected and your assets are distributed according to your desires.

Creating a Comprehensive Will

The Importance of an Up-to-Date Will

A comprehensive will forms the foundation of any effective estate plan. It’s not just a document; it’s your voice after you’re gone, ensuring your wishes are respected and your loved ones are protected.

An up-to-date will is your best defence against intestacy laws. The consequences of dying intestate in Australia are simple: instead of you deciding who will inherit your property, the courts will decide. According to the NSW Trustee & Guardian, 30% of estates in NSW are intestate.

Regular updates to your will are essential. Major life events such as marriage, divorce, or the birth of a child can significantly impact your estate planning needs. A study by the University of Queensland found that nearly 50% of do-it-yourself wills may be invalid or ineffective, highlighting the importance of professional legal guidance in this process.

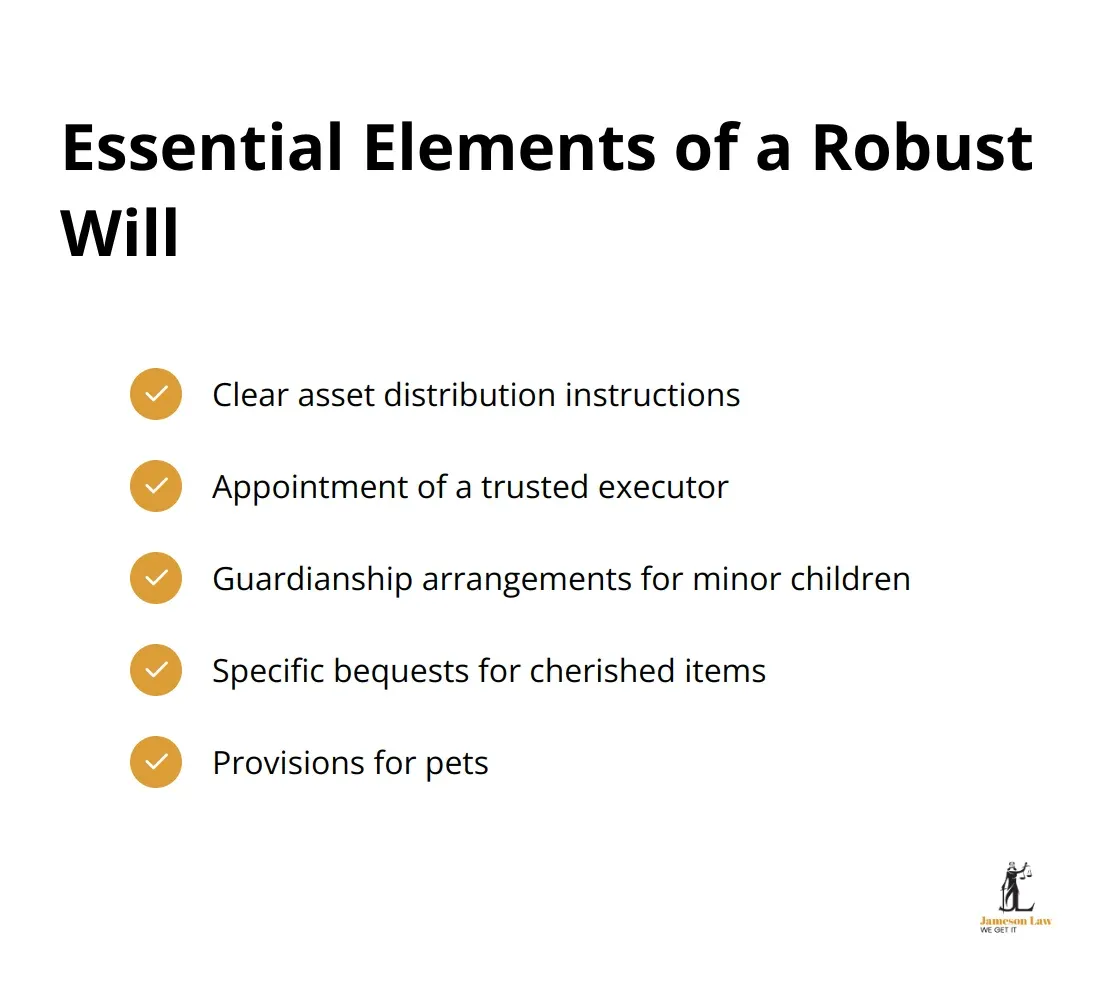

Essential Elements of a Robust Will

When you craft your will, try to include these key elements:

![]() Clear asset distribution instructions

Clear asset distribution instructions

![]() Appointment of a trusted executor

Appointment of a trusted executor

![]() Guardianship arrangements for minor children

Guardianship arrangements for minor children

![]() Specific bequests for cherished items

Specific bequests for cherished items

![]() Provisions for pets

Provisions for pets

Don’t forget digital assets. With the rise of cryptocurrencies and online accounts, it’s vital to include instructions for these in your will. The Australian Taxation Office provides guidelines on how these assets are treated for tax purposes.

Selecting Your Executor and Beneficiaries

Choosing an executor is a critical decision. This person will carry out your wishes and manage your estate. Select someone trustworthy, financially savvy, and emotionally prepared for the task.

When you name beneficiaries, be specific. Vague language can lead to disputes. If you’re leaving assets to charities, ensure you include their correct legal names and registration numbers.

Navigating Complex Family Structures

Blended families present unique challenges in estate planning. It’s important to balance the needs of current partners with those of children from previous relationships. Consider using testamentary trusts. A testamentary trust enables a testator to adopt the trust structure so that the testator can design and control the manner in which the estate is distributed.

For those in de facto relationships, don’t assume your partner will automatically inherit. In Australia, de facto partners may need to prove their relationship status to claim inheritance rights. A clear will can prevent such complications.

A will is more than just a legal document – it’s your final act of care for those you leave behind. Don’t leave it to chance. Take control of your legacy today. In the next section, we’ll explore strategies for protecting your assets and minimising tax implications in your estate plan.

Protecting Assets and Minimising Tax in Estate Planning

Strategic Asset Protection

Estate planning involves more than asset distribution; it focuses on asset protection and tax burden reduction for beneficiaries. Trusts serve as effective tools for asset protection. Family trusts, for example, can shield assets from creditors and offer tax advantages. The Australian Taxation Office notes that family trusts can distribute income to beneficiaries in lower tax brackets, potentially lowering overall tax payments.

Asset gifting during one’s lifetime presents another strategy. In Australia, individuals can gift up to $10,000 each financial year without affecting pension eligibility. This approach can reduce the taxable estate while benefiting loved ones immediately.

Navigating Inheritance Tax Implications

While Australia doesn’t impose inheritance tax, capital gains tax (CGT) may apply when beneficiaries sell inherited assets. The ‘cost base’ of the asset typically equals its market value at the date of death, which significantly impacts the payable tax.

For example, inherited shares that have appreciated in value may incur CGT upon sale. However, special rules apply to shares acquired before CGT’s introduction in September 1985, potentially reducing the tax burden.

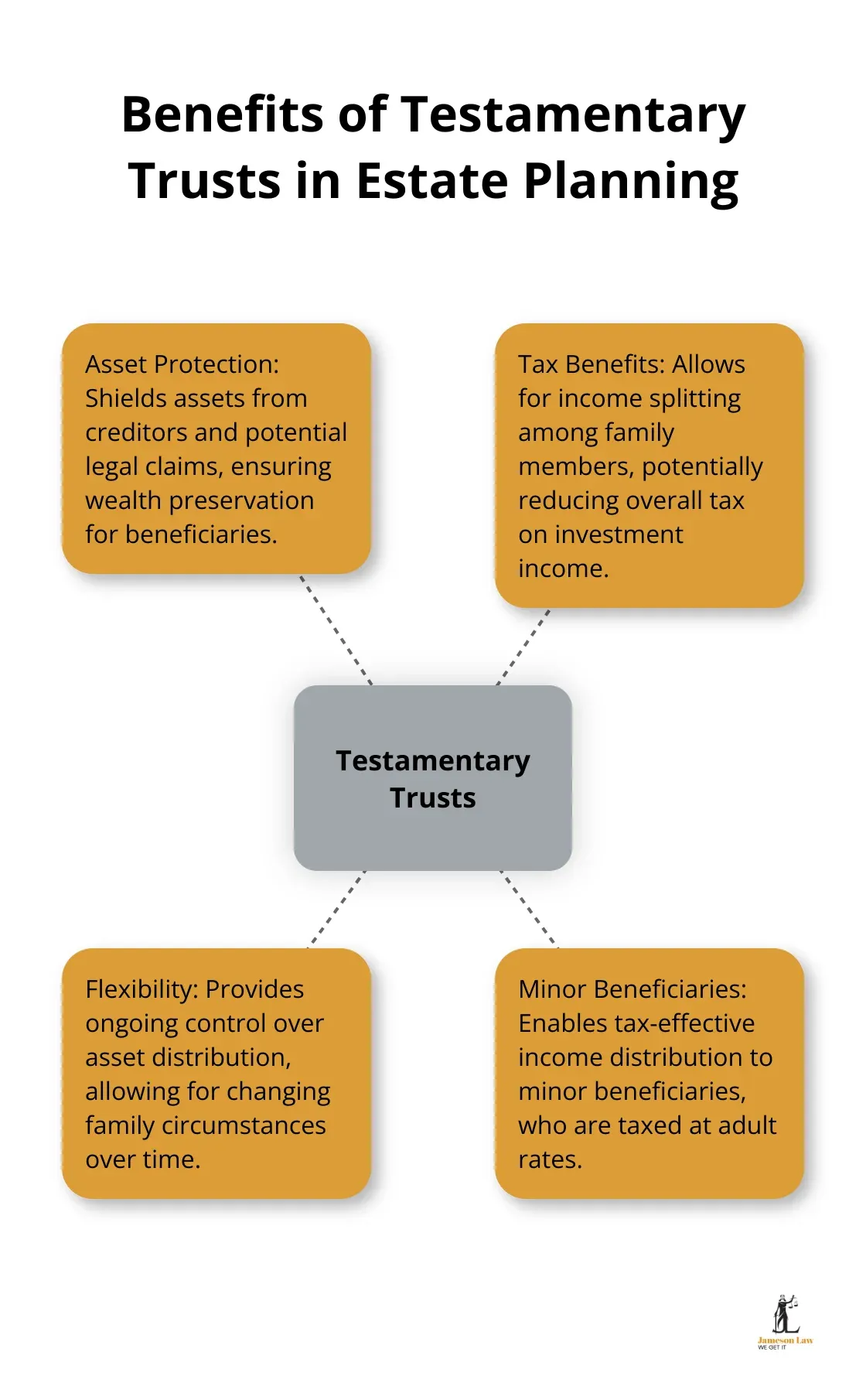

Leveraging Trusts for Estate Planning

Trusts offer both asset protection and potential tax benefits in estate planning. Testamentary trusts, created through a will, prove particularly effective. These trusts allow income splitting among family members, potentially reducing overall tax on investment income.

A testamentary trust can distribute income to minor beneficiaries who are taxed at adult rates (unlike the punitive tax rates usually applied to minors’ unearned income). This strategy can result in substantial tax savings over time.

Superannuation in Estate Planning

Superannuation plays a vital role in estate planning, yet many overlook its importance. Super doesn’t automatically become part of an estate; a binding death benefit nomination ensures its distribution according to one’s wishes.

The tax treatment of super death benefits varies based on the recipient. Benefits paid to dependants (as defined by superannuation law) are generally tax-free, while benefits paid to non-dependants may incur tax.

Self-managed super funds (SMSFs) offer additional flexibility in estate planning. They allow strategies like reversionary pensions, providing ongoing income to a single-nominated beneficiary while keeping assets in the concessionally taxed super environment.

Professional Guidance for Comprehensive Planning

Estate planning encompasses complex areas where professional advice proves invaluable. A proactive approach to estate planning secures one’s legacy and provides for loved ones long into the future. We at Jameson Law work closely with our clients to develop comprehensive estate plans that protect assets, minimise tax, and ensure the execution of their wishes.

Final Thoughts

Estate planning strategies in Australia protect your legacy and secure your family’s future. A comprehensive will, strategic use of trusts, and careful superannuation considerations form the foundation of an effective plan. Professional legal advice proves invaluable in navigating the complexities of estate planning, especially for those with complex family structures or substantial assets.

We at Jameson Law specialise in crafting personalised estate planning strategies for Australians. Our experienced team can help you develop a comprehensive plan that protects your assets, minimises tax burdens, and ensures your wishes are respected. We understand the nuances of Australian estate law and can guide you through every step of the process.

Take control of your future and protect your loved ones by implementing effective estate planning strategies today. With the right approach and professional support, you can achieve peace of mind knowing that your affairs are in order and your family’s future is secure. Contact Jameson Law to start securing your legacy now.