Section 52A of the Conveyancing Act creates real obligations that many property sellers misunderstand or overlook entirely. Getting this wrong can cost you thousands in compensation claims and legal fees.

We at Jameson Law have seen transactions derailed because sellers didn’t grasp what vendor disclosure requires. This guide walks you through the exact requirements, compliance steps, and serious risks of non-disclosure.

What Section 52A Actually Means for Your Sale?

Section 52A of the Conveyancing Act 1919 mandates that you attach prescribed documents to every land contract before a buyer signs. This isn’t optional. The Conveyancing (Sale of Land) Regulation 2022 defines exactly which documents you must provide.

Core Documents You Must Attach

The core list includes a Section 10.7 Planning Certificate from your local council, a current Land Tax Clearance Certificate, title searches, and Sydney Water sewerage diagrams. For strata properties, you’ll need additional documentation such as by-laws.

What Happens When Documents Go Missing?

If you fail to attach even one required document, your buyer has a 14-day rescission window. This allows them to pull out of the sale entirely and recover their deposit. The law also creates an implied warranty that the land isn’t subject to adverse affectations.

Getting Your Documents Ready in Time

Assembling Section 52A documents demands action the moment you list your property. Council processing delays can stretch to weeks. Contact your local council immediately to request the planning certificate.

Certificate Validity Windows Create Hidden Risks

Sellers frequently underestimate how quickly certificates expire. A planning certificate remains valid for limited periods. Pool compliance certificates must be current. An expired certificate triggers the same rescission right as a missing one.

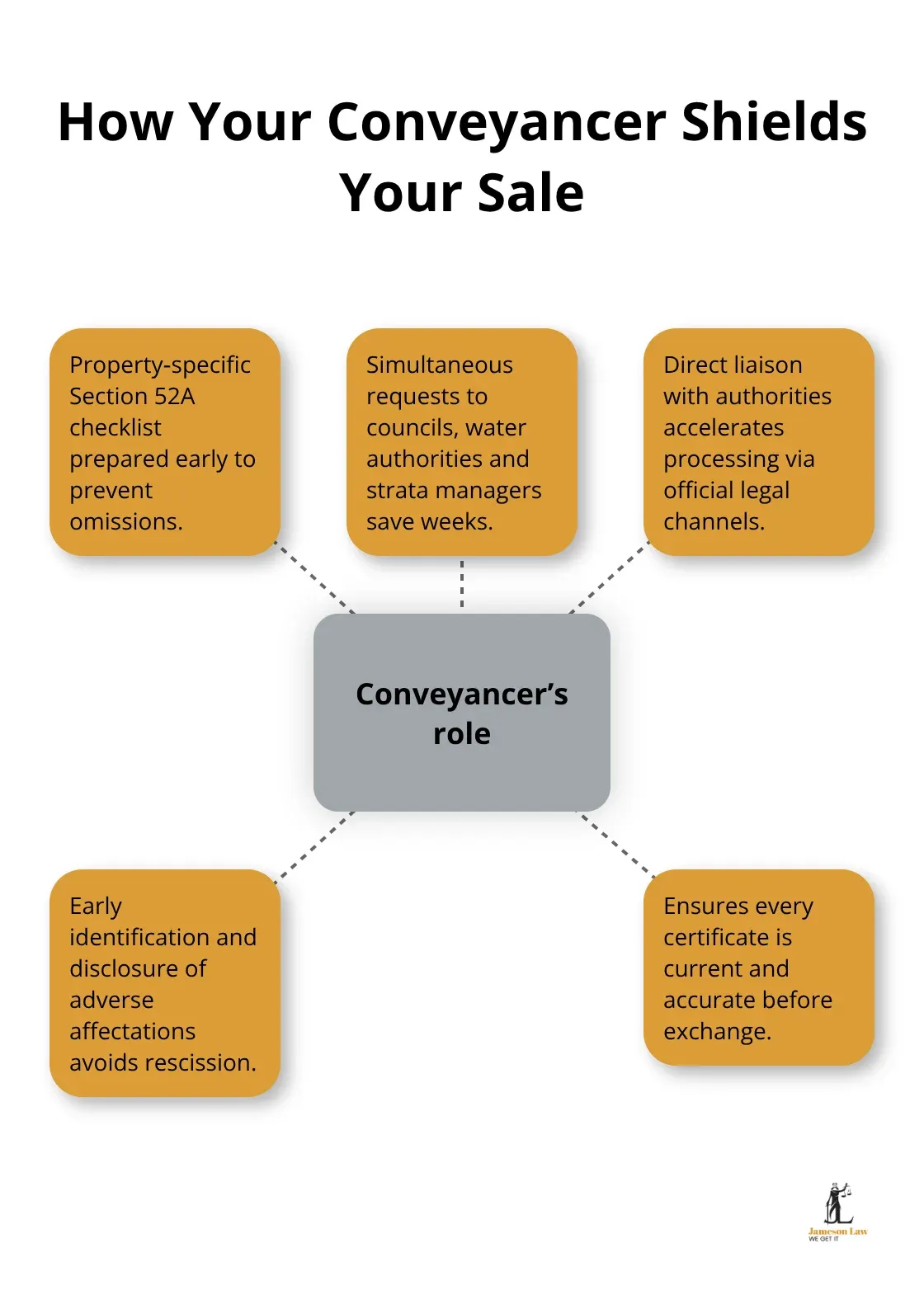

Your Conveyancer Accelerates the Entire Process

Your conveyancer functions as your compliance shield. A competent conveyancer prepares a Section 52A checklist specific to your property type and requests all documents simultaneously. This ensures your Contract for Sale is compliant before marketing begins.

What Happens When You Miss Section 52A Requirements?

The Rescission Right Your Buyer Can Exercise

Non-compliance with Section 52A hands your buyer a legal weapon. They can rescind the contract within 14 days of exchange. The NSW Fair Trading guidelines emphasize that prescribed documents must attach to the contract before the buyer signs.

Financial Liability Beyond the Lost Sale

Your financial exposure extends far beyond losing the sale. Buyers can claim compensation for breaches of the implied warranty. This highlights the importance of full disclosure regarding any easements or restrictions on the title search from NSW Land Registry Services.

Final Thoughts

Section 52A of the Conveyancing Act is a legal framework that protects buyers and creates serious consequences for sellers. The 14-day rescission right and implied warranties mean non-compliance is costly.

We at Jameson Law have guided hundreds of property sellers through compliance. Your conveyancer accelerates document collection and prevents the buyer from exercising rescission rights. Contact Jameson Law to ensure your property sale is secure and compliant.