Section 90C Family Law Act applications can feel overwhelming when you’re dealing with property settlements after separation. The legal requirements are strict, and one mistake can delay your case for months.

We at Jameson Law see families struggle with these complex procedures daily. This guide breaks down the essential steps to navigate Section 90C requirements successfully.

What Is Section 90C and When Do You Need It

Section 90C of the Family Law Act 1975 governs binding financial agreements between married couples, giving you the power to determine how property and assets split before problems arise. These agreements cover all property types acquired before, during, or after marriage, including real estate, business interests, investments, and personal assets. The Federal Circuit and Family Court processed over 8,200 property applications in the 2023-24 financial year, showing how common these disputes become without proper planning.

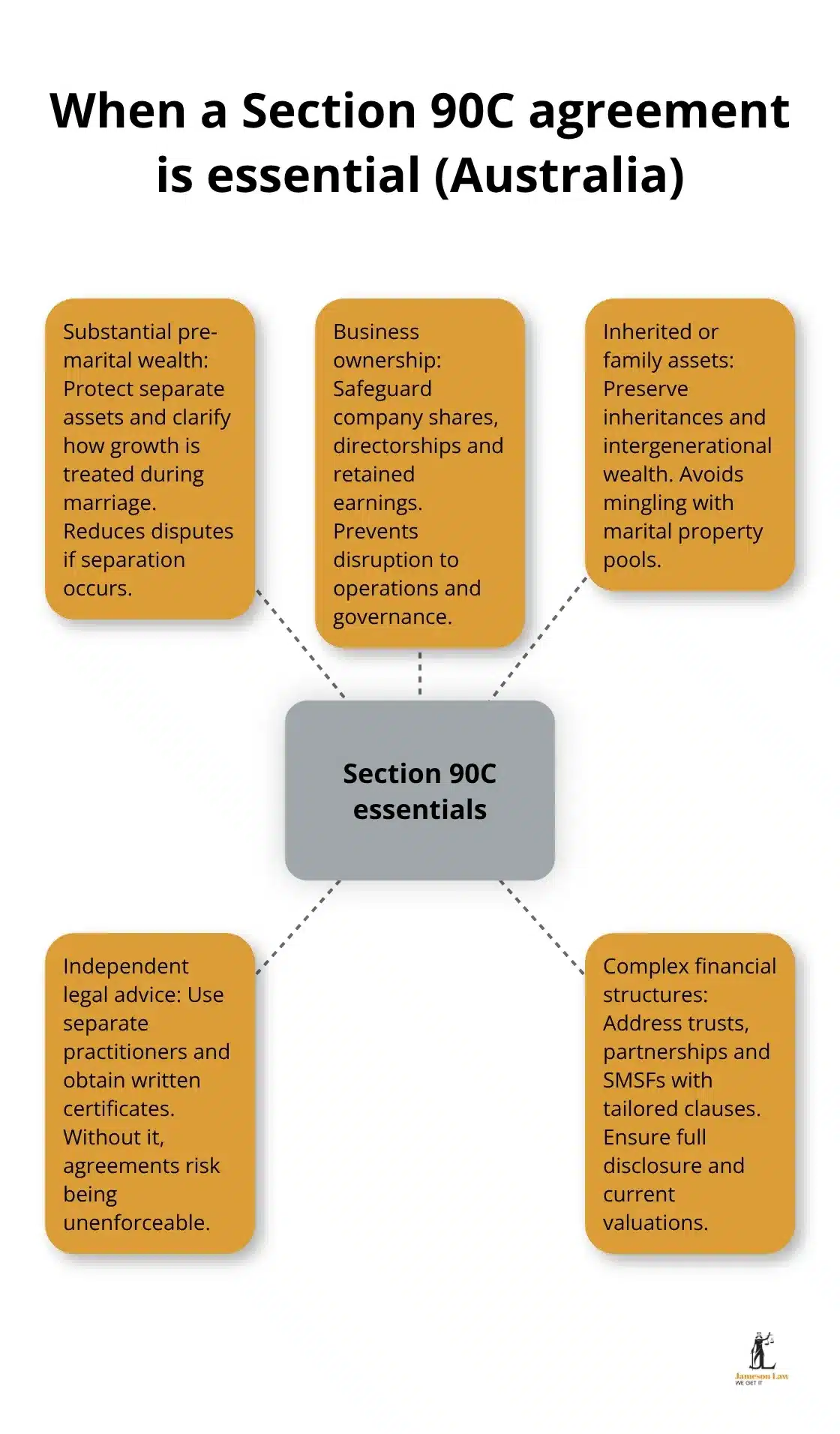

When Section 90C Becomes Essential

You need a Section 90C agreement when significant assets or complex business structures require protection during potential separation. The agreement works best for couples who enter marriage with substantial individual wealth, business owners who want to protect company interests, or those with inherited family assets. Courts have consistently ruled that agreements which lack proper independent legal advice become unenforceable, as demonstrated in the Abrum & Abrum case where inadequate counsel invalidated the entire agreement.

Mandatory Legal Requirements You Cannot Ignore

Both parties must receive independent legal advice from separate practitioners before they sign any Section 90C agreement. Your legal adviser must explain the rights you would have without the agreement and the specific effects of signing it (per Section 90G requirements). Complete financial disclosure remains mandatory, including current property valuations from Certified Practising Valuers and comprehensive asset listings. The agreement must be written, signed by both parties, and include certificates from legal practitioners who confirm independent advice was provided.

Common Enforcement Challenges

Courts can set aside agreements under Section 90K for fraud, failure to disclose material facts, or inadequate legal representation. The Chetri v Thapa case highlights how failure to use separate legal practitioners can invalidate agreements entirely. Rushed consultations or inadequate legal representation often result in court rejections (as seen in Adame & Adame). Property valuations must be current and properly prepared to satisfy disclosure requirements, with courts vigilant about detailed asset descriptions.

Understanding these requirements sets the foundation for success, but the actual application process involves specific documentation and strict procedural steps that demand careful attention.

The Application Process for Section 90C

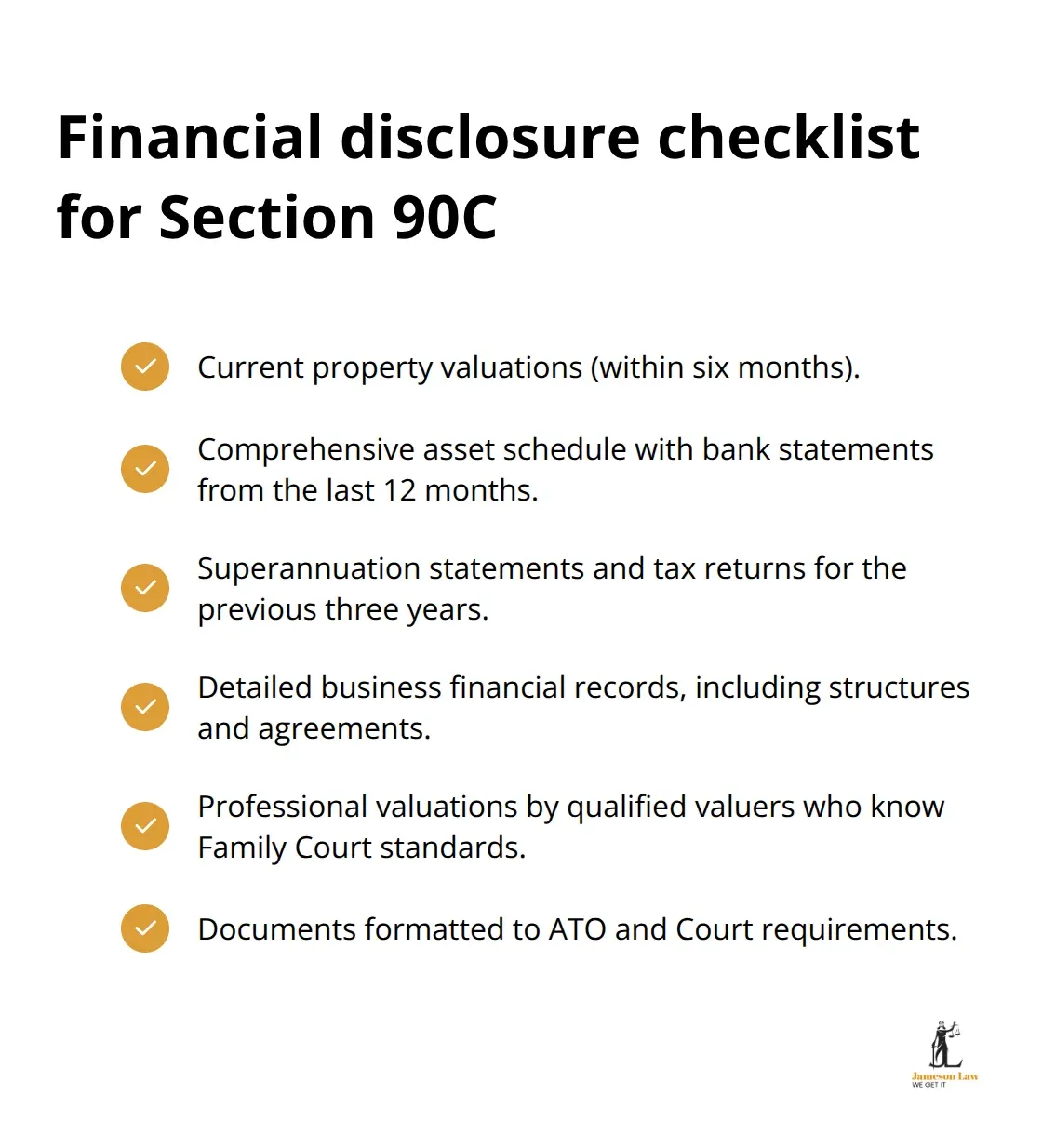

Financial Disclosure Requirements That Courts Demand

Your financial disclosure forms the backbone of any Section 90C application, and courts reject incomplete submissions without hesitation. You must provide current property valuations completed within six months of filing, comprehensive asset schedules that include bank statements from the past 12 months, superannuation statements, tax returns for the previous three years, and detailed business financial records if applicable. The Australian Taxation Office requires specific documentation formats, and courts will delay your case when you miss even one document while you gather additional evidence. Courts particularly scrutinise property valuations and business interests, and they demand professional assessments from qualified valuers who understand Family Court requirements.

Required Forms and Supporting Documents

Applications require an Initiating Application form, supporting affidavits that detail your relationship history and financial contributions, and certificates that confirm independent legal advice was provided to both parties. You must submit witness statements that establish the genuine nature of your relationship, joint bank statements, utility bills, lease agreements, and any correspondence that demonstrates shared financial responsibilities. Courts expect comprehensive documentation that covers the entire relationship period, and incomplete affidavits often result in requests for additional information that extend processing times significantly.

Filing Procedures and Associated Costs

Filing fees for corporations are $5,050 and in any other case $1,735, with potential exemptions available for eligible applicants based on financial hardship criteria (determined through Centrelink assessments). You must lodge all documents through the Federal Circuit and Family Court registry, either in person or through electronic filing systems that require specific formatting standards. Courts process applications in order of receipt, and any errors in documentation or fee payments will push your application to the back of the queue.

Court Processing Timeline and Expectations

In non-urgent matters, it commonly takes one to two years for a matter to progress to a Final Hearing and for a Court to subsequently make Final Orders, though interim hearings for urgent financial protection needs can be scheduled within 6-8 weeks. The Federal Circuit and Family Court manages substantial caseloads across all states. The court follows a structured four-step process when determining property orders, and this systematic approach affects how quickly your case progresses through the system.

Even with perfect documentation and timely filing, many applicants face unexpected challenges that can derail their Section 90C applications entirely.

Common Challenges and How to Overcome Them

Documentation Failures That Courts Reject Immediately

Courts consistently reject applications when financial disclosure fails to meet their strict standards, and the most common failure involves outdated property valuations or incomplete asset schedules. Applications fail when couples submit bank statements that are three months old instead of current ones, or when they provide business financial records that exclude partnership agreements or trust structures. The Chetri v Thapa case demonstrates how one party’s legal practitioner failed to provide proper documentation, which invalidated the entire agreement and cost both parties months of additional legal fees and court delays. Courts demand witness statements that specifically address shared financial responsibilities, and generic statements about cohabitation won’t meet their evidence standards.

Procedural Errors That Destroy Your Case

Incorrect forms and procedures account for the majority of Section 90C application delays, particularly when applicants submit wrong documentation or fail to include required legal practitioner certificates. Courts automatically reject applications when both parties use the same legal adviser, as this violates the independent advice requirement under Section 90G. The most expensive mistake involves applications without proper signatures or with pages that are absent, which pushes your case back to the start of the process queue. Late applications face additional scrutiny, and courts require compelling reasons to grant extensions beyond standard deadlines (often adding 6-12 months to your case timeline).

How to Transform Court Rejections Into Approvals

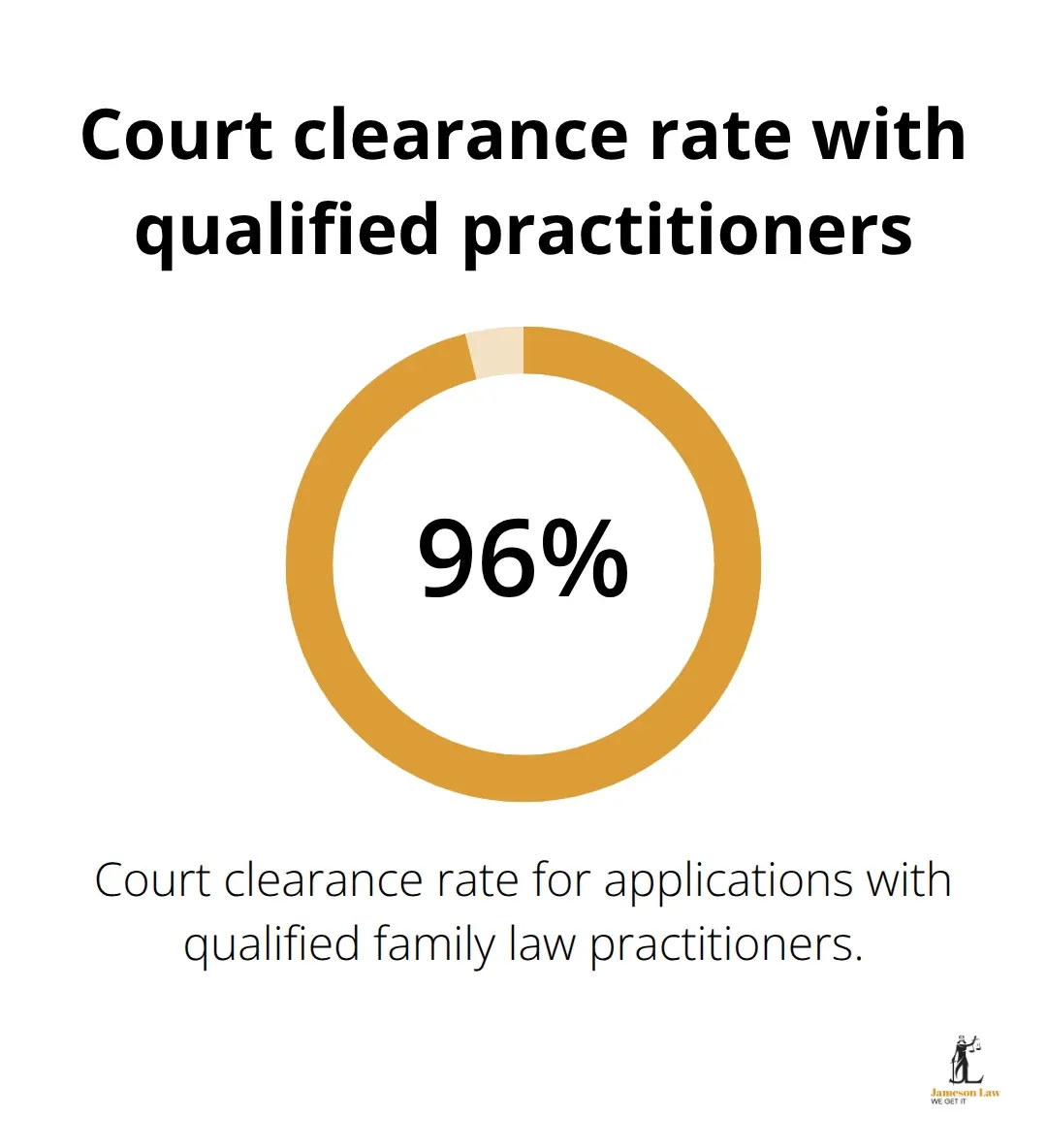

When courts reject your Section 90C application, you have 28 days to address their specific concerns and refile with corrected documentation. The Adame & Adame case shows that vague language in agreements leads to problems with enforcement, so rewritten applications must include precise terms about property division and maintenance obligations. Courts provide detailed reasons for rejection, and successful reapplications directly address each concern with additional evidence or corrected procedures. Professional legal representation becomes essential at this stage, as the Court maintains an impressive clearance rate of 96 per cent for applications with qualified family law practitioners who understand court requirements.

Final Thoughts

Section 90C Family Law Act applications require meticulous attention to detail and strict adherence to court procedures. Courts process comprehensive financial disclosure, independent legal advice for both parties, and precise documentation that meets Federal Circuit and Family Court standards. With over 8,200 property applications processed in 2023-24, courts maintain standards that reject incomplete or improperly prepared submissions.

The complexity of Section 90C applications makes professional legal representation essential rather than optional. Courts reject applications with procedural errors, inadequate financial disclosure, or insufficient independent legal advice. The Chetri v Thapa and Adame & Adame cases demonstrate how technical failures can invalidate entire agreements and cost families significant time and money (often adding 6-12 months to case timelines).

We at Jameson Law provide expert guidance through every stage of your Section 90C application. Our experienced family law team helps clients avoid common pitfalls while meeting all court requirements efficiently. Taking immediate action with qualified legal support protects your interests and maximises your chances of a successful outcome in your family law matter.