Family Law Act Section 75 determines how courts assess financial support needs during property settlements. This section focuses specifically on the ongoing financial requirements of each party after separation.

We at Jameson Law see many clients confused about how Section 75 factors influence their settlement outcomes. Understanding these provisions can significantly impact your financial future after divorce.

What Section 75 Actually Covers

Section 75 of the Family Law Act 1975 addresses the ongoing financial support needs of former spouses after property division occurs. This section specifically empowers courts to make spousal maintenance orders based on each party’s ability to support themselves adequately after separation. Unlike property settlements that divide assets, Section 75 focuses on future financial obligations between former partners.

The Court’s Assessment Framework

Courts examine specific criteria when they determine spousal maintenance under Section 75. The legislation requires judges to consider each party’s age, health status, income capacity, and standard of life during the relationship. Physical or mental health conditions that limit income potential carry significant weight in these decisions.

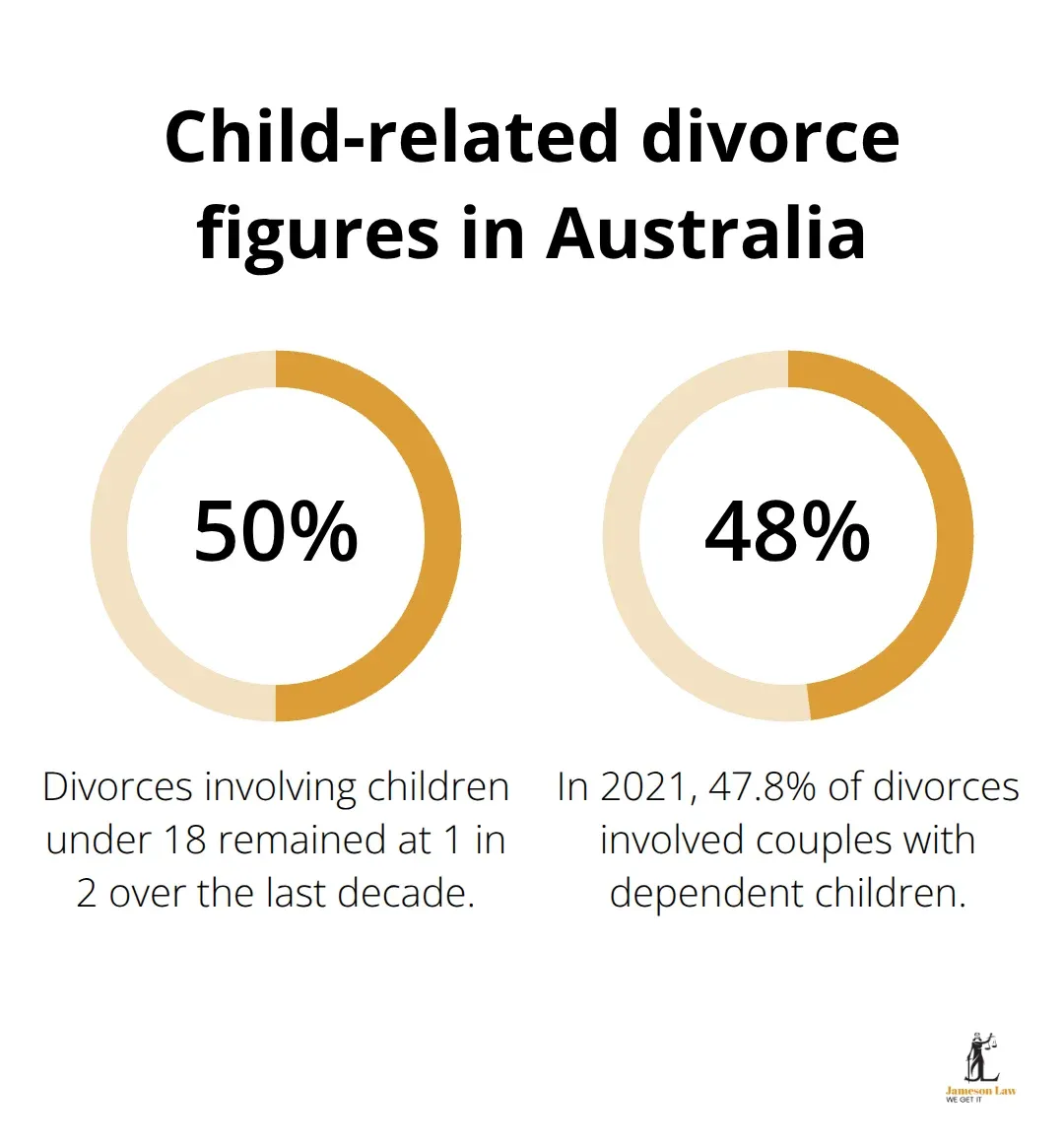

Courts also assess whether one party sacrificed career advancement to care for children or support their partner’s career development. The number of divorces involving children under 18 years remained stable over the last decade at 1 in 2, which makes childcare responsibilities a frequent factor in maintenance determinations.

Key Differences from Property Division

Section 75 maintenance orders serve a fundamentally different purpose than Section 79 property settlements. Property settlements under Section 79 divide assets and debts between parties, while Section 75 creates payment obligations from one spouse to another. Property division typically occurs once at separation, but maintenance payments continue for specified periods or until circumstances change substantially.

Courts can modify Section 75 orders when financial situations alter, whereas property settlements generally remain final. The Family Law Amendment Act 2024 integrated some Section 75 factors into Section 79 assessments, but maintenance orders retain their distinct function.

When Courts Apply Section 75

Courts apply Section 75 when one party cannot adequately support themselves after separation. This situation often arises when one spouse has limited income capacity due to age, health issues, or extended periods out of the workforce. The court must establish that the other party has the financial capacity to provide support without causing undue hardship.

The assessment process considers both parties’ current circumstances and future prospects. Courts examine whether the need for support stems from the relationship itself or pre-existing factors. These detailed evaluations help determine the specific factors that courts must weigh when they assess each party’s financial position.

Section 75 Factors Explained

Financial Resources and Earning Capacity

Courts examine both parties’ current income and their potential to earn money in the future. This assessment goes beyond basic salary figures to include investment returns, rental income, business profits, and government benefits. The Court has power to make financial or property orders in relation to marriages under Part VIII of the Family Law Act 1975, which courts factor into long-term financial capacity evaluations.

The court scrutinises whether either party deliberately reduced their income or assets to avoid maintenance obligations. Judges also consider professional qualifications, work experience, and local job market conditions when they assess earning potential. A qualified accountant who left the workforce for ten years faces different prospects than someone with limited formal education or skills.

Age, Health and Standard of Living Considerations

Physical and mental health conditions significantly influence maintenance determinations. Courts recognise that chronic illnesses, disabilities, or mental health issues can limit work capacity permanently. Age becomes particularly relevant for parties over 50, as Australian employment statistics show job seekers in this age group face longer unemployment periods and reduced earning opportunities.

The standard of living during the relationship establishes a benchmark for post-separation needs. Courts examine housing costs, lifestyle expenses, and financial commitments that existed during the marriage. This analysis helps determine whether one party requires ongoing support to maintain reasonable living standards after property division.

Care Responsibilities for Children Under 18

Primary caregivers often receive favourable consideration under Section 75, especially when children are under 18 years old. Courts acknowledge that childcare responsibilities limit work opportunities, career advancement, and earning capacity. The 2021 divorce statistics show 47.8% of divorces involved couples with dependent children, making this factor highly relevant in many cases.

Career sacrifices made during the relationship carry substantial weight in maintenance decisions. A spouse who reduced work hours, declined promotions, or changed careers to support family needs demonstrates quantifiable financial impact. Courts assess how these decisions affected superannuation contributions, skill development, and future employment prospects when they determine appropriate support levels.

These factors work together to create a comprehensive picture of each party’s financial position. The practical application of these considerations varies significantly across different cases, which explains why courts must examine real-world examples to understand how Section 75 operates in practice.

How Courts Apply Section 75 in Practice

Real Case Examples and Outcomes

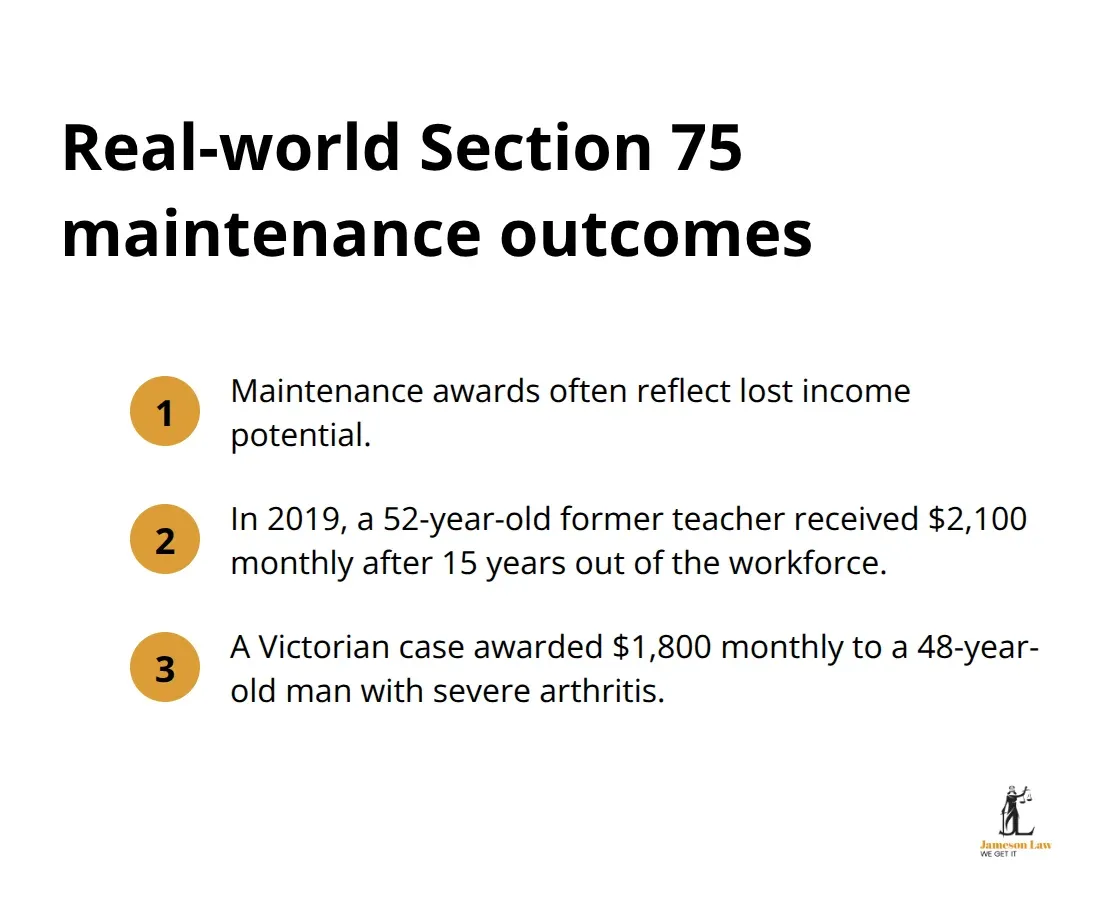

Courts apply Section 75 with significant variation based on individual circumstances. In cases where one spouse sacrificed career advancement for family responsibilities, maintenance awards often reflect lost income potential. A 2019 Federal Circuit Court case awarded a 52-year-old former teacher $2,100 monthly maintenance after she left work for 15 years to raise three children while her husband built a successful medical practice. The court recognised her reduced superannuation balance and limited re-entry prospects in education.

Health-related maintenance decisions show similar practical considerations. Courts regularly award higher maintenance to parties with chronic conditions that limit work capacity. A recent Victorian case involved a 48-year-old man with severe arthritis who received $1,800 monthly support after his construction career ended due to his condition. The court emphasised his inability to retrain for alternative employment given his age and physical limitations.

When Section 75 Takes Priority Over Other Considerations

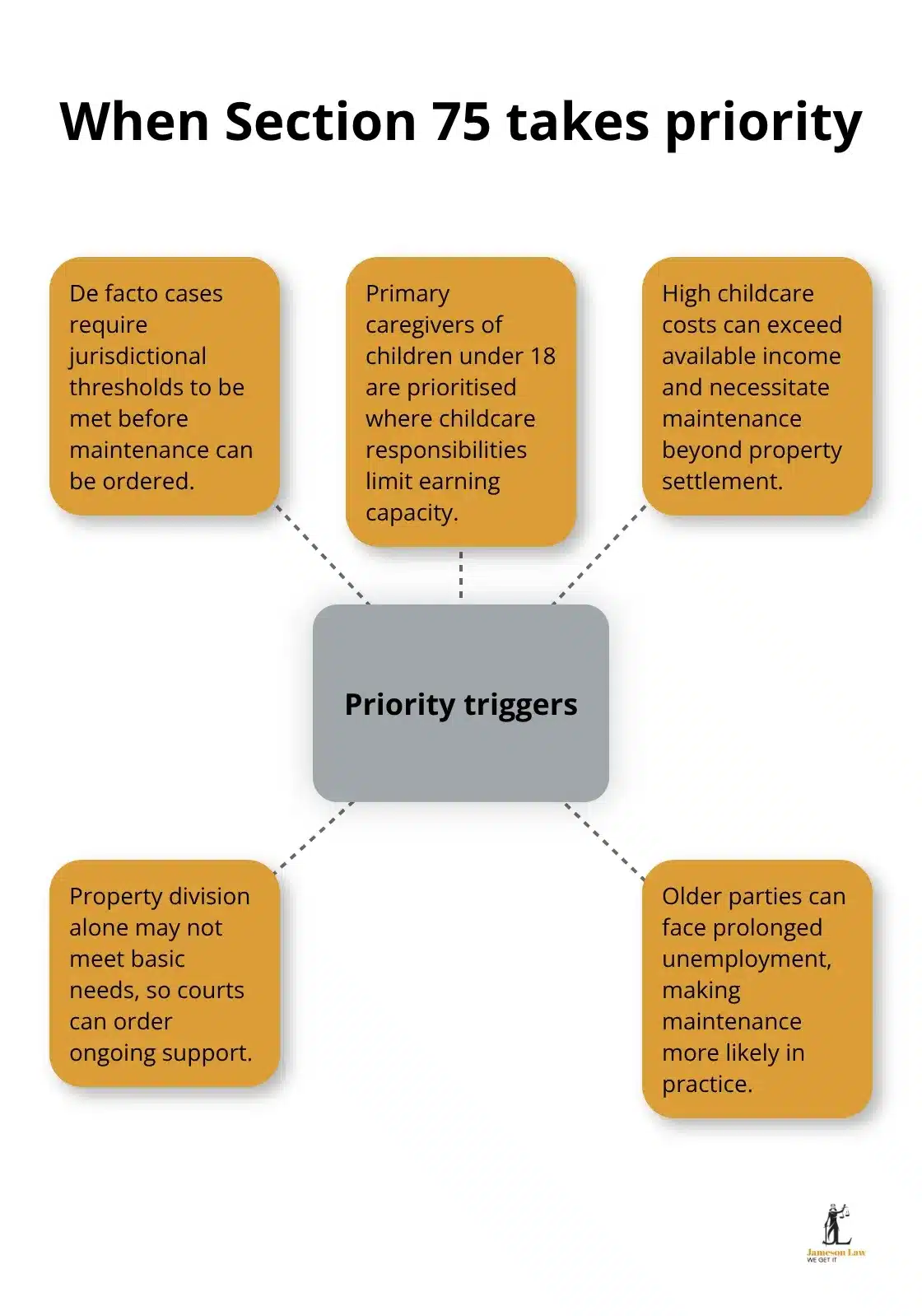

Section 75 takes priority when property division alone cannot meet basic needs. The Court can only make a de facto maintenance order if your de facto relationship meets certain jurisdictional requirements. Courts prioritise maintenance orders for primary caregivers of children under 18, particularly when childcare costs exceed available income. Recent data shows significant childcare expenses that often necessitate support beyond property settlement.

Age discrimination in employment makes Section 75 particularly relevant for older parties. Australian Human Rights Commission data shows job seekers over 55 face unemployment periods that average 68 weeks compared to 20 weeks for younger workers. Courts consistently recognise this reality when they assess income capacity for parties who approach retirement age.

Common Misconceptions About Section 75

Many clients wrongly assume equal property division eliminates maintenance obligations. Courts frequently order payments when one party cannot achieve financial independence through assets alone. Property settlements divide existing wealth, but Section 75 addresses future income needs that assets cannot satisfy.

Another misconception involves the permanence of maintenance orders. Courts can modify Section 75 orders when circumstances change substantially such as remarriage, significant health improvements, or major income increases. This flexibility distinguishes maintenance from property settlements, which typically remain final once completed.

Final Thoughts

Family Law Act Section 75 protects vulnerable parties after relationship breakdown by addressing ongoing support needs. Courts order maintenance when property division alone cannot provide financial independence. This section considers age, health, income capacity, and childcare responsibilities to determine fair support arrangements.

Many people assume equal property division eliminates all financial obligations between former spouses. Courts regularly order maintenance payments when one party cannot support themselves adequately after separation. Section 75 orders adapt to changing circumstances (unlike property settlements that remain final), which provides flexibility for both parties.

Each case involves unique circumstances that require careful analysis of financial capacity and future needs. We at Jameson Law help clients navigate these complex assessments to achieve outcomes that protect their financial security. Professional legal guidance proves essential when courts evaluate maintenance determinations under Family Law Act Section 75.