Buying property in NSW involves multiple stages, legal requirements, and moving parts that can feel overwhelming without proper guidance. At Jameson Law, we’ve helped countless buyers navigate NSW property conveyancing steps smoothly from offer through to settlement.

This guide breaks down exactly what happens at each stage, who you’ll work with, and what to expect on the day you take possession of your new home.

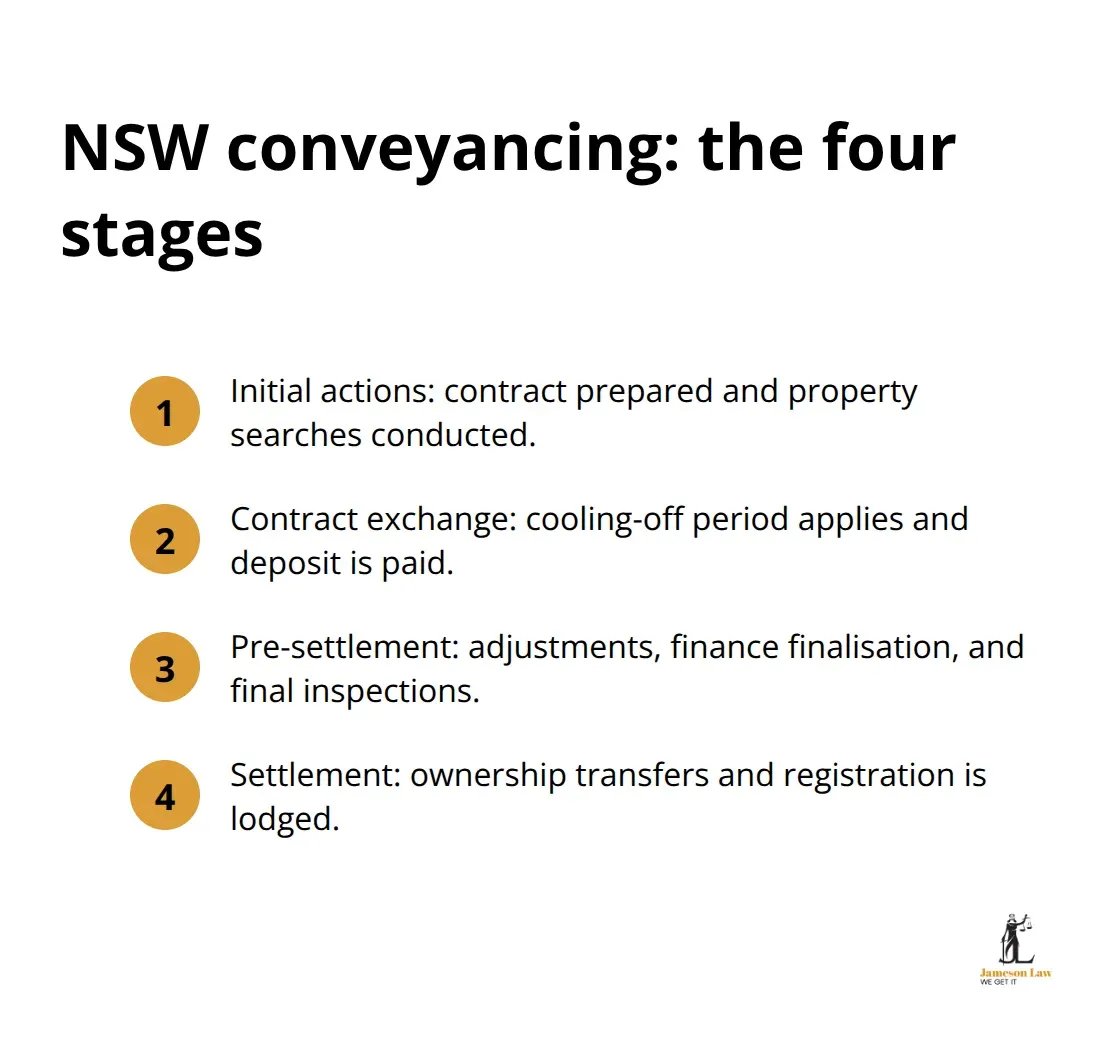

NSW Property Conveyancing: The Four-Stage Process

Conveyancing in NSW is a structured legal process that transfers property ownership from seller to buyer. It covers far more than signing documents. NSW Fair Trading requires that a residential property contract must be prepared by an Australian legal practitioner or licensed conveyancer before marketing can occur. This means the legal framework is embedded into every transaction from the start.

The process involves examining the contract thoroughly, arranging building and pest inspections, obtaining strata inspection reports if applicable, arranging finance, exchanging contracts, paying the deposit, handling stamp duty, preparing and examining mortgage documents, and finally settlement. Most NSW conveyancing follows a four-stage structure: initial actions where the contract is prepared and property searches are conducted, contract exchange with a cooling-off period, pre-settlement adjustments and final inspections, and settlement itself where ownership transfers. Settlement typically occurs 30 to 90 days after exchange, depending on contract terms.

Understanding the Cooling-Off Period

The cooling-off period is a critical protection mechanism. According to NSW Fair Trading, you have five business days after exchange to reconsider, ending at 5pm on the fifth business day. If you withdraw during this window, you pay 0.25% of the purchase price. Off-the-plan contracts allow 10 business days due to their complexity. This cooling-off period can be waived with a 66W certificate or written agreement, but this removes your exit option and increases your risk.

Who Coordinates Your Conveyancing

You’ll work with either a licensed conveyancer or a solicitor. NSW Fair Trading requires conveyancers to hold a licence with NSW Fair Trading, and most hold an unrestricted licence to handle residential, commercial, and rural property. Both solicitors and licensed conveyancers must carry professional indemnity insurance to protect you against negligence. The choice between them often comes down to preference and availability rather than capability, as both are equally qualified to perform conveyancing duties.

Your lender plays another key role. The lender registers a mortgage against the title and provides the funds to complete the purchase on settlement day. Your settlement agent coordinates the exchange of documents and funds between your lender and the seller. If anything goes wrong, the Property Services Compensation Fund administered by NSW Fair Trading may provide access to compensation if a conveyancer misuses client funds. Settlement occurs electronically through the Electronic Lodgment Network, meaning no cheques or paper documents are required. You’ll need to provide your settlement agent with written client authorisation, photo ID, and evidence of land ownership to verify your identity and right to deal in the land.

Critical Dates and Deadlines

Request a copy of the contract early from your agent to allow your conveyancer to review it thoroughly and raise questions before you’re locked in. Changes to the contract must be handled by your solicitor or conveyancer, not the agent. NSW Fair Trading is clear that agents cannot alter contract terms. About 7 to 14 days before settlement, settlement times are scheduled so you can arrange moving crews and logistics.

Conduct a final inspection the morning of settlement to confirm the property is in the same condition as at exchange. Check appliances, hot water systems, heating and cooling, structure and walls, fixtures, locks and keys, and ensure any installed appliances are working. If you’re not confident in conducting these checks yourself, hire a building inspector for a defects inspection.

What Happens on Settlement Day

Settlement itself typically takes about an hour on the day. Your conveyancer ensures any existing mortgage is discharged, removes third-party rights such as caveats, and confirms all contract conditions are fulfilled before transfers are registered with NSW Land Registry Services. Council and water rates searches are ordered to identify delinquent payments, and your conveyancer notifies councils and water authorities of the ownership change. You must also notify gas and power providers yourself. After settlement completes, the transfer of land and mortgage is formally registered with the title office to effect the title change. Once this registration is complete, you can collect the keys from the agent and take possession of your new property.

What to Check Before Settlement

Order Inspections Immediately After Exchange

The period between contract exchange and settlement is when problems surface. You have anywhere from 30 to 90 days to investigate the property thoroughly, and this is not the time to skip steps. Start by ordering a building and pest inspection immediately after exchange. These inspections help you understand the condition of the property and avoid problems and costs.

If the property is in a strata scheme, obtain a strata inspection report as well. These reports reveal financial, legal, and management insights that directly affect your ownership costs. Request copies of all council and water rates from your conveyancer to check for arrears or outstanding obligations.

Verify Title and Identify Hidden Issues

Your conveyancer will conduct title searches to ensure there are no outstanding interests or caveats on the property that could affect your ownership. NSW Fair Trading advises checking for government authority interests in the land, such as local council or Transport for NSW, and assessing any planned development that could affect your property. Don’t assume the contract is final either. NSW Fair Trading is explicit that real estate agents cannot modify contracts, so any changes must go through your conveyancer or solicitor and be confirmed with the vendor’s legal representative.

Review the contract line by line with your conveyancer. Ambiguous settlement dates, missing chattels, or unclear responsibility for rates adjustments create disputes later. This careful review protects you from costly misunderstandings.

Act Quickly on Defects and Negotiate Solutions

If inspections reveal defects, act quickly. You have limited time to negotiate repairs or price reductions before settlement becomes binding. Request written quotes from tradespeople for any major issues and present these to the vendor’s conveyancer with a formal request for adjustment or remediation. If the vendor refuses and the defects are serious, you may have grounds to renegotiate or withdraw, though you’ll lose your deposit if you’re outside the cooling-off period.

Council and water rate adjustments must be calculated precisely at settlement-your conveyancer handles this, but verify the figures yourself. Check whether stamp duty applies to your purchase and understand the amount owed, as this is a separate cost from the purchase price.

Arrange Insurance and Confirm Settlement Details

Arrange building and contents insurance to be effective from your purchase date, not from settlement day, to protect the property from the moment you exchange contracts. If you’re refinancing to a new lender rather than purchasing, the settlement process is simpler, but you still need your conveyancer to verify the new loan terms and ensure discharge of your existing mortgage occurs on time.

About 7 to 14 days before settlement, confirm the settlement time with your conveyancer so you can arrange moving logistics and utilities disconnection and connection. This coordination ensures everything aligns smoothly when settlement day arrives, and your conveyancer will guide you through the final steps that lead directly into the settlement process itself.

Settlement Day: What Happens in the Final Hour

Settlement day moves quickly if you’ve prepared properly. Your conveyancer handles most of the work, but understanding what occurs during that final hour keeps you in control.

The Settlement Process Takes About One Hour

Settlement itself takes approximately 60 minutes from start to finish. Your conveyancer coordinates with your lender to transfer funds electronically to the seller’s account. No cheques change hands. No paper documents move across a desk. Everything flows through electronic completion, a digital platform that performs settlement quickly and securely. Once your lender confirms the funds have arrived in the seller’s account, your conveyancer discharges any existing mortgage against the property and removes third-party rights such as caveats. Your conveyancer verifies that all contract conditions have been fulfilled, then lodges the transfer documents with NSW Land Registry Services for examination and registration.

Managing Rates, Utilities, and Ownership Transfer

Council and water rates searches are ordered to identify any delinquent payments, and your conveyancer notifies the local council and water authority of the ownership change. You must notify gas and electricity providers separately to arrange disconnection at the seller’s address and connection at your new property. Once NSW Land Registry Services registers the transfer, you officially own the property. Your conveyancer sends you a final settlement letter confirming completion and funds received. At this point, you collect the keys from the real estate agent and take possession.

Conduct Your Final Walkthrough

The morning of settlement, conduct a final inspection to confirm the property matches the condition at exchange. Check that all fixtures, fittings, and inclusions listed in the contract are still in place and in good working order. If serious defects appear on settlement day that weren’t previously disclosed, contact your conveyancer immediately before settlement is finalised.

Your Responsibilities After Settlement Completes

After settlement completes and title transfers into your name, you become responsible for all ongoing council rates, water rates, and any body corporate levies if applicable. The seller pays these charges only up to settlement day. Move in, notify your service providers of the address change, and begin managing your new property and loan repayments. Within 7 to 14 days after settlement, you’ll receive confirmation from NSW Land Registry Services that your name appears on the title (this serves as your final proof of ownership).

Final Thoughts

NSW property conveyancing steps from offer to settlement demand attention at every stage, and skipping corners costs money and creates stress. We at Jameson Law have seen buyers lose thousands because they rushed through inspections, ignored title searches, or failed to verify settlement details with their conveyancer. The most common mistake is assuming the contract is final without review-real estate agents cannot alter terms, so any changes must flow through your conveyancer or solicitor.

Ordering inspections too late ranks as another frequent error that buyers make. You need building and pest reports immediately after exchange to negotiate repairs or price reductions while you still have leverage, and strata inspection reports reveal financial and legal issues that directly affect your ownership costs. Council and water rate searches must be checked for arrears before settlement, and stamp duty calculations need verification to avoid surprises at the final hour.

Settlement day itself moves quickly if you have prepared properly, with your conveyancer handling the electronic transfer of funds, discharge of existing mortgages, and lodgement with NSW Land Registry Services. You conduct a final walkthrough that morning to confirm the property matches the condition at exchange, then collect the keys once registration completes. Contact Jameson Law to speak with our conveyancing team and start your property journey with clarity and expert guidance.