Car accidents can be life-changing events, often resulting in injuries that require extensive medical treatment and recovery time. At Jameson Law, we frequently encounter clients wondering: does car insurance cover injury claims?

The answer isn’t always straightforward, as it depends on various factors including the type of insurance policy, the severity of injuries, and the circumstances of the accident. This guide breaks down the different types of car insurance coverage in Australia and explains how they relate to injury claims.

Types of Car Insurance in Australia

Car insurance in Australia comes in several forms, each offering different levels of protection. Understanding these options helps you make informed decisions about your coverage.

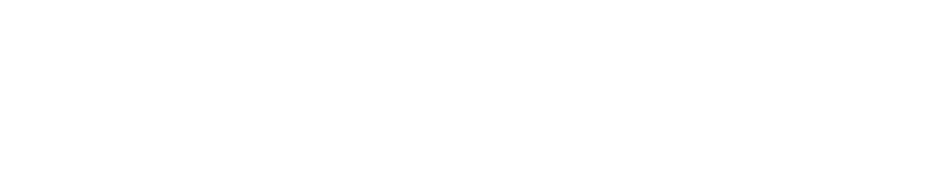

Compulsory Third Party (CTP) Insurance

CTP insurance is mandatory in Australia. It covers the cost of compensation claims of injury to others. States and territories manage CTP differently. The State Insurance Regulatory Authority (SIRA) reports that CTP premiums in NSW have decreased by an average of $124 since the 2017 reforms, making it more affordable for drivers.

Comprehensive Car Insurance

Comprehensive insurance offers the highest level of protection. It covers damage to your car, other vehicles, and property, as well as theft and weather-related incidents. Some policies may also include personal injury coverage for drivers and passengers.

Third Party Property Damage Insurance

This type of insurance covers damage you cause to other people’s property (but not your own vehicle). It’s a more affordable option for those with older cars or tight budgets. However, it does not generally extend to personal injury compensation.

Third Party Fire and Theft Insurance

This policy sits between Third Party Property Damage and Comprehensive insurance. It covers damage to other people’s property, plus fire damage or theft of your own vehicle. It’s a good middle-ground option for those who want more protection than basic third-party cover but can’t afford comprehensive insurance.

Many Australians are underinsured, which can lead to significant financial stress after an accident. It’s important to review your policy regularly to ensure it meets your current needs and circumstances. The next section explains how these different types of insurance cover injury claims.

How Car Insurance Covers Injury Claims

CTP Insurance: Your Primary Protection

CTP insurance forms the foundation of injury claim coverage in Australia. All states and territories mandate this insurance, typically included in vehicle registration. CTP insurance covers personal injury claims after motor vehicle accidents, regardless of fault.

Expanded Coverage Options

While CTP insurance offers essential protection, its scope remains limited. Many Australians choose additional insurance policies for more comprehensive coverage. Comprehensive car insurance often includes personal injury cover for the policyholder and passengers.

The level of protection varies between insurers. Some policies cover medical expenses, while others include income replacement. Always review the Product Disclosure Statement (PDS) carefully to understand your entitlements.

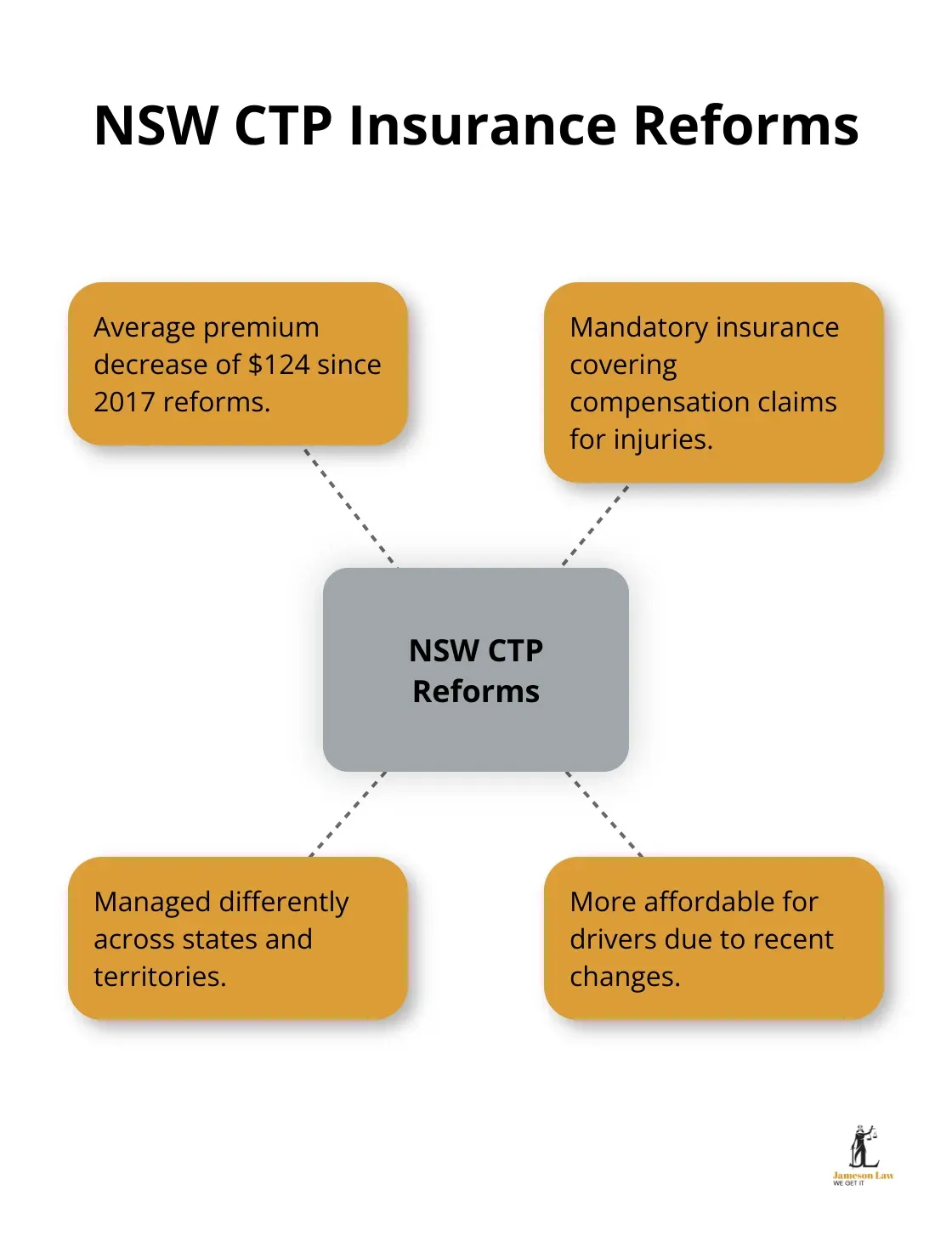

The Claims Process Explained

Involvement in an accident resulting in injury initiates a complex claims process. Here’s what you can expect:

Many individuals find this process challenging to navigate alone. Seeking No Win No Fee solicitors often proves beneficial to ensure you receive the full compensation you’re entitled to.

Time Limits and Legal Considerations

Time limits apply for lodging injury claims. In NSW, you must lodge a personal injury benefits claim within 3 months of the accident. Prompt action in seeking advice and initiating the process is crucial. At Jameson Law, we guide clients through strict deadlines to protect their rights.

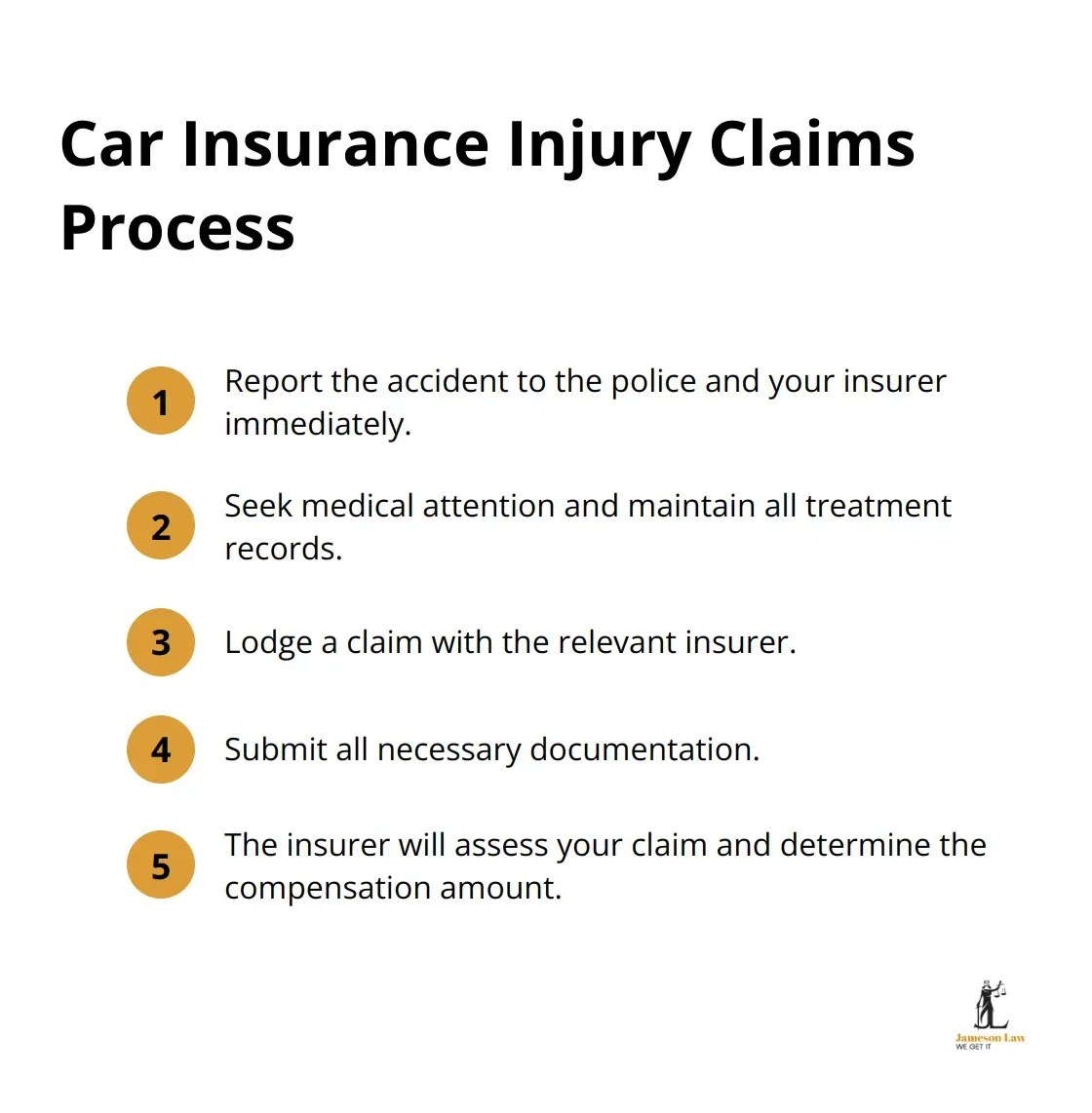

Factors Affecting Injury Claim Coverage

Injury Severity and Long-Term Impact

The severity of your injuries significantly affects the coverage you’ll receive. Minor injuries may result in smaller claims, while severe injuries can lead to substantial compensation. If long-term rehabilitation or inability to work applies, these factors increase the compensation calculation.

Fault and Liability Assessment

In Australia, contributory negligence can impact claims. If you’re partly at fault, your payout may be reduced. For example, if deemed 20% responsible, your compensation claim could be reduced by 20%. In NSW, being more than 50% at fault may bar you from damages for pain and suffering.

Policy Specifics and Exclusions

Your insurance policy’s terms and exclusions matter greatly. Some policies exclude claims if you were under the influence of alcohol or drugs. Reviewing your PDS is critical, and Jameson Law solicitors can help interpret these provisions.

State-Specific Regulations

Each state and territory has unique rules governing motor vehicle accident claims. In WA, you have three years to file a claim; in Victoria, it may extend to six years. These variations mean it’s essential to get tailored legal advice for your situation.

Final Thoughts

Car insurance coverage for injury claims varies based on policy type, injury severity, and state regulations. Adequate coverage provides peace of mind and financial protection, assisting with medical expenses, rehabilitation, and lost income. This allows you to focus on recovery instead of financial stress.

At Jameson Law, our No Win No Fee solicitors specialise in car accident injury claims and will help you secure fair compensation. For tailored guidance and representation, contact us today.