At Jameson Law, we understand the unique challenges self-employed individuals face when it comes to protecting their income and health.

Personal injury insurance for self-employed workers is a vital safety net that can provide financial security in case of accidents or illnesses.

This guide will explore the various options available for personal injury insurance when self-employed, helping you make informed decisions about your coverage.

We’ll also discuss key factors to consider when choosing a policy, ensuring you find the right protection for your specific needs.

What Is Personal Injury Insurance for Self-Employed Workers?

Definition and Purpose

Personal injury insurance for self-employed workers serves as a financial safety net. It protects your income if you can’t work due to an injury or illness. As a self-employed individual in Australia, you don’t have employer-provided sick leave or workers’ compensation. This makes personal injury insurance an essential part of your financial planning.

The Significance for Self-Employed Individuals

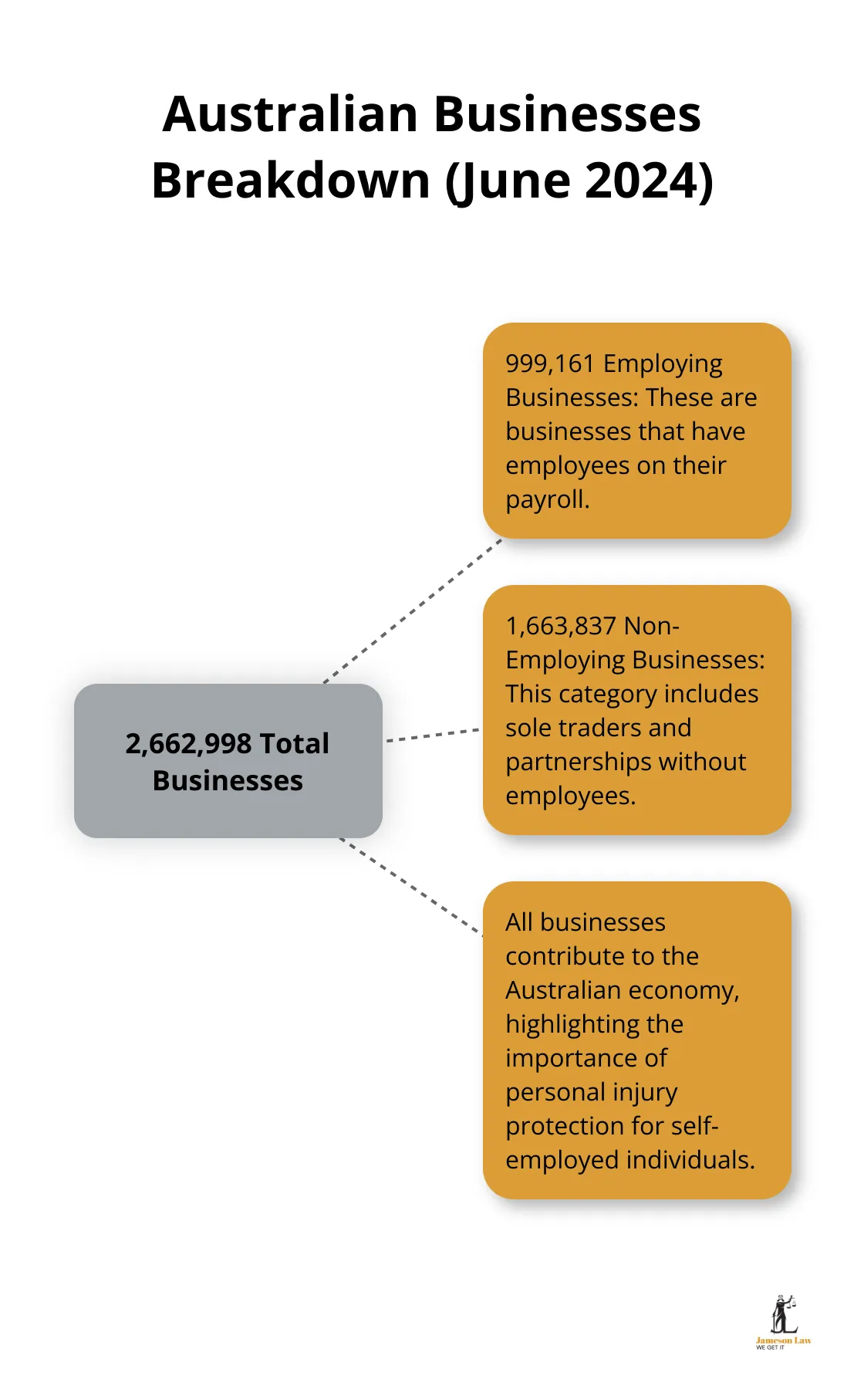

Self-employed workers face unique risks. An injury or illness could wipe out your entire income overnight. The Australian Bureau of Statistics reports that as of June 2024, there were 2,662,998 actively trading businesses in Australia. Approximately 999,161 of these were employing businesses. This large number underscores the need for personal injury protection.

Personal injury insurance can cover a portion of your regular income, depending on your chosen policy. This financial buffer helps you maintain your lifestyle, pay bills, and keep your business afloat during recovery.

Types of Coverage in Australia

Australia offers several types of personal injury insurance for self-employed workers. Each provides different levels of protection and benefits:

Income Protection Insurance

This insurance type provides regular payments if you can’t work due to illness or injury. You can customise waiting periods and benefit periods to suit your needs.

Total and Permanent Disability (TPD) Insurance

TPD insurance pays a lump sum if you become totally and permanently disabled and can’t return to work. It helps cover medical expenses, rehabilitation costs, and long-term living expenses.

Trauma Insurance

Also known as critical illness insurance, this policy pays a lump sum if you’re diagnosed with a specific serious illness or injury (such as cancer, heart attack, or stroke). It helps cover immediate medical costs and provides financial support during recovery.

Personal Accident Insurance

This insurance type specifically covers injuries resulting from accidents. It’s often more affordable than comprehensive income protection insurance but offers more limited coverage.

When selecting personal injury insurance, you must carefully consider your specific needs and circumstances. Factors such as your income, savings, debts, and family situation should all influence your choice of coverage level and type.

As we move forward, let’s explore the various options for personal injury insurance available to self-employed individuals in more detail.

Personal Injury Insurance Options for Self-Employed Australians

Income Protection Insurance

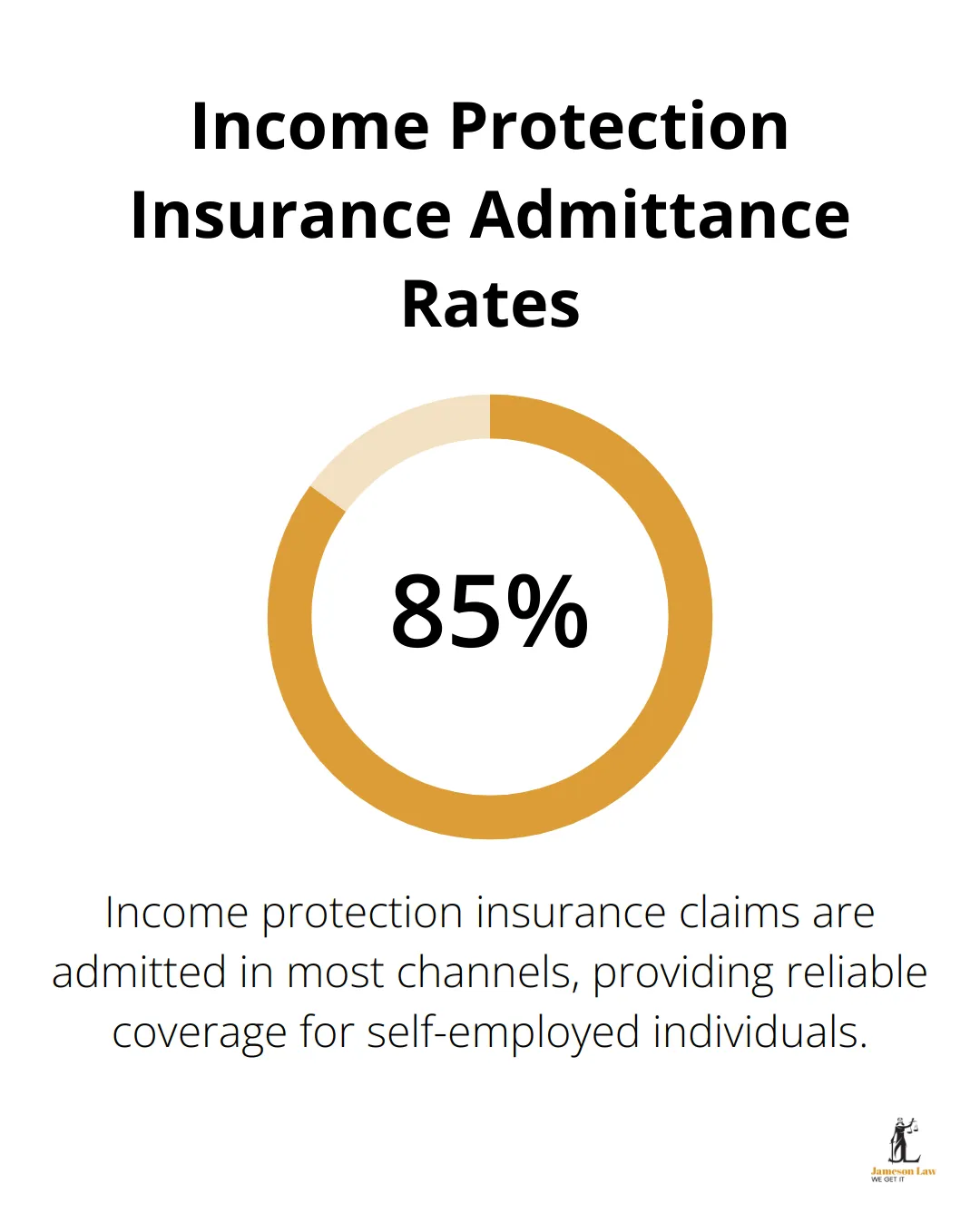

Income protection insurance stands out as a top choice for self-employed individuals in Australia. This type of insurance provides regular payments (typically up to 75% of your pre-tax income) if you can’t work due to illness or injury. Income protection insurance has shown admittance rates above 85% in most channels.

When you select an income protection policy, you must consider the waiting period and benefit period. Waiting periods range from 14 days to 2 years, while benefit periods can extend from 2 years to age 65. Longer waiting periods often result in lower premiums but require you to rely on savings for a longer time before receiving benefits.

Total and Permanent Disability (TPD) Insurance

TPD insurance offers a lump sum payment if you become permanently disabled and can’t return to work. This insurance helps cover medical expenses, rehabilitation costs, and ongoing living expenses. TPD insurance claims had an industry average acceptance rate of 83% in 2023, with an average processing time of 7.3 months.

As you choose a TPD policy, pay close attention to the definition of disability. ‘Any occupation’ policies cost less but make claims more difficult, while ‘own occupation’ policies provide more comprehensive coverage for your specific profession.

Trauma Insurance

Trauma insurance (also known as critical illness insurance) pays a lump sum if doctors diagnose you with a specific serious illness or injury. Common covered conditions include cancer, heart attack, and stroke.

When you consider trauma insurance, review the list of covered conditions carefully. Some policies offer more comprehensive coverage than others. Also, evaluate how the benefit amount aligns with your potential medical and living expenses.

Personal Accident Insurance

Personal accident insurance specifically covers injuries resulting from accidents. This type of insurance often costs less than comprehensive income protection insurance but offers more limited coverage. It can serve as a good option if you work in a high-risk industry or participate in dangerous activities.

Personal accident insurance typically provides weekly benefits if you can’t work due to an accidental injury. Some policies also include a lump sum payment for permanent disability or death resulting from an accident.

WorkCover for Sole Traders

In some Australian states, sole traders can opt into the WorkCover scheme. This provides coverage similar to what employees receive, including weekly payments if you can’t work due to a work-related injury or illness, and coverage for medical expenses.

However, WorkCover only covers work-related injuries and illnesses, unlike personal injury insurance which often provides 24/7 coverage. The eligibility and terms for sole traders vary by state, so check with your local WorkCover authority for specific details.

As you weigh these options, consider how each type of insurance fits your specific needs and circumstances. Your income, savings, debts, and family situation should all influence your choice of coverage. The next section will guide you through the key factors to consider when selecting personal injury insurance, helping you make an informed decision to protect your financial future.

How to Choose the Right Personal Injury Insurance

Self-employed individuals in Australia must carefully select personal injury insurance to protect their financial security. This chapter outlines key factors to consider when choosing coverage.

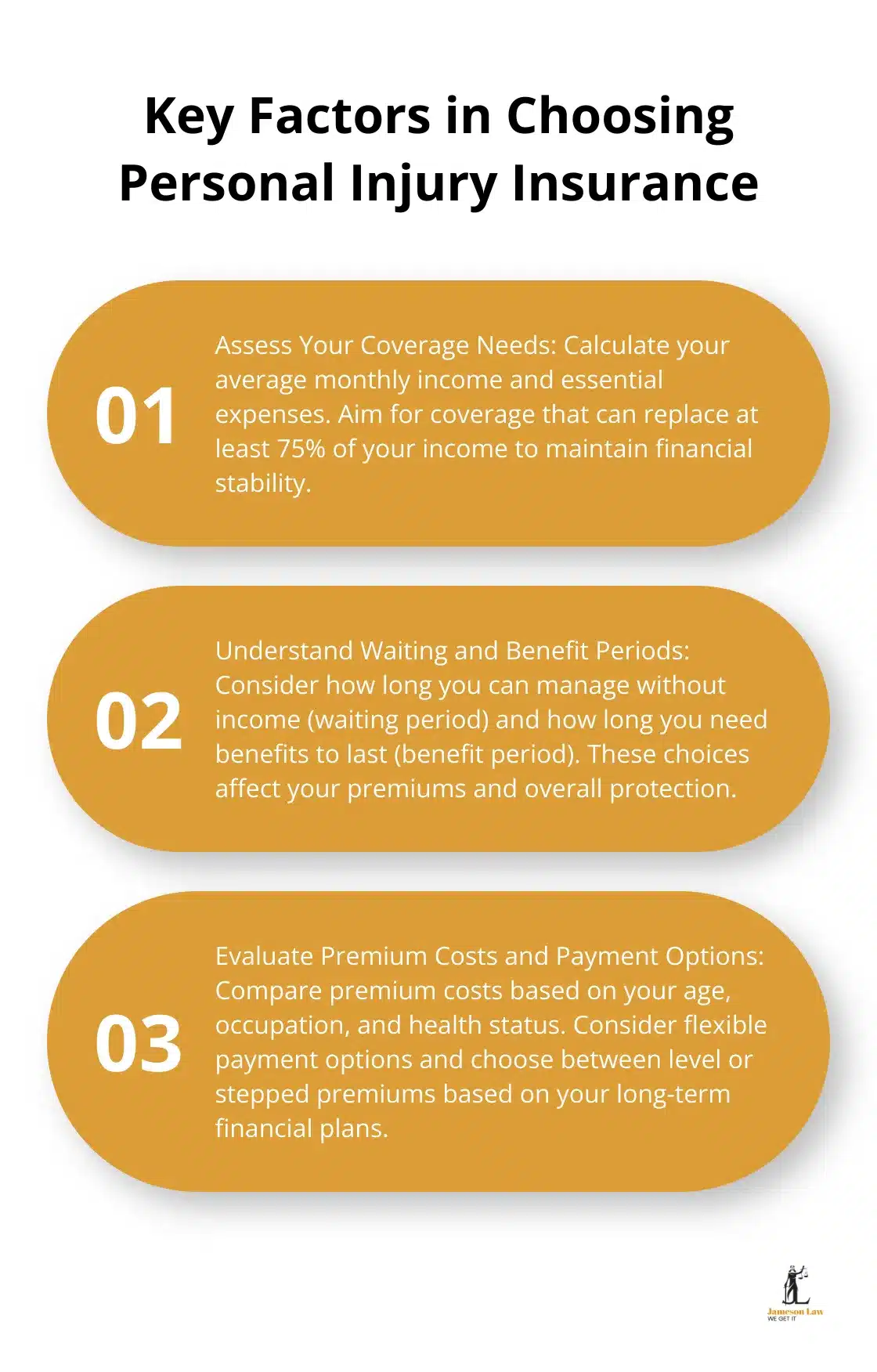

Assess Your Coverage Needs

The first step in selecting personal injury insurance involves a thorough evaluation of your financial situation. Calculate your average monthly income over the past 12 months and list all essential expenses (including mortgage or rent, utilities, food, and business overheads). The Australian Securities and Investments Commission (ASIC) reports that the average Australian household spends $74,301 per year on living expenses. Try to secure coverage that can replace at least 75% of your income.

Understand Waiting and Benefit Periods

Waiting periods and benefit periods significantly impact personal injury insurance policies. Waiting periods (the time before you start receiving benefits) typically range from 14 to 90 days in Australia. Longer waiting periods often result in lower premiums but require more savings to cover the gap.

Benefit periods determine the duration of payments, ranging from 2 years to age 65. Consider this when selecting your benefit period.

Evaluate Premium Costs and Payment Options

Premium costs vary based on factors such as age, occupation, health status, and coverage level. Risk assessment by insurers evaluates the likelihood and potential cost of risks to determine premiums through the process of underwriting.

Insurers offer flexible payment options, including monthly, quarterly, or annual payments. Some policies feature level premiums (stable over time) or stepped premiums (increase with age). Your cash flow and long-term financial plans should guide your choice between these options.

Compare Multiple Insurers

Obtain quotes from several insurers and compare them carefully. Look beyond premium costs and consider overall policy value, including coverage limits, waiting periods, and additional benefits. The cheapest policy doesn’t always provide the best protection. Strive to find a balance between affordability and comprehensive coverage that meets your specific needs as a self-employed individual.

Review Policy Exclusions and Limitations

Carefully examine policy exclusions and limitations before making a decision. Some policies may not cover pre-existing conditions or certain high-risk activities. Understanding these restrictions helps you avoid surprises when filing a claim. (It’s advisable to consult with a financial advisor or insurance specialist to clarify any complex terms or conditions.)

Final Thoughts

Personal injury insurance for self-employed individuals protects against financial hardship due to injury or illness. Self-employed workers in Australia face unique risks without employer-provided benefits, making this insurance essential. We recommend you assess your coverage needs, understand waiting periods and benefit durations, and compare options from multiple insurers to find the best value for your situation.

The process of choosing the right personal injury insurance for self-employed individuals can be complex. Our team at Jameson Law can guide you through the intricacies of personal injury claims and help you understand your rights and options. We advise you to seek professional advice to find personalised solutions that fit your unique circumstances.

Personal injury insurance for self-employed workers is an investment in your financial security and peace of mind. You should not leave your future to chance. Take action today to safeguard your self-employed career against unexpected setbacks (this includes reviewing policy exclusions and limitations to avoid surprises when filing a claim).