At Jameson Law, we understand the importance of protecting yourself and others on the road. Third party personal injury insurance is a vital safeguard for drivers in Australia.

This guide will walk you through the process of obtaining the right coverage for your needs. We’ll explore the key factors to consider and provide practical steps to secure your policy.

What Is Third Party Personal Injury Insurance?

The Basics of CTP Insurance

Third party personal injury insurance, also known as Compulsory Third Party (CTP) insurance in Australia, is a legal requirement for all registered vehicles. This insurance covers the cost of compensation claims of injury to others if you’re at fault in a car accident.

CTP insurance is mandatory in Australia, but the specifics can vary by state. States and territories manage CTP differently. In Queensland, New South Wales, and the Australian Capital Territory, drivers can choose their CTP provider. In other states, it’s included in your registration fees.

The Motor Accident Insurance Commission (MAIC), which oversees the CTP scheme in Queensland, reports on the distribution of CTP premiums. This highlights the significant impact this insurance has on protecting Australians involved in road accidents.

CTP vs Comprehensive Car Insurance

It’s important to understand that CTP insurance doesn’t cover damage to your own vehicle or property. For that, you need comprehensive car insurance. Here’s a quick breakdown:

CTP Insurance:

- Covers injuries to others in accidents you cause

- Mandatory for all registered vehicles

- Doesn’t cover vehicle damage

Comprehensive Car Insurance:

- Covers damage to your vehicle and others’ property

- Optional but recommended

- Doesn’t replace the need for CTP

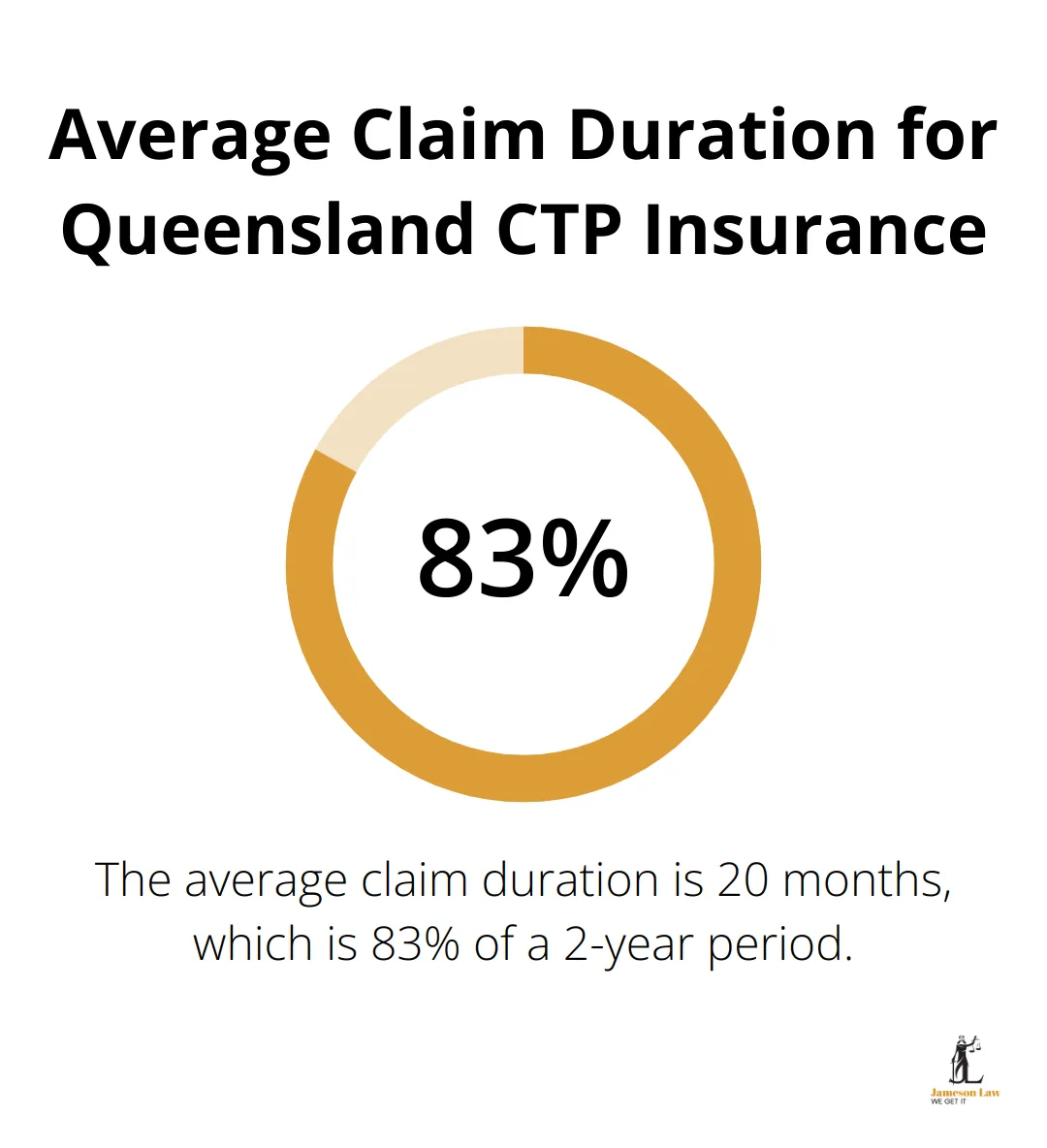

The Claims Process

If you’re involved in an accident, understanding the claims process is vital. For legally represented claimants, the average claim duration can vary. In 2023-2024, the average claim duration for Queensland third-party car accident insurance policies was 20 months to settle.

Proper legal representation can significantly impact the outcome of a CTP claim. Experienced lawyers (like those at Jameson Law) can navigate the complexities of these claims efficiently, potentially leading to better outcomes for claimants.

Importance of Proper Coverage

The State Insurance Regulatory Authority (SIRA) in New South Wales emphasises that CTP insurance is essential for protecting yourself financially. Without it, you could be personally liable for substantial medical and rehabilitation costs if you cause an accident.

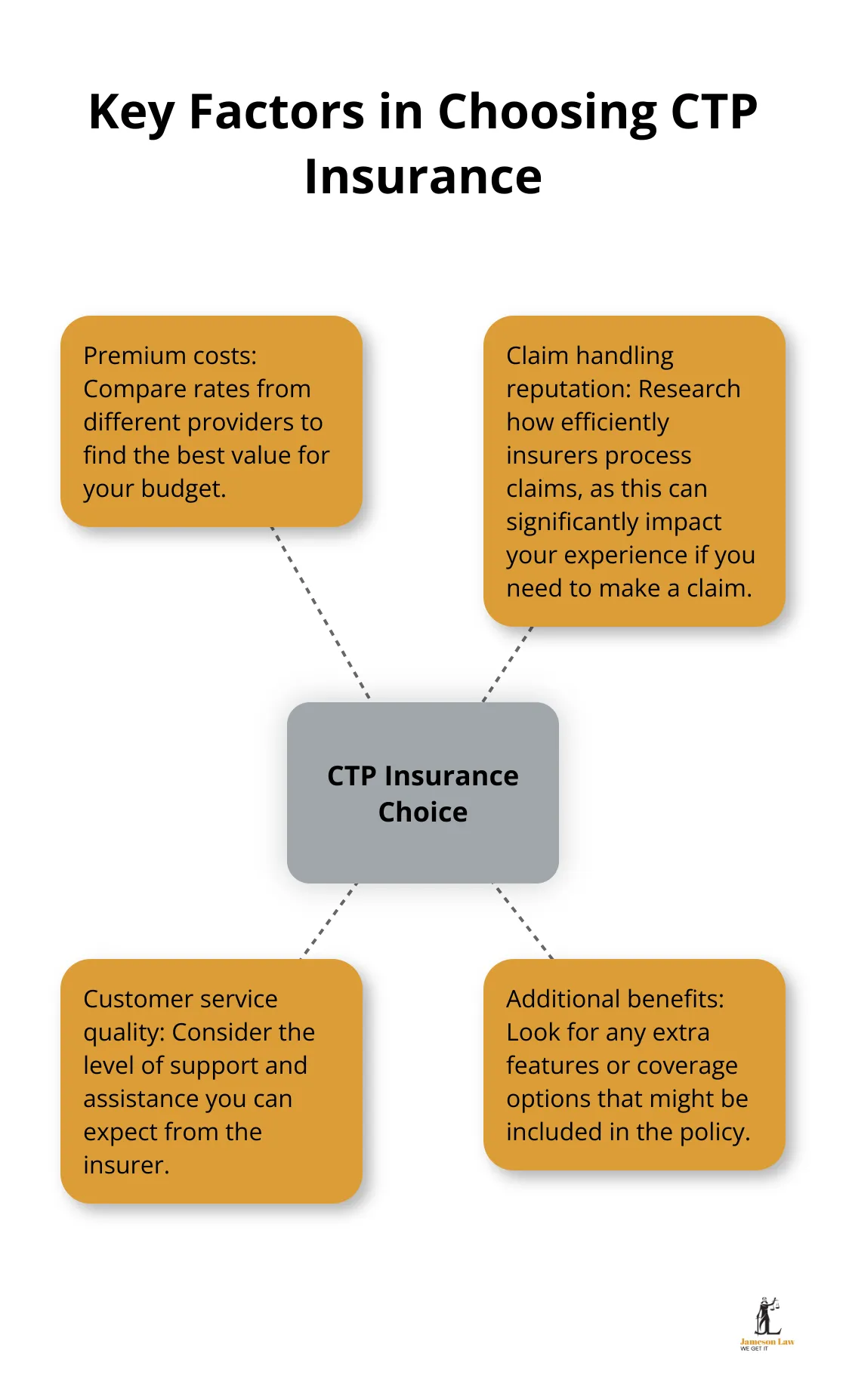

Choosing the Right CTP Provider

When selecting a CTP provider (in states where you have a choice), consider factors such as:

- Premium costs

- Claim handling reputation

- Customer service quality

- Additional benefits offered

Try to compare at least three different providers before making your decision. This comparison can help you find the best value for your specific circumstances.

As we move forward, let’s explore how to choose the right third party personal injury insurance for your needs, considering various factors that can influence your decision.

How to Choose the Best CTP Insurance

Evaluating CTP Providers

Selecting the right Compulsory Third Party (CTP) insurance is a critical decision for Australian drivers. While CTP is mandatory, the choice of provider and policy can significantly impact your coverage and financial security.

The Insurance Council of Australia provides policy recommendations for the next Federal Government that will protect Australians and improve affordability for homeowners and businesses. Consider these recommendations when comparing CTP providers. Look beyond just the premium cost and consider the insurer’s claim handling reputation and customer service quality.

However, smaller providers might offer more personalised service. RACQ performed best in terms of time from claim inception to resolution but then came in fourth position from the date of resolution to paying. This efficiency can prove valuable if you ever need to make a claim.

Understanding Policy Details

You must read and understand your policy’s terms, conditions, and exclusions thoroughly. The State Insurance Regulatory Authority (SIRA) in New South Wales provides resources to help drivers understand these complex documents.

Pay close attention to:

- Coverage limits

- Exclusions (situations where you might not be covered)

- Additional benefits (some providers offer extras like limited coverage for at-fault drivers)

Considering Your Specific Needs

Your personal circumstances should guide your CTP insurance choice. Factors to consider include:

- Your vehicle type (premiums can vary based on this)

- Your driving history (past claims or traffic offences may affect your premium)

- Your location (some areas have higher accident rates, which can influence pricing)

If you’re entitled to Input Tax Credits (ITCs), be aware that your premiums might be higher. This is because the claims costs associated with ITC-entitled policyholders are typically higher.

Seeking Expert Advice

The complexities of CTP insurance can challenge many drivers. While we can’t recommend specific insurers, legal professionals can help you understand the implications of different policy features. Your future financial security may depend on making an informed choice.

Now that you understand how to choose the best CTP insurance, let’s move on to the practical steps you need to take to obtain your coverage.

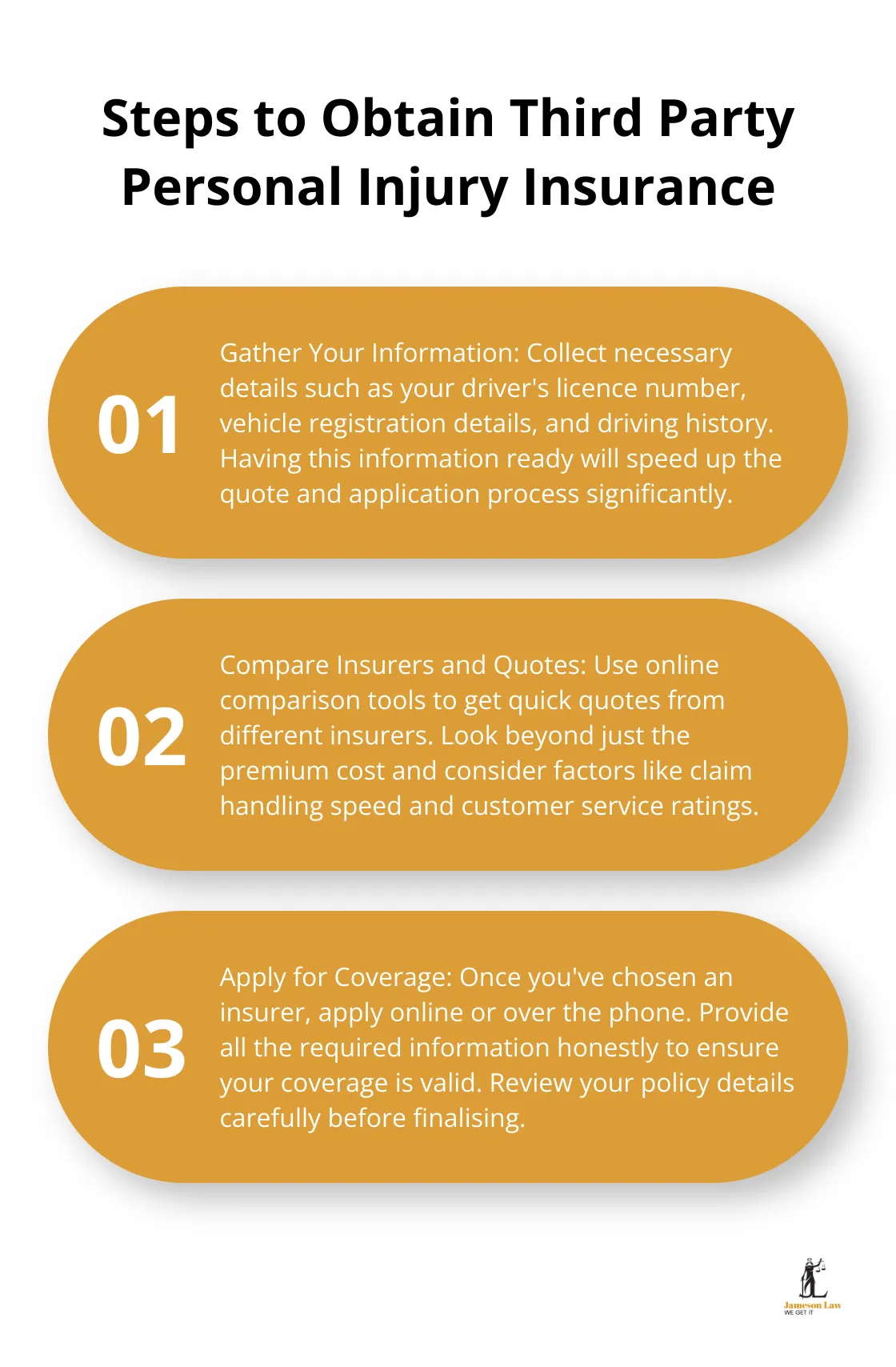

How to Get Third Party Personal Injury Insurance

Gather Your Information

Before you start your insurance search, collect all the necessary details. You’ll need:

- Your driver’s licence number

- Your vehicle registration details

- Your vehicle’s make, model, and year

- Your driving history (including any accidents or violations)

Having this information ready will speed up the quote and application process significantly.

Compare Insurers and Quotes

In states where you can choose your CTP provider, it’s vital to compare options. The Insurance Council of Australia provides a comprehensive analysis of factors influencing motor insurance pricing and offers strategic recommendations for government action.

Use online comparison tools to get quick quotes. These tools often provide side-by-side comparisons of coverage and costs. The cheapest option isn’t always the best. Look at factors like claim handling speed and customer service ratings.

For example, in Queensland, Suncorp has shown the shortest average claim duration for direct claimants at about 5 months. This efficiency could prove crucial if you ever need to make a claim.

Apply for Coverage

Once you’ve chosen an insurer, you can usually apply online or over the phone. Be prepared to provide all the information you gathered earlier.

Some insurers might ask additional questions about your driving habits or vehicle usage. Answer honestly to ensure your coverage is valid.

If you’re unsure about any part of the application, don’t hesitate to ask questions. Insurance providers should be able to explain any confusing terms or conditions.

Finalise Your Policy

After submitting your application, review your policy details carefully. Check that all information is correct and that you understand the terms and conditions.

Pay your premium as directed by the insurer. Many offer flexible payment options, including monthly instalments or annual lump sums. Choose the option that best fits your budget.

Once payment is processed, you’ll receive your certificate of insurance. Keep this document safe – you might need it when registering your vehicle or if you’re involved in a hit & run car accident.

Maintain Your Coverage

CTP insurance isn’t a set-and-forget product. You need to keep your policy active and up-to-date.

Set reminders for renewal dates to avoid any lapses in coverage. If your circumstances change (like moving to a new address or changing vehicles), inform your insurer promptly.

Regularly review your policy to ensure it still meets your needs. As your situation changes, you might need to adjust your coverage or switch providers.

While CTP insurance is mandatory, it doesn’t cover all scenarios. Consider additional coverage like comprehensive car insurance for fuller protection. For advice on the legal aspects of insurance coverage (to ensure you’re adequately protected), consult with legal professionals such as those at Jameson Law.

Final Thoughts

Third party personal injury insurance protects drivers from financial consequences if they cause accidents that injure others. Drivers must gather necessary information, compare insurers, and apply for coverage carefully. Regular policy reviews and prompt updates to insurers about life changes will ensure continuous, appropriate coverage.

CTP insurance forms a critical part of responsible driving, but it doesn’t cover all scenarios. Additional coverage options can provide more comprehensive protection on the road. Professional advice can help clarify insurance needs and ensure adequate protection.

At Jameson Law, we help Australians navigate personal injury law and insurance complexities. Our experienced team offers guidance on securing the right protection. Taking a proactive approach to third party personal injury insurance safeguards your financial future and contributes to safer roads for all Australians.