Estate planning is a vital process that safeguards your assets and ensures your wishes are respected after you’re gone. At Jameson Law, we’ve created this comprehensive estate planning checklist to guide you through the essential steps.

Whether you’re just starting or updating your existing plan, this guide will help you navigate the complexities of Australian estate law.

What is Estate Planning in Australia?

Definition and Scope

Estate planning in Australia extends beyond the creation of a Will. It encompasses a comprehensive process that protects your assets and ensures the execution of your wishes after your death or incapacity. This process involves making critical decisions about the management and distribution of your assets in these scenarios.

Importance of Estate Planning

The significance of estate planning cannot be underestimated. A lack of proper planning can result in asset distribution that doesn’t align with your wishes, potentially sparking family conflicts and incurring unnecessary legal expenses. It’s estimated more than half of Australians die without a will, leaving their estates vulnerable to intestacy laws (which dictate how assets are distributed in the absence of a Will).

Key Components of an Estate Plan

A robust estate plan typically includes several essential elements:

- Will: This document outlines your desired asset distribution.

- Enduring Power of Attorney: This appointment allows someone to manage your financial affairs if you become incapacitated.

- Advance Care Directive: This specifies your healthcare preferences if you’re unable to make decisions for yourself.

- Testamentary Trust: For those with complex financial situations or young children, this can offer significant tax and saving benefits when incorporated into your Will.

Legal Requirements in Australia

While legal requirements for estate planning vary across Australian states and territories, some general principles apply universally. To create a valid Will, you must:

- Be over 18 years old

- Be of sound mind

- Have the Will in writing

- Sign the Will in the presence of two witnesses (who are not beneficiaries)

It’s important to note that superannuation and life insurance policies often fall outside your Will. You need to nominate beneficiaries directly with your super fund and insurance provider to ensure these assets are distributed according to your wishes.

Regular Review and Updates

We recommend reviewing your estate plan every 3-5 years or after significant life events (such as marriage, divorce, or the birth of a child). This practice ensures your plan remains current and accurately reflects your wishes.

As we move forward, let’s explore the essential documents required for a comprehensive estate plan. These documents form the backbone of your estate planning strategy and provide clear instructions for your loved ones and legal representatives.

Essential Documents for Estate Planning

Last Will and Testament

Your Last Will and Testament forms the foundation of your estate plan. It outlines your asset distribution wishes and names an executor to manage your estate. In Australia, approximately one in two adult Australians don’t have a Will in place, which means everyday people are dying without one. This leaves a significant portion of the population at risk of complications for their loved ones.

To create a valid Will, you must:

- Be over 18 years old

- Be of sound mind

- Have the document in writing

- Sign it in the presence of two witnesses (who aren’t beneficiaries)

While DIY Will kits exist, they often fall short in addressing complex situations. Professional legal advice ensures your Will is comprehensive and legally sound.

Power of Attorney

A Power of Attorney (POA) allows someone else to make decisions on your behalf. There are two main types:

- General Power of Attorney: This grants authority for financial decisions for a specific period or purpose.

- Enduring Power of Attorney: This remains valid even if you lose mental capacity.

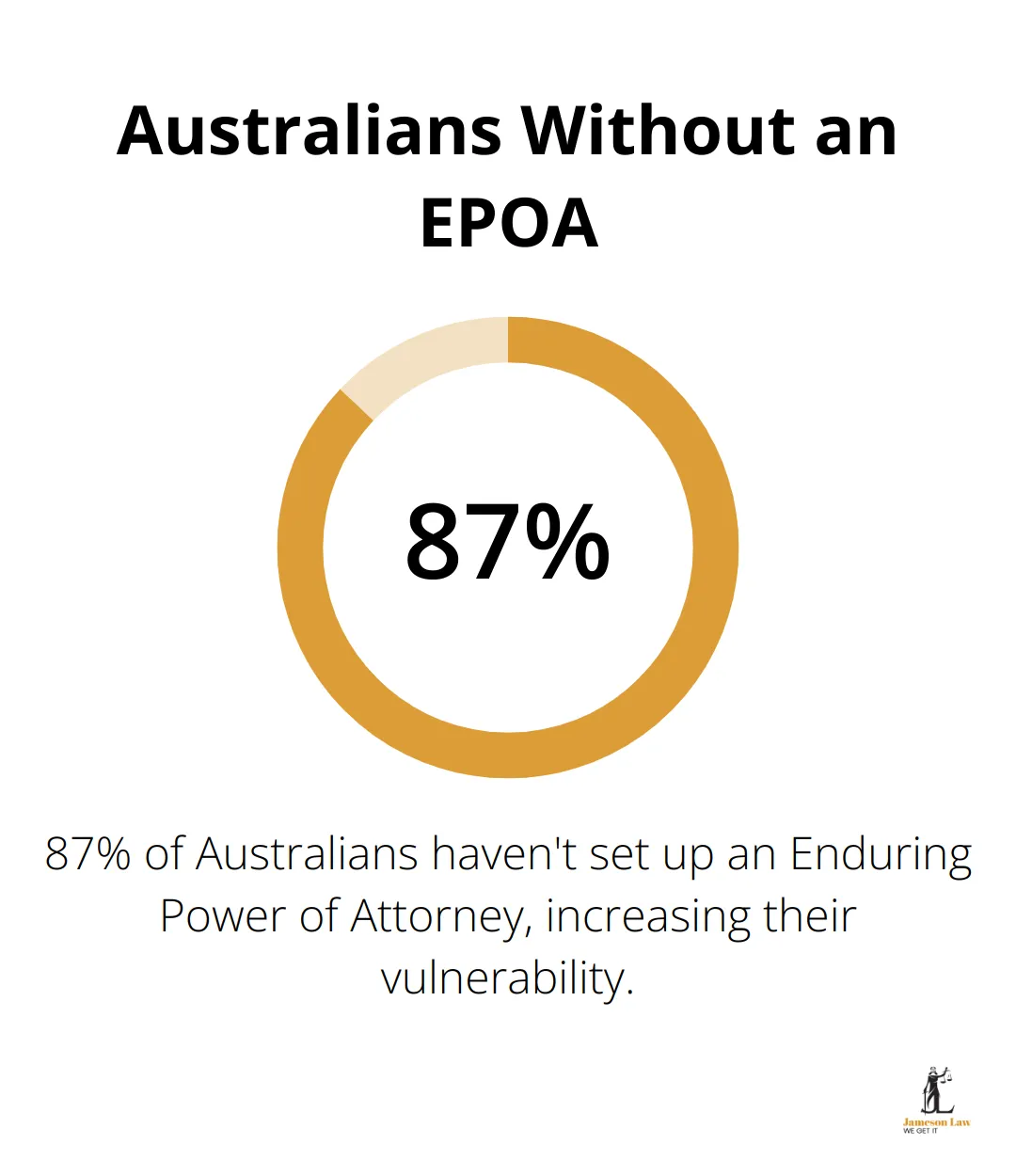

Findings indicate that 87% of Australians haven’t set up an EPOA for themselves. This heightens the risk of elder financial abuse and leaves many vulnerable if they become incapacitated.

Advance Care Directive

An Advance Care Directive (also known as a Living Will) outlines your medical treatment preferences if you’re unable to make decisions for yourself. It can cover various scenarios, from life-sustaining treatments to pain management preferences.

Testamentary Trust

A Testamentary Trust is created within your Will and activates after your death. It offers significant benefits, particularly for beneficiaries with complex financial situations or young children.

These trusts provide tax advantages and asset protection. For example, income distributed to minors from a testamentary trust is taxed at adult rates, potentially saving thousands in tax each year.

While these documents form the core of a comprehensive estate plan, each individual’s situation is unique. A tailored approach ensures your estate plan is robust and reflective of your wishes.

As we move forward, it’s important to consider the key factors that influence your estate planning decisions. The next section will explore these considerations in detail, helping you create a more effective and personalised estate plan.

How to Navigate Key Estate Planning Decisions

Identifying and Valuing Your Assets

The first step in effective estate planning requires you to create a comprehensive inventory of your assets. This includes physical property, financial accounts, investments, and personal belongings. Don’t overlook digital assets like cryptocurrency or online accounts.

For complex assets like businesses or investment portfolios, you need professional valuation. The Australian Taxation Office provides guidelines for valuing assets, which can serve as a helpful starting point.

Selecting Beneficiaries and Executors

Choosing beneficiaries is a personal decision. You should consider not just immediate family, but also friends, charities, or other organisations you wish to support. Be specific in your Will to avoid potential conflicts.

Selecting an executor is equally important. This person will manage your estate, so you must choose someone trustworthy and capable. According to the NSW Trustee and Guardian, about 45% of Australians appoint a family member as executor, while others opt for professionals like lawyers or accountants.

Understanding Tax Implications

Tax considerations play a significant role in estate planning. Capital Gains Tax (CGT) can impact beneficiaries when they inherit certain assets. As a beneficiary inheriting property in Australia, you generally don’t have any CGT liability when you inherit the property.

Testamentary trusts can offer tax advantages. For beneficiaries incurring high personal tax rates, significant savings are possible, making them an attractive option.

Managing Superannuation and Life Insurance

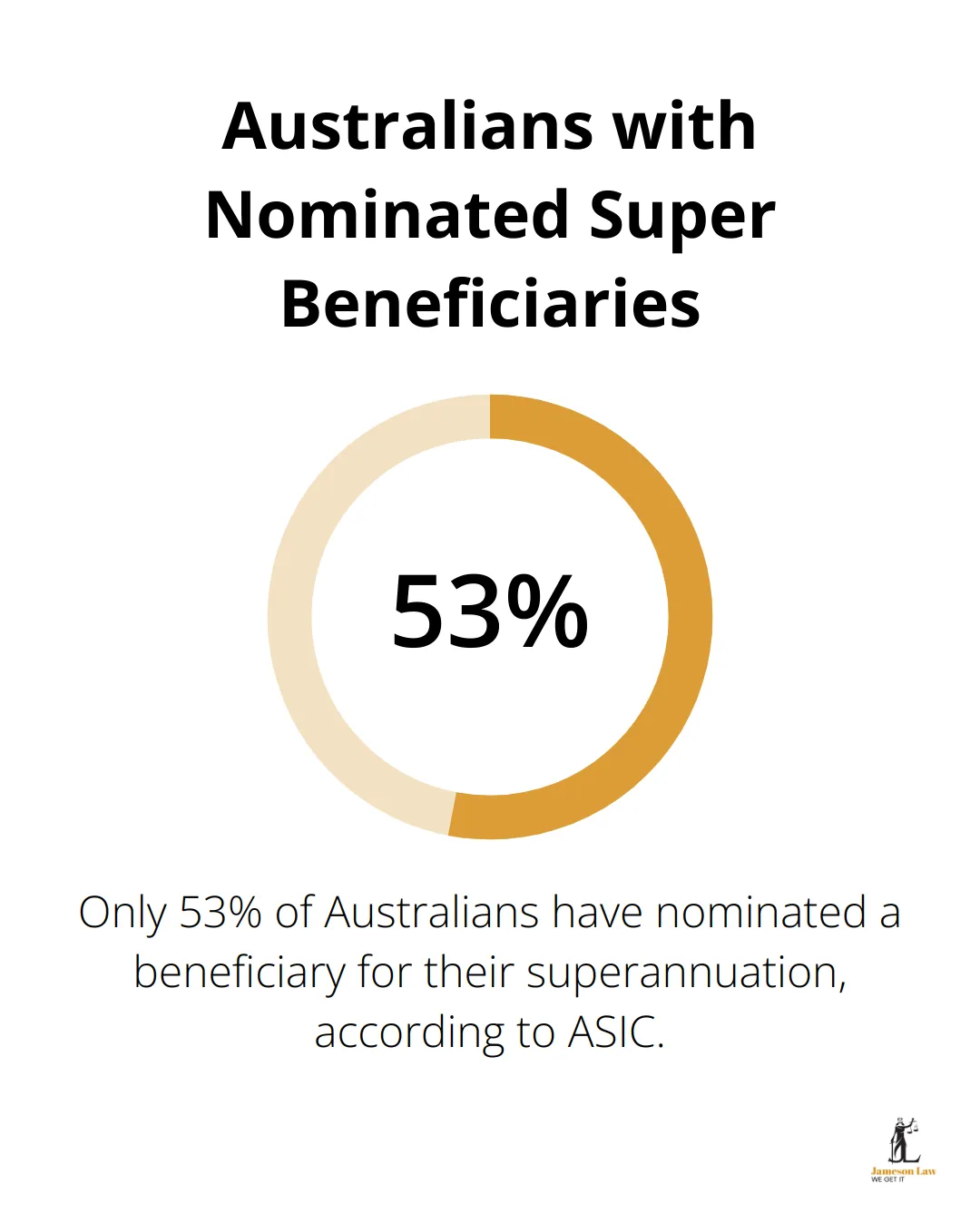

Superannuation and life insurance often fall outside your Will. You need to nominate beneficiaries directly with your super fund and insurance provider. According to the Australian Securities and Investment Commission, only 53% of Australians have nominated a beneficiary for their super.

Try to make binding death benefit nominations for your super to ensure it’s distributed according to your wishes. Super fund members should not underestimate the importance of a binding death benefit nomination.

Seeking Professional Advice

Estate planning involves complex legal and financial considerations. You should seek professional advice to ensure your plan is comprehensive and legally sound. A qualified estate planning lawyer (such as those at Jameson Law) can help you navigate these decisions and create a tailored plan that protects your assets and provides for your loved ones.

Final Thoughts

Estate planning protects your assets and ensures your wishes are respected after death. Our estate planning checklist includes essential documents like a Will, Power of Attorney, and Advance Care Directive. You should review your plan every 3-5 years or after significant life events to keep it current.

Estate planning involves complex legal and financial considerations. You need to identify assets, choose beneficiaries, and understand tax implications. Addressing superannuation and life insurance considerations is also important, as these often fall outside your Will.

Professional advice can help you create a comprehensive and legally sound plan. At Jameson Law, we specialise in tailored estate plans that address unique needs and circumstances. Our team can guide you through the process to align your plan with your goals.