Estate planning is a crucial step in securing your family’s future, but many people struggle with knowing when to start. At Jameson Law, we often hear the question: “When should you start estate planning?”

The truth is, it’s never too early to begin this important process. Whether you’re newly married, expecting a child, or experiencing significant life changes, proactive estate planning can protect your assets and ensure your wishes are respected.

When Should You Start Estate Planning?

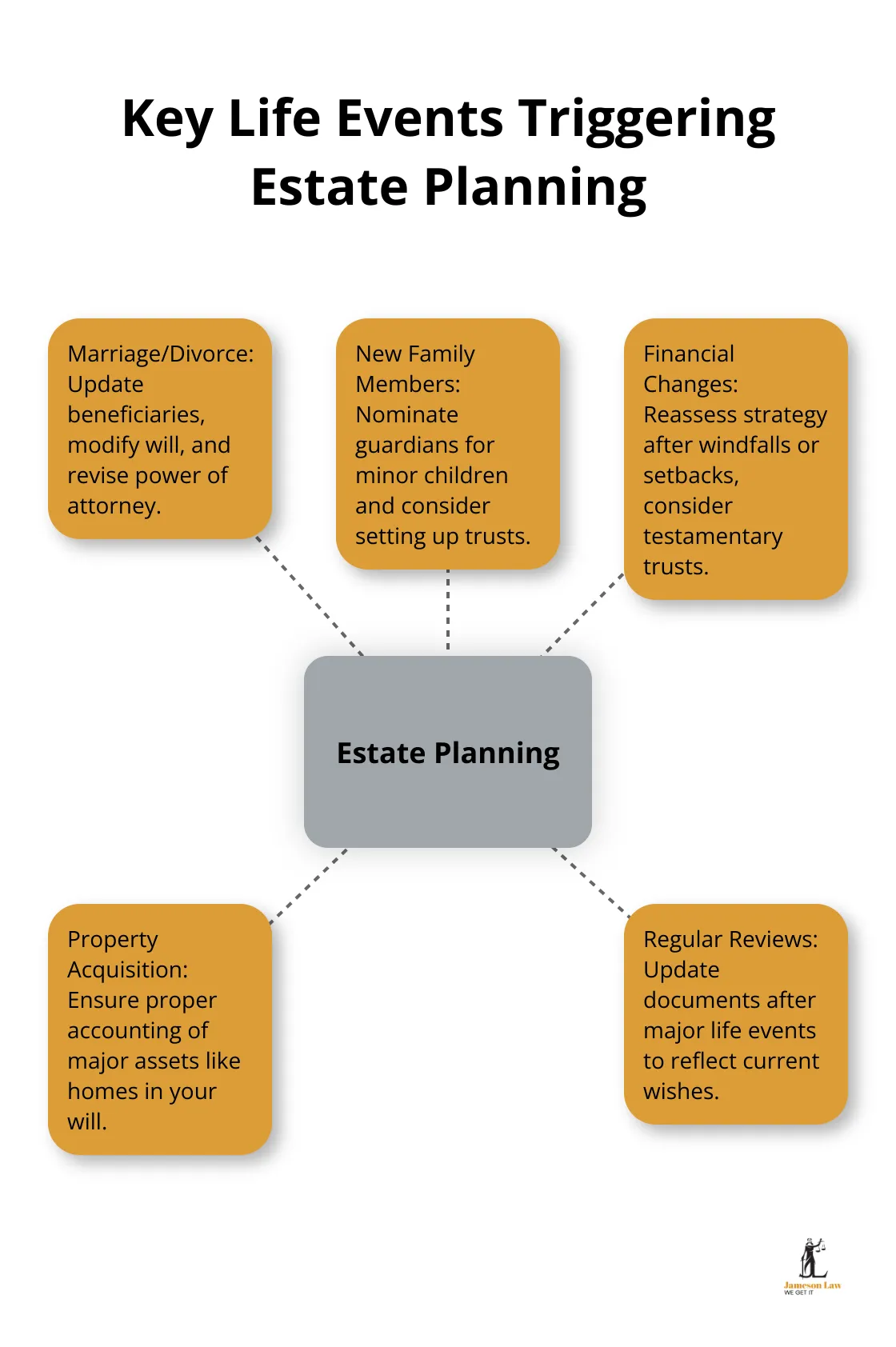

Marriage and Divorce: Protecting Your Spouse and Assets

Marriage and divorce are major life changes that require a review of your estate plan. When you marry, you must ensure your spouse is provided for if you pass away. This involves updating beneficiary designations on your superannuation and life insurance policies, as well as creating or modifying your will to include your new partner.

Divorce can complicate matters. You need to revise your estate plan to reflect your changed circumstances, potentially removing your ex-spouse as a beneficiary and updating your power of attorney. Google searches for ‘divorce’ reportedly peaked in June 2020, highlighting the importance of keeping your estate plan current.

Welcoming New Family Members: Securing Their Future

The arrival of children or grandchildren calls for What Is Estate Planning and Why Is It Important?. You should nominate guardians for your minor children in case something happens to you and your partner. You might also consider setting up trusts to manage assets for your children until they reach a certain age.

For grandparents, updating your will to include your grandchildren as beneficiaries or establishing education funds for their future is a wise move. With the rising cost of education in Australia, planning ahead can make a significant difference in your grandchildren’s lives.

Financial Windfalls and Setbacks: Adapting Your Plan

Significant changes in your financial situation (positive or negative) should trigger a review of your estate plan. This could include receiving an inheritance, selling a business, or experiencing a substantial increase in income. Financial setbacks like job loss or bankruptcy also warrant a reassessment of your estate planning strategy.

If you’ve come into a large sum of money, you might want to consider establishing a testamentary trust in your will. This can provide tax benefits for your beneficiaries and protect your assets from potential creditors.

Property Acquisition: Protecting Your Biggest Asset

Purchasing a home or other major assets is another critical time to start or update your estate plan. Your home is likely to be your most valuable asset, and you must ensure it’s properly accounted for in your will. This is particularly important if you have a mortgage, as you’ll need to consider how the debt will be handled after your passing.

The CoreLogic Daily Home Value Index provides daily capital growth measurements for all dwellings, including both houses and units. With such significant investments at stake, it’s vital to have a clear plan for how your property will be managed and distributed after your death.

Estate planning isn’t a one-time event. It’s an ongoing process that you should review regularly, especially when these life events occur. We recommend reviewing and updating these documents regularly, especially after major life events such as marriage, divorce, or the birth of a child. This proactive approach ensures your estate plan always reflects your current wishes and circumstances.

As we move forward, it’s important to understand why starting your estate planning early can provide significant benefits. Let’s explore the advantages of early estate planning and how it can protect your assets and beneficiaries.

Why Early Estate Planning Matters

Estate planning isn’t just for the wealthy or elderly. It’s an essential step for anyone who wants to protect their assets and loved ones. Early estate planning can make a world of difference in securing your legacy and ensuring your wishes are respected.

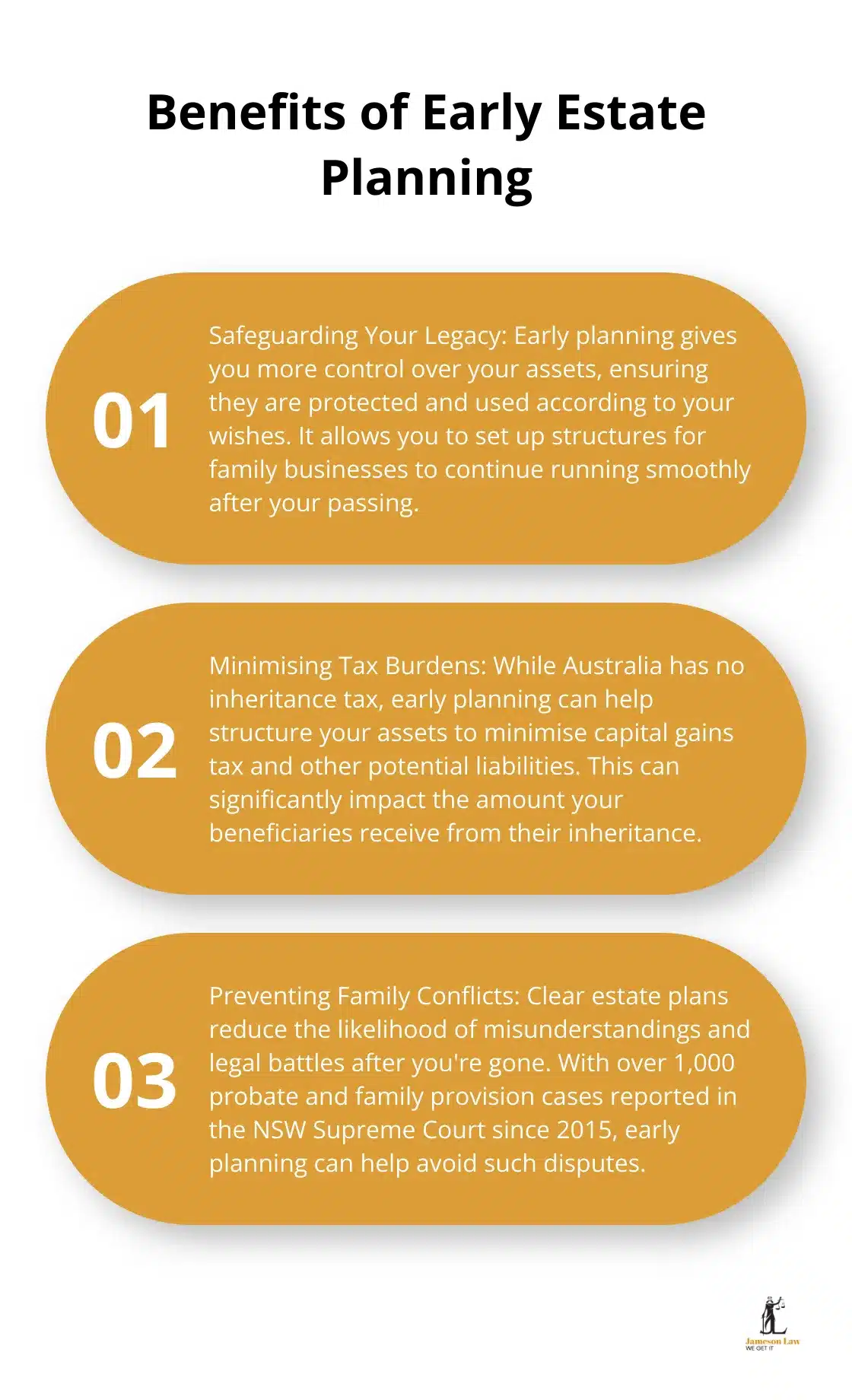

Safeguarding Your Legacy

Starting your estate planning early gives you more control over your assets. It’s not just about distributing wealth; it’s about ensuring your hard-earned assets are protected and used according to your wishes. If you have a family business, early planning allows you to set up structures that can keep the business running smoothly after you’re gone.

Minimising Tax Burdens

Early estate planning can significantly reduce the tax burden on your beneficiaries. While no inheritance tax exists in Australia, other taxes can impact your estate. Planning ahead allows you to structure your assets in a way that minimises capital gains tax and other potential liabilities. This could mean the difference between your beneficiaries receiving their full inheritance or losing a substantial portion to taxes.

Preventing Family Conflicts

One of the most heart-wrenching scenarios in estate planning is families torn apart by disputes over estates. Early planning can prevent these conflicts. A clear outline of your wishes and discussions with your family reduce the likelihood of misunderstandings and legal battles after you’re gone. Since 2015, more than 1,000 cases in probate and family provision have been reported in the Supreme Court of NSW, highlighting the growing importance of clear estate plans.

Adapting to Life Changes

Life is unpredictable, and your estate plan should evolve with it. Starting early gives you the flexibility to adapt your plan as your circumstances change. Whether it’s a new marriage, the birth of a child, or a significant career change, you’ll have a solid foundation to build upon.

Ensuring Your Wishes Are Respected

Early estate planning empowers you to make decisions about your healthcare and financial affairs while you’re still able to do so. This includes creating advance care directives and appointing powers of attorney. These documents ensure that your wishes are respected even if you become incapacitated. It’s important to note that an Enduring Power of Attorney document must be signed by two witnesses, one of whom must be an authorised witness, to become legally binding.

Early estate planning isn’t just about preparing for the worst; it’s about taking control of your future and ensuring your legacy is preserved exactly as you intend. Don’t wait for a crisis to start planning. The sooner you begin, the more options you’ll have to protect what matters most to you.

Now that we understand the importance of early estate planning, let’s explore the common tools used in Australia to create a comprehensive estate plan.

Essential Estate Planning Tools in Australia

Wills: The Foundation of Your Estate Plan

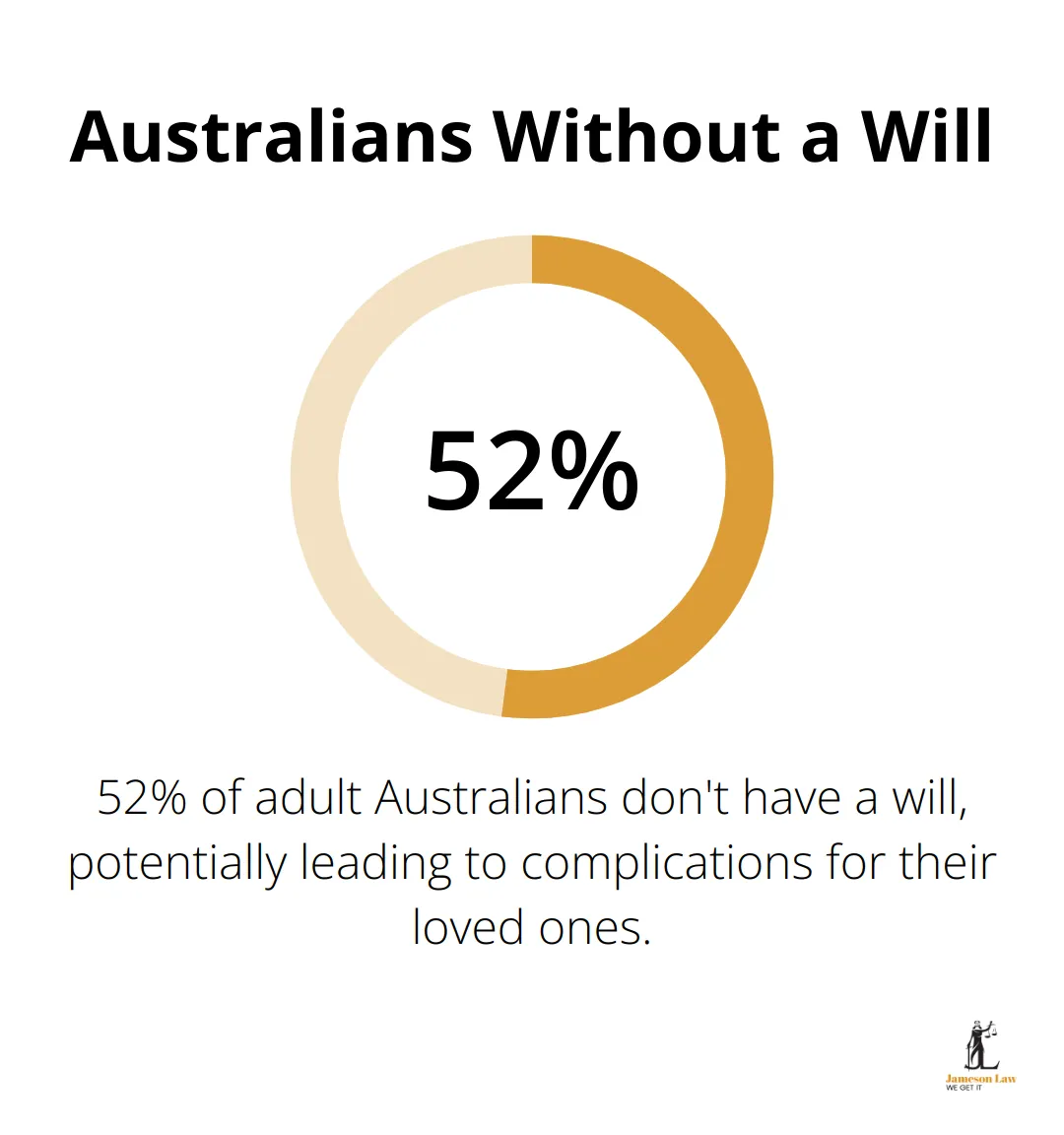

A will forms the cornerstone of any estate plan. It outlines how you want your assets distributed after your death and names an executor to manage your estate. New research reveals that 52% of adult Australians don’t have a will. This oversight can lead to significant complications for your loved ones.

When you create a will, be specific about asset distribution and consider including a residuary clause to cover any assets not explicitly mentioned. Update your will regularly, especially after major life events.

Powers of Attorney: Managing Your Affairs

Powers of Attorney (POA) allow you to appoint someone to make decisions on your behalf if you become incapacitated. In Australia, there are two main types:

- General Power of Attorney: For financial decisions when you’re unavailable or unable to act for a specific period.

- Enduring Power of Attorney: Continues even if you lose mental capacity.

Advance Care Directives: Ensuring Your Healthcare Wishes

Advance Care Directives (also known as living wills) outline your preferences for medical treatment if you’re unable to communicate. These documents can cover everything from life support preferences to pain management strategies.

Trusts: Protecting and Managing Assets

Trusts offer a flexible way to manage and protect assets. They can provide tax benefits, protect assets from creditors, and allow for more complex distribution arrangements. The most common types in Australia are:

- Testamentary Trusts: Created by a will and come into effect after death.

- Discretionary Trusts: Offer flexibility in distributing income and capital.

Estate planning involves complex processes, and these tools are just the beginning. Each situation is unique, and professional legal advice is important to ensure your estate plan meets your specific needs and complies with Australian law. Don’t leave your legacy to chance – start planning today with Jameson Law.

Final Thoughts

Estate planning secures your future and protects your loved ones. The best time to start estate planning is now, regardless of your life stage or financial situation. Early planning offers numerous benefits, including asset protection, tax minimisation, and dispute prevention.

We at Jameson Law understand that every individual’s situation is unique. Our experienced team can guide you through the estate planning process, tailoring a plan to your specific needs and ensuring compliance with Australian law. We will help you protect what matters most.

Estate planning isn’t just for the wealthy or elderly – it’s for anyone who wants to secure their legacy and provide for their loved ones. Don’t leave your future to chance. Take the first step in your estate planning journey today (when should you start estate planning? The answer is clear: there’s no better time than now).